[ad_1]

There are three issues individuals within the finance world hate to confess:

- I don’t know.

- I used to be unsuitable.

- I didn’t count on that to occur.

A master-of-the-universe mentality is pervasive in finance as a result of it’s a bunch of extremely educated, aggressive individuals. They see it as an indication of weak spot in the event you admit you don’t know what’s going to occur subsequent.

The issue is finance individuals (all individuals, actually) are superb at telling you why one thing that simply occurred was apparent in hindsight. They’re horrible at telling you what is going to occur sooner or later.

I’ve been stunned by numerous what’s transpired within the markets and the financial system these previous few years.

Listed below are some issues I wouldn’t have anticipated to occur even after realizing what we now know:

I’m stunned the financial system has been so resilient. It’s been 18 months since Russia invaded Ukraine, sending gasoline and meals costs (that had been already shifting up) skyrocketing.

Right here’s a query I used to be requested on the time:

Right here’s what I wrote again then:

Inflationary spikes don’t trigger each recession however each inflationary spike has solely been alleviated by a recession.

Every time inflation went over 5% in brief order there was a recession both instantly or in brief order.

Within the ensuing year-and-a-half, the Fed has gone on some of the aggressive fee mountaineering campaigns in historical past, shares and bonds each went right into a bear market, we hit $5/gallon in gasoline and inflation reached 9%.

However we by no means had a recession.

Inflation fell. The unemployment fee by no means spiked and really went down. Financial development accelerated.

Contemplating we’ve been debating a doable recession for 18-24 months now, it seems like we’ve already had a tender touchdown in some respects.

Possibly the Fed retains charges larger for longer and that lastly slows issues down however the ongoing energy of the U.S. financial system is one thing principally nobody noticed coming in any case that’s been thrown at it.

I’m stunned nothing has damaged but. These are the bottom closing Treasury yields throughout the onset of the pandemic:

- 1 yr 0.04%

- 2 yr 0.09%

- 5 yr 0.19%

- 10 yr 0.52%

- 30 yr 0.99%

Authorities bonds went from risk-free to return-free.

Listed below are those self same yields as of this writing:

- 1 yr 5.45%

- 2 yr 5.02%

- 5 yr 4.57%

- 10 yr 4.53%

- 30 yr 4.68%

We have now the best yields since 2007 principally throughout the yield curve. Sure, I do know we’ve had larger yields up to now however there was a decade-and-a-half for individuals to get used to decrease yields.

After which yields simply took off like a rocketship.

I’m stunned we haven’t had extra blow-ups from this.

Positive we had a 3 day regional banking disaster and the housing market is kind of damaged however nothing has damaged like most individuals would have assumed with charges rising this a lot this quick.

