[ad_1]

As a higher variety of tech firms develop their very own in-house synthetic intelligence (AI) options to realize a aggressive edge, this has created a chance for insurers. Munich Re and different (re)insurers are actually concentrating on companies that use independently developed AI options with new insurance coverage merchandise that defend them from monetary losses. This development comes because of elevated AI improvement in recent times.

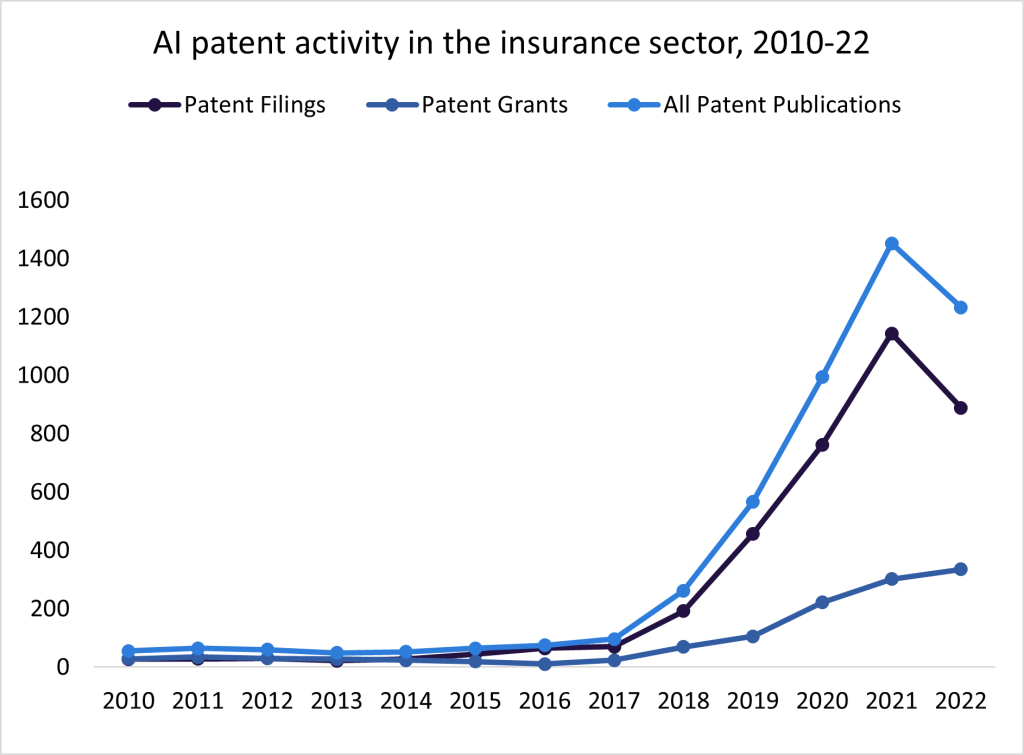

The insurance coverage trade has seen a rise in patent filings in recent times in keeping with GlobalData’s Patent Analytics database, which signifies rising curiosity in innovation and expertise inside the sector. It isn’t simply tech corporations which can be incorporating AI into their operations; insurers all through the trade have additionally been using AI to help their claims, customer support, and underwriting capabilities. One instance is Zurich, which is testing the way it can use ChatGPT in areas resembling claims and modeling. Provided that AI is turning into a serious a part of operations throughout a number of industries, the introduction of insurance coverage merchandise concentrating on the AI house comes on the proper time. It’s anticipated that insurers will proceed to develop on this house to cater to the ever-growing variety of potential shoppers.

Munich Re’s aiSelf – which is particularly designed for companies which have created their very own in-house AI options – is a first-rate instance of this development. Munich Re launched the product in April 2023, providing safety from monetary loss as a consequence of errors and omissions ensuing from using these AI options. As extra companies try and implement their very own AI options and because the dangers associated to AI develop into extra broadly identified, any such cowl can be more and more important.

The introduction of aiSelf exhibits that the insurance coverage sector is conscious of the necessity to present help for companies trying to make use of superior AI and expertise. Insurance coverage firms are working to undertake and invent new merchandise for these applied sciences whereas additionally making an attempt to patent investments in their very own AI options. That is prone to proceed because the dangers develop into extra understood and as all industries place higher emphasis on innovation utilizing AI.

[ad_2]