[ad_1]

Samsung Bioepis has a Biosimilar Market Report for Q2 2024. Some key highlights:

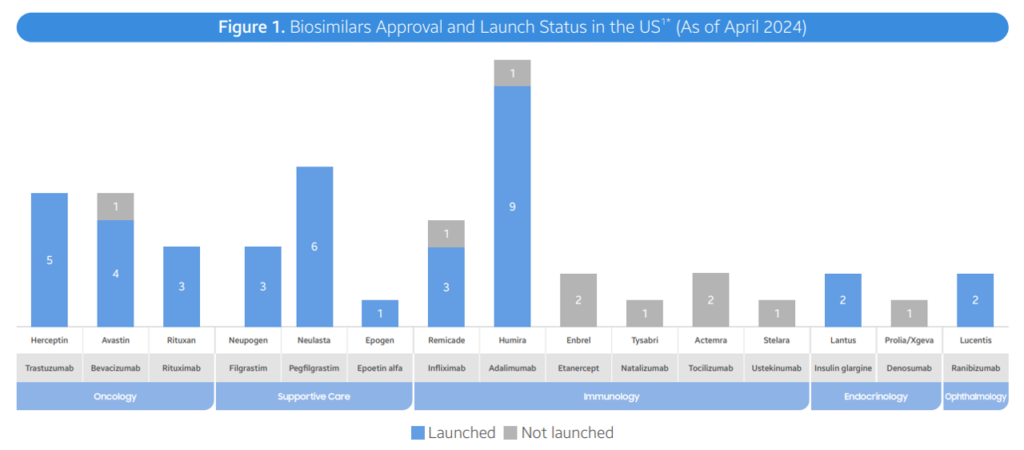

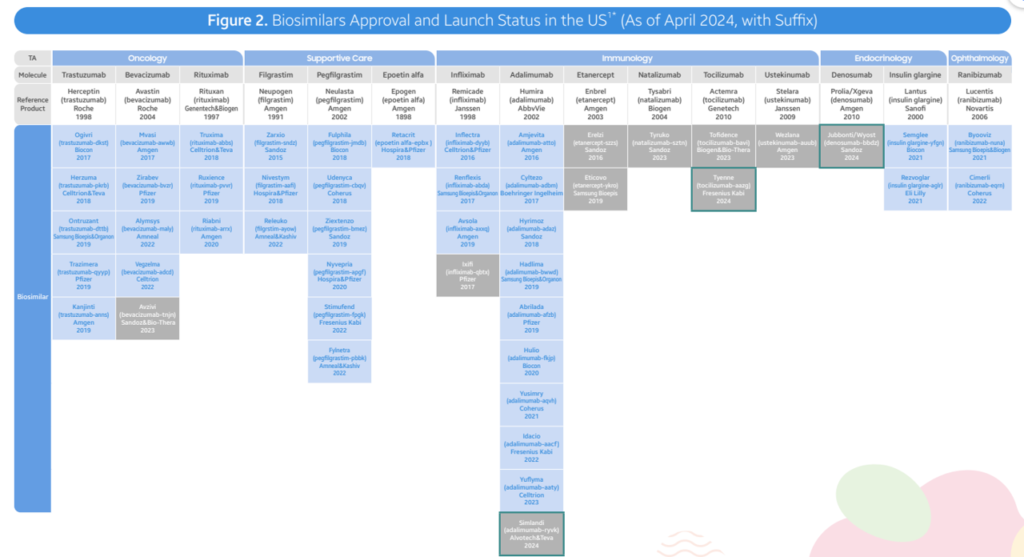

- As of April 2024, the FDA has authorized a complete of 48 biosimilars throughout 15 distinctive organic molecules. Of the 48 approvals, 38 biosimilars have launched within the US market. In Q2 2024, 3 new biosimilars have been authorized within the US (Simlandi for Humira (adalimumab); Jubbonti/Wyost for Prolia/Xgeva (denosumab); Tyenne for Actemra (tocilizumab))

