[ad_1]

Small and medium-sized enterprises (SMEs) within the UK are more and more involved about cybercrime. Based on GlobalData’s 2023 UK SME Insurance coverage Survey, the proportion of SMEs which are frightened about cybercrime rose 3.7 proportion factors (pp) to 54.4% in comparison with 2022. Quite a few variables—together with heightened tensions within the Russia/Ukraine battle, the continuing reputation of distant work, and high-profile cyberattacks—are responsible for this elevated concern. With the aim of addressing these points and responding to rising demand, cyber insurance coverage supplier Onda has entered the market.

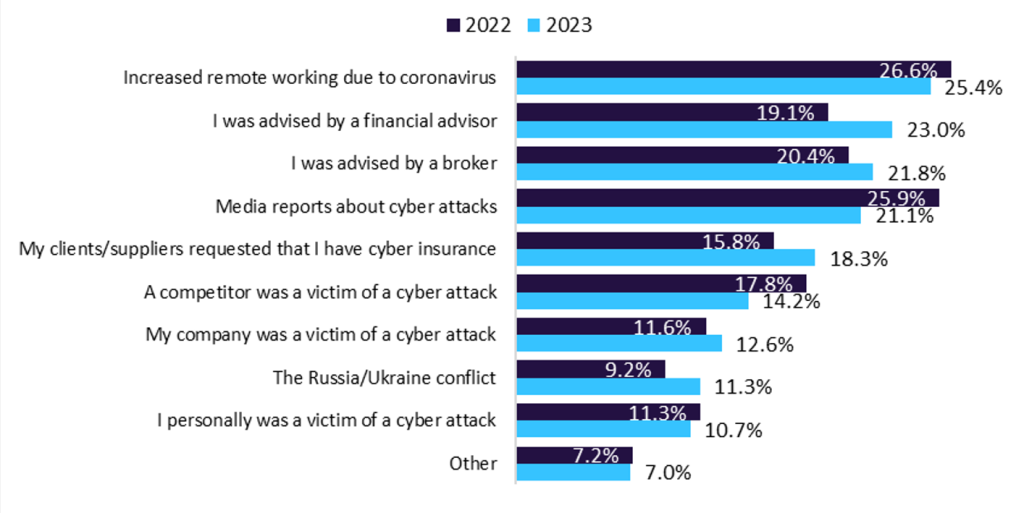

Based on GlobalData’s 2023 UK SME Insurance coverage Survey, the best set off behind the acquisition of cyber insurance coverage is elevated distant working (25.4%). The proportion of SMEs shopping for cyber insurance coverage after being the goal of a cyberattack rose by 1pp to 12.6% in 2023. Moreover, there was a 2.1pp rise in SMEs searching for cyber insurance coverage safety as a result of Russia/Ukraine battle. Moreover, 34.3% of SMEs reported seeing a rise in cyber dangers in 2023 because of the persevering with evolution of cyber threats. These findings spotlight the pressing want for cyber insurance coverage options.

What was your set off for planning cyber cowl? 2022-2023

Supply: GlobalData’s 2022-2023 UK SME Insurance coverage Surveys.

Towards this backdrop, Onda stands out for its streamlined onboarding course of. This not solely hurries up the method of getting protection in place but additionally makes it simpler for brokers and SME shoppers to obtain a quote, which may contain a protracted course of. With options resembling free automated threat monitoring, ongoing threat alerts, and a 24/7 response line, Onda goals to supply a complete resolution to guard SMEs. These options assure immediate help in instances of want and will enhance cyber hygiene. Onda’s product gives cowl for the prices of a required response, prices incurred by the corporate (resembling enterprise interruption), and at last the legal responsibility of paying others affected by an information breach. Onda’s entry into the cyber insurance coverage market serves the group of UK SMEs that must cope with the evolving menace of cybercrime. Insurance coverage firms have to be versatile and react to the shifting atmosphere in a world the place cyber threats are at all times increasing and changing into extra subtle.

Within the 12 months to October 2023, 53% of companies suffered not less than one cyberattack in keeping with the Hiscox Cyber Readiness Report 2023. This was a 5pp improve in comparison with the earlier 12-month interval, highlighting the rising menace posed to the sector. Insurers ought to look to include cyber hygiene companies and safety for his or her shoppers towards the rising menace of cybercrime.

Entry probably the most complete Firm Profiles

available on the market, powered by GlobalData. Save hours of analysis. Acquire aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain electronic mail will arrive shortly

We’re assured in regards to the

distinctive

high quality of our Firm Profiles. Nevertheless, we wish you to take advantage of

useful

resolution for your small business, so we provide a free pattern you can obtain by

submitting the beneath type

By GlobalData

[ad_2]