[ad_1]

Immediately’s Animal Spirits is dropped at you by YCharts:

Enter your data right here to get 20% off YCharts (new purchasers solely)

On in the present day’s present, we talk about:

Future Proof:

YCharts x Animal Spirits Webinar on March twenty third at 2:30 Jap

Pay attention Right here:

Suggestions:

Charts:

Tweets:

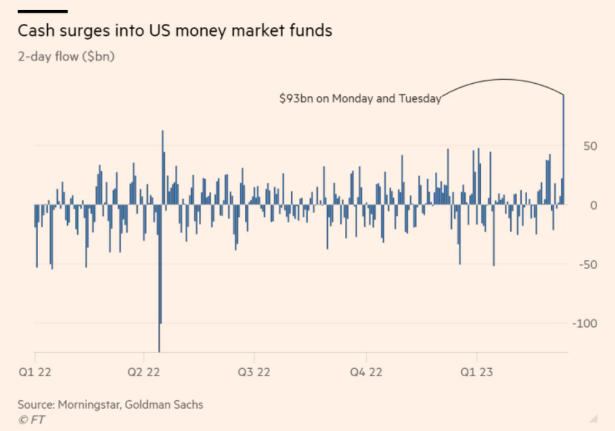

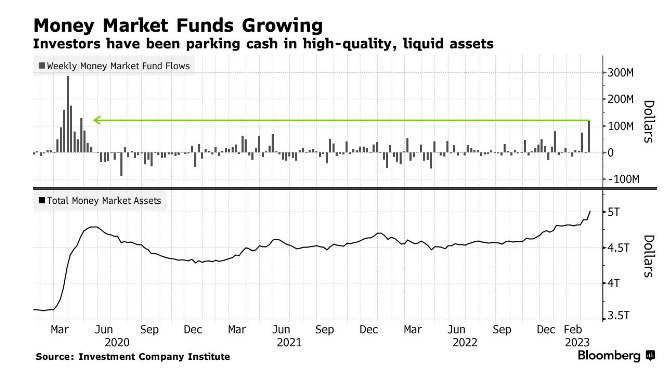

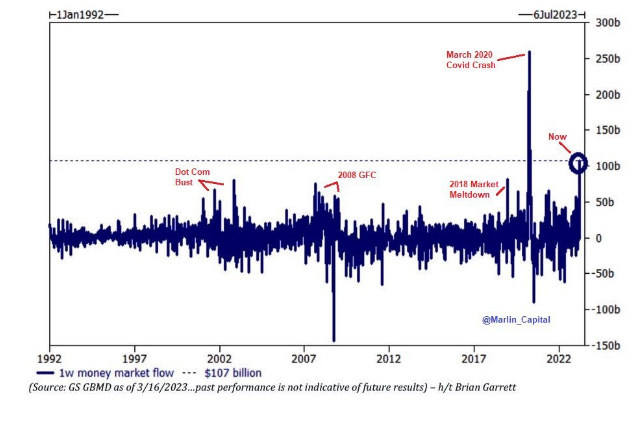

“For the reason that Fed started to boost rates of interest a 12 months in the past, the sum of money in cash market funds has elevated by roughly $400bn, and the inflows elevated by greater than $100bn final week” @apolloglobal pic.twitter.com/hyDlIX8Tpv

— Sam Ro 📈 (@SamRo) March 20, 2023

A report excessive $152.85B borrowed from the Fed’s low cost window this week…

Prior all-time excessive was $111B in 2008.

(Chart @zerohedge) pic.twitter.com/sRBh96qxXL— Stephen Geiger (@Stephen_Geiger) March 16, 2023

Nearly all of America has no thought concerning the banking disaster taking place on Twitter.

— Chris Powers (@fortworthchris) March 18, 2023

The media’s place on financial institution runs: Their reporting of giant unrealized losses at a financial institution under no circumstances contributes to a run. If you happen to react to their reporting by eager to withdraw your cash, you’re panicking. However for those who keep within the financial institution and it fails, you need to lose your cash.

— David Sacks (@DavidSacks) March 18, 2023

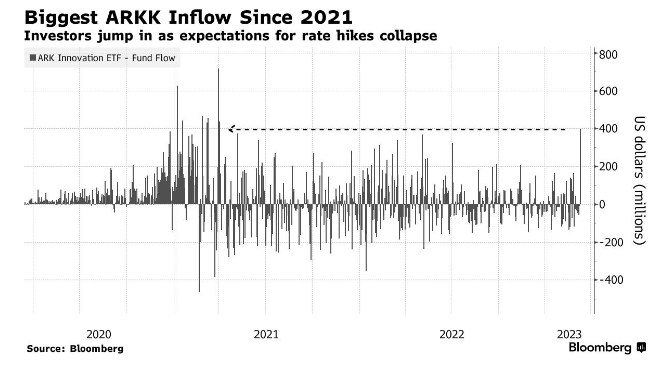

Not regular. pic.twitter.com/uCMCT7e6bS

— Bespoke (@bespokeinvest) March 17, 2023

Takeaway: fixing a “banking disaster” is rather a lot simpler than fixing inflation.

