[ad_1]

In a rational world each investor would set their asset allocation based mostly on their willingness, capacity and must take threat.

One would steadiness a variety of expectations for the varied asset lessons and match these potentialities with their objectives and targets.

Certain, loads of traders take into account their threat profile and time horizon when constructing a portfolio.

However we stay in an irrational world — one through which experiences, feelings, circumstances, luck and timing form each emotions and portfolios.

The Economist lately had a wonderful profile on how younger individuals ought to take into consideration investing and why they shouldn’t freak out due to the inflationary bear market of 2022.

They level to analysis from Vanguard that exhibits your early expertise within the markets can form your asset allocation and funding posture for years to return:

Ordering the portfolios of Vanguard’s retail traders by the 12 months their accounts have been opened, his crew has calculated the median fairness allocation for every classic (see chart 3). The outcomes present that traders who opened accounts throughout a growth retain considerably increased fairness allocations even many years later. The median investor who began out in 1999, because the dotcom bubble swelled, nonetheless held 86% of their portfolio in shares in 2022. For many who started in 2004, when reminiscences of the bubble bursting have been nonetheless recent, the equal determine was simply 72%.

Subsequently it is rather attainable at the moment’s younger traders are selecting methods they are going to comply with for many years to return.

That is the aforementioned chart:

These outcomes are considerably shocking. Most individuals assume dwelling by way of the inevitable bust that follows a growth would go away a bitter style in your mouth.

However the reverse is true. Traders who opened accounts throughout growth occasions truly retained a increased allocation to shares for years to return.

Possibly it’s inertia but it surely’s apparent inventory market returns in your childhood as an investor can have an effect on the way you make investments.

The onerous half about all of that is you don’t get to decide on when your returns come as an investor. Generally you get good returns whenever you’re younger, typically whenever you’re previous.

Some retirees get fabulous bull markets proper once they go away the working world whereas some retire into the tooth of a bear market.

Timing and luck — each good and dangerous — play an enormous function in your expertise as an investor.