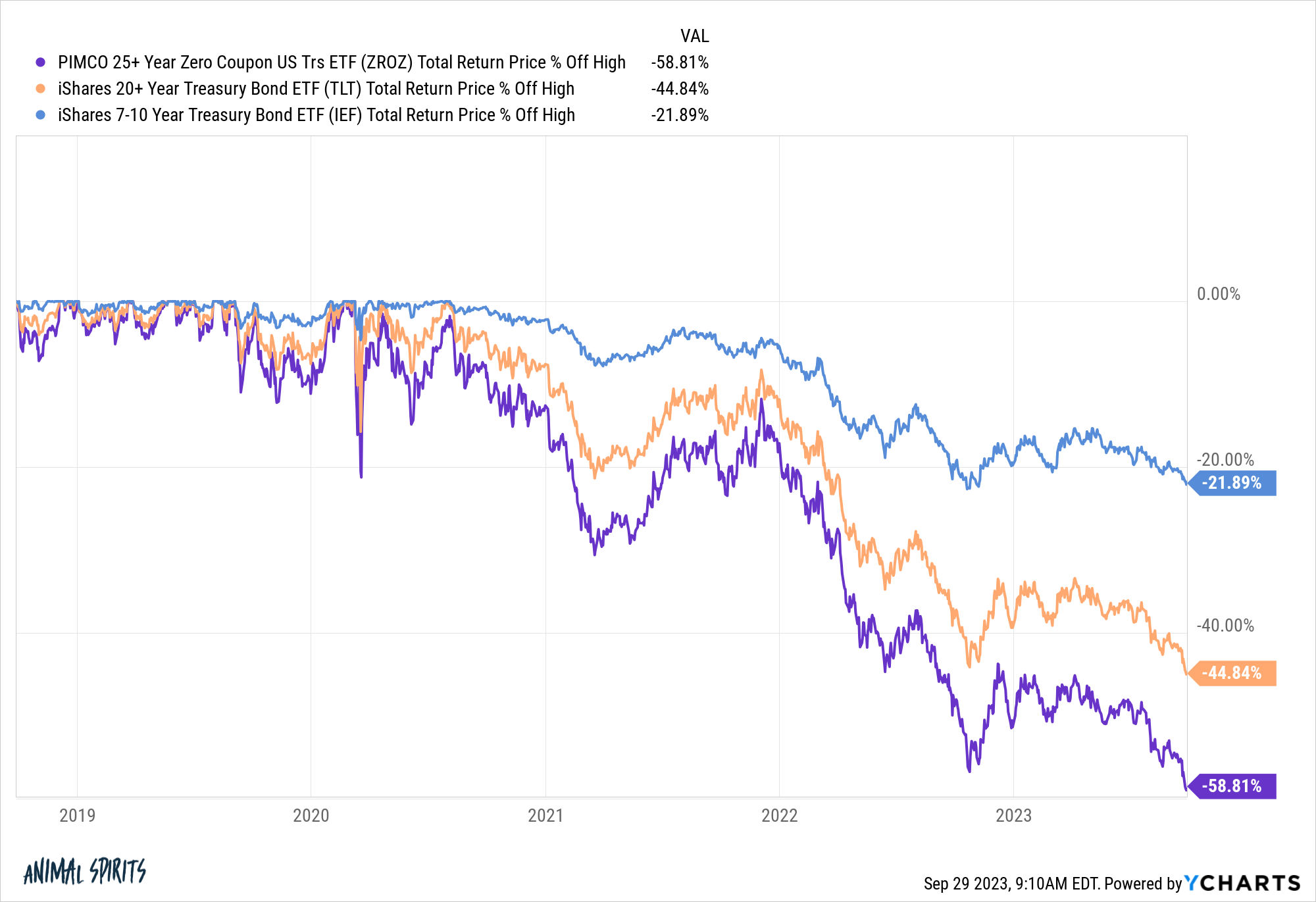

Simply take a look at the losses in longer period mounted earnings:

By some means the market has (up to now) digested larger yields although lengthy period bonds have gotten pummeled.1

It’s stunning we haven’t seen any fund blow-ups or different unintended penalties from these losses but.

