[ad_1]

At the moment’s Animal Spirits is dropped at you by PacerETFs:

See right here for extra info on the Pacer Money Cow ETF Collection

On at the moment’s present, we focus on:

Future Proof:

Hear Right here:

Suggestions:

Charts:

Tweets:

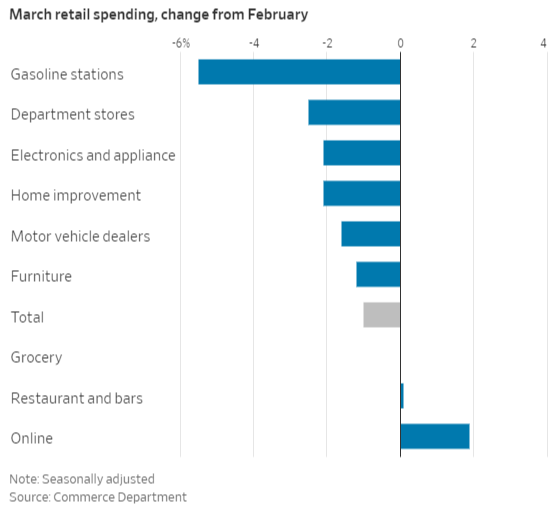

“.. Retail Gross sales – Yikes ..

.. the diffusion index is the bottom since April 2020, and .. it has by no means been this damaging exterior of a recession.”@bespokeinvest pic.twitter.com/boGHn1AjQ5

— Carl Quintanilla (@carlquintanilla) April 14, 2023

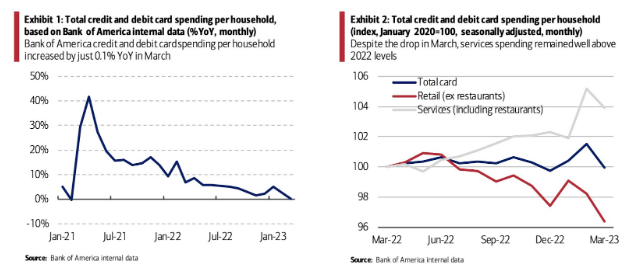

“Financial institution of America credit score and debit card spending per family moderated additional in March, to 0.1% year-over-year (YoY), the slowest tempo since February 2021. Sequentially, card spending per family fell 1.5% month- over-month (MoM), seasonally adjusted.” BofA pic.twitter.com/SK82eeS0v1

— Sam Ro 📈 (@SamRo) April 12, 2023

Vanguard additionally led in ETF flows w $25b (36% forward of #2), closing mkt share hole w BlackRock which noticed outflows (altho that will not final). Additionally loopy stat: Vanguard’s US fairness ETFs took in $13b in Q1, remainder of trade mixed noticed outflows. Relentless bid staying relentless. pic.twitter.com/xcA9ABnhO2

— Eric Balchunas (@EricBalchunas) April 14, 2023

We anticipate Vanguard to dominate ETFs for fairly some time and surpass BlackRock in market share in subsequent two years-ish. Not solely have they got the pure demand but in addition BYOA as mutual funds nonetheless make up about 3/4 of their aum and chunk of that can change over to ETF format. pic.twitter.com/n3zYsGFe0A

— Eric Balchunas (@EricBalchunas) April 14, 2023

The final 10 annualized inflation readings:

June 9.06%

July 8.52%

Aug 8.26%

Sept 8.20%

Oct 7.75%

Nov 7.11%

Dec 6.45%

Jan 6.41%

Feb 6.04%

March 4.98%I spot a pattern in there someplace

— Ben Carlson (@awealthofcs) April 12, 2023

Power costs declined over the previous 12 months, the primary 12-month decline since January 2021. Collectively, meals and vitality clarify simply over a tenth of inflation over the previous 12 months. 15/ pic.twitter.com/u32ktek4O7

— Council of Financial Advisers (@WhiteHouseCEA) April 12, 2023

A couple of chart updates with our CPI calculations that embody different shelter elements.

Formally CPI shos headline inflation of 5.0% final 12m, our calculations present <3%:

Inflation was a lot increased in actuality earlier than and now a lot decrease. pic.twitter.com/okOMZZofmd

— Jeremy Schwartz (@JeremyDSchwartz) April 12, 2023

A decent labor market has led to document good points for employees on the backside — even after inflation.

Against this, it took till 2017 for the underside half of Individuals to climb again to pre-Nice Recession ranges of actual earnings. @Morning_Joe pic.twitter.com/LzX8RVl1hT

— Steven Rattner (@SteveRattner) April 13, 2023

The music trade is about to alter ceaselessly.

This AI-generated track created by “ghostwriter977” is blowing up on TikTok.

It options AI Drake ft. The Weeknd, and is SO good. Sound on 🔊👇 pic.twitter.com/R7xb7xxOI1

— Rowan Cheung (@rowancheung) April 15, 2023

I’m fairly freaked out about job losses from AI

This isn’t like we created a brand new tractor for farmers that requires 10 fewer farmers

AI is a software that can require fewer individuals for ALL work

That is like the discharge of a brand new mega tractor for each trade, all on the identical time

— Andrew “The Metaverse Man” Steinwold (@AndrewSteinwold) April 15, 2023

#NEW The house worth correction has misplaced extra geographical steam in March.

