[ad_1]

There are all the time going to be winners and losers within the system below which we function.

Some folks will all the time be doing higher than you whereas some folks will all the time be folks doing worse than you.

Proper or flawed, that’s a characteristic, not a bug.

More often than not it may take years, many years and even generations to separate the winners from the losers within the financial system.

Within the housing market, it occurred within the blink of an eye fixed, first with housing worth good points, then with the swift enhance in mortgage charges.

When you owned a house earlier than 2020 or so you need to be sitting on a pleasant pile of fairness. And in case you took out a mortgage or have been capable of refinance when mortgage charges have been at generational lows, you locked in among the finest inflation hedges possible.

When you missed out on each of those strikes, you’re rightfully feeling disregarded.

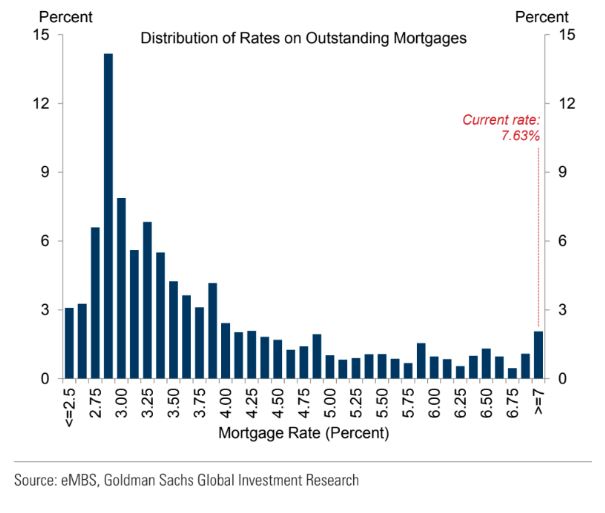

That is the present distribution of mortgage charges courtesy of Goldman Sachs:

If charges stay greater for longer this distribution will slowly change however that can be a gradual course of. Loads of owners have low charges locked in for the foreseeable future.

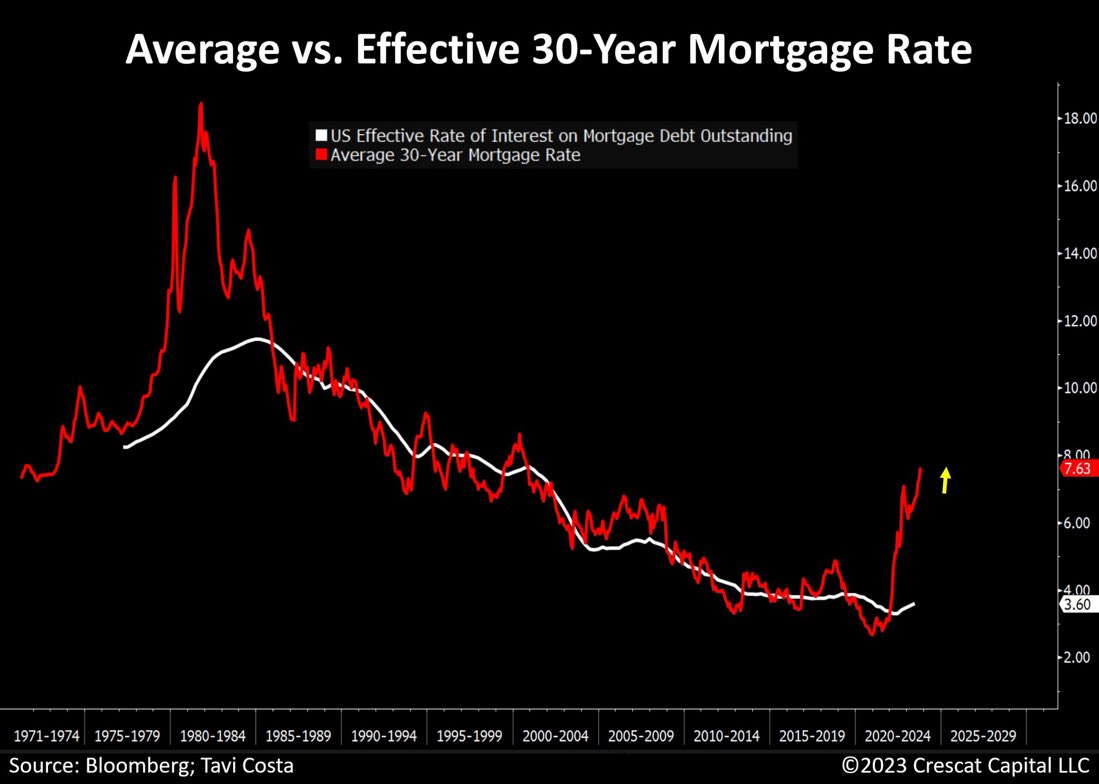

Right here’s one other method to have a look at this by evaluating the present mortgage charge to the efficient mortgage charge primarily based on the charges present owners are literally paying:

The final time we noticed a divergence this huge was within the early Eighties.

