[ad_1]

Arch, a know-how platform that automates the operations and reporting for personal investments, has raised $20 million in Sequence A funding, led by Menlo Ventures. Present buyers Craft Ventures and Quiet Capital additionally participated within the funding spherical, in addition to new buyers, together with Carta, Citi Ventures, GPS Funding Companions and Focus Monetary Companions.

A coterie of particular person fintech founders, buyers and entrepreneurs additionally participated within the spherical, together with the founders of Altruist and Vanilla, in addition to that of Aduro Advisors (a fund administration firm), Equi (an alternate options platform), and Sydecar (a deal execution platform for enterprise buyers). Scott Prince, govt chairman at Service provider; Gary Cohn, vice chairman at IBM; and Marc Spilker, co-founder at GPS Funding Companions and govt chairman at Service provider, additionally invested.

In 2021, Arch raised an preliminary $5.5 million, bringing its whole funding to this point at over $25 million.

Arch was launched in 2018 by co-founders Ryan Eisenman, Joel Stein and Jason Trigg, and goals to resolve many of the ache factors monetary advisors have with investing in alternate options, together with accumulating Okay-1s, the tax types used for personal investments; managing capital calls; and monitoring efficiency, money flows and metrics throughout investments.

“Arch solves these workflow and knowledge issues,” Eisenman stated. “We’ll join to each portal, platform, fund, admin, pull all of the paperwork right into a single platform, digitize these paperwork and pull the important thing knowledge factors out of them, after which replace downstream reporting programs like Addepar, Black Diamond, Orion and Tamarac, in order that shoppers know what they’re invested in and the way these investments are performing, in order that advisors can report on these belongings, and likewise to avoid wasting a number of the executive and operational time of getting Okay-1s to accountants and realizing what capital calls have to be accomplished.”

On common, a personal fund will concern 4 capital calls a 12 months, Eisenman stated.

“You probably have 500 energetic funds throughout your shoppers, that may very well be 2,000 capital calls a 12 months,” he stated.

“In my very own private account, I do know these pains. I’ve lived them,” stated Luis Valdich, managing director of the VC group at Citi Ventures. “What actually excites us about Arch is how they’ve honed in on this huge downside for the business and for buyers, and developed a reasonably compelling answer that can successfully extract all of the related knowledge out of your Okay-1s in a central place that can make all these features of managing your alternate options, beginning with the tax piece, much more environment friendly.”

To make certain, there are different platforms already on the market doing a few of this administrative work on behalf of advisors, comparable to CAIS and iCapital Community. Actually, Citi Ventures can be invested in iCapital. However these platforms automate these duties just for the asset managers on their platforms. Arch captures something with a GP or LP construction, in addition to personal firms, immediately held actual property and immediately held startup investments.

“If all your investments are with a CAIS or an iCapital, then you definitely seemingly don’t want Arch, as a result of every part is centralized in a single platform,” Eisenman stated. “The truth on the bottom is, even when an advisor has an unique relationship with CAIS or iCapital, they may have alts that pre-date CAIS or iCapital, and their shoppers would possibly spend money on alts outdoors of the platform—what folks would possibly name ‘off-platform’ or ‘held-away alts.’

“What Arch will do is acquire all that data—from CAIS, iCapital and any outdoors managers direct from managers or direct from the platform—and put all of it right into a single platform.”

