[ad_1]

I like to take a look at either side of issues as a result of so many features of life have some form of steadiness.

You don’t get the great with out the unhealthy, the reward with out the chance, the pleasure with out the ache or the bull markets with out the bear markets.

This previous week I checked out among the causes the inventory market could make you’re feeling horrible on a regular basis.

And whereas it’s true the inventory market may be unforgiving within the short-run, even over comparatively quick durations of time the inventory market generally is a enjoyable place too.

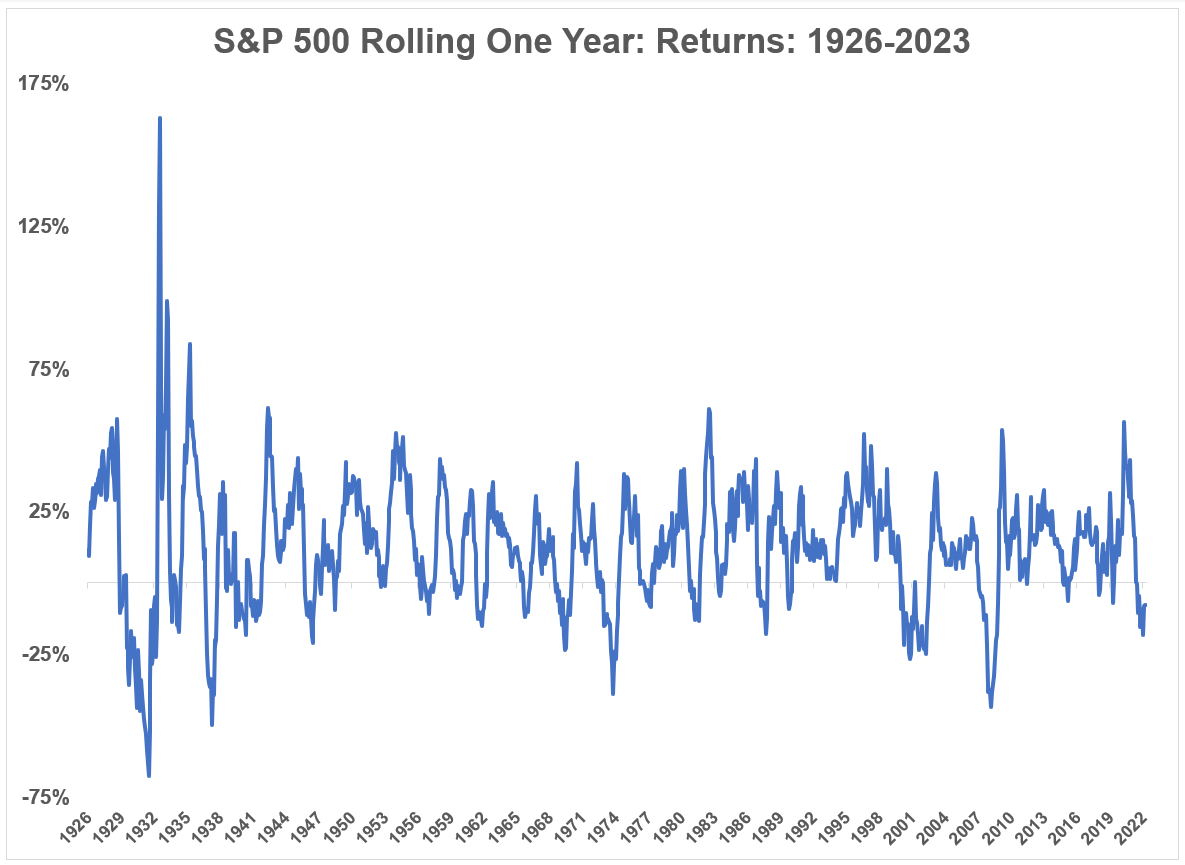

Here’s a have a look at rolling one yr returns for the S&P 500 again to 1926:

Loads of unhealthy instances to make certain however the inventory market has been up in 75% of all rolling one yr returns on this time.1

You don’t should be Sherlock Holmes to infer the truth that this implies the market has been down 1 out of each 4 years (on common).

These are fairly respectable odds. The unhealthy instances are painful however the good instances greater than make up for it.

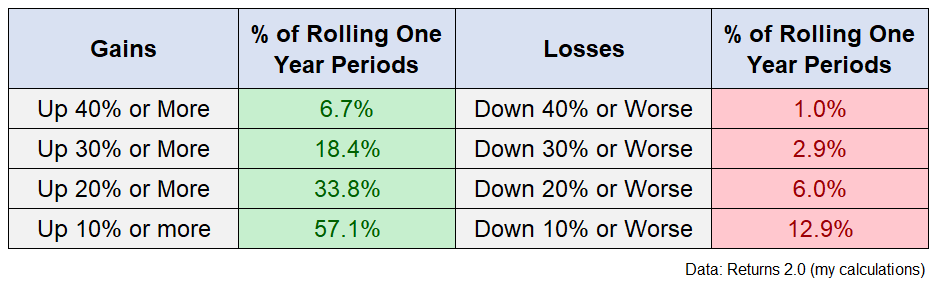

To emphasise this level, it may be useful to transcend simply constructive or damaging returns and have a look at completely different magnitudes of efficiency over these one yr durations.

As an illustration, the S&P 500 has been down 10% or worse in round 13% of all rolling one yr durations. However the market has been up by 10% or extra 57% of the time.

The positive factors outweigh the losses at different magnitudes as effectively:

The inventory market is down 20% or worse 6% of the time however up 20% or extra virtually 34% of the time over rolling one yr durations.

Almost one out of each 5 one yr durations is up 30% or extra whereas the market is down 30% or worse lower than 3% of the time.

Forty % strikes over a one yr timeframe are uncommon however even then the positive factors outweigh the losses by an element of virtually 7-to-1.

The newest 12 month return by way of the top of March is a lack of round 8%. Losses of 8% or worse have solely occurred in 15% of historic one yr returns.

More often than not issues are higher than the present market setting however I suppose that’s the rub when investing in shares.

More often than not issues are fairly good and typically they’re fairly unhealthy.

You don’t get one with out the opposite.

Additional Studying:

Why the Inventory Market Makes You Really feel Unhealthy All of the Time

1The very best 12-month rolling return of 162% for the month ending in June 1933 adopted the worst 12-month rolling return of -68% within the month ending June of 1932. A melancholy can have that impact on markets.

[ad_2]