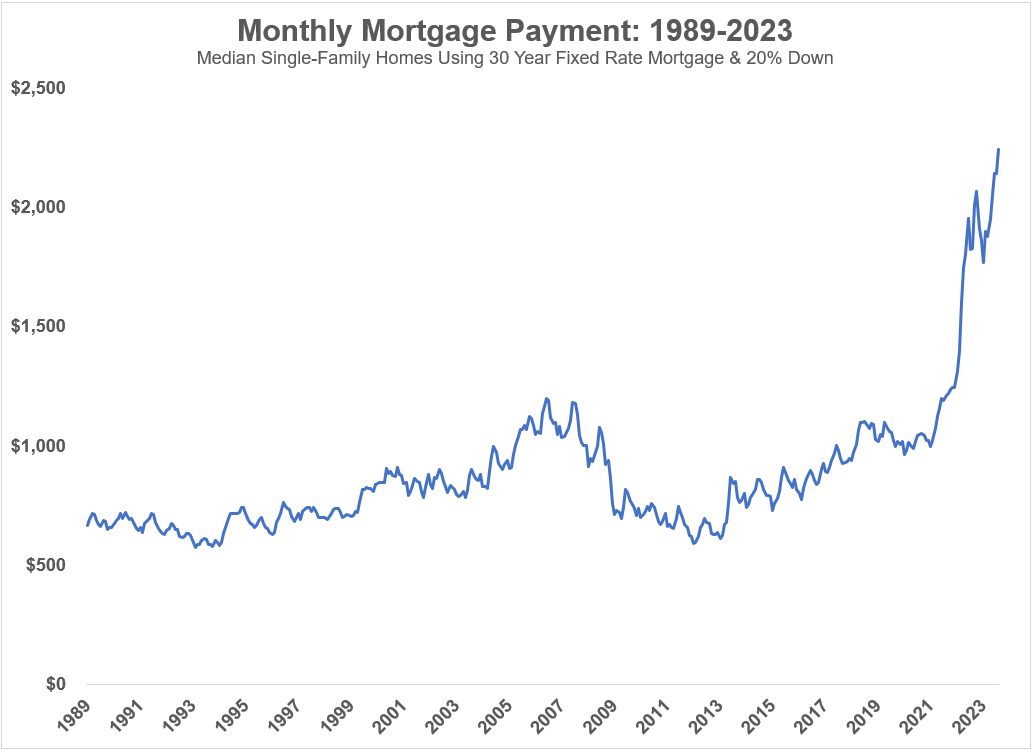

I’ve been maintaining monitor of month-to-month funds on U.S. current residence costs over time assuming a 20% down fee and the prevailing month-end 30 yr mortgage charges:

Each the rise and the tempo of change since 2021 are breathtaking.

The hope for folks taking out nosebleed mortgage charges proper now’s finally they’ll come again down. Possibly to not 3% however even 5% would sound interesting in the meanwhile.

That’s potential if inflation falls or the Fed lowers charges or development slows or we go right into a recession or the entire above.