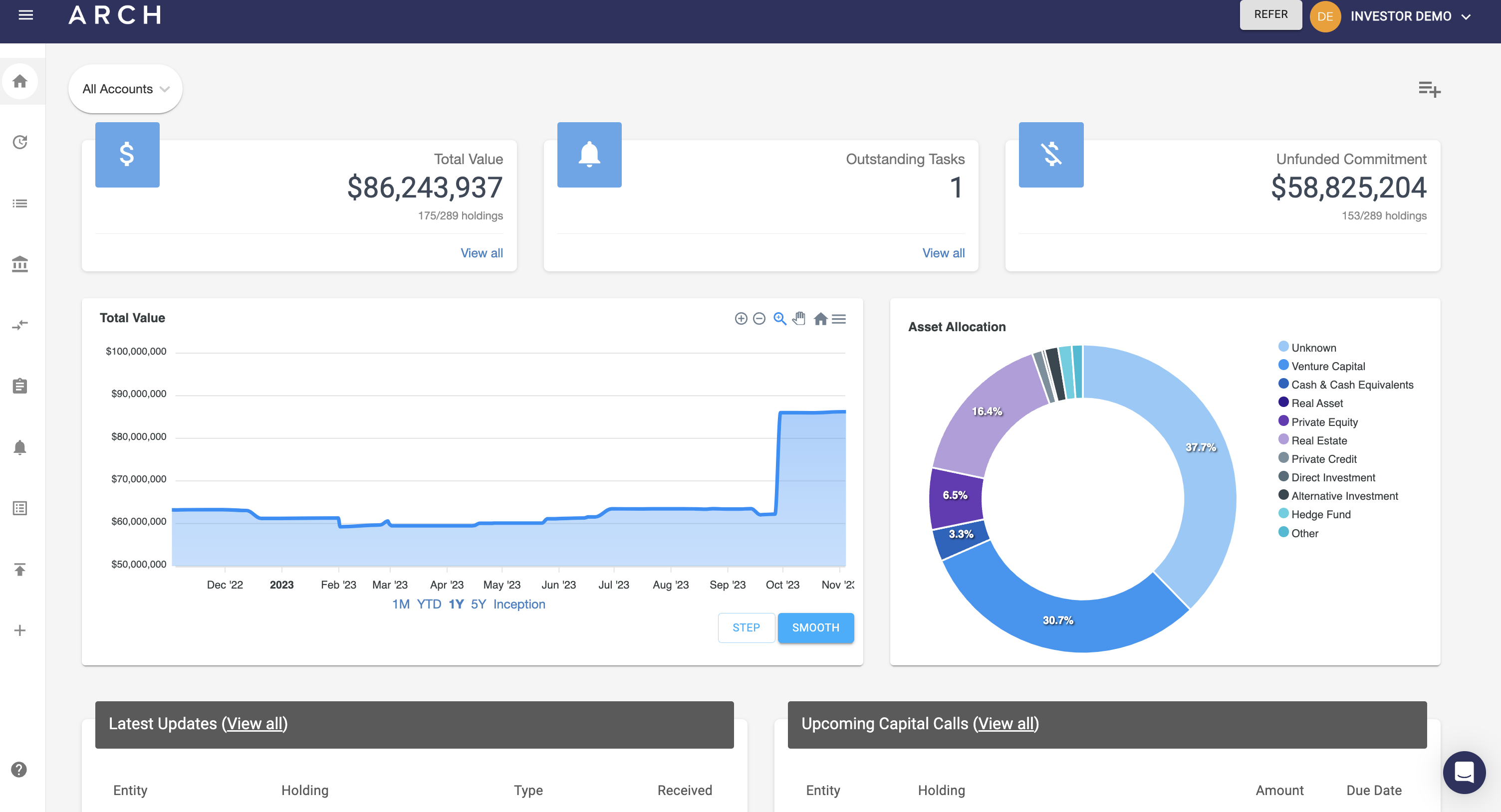

The Arch residence display screen.

A number of the folks and the corporations that invested on this funding spherical have skilled the ache factors with alternate options firsthand, Eisenman stated.

“Alts is a key a part of a number of these companies, and it’s a rising a part of a number of these companies. And a number of the those who have invested have seen this ache level personally, along with seeing a few of the functions inside their companies. They see the potential of, ‘Effectively, if Arch does their job and executes, then we don’t should construct a few of these painful components of the tech stack. We are able to simply combine this knowledge into what they’re doing.’”

Croom Beatty, accomplice at Menlo Ventures, stated the info infrastructure facet of Arch was actually attention-grabbing to him; the corporate is constructing that infrastructure by integrating into all of the GP portals and fund directors. He in contrast it to what Plaid is doing with its knowledge connectivity instruments.

“It’s very attention-grabbing, this Plaid-esque knowledge aggregation downside that they’re fixing, which is giving them this nearly like foundational plank from which they’ll sort of spin off all these different knowledge merchandise and workflows,” Beatty stated.

Arch presently serves over 50 RIAs and multi-family places of work, over 50 single-family places of work and a pair dozen institutional shoppers, representing about $62 billion in belongings. In addition they lately signed on one of many 5 greatest U.S. banks by belongings, however he declined to call them.

Advisors are charged by the variety of investments on the platform, not on an AUM foundation, as this anchors the value to the fee financial savings it brings corporations.

“It permits us to essentially be intentional and bold round our roadmap and what we’re capable of construct and the way we’re capable of enhance shoppers’ alts expertise. It permits us to scale our inside operations and our consumer service workforce forward of bigger shoppers which are coming onto the platform later this 12 months and into subsequent 12 months,” Eisenman stated.

Whereas iterating on the preliminary build-out of Arch Eisenman’s workforce remained lean with simply 5 staff, however within the final two years it has grown to 60. Arch plans to place the funding towards analysis and growth and constructing out its options and performance. One space of growth is decreasing the danger of fraud inside capital calls, whereas one other is integrating the info with totally different programs, comparable to normal ledgers, reporting platforms and CRMs. The corporate shall be releasing an API to permit anybody to combine with Arch. The funding may even go in direction of ramping up its advertising efforts, till now, most of its enterprise has come by way of consumer referrals.

[ad_2]