[ad_1]

Individuals have been predicting a housing market crash ever since costs took off like a rocketship early within the pandemic.

Housing is a bubble!

Simply await the entire Airbnb hosts which are compelled to promote!

Rising mortgage charges imply housing has to crash!

It’s the large brief once more!

Who is aware of perhaps housing costs will fall and even crash finally. I can’t predict what’s going to occur subsequent on this loopy market.

However so many individuals discuss falling housing costs as if it could be a foul factor, like a repeat of the 2008 crash. I truly assume housing costs falling could be a good factor.

Give it some thought.

Tons of individuals have locked in ultra-low rates of interest. House fairness is thru the roof. Owners on this nation have by no means had a much bigger margin of security for falling costs.

In truth, I’d argue falling housing costs could be a boon to the financial system. There may be certainly pent-up demand within the housing market from the tens of millions of younger millennials trying to quiet down and purchase a spot of their very own.

If costs had been to fall, I imagine you’ll see an enormous upswing in homebuying exercise.

Extra individuals would record. Extra individuals would purchase. Stock numbers would rise. And when there’s exercise within the housing market, individuals spend cash. Numerous it — transferring, furnishings, decorations, lawncare, renovations, and so on.

The worst-case state of affairs for the housing market is that if mortgage charges keep comparatively excessive and housing costs refuse to fall.

In that case, affordability stays excessive and we have now a whole era of people who find themselves both boxed out from ever proudly owning a house or compelled to pay an ever-increasing portion of their finances on a house.

You get right into a state of affairs of haves and have-nots within the housing market. The one ones who can afford are individuals who make some huge cash, already personal a house or get assist from their dad and mom.

Plus an enormous a part of the financial system is mainly benched.

That’s unhealthy and unfair for younger individuals who have accomplished nothing unsuitable apart from coming into their prime family formation years throughout a horrible, no-good time to purchase a house.

There may be precedent for an unhealthy housing market changing into even unhealthier.

Canada is a first-rate instance I’ve written about on this weblog in latest months (right here and right here). Canadian residence costs went loopy within the 2010s however then by some means discovered one other gear and went to ludicrous ranges within the 2020s.

This additionally occurred the final time we had a big demographic enter their family formation years in the USA as properly.

The Seventies had been a horrible decade for monetary property. Shares and bonds every technically confirmed good points on a nominal foundation however misplaced cash after accounting for inflation.

Housing was the one monetary asset that beat inflation on behalf of the center class.1

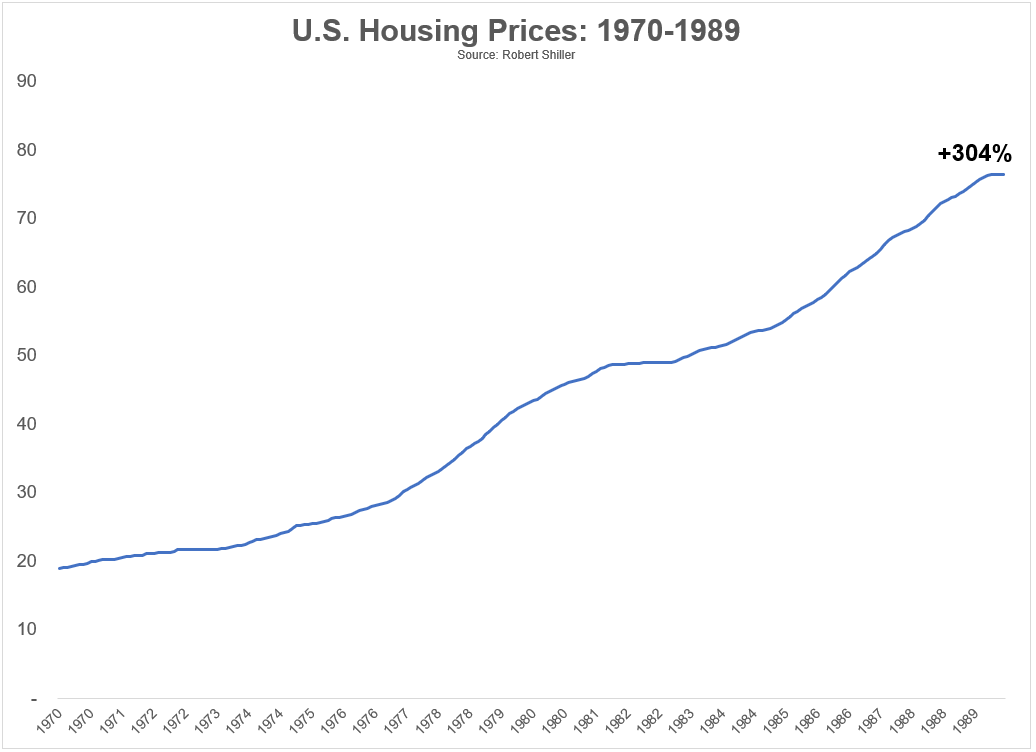

In response to information from Robert Shiller, nationwide housing costs had been up practically 130% within the Seventies. Even after accounting for sky-high inflation that decade, housing costs had been up double-digits on an actual foundation.

