[ad_1]

The inventory market is a sophisticated place.

You will have all types of various members: day merchants and swing merchants, high-frequency merchants and market makers, inventory pickers and asset allocators, progress traders and worth traders, and on and on.

Then you’ve gotten macroeconomic information that would influence the inventory market within the quick or long run: manufacturing and repair studies, jobless claims and complete employment, headline and core inflation, each CPI and PCE. You will have authorities spending and deficits and surpluses. You will have the fed funds fee and the thirty-year rate of interest and every thing in between. There are housing begins and present dwelling gross sales, and on and on it goes.

Lastly, you’ve gotten the businesses that make up the inventory market. Small caps and mega caps. New points and incumbents. Then you’ve gotten all of the sectors from industrials to financials, and all of the business teams from low cost shops to specialty chemical compounds. Then you’ve gotten what these companies resolve to do with their money flows; R&D and cap-ex, dividends and buybacks.

Yep. The inventory market is a sophisticated place.

The worth of all of those corporations are based mostly on earnings. However even that isn’t actually the entire story. Are earnings rising or falling? Are corporations guiding greater or decrease? Does the market imagine mentioned earnings are sustainable, or will they arrive underneath stress? And who determines what earnings are value? And the place do earnings estimates come from? Okay, that final one is fairly easy; they arrive from analysts.

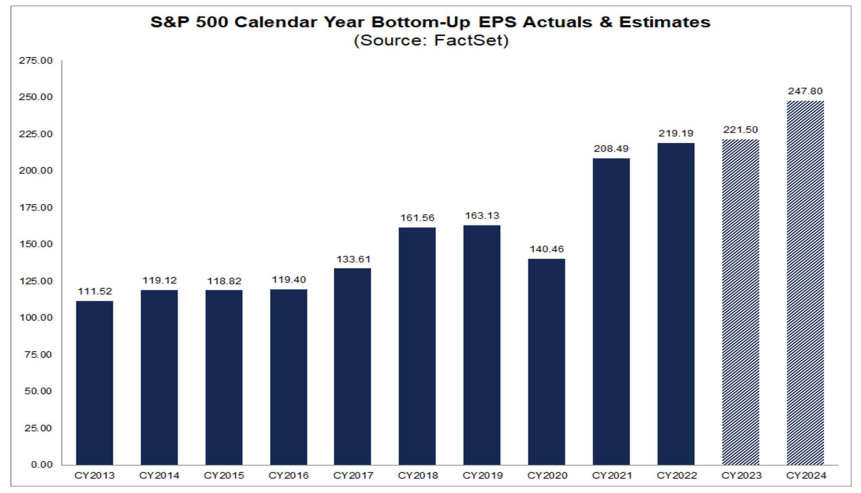

They estimate that S&P 500 earnings are going to return in flat this yr. And but the S&P 500 is up 13% on the yr, even after the current selloff.

One different little element about tips on how to worth the market is what are these earnings competing with? Throughout the zirp period, the reply was “not a lot.” When cash prices nothing, shares are the one sport on the town. However when rates of interest are providing another, then at the very least theoretically, multiples of earnings ought to come down.

Double-digit fed funds charges within the 70s and early 80s, together with inflation, stored a lid on multiples.

Whereas excessive rates of interest are likely to result in decrease multiples, that’s not all the time the case. The Nineteen Nineties, which was among the finest many years for the inventory market ever, had a Fed funds fee that averaged 5.15%, which is principally the place we’re right now.

I’d have thought that rates of interest going from 0 to five% would put a critical dent within the inventory market. However then once more, the inventory market is a sophisticated place. And possibly there’s extra to the story than wanting on the inventory market as an entire.

I confirmed final week that bigger corporations have weathered the storm a lot better because the Fed began elevating charges. There are a number of causes for this, like the truth that they’re much less reliant on recent debt than smaller corporations, simply to call one.

