[ad_1]

Different funding methods proceed to supply the potential for more and more distinctive sources of tolerating diversification. Different investments totaled $13 trillion in property in 2021, in accordance with the market analysis agency Preqin. The full greenback worth in these courses has greater than doubled between 2015-2021 and is forecast to achieve $23 trillion by 2026.

Actual property, infrastructure and pure useful resource investments (actual property) have more and more performed a crucial function within the success of a few of the largest endowments and foundations worldwide, with Harvard, Stanford and Yale allocating north of 25% of their total funds towards actual property.

Alternate options Property are Rising

It could be useful to look at the expansion of alternate options, as illustrated beneath within the 2023 NACUBO-TIAA Examine of Endowments. The chart demonstrates that endowments allotted on common 58.64% of property below administration to various methods.

In response to the report, “In contrast with FY21, probably the most notable asset allocation distinction is that, throughout all collaborating endowments, allocations to non-public fairness and enterprise capital barely exceeded these of public equities (U.S., non-U.S. and international).

Portfolio allocations as of June 30, 2022, had been 28 % in public equities (U.S., non-U.S. and international), 30 % in a mixture of personal fairness and enterprise capital, 17 % in marketable alternate options, 11 % in fastened revenue, 12 % in actual property, and slightly below 3 % in different property.

Personal power and infrastructure had been the strongest-performing property for endowments, pushed by spiking oil and pure gasoline costs brought on by the Ukraine/Russia battle, and growing demand for commodities as the worldwide financial system continues to get better from the COVID-19 pandemic. Personal fairness, enterprise capital, personal actual property, and different personal actual property all posted robust returns in FY22 as nicely.” (Percentages are dollar-weighted averages for all 678 faculties, universities and education-related foundations accomplished the FY2022. $807 billion of endowment property represented within the FY2022 survey)

The report’s conclusion states, “We imagine that there’s clear tutorial and empirical proof that various funding methods have contributed considerably to portfolio returns during the last 20 years… Allocations to alternate options ought to be reserved for the investor that may entry top-tier managers, because the distribution of returns amongst various managers is way larger than it’s amongst conventional managers.”

Different funding methods are included in a portfolio to boost returns, scale back threat, or could obtain a twin mandate. They’re elementary to the construction of the so-called endowment mannequin of investing, which concludes that long-term asset swimming pools can outperform traders with shorter-term time horizons by offering capital to much less environment friendly, extra sophisticated and illiquid sectors of the capital markets.

Constructing Profitable Portfolios

Actual property have more and more performed a crucial function within the success of a few of the largest astute endowments and foundations worldwide, with a few of the top-performing endowments allocating 20% to 25% to actual property. With many monetary advisers looking for to emulate the endowment mannequin with their particular person purchasers, they’re asking the query, “What’s the correct method by which to allocate to actual property, via liquid or illiquid actual property?”

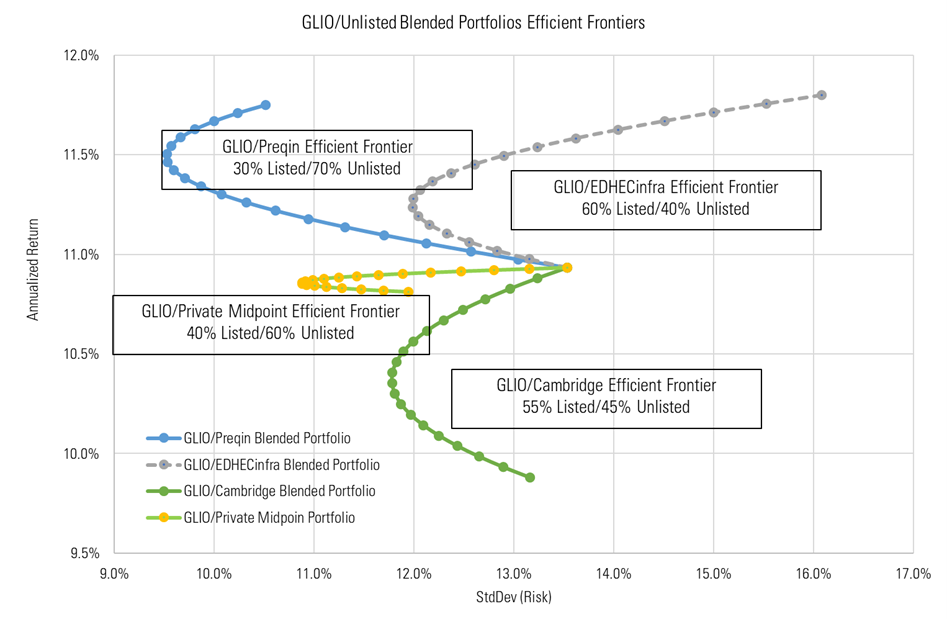

Let’s check out a selected class: infrastructure. In response to The International Listed Infrastructure Group (GLIO), the optimum infrastructure portfolio incorporates 30% listed infrastructure and 70% unlisted (personal markets) infrastructure to attain the portfolio that generates the very best return whereas sustaining the bottom customary deviation which could be seen within the environment friendly frontier chart beneath. (Chart: Supply – Supply: International Listed Infrastructure Group https://www.glio.org/journal problem 13)

Extremely-high web price people and enormous establishments sometimes make their infrastructure investments via personal infrastructure funds, the place they’ll profit from the funds’ diversification and the infrastructure funding experience of the managers. Nonetheless, these funds sometimes require giant minimal funding quantities (starting from $5 million to greater than $25 million for every fund), far past the technique of most particular person traders. Assembling a diversified portfolio requiring a number of funds is much more difficult for people and sometimes includes committing a number of hundred million {dollars} to diversify throughout primaries, secondaries and co-investments.