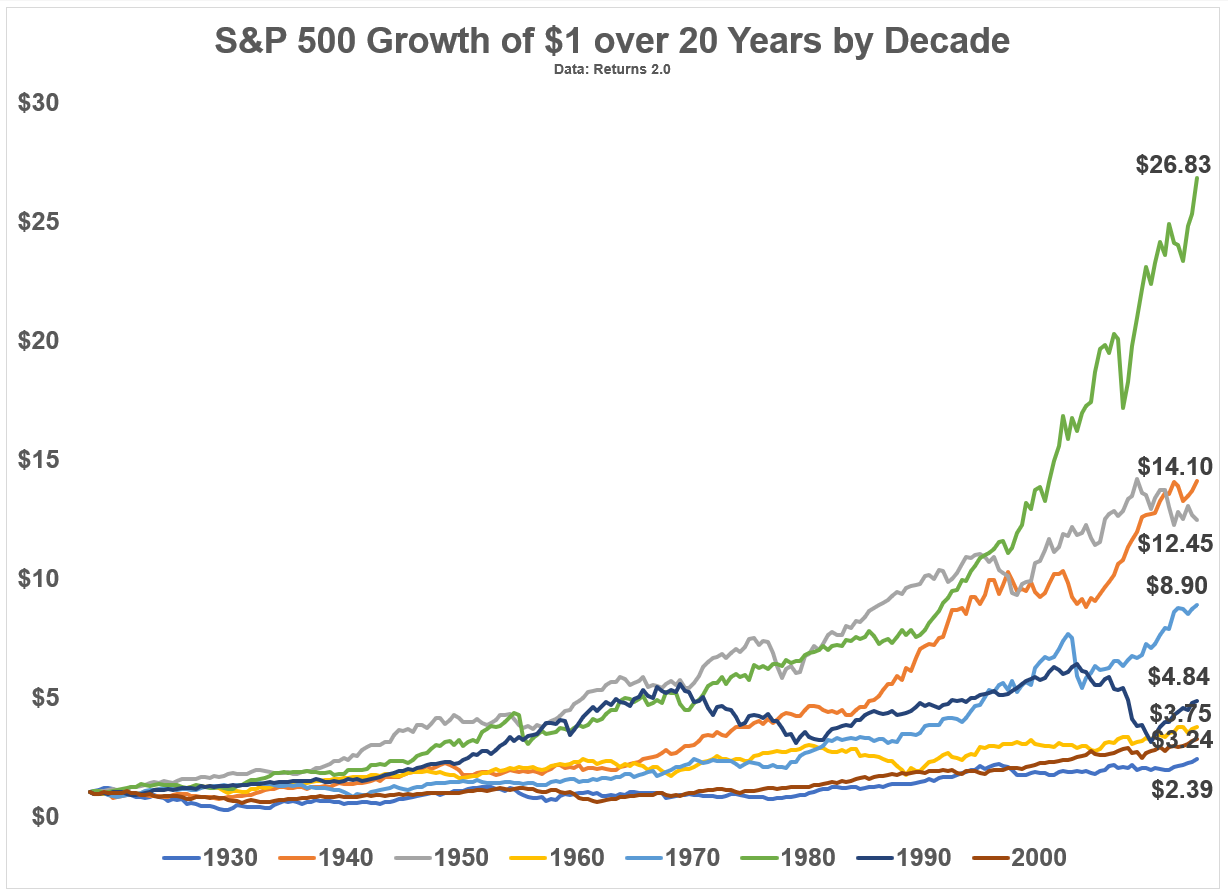

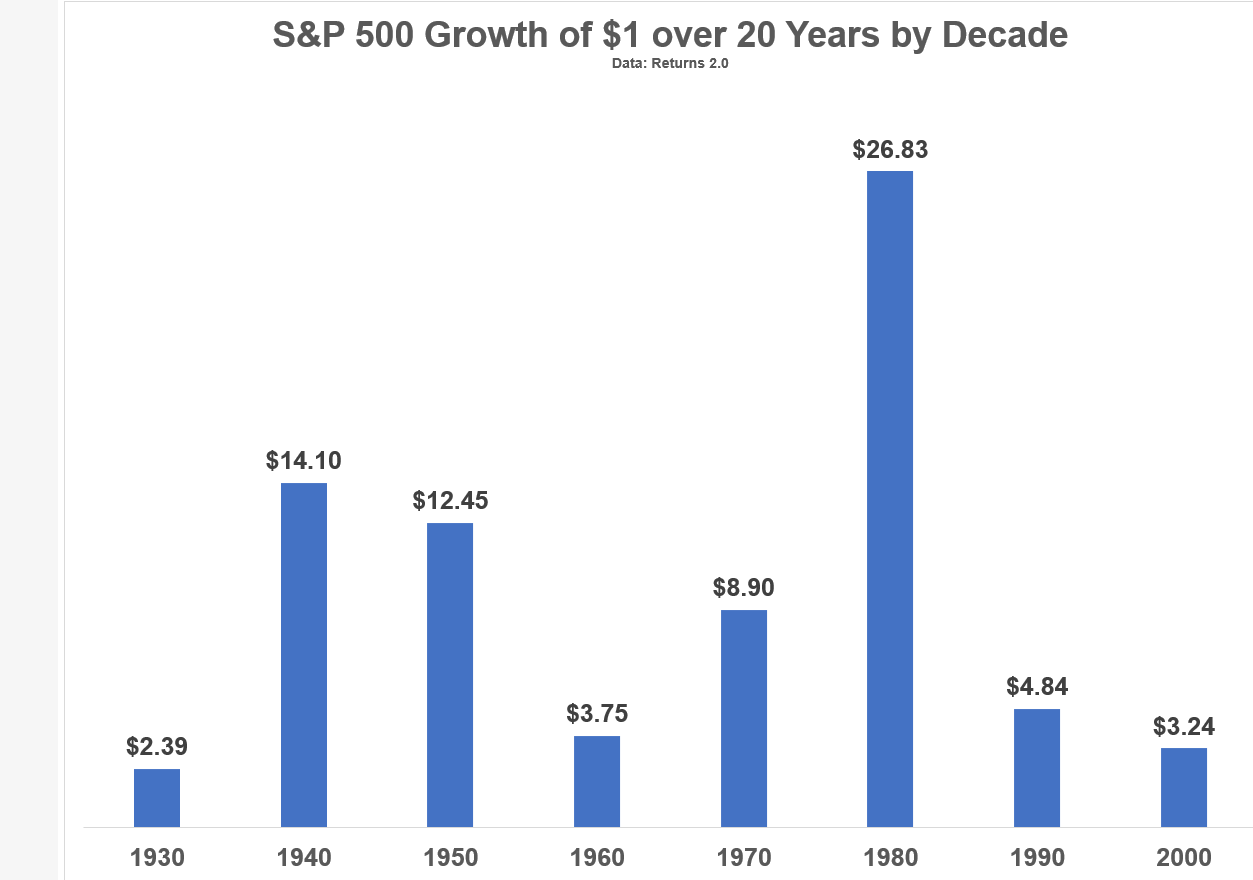

I calculated the expansion of $1 invested within the S&P 500 over a 20 12 months interval firstly of every decade going again to the Nineteen Thirties:

There’s a variety of outcomes, to say the least.

Right here’s one other means of taking a look at these numbers: FIX CHART

Begin investing in 1980 and it seems simple. Begin within the Nineteen Thirties and also you in all probability need nothing to do with shares.1

It’s additionally essential to notice “dangerous” markets with poor returns aren’t essentially a poor end result for everybody.

Should you’re a internet saver, you need to need crappy returns, particularly early in your profession.

Threat means various things to completely different traders relying on their stage in life.

Sadly, there are various variables exterior of your management in terms of investing.

You’ll be able to’t management the timing or magnitude of returns the markets provide. You additionally don’t management rates of interest or inflation or financial development or tax charges or the labor market or the actions of the Fed and politicians.

Life could be simpler for those who did however nobody stated life is straightforward.

One of the best you are able to do is concentrate on what you’ll be able to management — your habits, your financial savings charge, your asset allocation, your prices, your time horizon — and play the hand you’re dealt.

Additional Studying:

The Psychological Account of Asset Allocation

1I might have adjusted these outcomes for inflation as a result of that’s what everybody asks me for lately however you get the thought.

[ad_2]