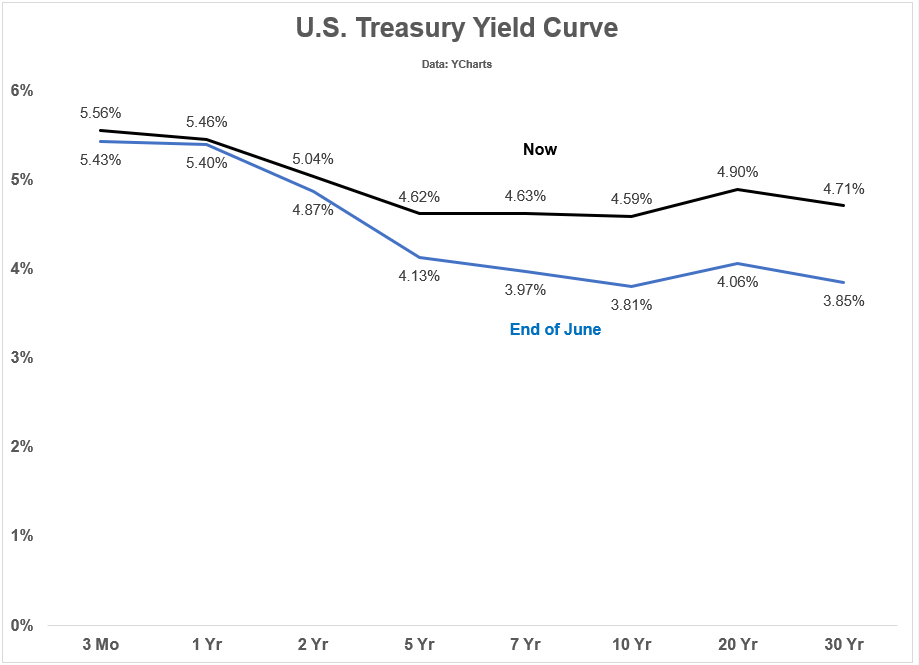

I’m stunned the yield curve is steepening like it’s. The Fed controls short-term rates of interest however not essentially long-term charges.2

After they jacked up short-term charges, yields on longer-term bonds rose however not almost as a lot, which led to an inverted yield curve the place quick charges had been larger than lengthy charges.

It’s laborious to know precisely what the bond market is pondering however most market pundits assumed this meant bond merchants didn’t imagine excessive development or inflation had been right here to remain.

Most individuals additionally assumed it could take the Fed decreasing short-term charges to uninvert? disinvert? vert? steepen the yield curve.

The truth is, the market has been predicting fee cuts for a while now…till lately. Now long-term yields are rising.

Have a look at the modifications within the yield curve over the previous 3 months:

It’s lengthy charges which are inflicting a steepening of the curve, not quick charges as everybody assumed.

Nobody is aware of for certain why the lengthy finish lastly awoke. Possibly it’s the Fed signaling larger for longer. Possibly the bond market is nervous about inflation or larger financial development.

However definitely now nobody predicted this.