In March, 23% of the nation’s 200 largest housing markets registered a month-over-month decline in house costs.

77% of markets registered a rise.

Supply: Seasonally adjusted ZHVI pic.twitter.com/X9Hb7iJAYU

— Lance Lambert (@NewsLambert) April 12, 2023

Among the many nation’s 400 largest housing markets tracked by Zillow, 218 markets are again to—or simply set—a brand new all-time excessive for home costs. https://t.co/hZadj4ucrG

— Lance Lambert (@NewsLambert) April 15, 2023

#NEW Zillow house worth knowledge for America’s 30 largest housing markets

1. MoM (month over month)

2. YTD (12 months to this point)

3. Down from peak

4. YoY (12 months over 12 months)

5. Change since March 2020

6. Pandemic Housing Increase good points at peakSeasonally adjusted, by way of March 2023 pic.twitter.com/FiKumLBOat

— Lance Lambert (@NewsLambert) April 12, 2023

That being mentioned, costs are usually not leaping, however they’re ticking up. Comparisons to 2022 will preserve getting worse till Q3

Median worth of single household houses is $439,900. Nonetheless up a tad over 2022

Median worth of the brand new listings is $399,000. About 4% decrease than final 12 months.

3/6 pic.twitter.com/vqkSDJvZ5s

— Mike Simonsen 🐉 (@mikesimonsen) April 17, 2023

*New analysis* If distant work triggered inhabitants loss in large costly cities, why did their rents and home costs go up? My new paper with @ecarl_economics suggests one reply: family formation! https://t.co/rkUKZYlrTg

— Adam Ozimek (@ModeledBehavior) April 12, 2023

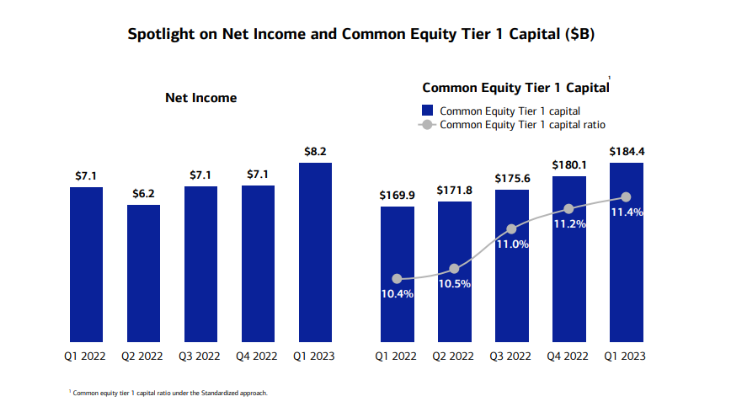

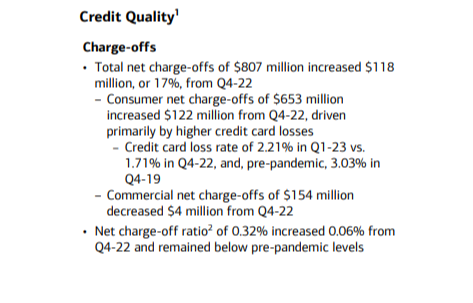

JPMorgan’s Dimon: U.S. Economic system Continues to Be on Usually Wholesome Footings

JPMorgan’s Dimon: Storm Clouds Stay on Horizon, Banking Trade Turmoil Provides to Dangers

— *Walter Bloomberg (@DeItaone) April 14, 2023

At one level within the Nineties, over 80% of all U.S. deposits had been explicitly lined by FDIC deposit insurance coverage. Since then, insured deposits have fallen to ~55%, the bottom stage because the Sixties. pic.twitter.com/u2rfBKWVf0

— John Paul Koning (@jp_koning) April 11, 2023

I do not assume we have spent sufficient time marveling at the truth that Meta fully upended its enterprise, renamed itself and insisted the metaverse was the Subsequent Massive Factor solely to have AI show that completely unsuitable like six months later.

— Philip Bump (@pbump) April 17, 2023

New automobile stock has formally hit HIGHEST stage in 2 years. Massive.

Manufacturers with most availability:

— Ram (most)

— Buick

— Jeep

— Chrysler

— JaguarSolely draw back?

There may be nonetheless large variation by model section.

Particularly, non-luxury and luxurious imports nonetheless have the bottom…

— CarDealershipGuy (@GuyDealership) April 13, 2023

Contact us at animalspiritspod@gmail.com with any suggestions, suggestions, or questions.

Comply with us on Fb, Instagram, and YouTube.

Take a look at our t-shirts, espresso mugs, and different swag right here.

Subscribe right here:

Wealthcast Media, an affiliate of Ritholtz Wealth Administration, obtained compensation from the sponsor of this commercial. Inclusion of such ads doesn’t represent or indicate endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investing in speculative securities entails the chance of loss. Nothing on this web site ought to be construed as, and is probably not utilized in reference to, a suggestion to promote, or a solicitation of a suggestion to purchase or maintain, an curiosity in any safety or funding product.

[ad_2]