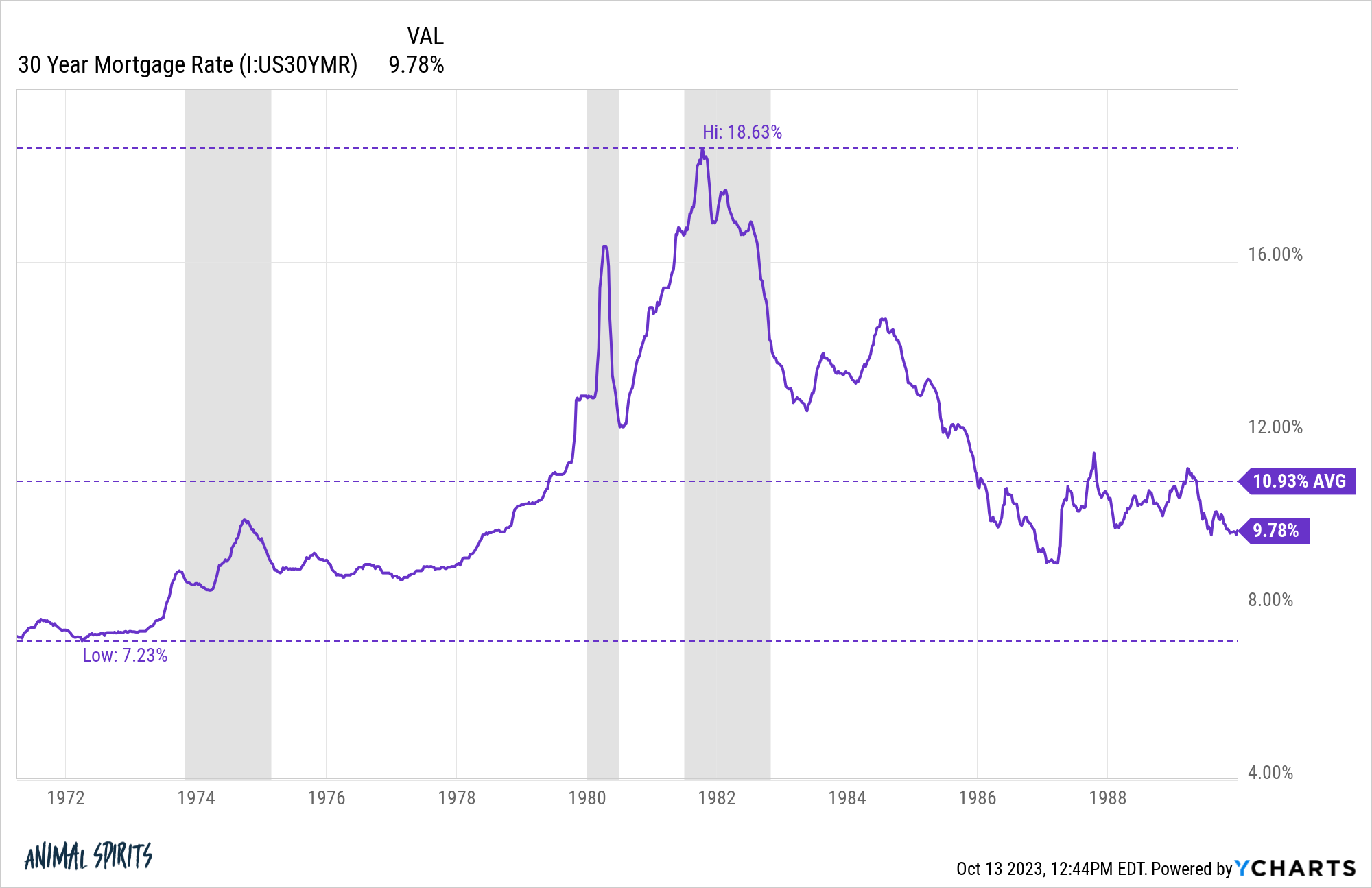

The issue for homebuyers is mortgage charges had been rising too:

For a 30 12 months fastened charge mortgage, the bottom borrowing charge was a bit greater than 7%. By the top of the Seventies you had been taking a look at 12% mortgages. As Paul Volcker’s Fed tried to snuff out inflation, mortgage charges topped out at practically 19% by 1981.

Certain, housing costs had been a lot decrease again then however affordability in month-to-month funds within the early-Nineteen Eighties skilled the same spike as what we’ve witnessed at this time, by a mixture of each rising housing costs and an insane spike in borrowing charges.

The issue for homebuyers again then, very similar to at this time, is housing costs refused to come back down. Right here’s a have a look at housing worth progress within the Seventies and Nineteen Eighties:

Sure, issues had been extra muted on an inflation-adjusted foundation however the mixture of ever-rising costs coupled with double-digit mortgage charges couldn’t have been straightforward to abdomen.

Housing costs took a bit breather within the early-Nineteen Eighties till mortgage charges lastly got here again down a bit nevertheless it’s not such as you noticed falling costs even after mortgage charges went into the stratosphere.

No two financial or market environments are ever the identical however the same dynamic taking part in out within the housing market at this time is the nightmare state of affairs.

It might be far more healthy if we did see costs fall to spur housing exercise and supply some aid to consumers who’ve been priced out of the housing market.

The worst-case state of affairs for the housing market isn’t a drop in costs.

Fairly the other.

The worst-case state of affairs for the housing market is a continuation of the present surroundings the place proudly owning a house turns into unaffordable for a bigger and bigger subset of the inhabitants by no fault of their very own.

Individuals who already personal their houses could be joyful to see costs proceed going up however it could be extra helpful to the financial system and make for a more healthy housing market in the long term if costs went down a bit.

Additional Studying:

The place the Housing Bubbles Are

1Gold was far and away the best-performing asset within the Seventies however let’s be sincere — it was mainly inconceivable for normal traders to purchase gold again then until they needed to retailer gold bars in a secure. There was no GLD to put money into.

[ad_2]