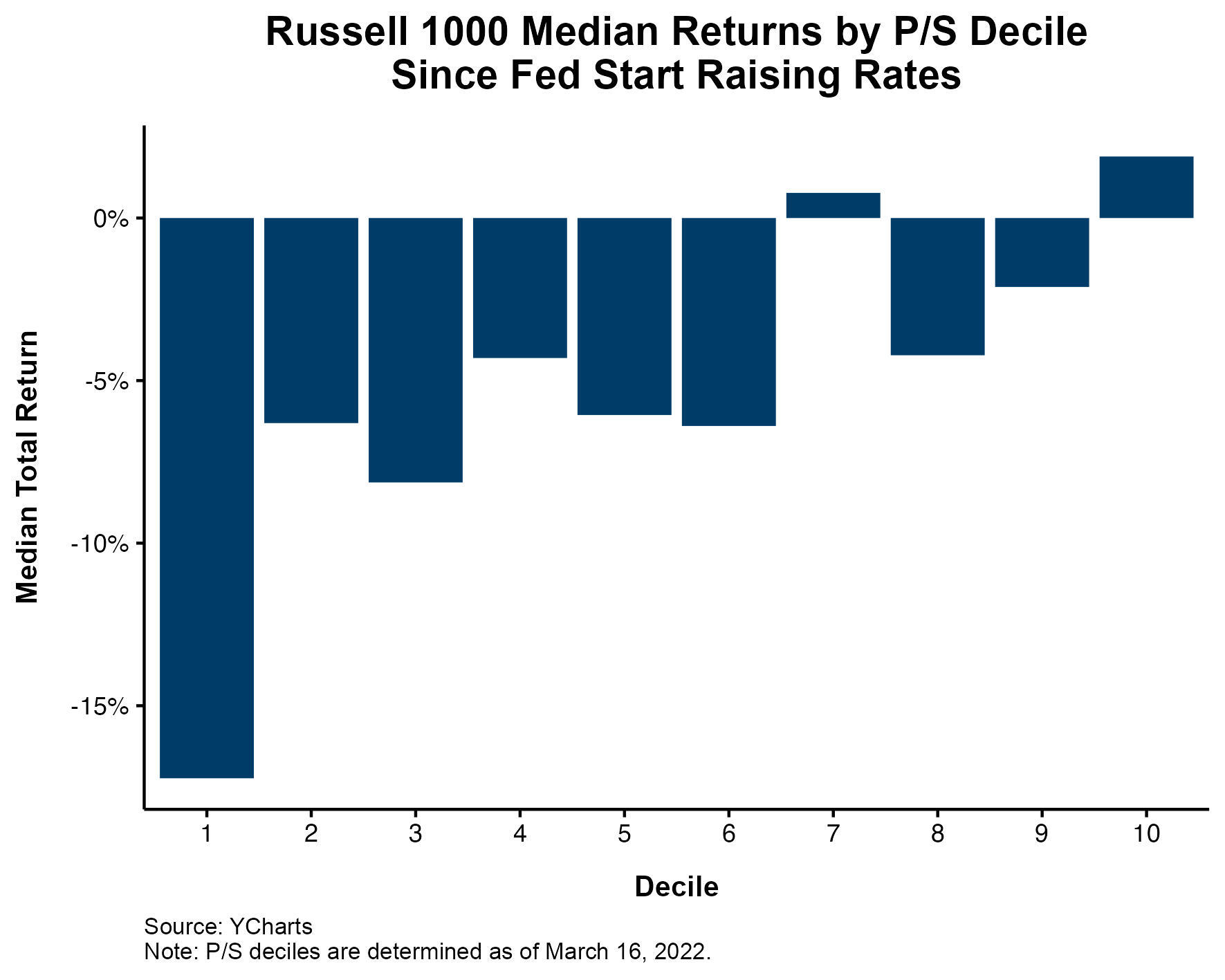

But when we kind the market a special manner, we are able to see that rates of interest have had a big influence on the firm degree. The chart under reveals shares sorted by their P/S ratio, with the best (costliest) within the first decile and the most cost effective ones all the way in which on the suitable. Because the fed began elevating charges, the median return is -17% for the costliest bucket, whereas the most cost effective bucket gained a few p.c.

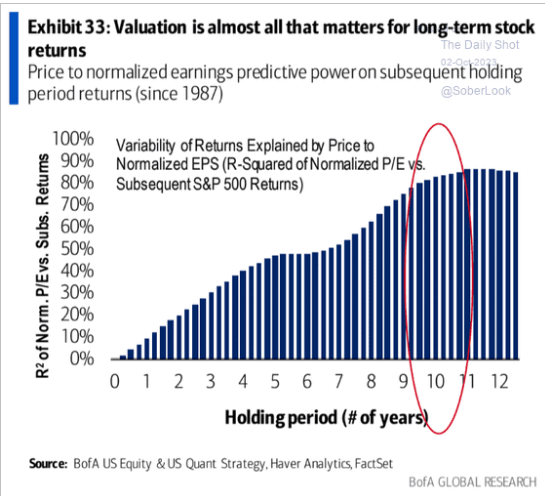

So, what’s the inventory market value? Sadly, it’s anyone’s guess over the short-term. Valuations don’t imply something right now, however they imply an entire lot sooner or later. Bob Elliott tweeted this chart and mentioned, “Yield is future relating to investing…Recognizing that for long-term inventory traders, just about all that issues is the earnings yield at preliminary buy.

Even when we knew that analysts had been proper and the S&P 500 would earn $248 subsequent yr, how would you understand what traders would pay for it? Fifteen occasions will get you to 3720, and twenty occasions will get you to 4960. Even for those who knew earnings, and rates of interest, and inflation, and employment, you continue to couldn’t confidently inform me the place the inventory market could be. Yep, the inventory market is a sophisticated place.

[ad_2]