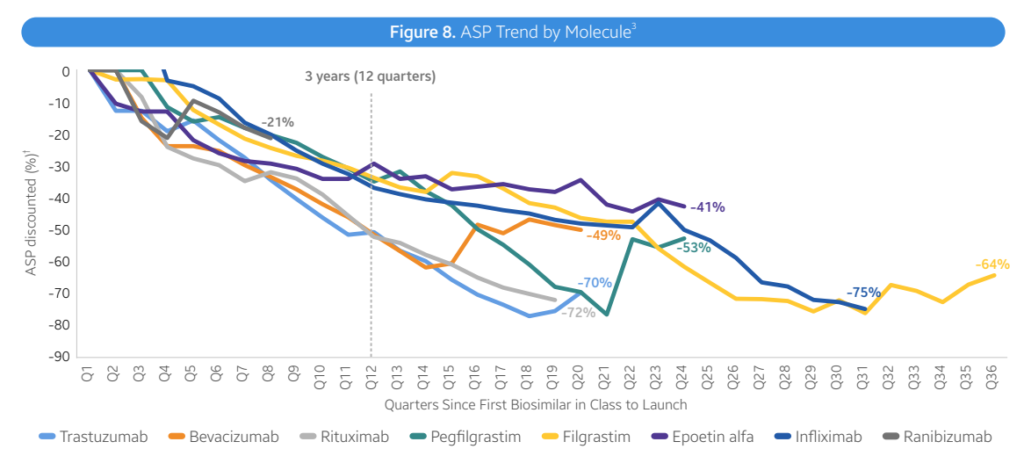

- Average reductions. Total, biosimilars are resulting in decrease costs, largely by way of rebates fairly than listing value. Nevertheless, costs fell by 41% inside 3 years with lots of variability throughout therapeutic areas.

- In oncology, biosimilars wholesale acquisition price (WAC) costs have been 10%-25% decrease than reference merchandise. In supportive care,

- For supportive care, WAC costs of biosimilars for pegfilgrastim and epoetin alfa are 20-60% decrease reference, however common gross sales costs (ASP) for the reference merchandise has fallen to match ASP for biosimilars in an effort to retain market share.

- Immunology (Infliximab). Infliximab biosimilars launched with progressively decrease WACs, starting from -19% to -59% in reductions. Biosimilar competitors has led to ASP costs 75-90% decrease than the reference product WAC

- Immunology (Humira). Adalimumab (Humira) biosimilars have taken totally different approaches. Two biosimilars have used decrease WAC costs (85% reductions). Most Infliximab biosimilars launched with progressively decrease WACs, starting from -19% to -59% in reductions. Biosimilar competitors has led to ASP costs 75-90% decrease than the reference product WAC

- Opthalmology. Latest ranibizumab (Lucentis) biosimilar launches have already led to 30-40% decrease reference product ASP prices. Six different biosimilars have used an strategy with comparable WAC costs to branded Humira however with massive rebates the scale back costs by 55%-90% of the reference product.

- Diabetes. Biosimilars for Lantus (insulin glargin) have additionally used a combined strategy the place some merchandise have decrease WAC and others have comparable WAC however decrease costs attributable to rebates.

- Biosimilar uptake varies by molecule. Three years post-launch, biosimilar uptake for bevacizumab, trastuzumab, pegfilgrastm and rituximab have been all >50%. For different medication comparable to insulin glargine, epoetin alfa and infliximab, market shares have been all <50% at 12 months 3. Usually, market share rises considerably over time, nonetheless, in immunology Humira branded merchandise nonetheless comprise 96% market share.

- Inflation Discount Act. There are some provisions which might be constructive for biosimilars and others much less so.

- Professional: Lack of producer income from Medicare Drug Value Negotiation and Inflation Rebate could lead producers to launch with greater listing costs and/or scale back rebate charges in different therapeutic areas or traces of enterprise (e.g. non-public insurance coverage). Biosimilars could provide better price reduction in these future markets. Moreover, the elevated Medicare fee restrict for biosimilars to ASP + 8% helps offset a few of the losses that suppliers could incur when utilizing cheaper ASP biosimilars on the medical profit

- Con: Medicare Drug Value Negotiation will impose pricing strain on the chosen medication and their related rivals. In these markets (i.e. Enbrel, Stelara), the financial savings that biosimilars can provide to plans could also be decreased, making step remedy by way of biosimilars a much less enticing technique for plan sponsors to implement. Furthermore, reductions and caps within the Half D member price sharing necessities, whereas a constructive enchancment for the general affordability of Medicare beneficiaries, unintentionally reduces the monetary incentive for members to modify to a biosimilar from an originator product

You’ll be able to learn the complete deck right here.

[ad_2]