[ad_1]

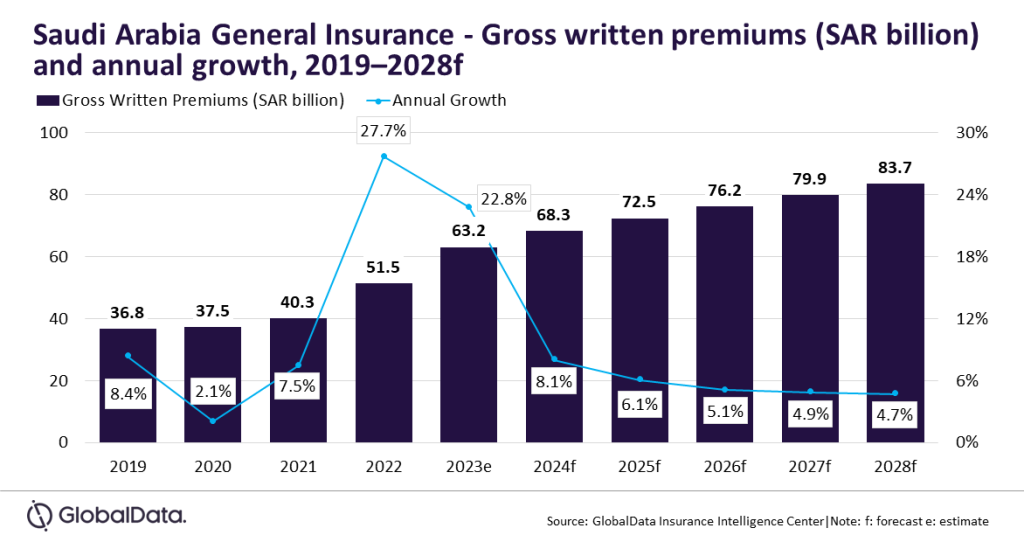

The overall insurance coverage market in Saudi Arabia is ready to develop at a CAGR of 5.2% between 2024 and 2028.

This might take the final insurance coverage trade from SAR68.3bn ($18.2bn) in 2024 to SAR83.7bn ($22.3bn) in 2028 by way of GWP.

In keeping with GlobalData and its insurance coverage database, additionally, the final insurance coverage trade will develop by 8.1% in 2024.

Well being and motor insurance coverage strains, accounting for 86% of the overall basic insurance coverage GWP in 2023, will assist this progress.

Sutirtha Dutta, insurance coverage analyst at GlobalData, commented: “The Saudi Arabian basic insurance coverage trade witnessed excessive progress of 27.7% in 2022 and 22.8% in 2023. The expansion was supported by favorable regulatory developments in motor and medical insurance strains, rising development actions, rising choice for specialised healthcare, and rising motorcar gross sales.”

Nevertheless, the expansion is anticipated to stablise from 2024 according to financial progress because the nation shifts from oil to develop different sectors comparable to transport, logistics, expertise, and metals.

Entry essentially the most complete Firm Profiles

in the marketplace, powered by GlobalData. Save hours of analysis. Achieve aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain electronic mail will arrive shortly

We’re assured concerning the

distinctive

high quality of our Firm Profiles. Nevertheless, we wish you to take advantage of

useful

choice for your enterprise, so we provide a free pattern which you can obtain by

submitting the under type

By GlobalData

Private Accident and Well being (PA&H) insurance coverage is the main line of enterprise, accounting for a 63.2% share of Saudi Arabia basic insurance coverage GWP in 2023.

Moreover, PA&H insurance coverage grew by 25.5% in 2023, pushed by an increase in well being consciousness and rising demand for specialised healthcare.

Motor insurance coverage is the subsequent largest line of enterprise, accounting for 23.1% of basic insurance coverage GWP in 2023. It’s anticipated to extend by 41.4% in 2023, pushed by rising automobile gross sales.

Dutta added: “The growth of the healthcare and development industries as a part of the Imaginative and prescient 2030 program will drive the expansion of Saudi Arabia’s basic insurance coverage trade. The nation’s shift from an oil-based financial system will promote improvement in different sectors and supply progress alternatives for basic insurers over the subsequent 5 years.”

[ad_2]