What choices can be found to realize publicity to this distinctive asset class?

With many monetary advisers and brokers looking for to emulate the endowment mannequin with their particular person purchasers, infrastructure and different actual asset methods have flourished up to now few years, aided by distinctive constructions that democratize entry to those asset courses via interval funds and non-traded REITs.

Interval funds supply particular person traders entry to an actively managed diversified portfolio of private and non-private investments with low funding minimums. This allows people to speculate alongside pension funds, endowments and different astute institutional traders.

There are challenges

Mass prosperous traders having access to illiquid alternate options creates each challenges and alternatives for all events concerned. Monetary advisors and dealer sellers should absolutely disclose the dangers launched with all these investments to purchasers. This may guarantee purchasers actually perceive the funding alternative from each side. Subsequently, training and coaching are required for advisors/brokers and their purchasers, together with asset high quality, appropriate kind and potential liquidity limitations with numerous merchandise.

A Difficult Monetary Atmosphere

International occasions akin to COVID, financial coverage, inflation and country-by-country financial repercussions have created difficult capital markets for international traders. The proof is mounting that that is resulting in liquidity points within the capital markets. As historical past has proven, there could be growing volatility and complexity in private and non-private markets.

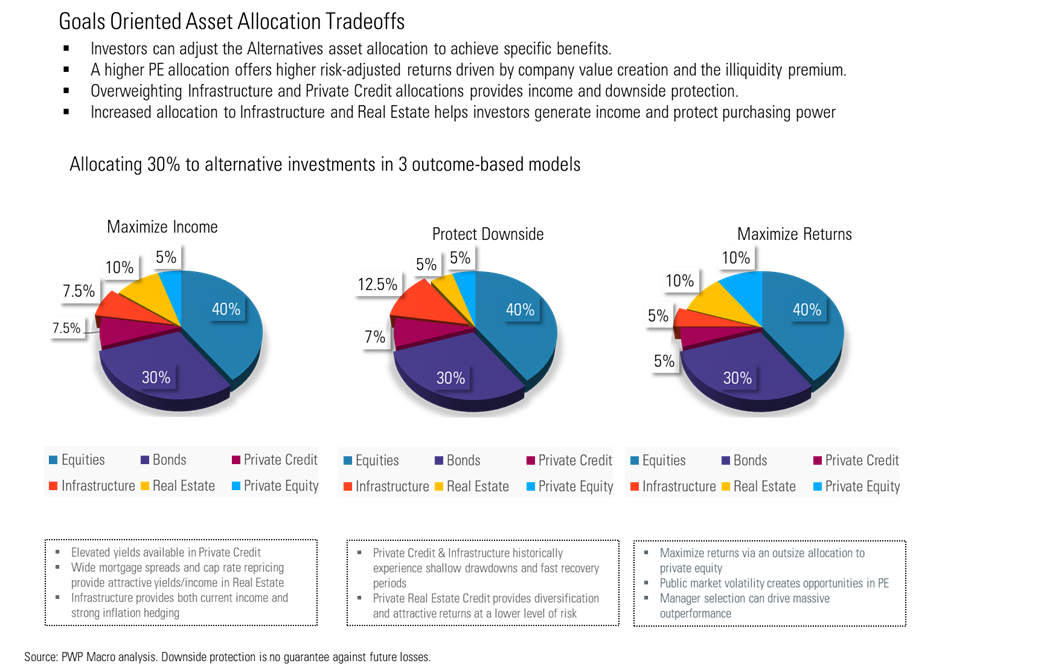

The latest consideration drawn to alternate options has been centered on headline grabbing points akin to liquidity and redemptions. There isn’t a digging into the elemental points akin to asset kind, portfolio administration inadequacies and asset legal responsibility which might be inflicting the issues. Each funding ought to require due diligence to find out if it’ll appropriately align with every investor’s targets and portfolio goal. Utilizing actual property requires the identical due diligence and extra elementary understanding of potential dangers vs rewards. Because the chart beneath illustrates, there are asset allocation trade-offs supplied with alternate options.

The investing public has been advised that investing in actual property carries extra threat and never as a lot potential return as conventional funding choices. Additional exacerbating the chance is the priority of liquidity for these investments. Nonetheless, as has been demonstrated, endowments, foundations and extremely excessive web price people have been having fun with vital monetary success with this asset class and over time have been allocating extra of their property into this house. We see a possibility for the mass prosperous traders to realize extra publicity to this asset house as a result of it could possibly doubtlessly enhance portfolio returns, present diversification away from conventional monetary merchandise, presumably enhance portfolio threat administration and improve entry to a big portion of the funding universe. The end result could possibly be a extra balanced enjoying discipline for all traders and an improved construction for profitable monetary outcomes.

Michael Underhill is President of ADISA. Underhill can also be founder and chief funding officer of Capital Improvements LLC. Underill is liable for overseeing international funding methods and leads Capital Improvements’ Funding Coverage Group, a discussion board for analyzing broader secular and cyclical developments that Capital Improvements believes will affect funding alternatives.

[ad_2]