— Jesse Livermore (@Jesse_Livermore) March 20, 2023

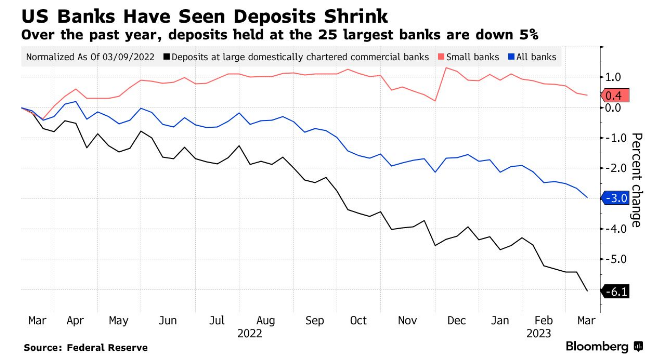

“Small banks account for 30% of all loans within the US economic system, and regional and group banks are prone to now spend a number of quarters repairing their steadiness sheets.”

-Torsten Slok, Apollo, on the approaching credit score crunch— Edward Harrison (@edwardnh) March 15, 2023

JP MORGAN APPROXIMATELY ESTIMATES SLOWER LOAN GROWTH BY MID-SIZE BANKS COULD DEDUCT A HALF TO A FULL PERCENTAGE-POINT OFF THE LEVEL OF US GDP OVER THE NEXT YEAR OR TWO.

— Breaking Market Information (@financialjuice) March 16, 2023

4/6 – Goal-maturity bond ETFs are getting extra widespread by the day and have introduced in additional than $15 Bil in cumulative inflows over the previous 12 months. pic.twitter.com/kQqMBM6I39

— Ben Johnson, CFA (@MstarBenJohnson) March 16, 2023

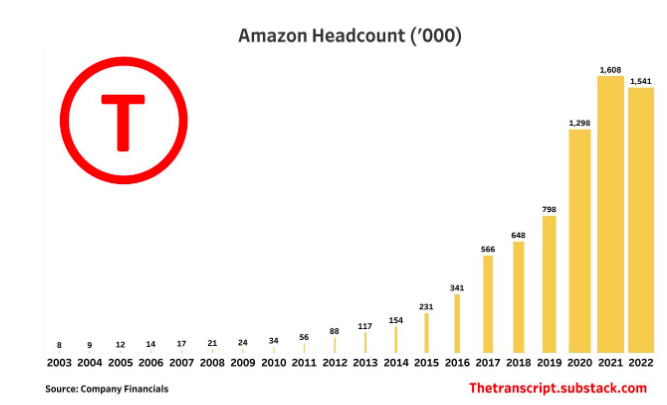

Amazon proclaims one other spherical of layoffs affecting 9,000 staff on prime of the 18,000 introduced in Jan. Small in comparison with their workforce of 1.5 million, however probably a extra vital % of their company employees.https://t.co/WXqqphridq pic.twitter.com/WharcYMYCW

— Daniel Zhao (@DanielBZhao) March 20, 2023

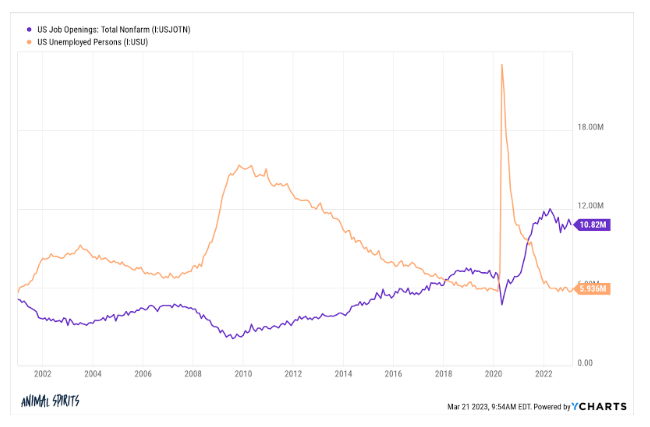

.@KellyCNBC Delayed reply to your on-air query (didn’t belief my recollection on the spot):

80% of job openings are at small companies with fewer than 250 staff proper now, up from round 72% in 2019.

50% are in these with fewer than 50, up from 41% in 2019.

— Julia Pollak (@juliaonjobs) March 16, 2023

BTC spot volumes are sky-high: Beneath my favourite metric (trusted exchanges from @coinmetrics, 3-day ma), BTC spot volumes hit the very best print since Might 2021.

Do you assume these excessive volumes are right here to remain? pic.twitter.com/MMNBlchWpg

— David Lawant (@dlawant) March 17, 2023

Per 2020 #IRS figures:

The highest 1% of particular person filers paid 42.31% of all US Revenue #Taxes up from 38.77% in 2019. They accounted for 22.19% of complete Adjusted Gross Revenue AGI.

You wanted an AGI of $548,336 to make it into this membership. pic.twitter.com/8GkWeXCezZ— George Papadopoulos (@feeonlyplanner) March 21, 2023

🚨Breaking:

Microsoft simply launched 365 Copilot, and it is insane.

It is basically ChatGPT for:

-Phrase

-Excel

-Powerpoint

-Outlook

-GroupsTake a look at the demo👇 pic.twitter.com/ATW0mfPwhC

— Rowan Cheung (@rowancheung) March 16, 2023

Contact us at animalspiritspod@gmail.com with any suggestions, suggestions, or questions.

Comply with us on Fb, Instagram, and YouTube.

Take a look at our t-shirts, espresso mugs, and different swag right here.

Subscribe right here:

Wealthcast Media, an affiliate of Ritholtz Wealth Administration, obtained compensation from the sponsor of this commercial. Inclusion of such commercials doesn’t represent or suggest endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investing in speculative securities includes the danger of loss. Nothing on this web site must be construed as, and will not be utilized in reference to, a proposal to promote, or a solicitation of a proposal to purchase or maintain, an curiosity in any safety or funding product.

[ad_2]