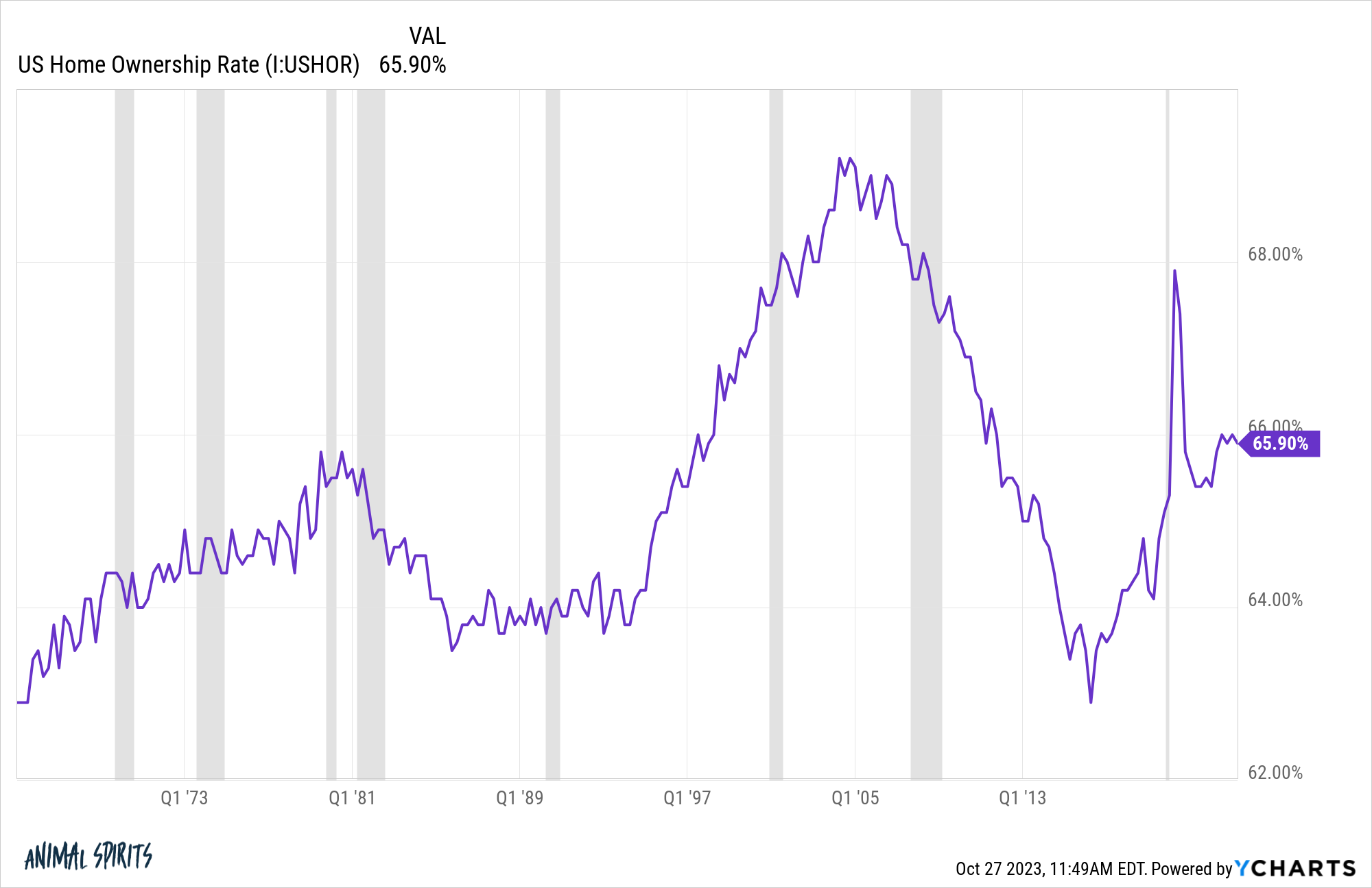

Whereas issues really feel extraordinarily unfair for younger folks and different first-time homebuyers, there are many individuals who already personal their properties:

The query is — how a lot is a low charge mortgage charge value proper now in a world of a lot greater charges?

For most owners, we’re in all probability speaking lots of of hundreds of {dollars}.

Mortgage charges have been 3% simply two years in the past on the tail-end of 2022. At the moment the median current residence worth was round $362k.

Listed below are the mortgage particulars for the median current residence worth in October 2021 with a 3% mortgage charge:

- 20% down fee: $72,400

- Remaining principal: $289,600

- Curiosity over the lifetime of the mortgage: $149,950

- Month-to-month fee: $1,220

It’s laborious to consider how affordable issues appeared not that way back.

Now listed below are the numbers utilizing the latest information with the identical assumptions:

- 20% down fee: $82,700

- Remaining principal: $330,800

- Curiosity over the lifetime of the mortgage: $477,555

- Month-to-month fee: $2,245

The largest distinction is clearly the curiosity expense, which flows by to a a lot greater month-to-month fee. Two years in the past you’ll have been paying round 40% of the acquisition worth in curiosity prices over the 30 yr lifetime of the mortgage.

Now the curiosity prices are greater than the price of the home!

It’s now slightly greater than $1,000 extra for the month-to-month fee. The all-in price with greater charges provides near $380k over the lifetime of a 30 yr mortgage.

That’s greater than the median existing-home worth was again in late-2021!

And we didn’t even add residence fairness to the equation.

Clearly, the hope is you finally get to refinance to take down that debt burden however the greater month-to-month funds within the meantime aren’t very a lot enjoyable.

Possibly mortgage charges or housing costs will come again down within the coming years to even issues out slightly. That’s the hope for many who wish to purchase.

Sadly, there are not any ensures for the place mortgage charges go from right here.

When you have been capable of lock in decrease housing costs and decrease mortgage charges think about your self fortunate.

I’m guessing many owners couldn’t afford their very own properties at prevailing costs and mortgage charges.

Generally it doesn’t appear truthful how the winners and losers are decided on this loopy world of ours.

Nonetheless, I’m unsure we’ve ever skilled a wider hole between the winners and losers in one thing as large and necessary because the housing market.

That is going to have an enduring affect for years to come back and I don’t suppose we’ve thought by the potential ramifications but.

Additional Studying:

The Worst Case State of affairs for the Housing Market

[ad_2]