[ad_1]

As our business continues to age, we discover our day by day conversations with advisors more and more centered round succession/continuation plans; the contemplation of when or if to retire is sort of a day by day incidence. Our private experiences, in addition to witnessing others’ journeys, mildew our preconceived notions on whether or not retirement is in the end in our greatest curiosity. The sharing of journeys in addition to statistical information with reference to retirement have proven us that working longer brings larger achievement, maintains your sense of purposefulness and provides longevity, all whereas serving to to protect psychological acuity. Listed here are two examples of deferring retirement so long as attainable and their motives.

A member of the family that may be a CFP, EA has had a tax apply and monetary planning enterprise for a few years, however at 68 he determined to decelerate, so he bought the tax preparation aspect of the enterprise to his associate and half his guide to his son. He meant to spend extra time with household and golf extra usually, whereas managing a smaller guide. Over the subsequent few years, his guide grew again to the place it was earlier than the sale. Being linked to his group and being older, folks got here to him for his knowledge and expertise. As he defined, “You may solely golf a lot, and albeit, I really feel that God made me for serving the shoppers I’ve. I get pleasure from what I do, so why not preserve doing this so long as I can?” Now 78, some well being points have surfaced and the stress that previously he thrived on, now wears him down. He’s now within the strategy of promoting his guide.

An advisor that I positioned in 2016 can’t carry himself to retire when his shoppers, as he places it, “Aren’t shoppers however buddies.” He works 20 hours every week with a guide made up of principally mutual funds, so his earnings is sort of all trails. Although many would salivate over the considered changing his $250 million of property to advisory, that by no means resonated for him nor to his shoppers. So, at age 66, he maintains his guide of mutual funds and retains in contact with shoppers. He was recognized with Parkinson’s two years in the past, but it surely hasn’t slowed him down nor brought on him to ponder retirement. In the end, will probably be his Parkinson’s that can outline his retirement date. He additionally appreciates the time at work, because it supplies time aside from his spouse as a result of an excessive amount of time collectively could be problematic, as they’ll drive one another a bit loopy with out some house. Absence usually does make the guts develop fonder; {couples} often get pleasure from one another extra after they’ve had a while aside.

If you see folks like Warren Buffett, age 92, or his associate Charlie Munger, age 99, nonetheless energetic within the enterprise, absolutely engaged, you’ll be able to’t assist however surprise, is that this the key to longevity?

It seems that statistically, persevering with to work later in life is best for longevity in addition to psychological and monetary well being.

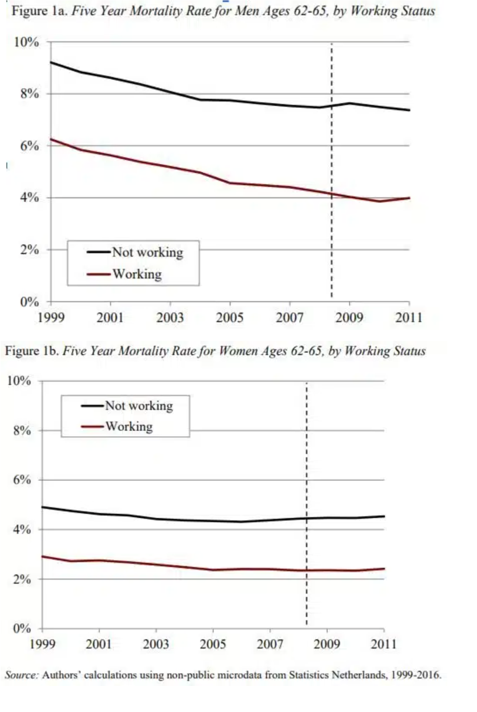

Oregon State College did a research in 2016 that discovered that wholesome individuals who labored only one extra yr past 65 had an 11% decrease danger of demise from all causes in contrast with those that retired at 65. A Netherlands research got here to the identical conclusion, as they studied the five-year mortality price of women and men aged between 62 and 65, with the outcomes exhibiting with out query, that our common life expectancy will increase by delaying retirement.

A 2015 research by the CDC added to this consensus, discovering that folks working previous age 65 had been about thrice extra prone to report being in good well being and half as prone to have severe well being issues. One facet to retirement that may’t be denied is dropping a way of function, which may result in psychological decline. After we cease working, oftentimes so does our mind. The CDC noticed the working group expertise some psychological decline, but it surely progressed at a 50% decrease price than retirees as a complete.

Paring Down Your Observe

In case you are in your 60s or 70s, think about paring down your guide to the place you’ve got the most effective of each worlds (nonetheless work however extra free time). One methodology we regularly see is to promote your “B” and “C” shoppers if you wish to reduce the time dedication you at the moment have. Along with your remaining “A” shoppers, take solely those who, as my advisor pal states, you think about to be extra like buddies. Undue stress is vital to maintain out of your life as you age, so removing these shoppers which are complainers, query your recommendation, waste your time or appear to be potential sources for future buyer complaints is a should. In case you are like my father-in legislation and discover new folks knocking in your door to be shoppers, don’t really feel it’s impolite to have clear boundaries to maintain your guide at a particular measurement. Have somebody you’ll be able to refer them to so that you don’t find yourself having extra of your time taken than you need.

We’re lucky in our business that many love what they do. Over half the advisors we ask, “How for much longer will you be within the enterprise?” reply, “So long as I can.”

Semi-retirement is a candy spot the place you’ll be able to nonetheless journey, spend time on exterior pursuits or broaden into new pursuits. You’ll nonetheless be energetic together with your finest shoppers, sustaining function and psychological acuity, whereas having fun with larger monetary freedom.

Jonathan Henschen is the president of Henschen & Associates, a recruiting agency in Marine on St. Croix, Minn.

[ad_2]