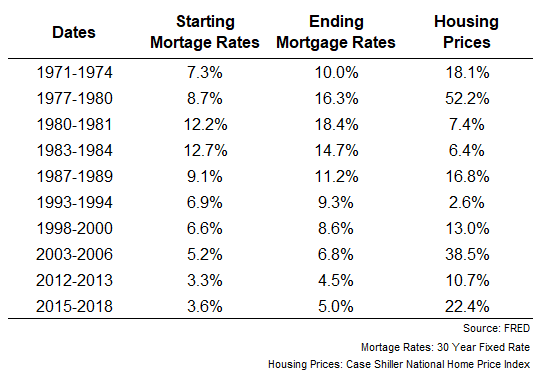

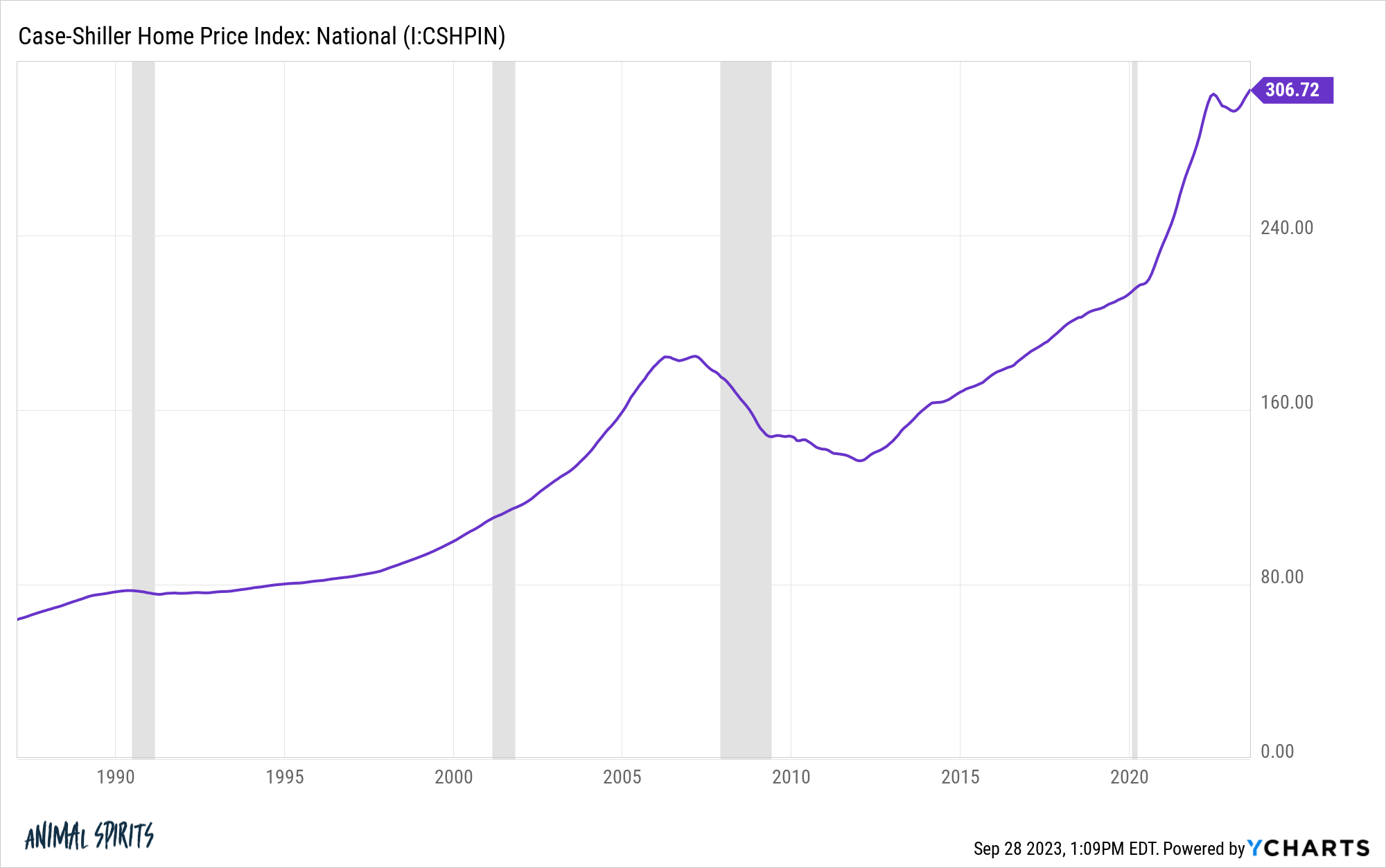

I’m stunned housing costs didn’t fall additional. I wrote a bit again in January 2022 about the historic impression of rising mortgage charges on housing costs. Right here’s the chart I used:

Up to now rising mortgage charges didn’t crush the housing market. Fairly the alternative. Costs haven’t fallen as soon as up to now 50 years when mortgage charges rose.

After I wrote that piece the 30 yr mounted mortgage was just a little greater than 3%.

I by no means would have predicted they’d go all the way in which to 7.5%!

Nobody did.

But even armed with this knowledge, I might have assumed housing costs must fall 10% or extra from the mixture of a doubling in mortgage charges and the 50% pop in housing costs from the pandemic.

As an alternative housing costs fell rather less than 3% and are actually proper again to all-time excessive ranges nationally:

Like all of those surprises, there are completely cheap explanations after the actual fact (lack of provide, 3% mortgage lock-ins, family formation, and so forth.).

The factor is nobody was making any of those predictions forward of time and now everybody needs to fake like this was all apparent.

It’s OK to confess you don’t know what’s going to occur.

It’s OK to confess while you had been unsuitable.

It’s OK to confess you had been stunned by what occurred.

A bit humble pie and self-awareness make it simpler to outlive this loopy world we stay in.

Michael and I talked about all the sudden issues which have occurred and way more on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

Are We Heading For a Recession?

Now right here’s what I’ve been studying recently:

Books:

1To be truthful, yields going so low within the pandemic led to outsized positive factors in lengthy period bonds main as much as this bloodbath.

2Except they purchase Treasuries to regulate charges, however they don’t set these charges like they do with the Fed funds fee.

[ad_2]