[ad_1]

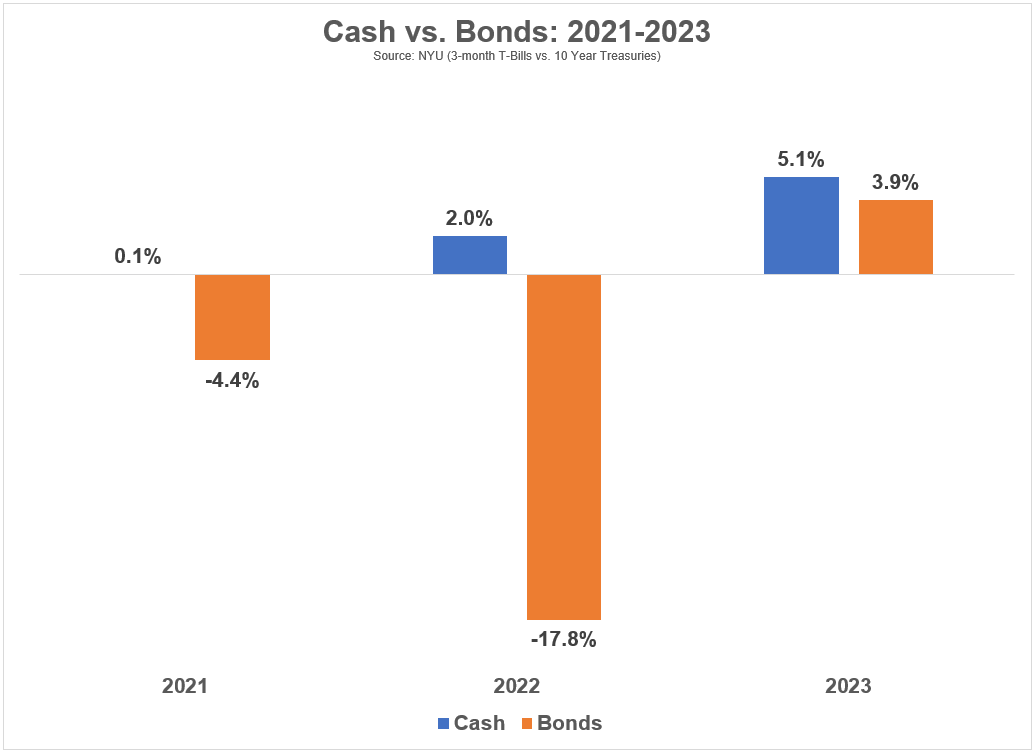

Bonds have had a tough go at it these previous few years.

2021 was a down 12 months. 2022 was the worst 12 months in historical past for bonds. 2023 was higher though charges have been so unstable that the journey certainty wasn’t a lot enjoyable to be on.

Within the 10 years ending 2023, 10 12 months Treasury bonds had an annual return of simply 1.5%. The annual inflation charge over that very same timeframe was 2.8%, that means you misplaced cash on an actual foundation within the benchmark U.S. authorities bond.

Returns have been so dangerous, money (3-month T-Payments) virtually outperformed bonds with a ten 12 months return of 1.3% in that very same timeframe. That’s fairly spectacular contemplating most of that 10 12 months interval was consumed by 0% rate of interest coverage from the Fed.

Money has now outperformed bonds for 3 years in a row:

The excellent news is shares did their half throughout this bond sell-off. Regardless of the bear market in 2022, the S&P 500 was up greater than 32% in whole from 2021-2023, an annualized return of round 10% per 12 months.

One asset class carried out poorly, however the different two asset lessons picked up the slack.

That is the great thing about diversification.

It’s simple to select on bonds proper now however there was a time when it was bonds holding issues collectively whereas the inventory market had a meltdown.

From 2000-2011, the S&P 500 was up a celebration 0.5% per 12 months. After inflation, you’ll have misplaced 2% per 12 months on an actual foundation for a misplaced decade after which some.

Money held up okay throughout this era with a 2.3% annual return.

But it surely was 10 12 months Treasuries that supplied the ballast throughout a monetary hurricane. Bonds returned greater than 7.2% per 12 months throughout this 12 12 months interval.

Generally it’s money that comes off the bench for a spark.

Within the 10 12 months interval from 1969-1978, the S&P 500 was up a scant 3.2% per 12 months. Tack on annual inflation of greater than 6% and actual returns have been destructive. Bonds did higher since rates of interest have been greater again then, returning 4.8% per 12 months, however they have been additionally swallowed up by inflation.

The most effective of the bunch was short-term T-bills, which returned 6% per 12 months over this 10 12 months stretch.

I’m cherry-picking time frames right here to show some extent but it surely’s an vital one for buyers.

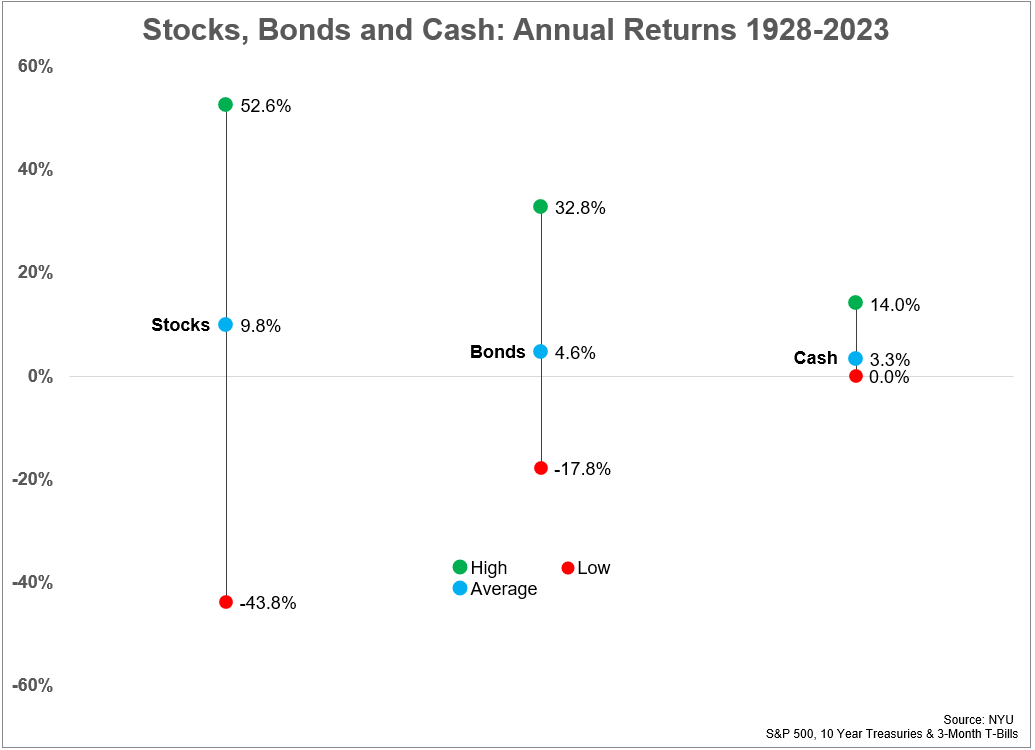

Should you take a look at the actually long-term, shares are clearly the perfect guess:

With a long-term inflation charge of three% over this era these are the historic actual returns for every asset class since 1928:

- Shares +6.8%

- Bonds +1.6%

- Money +0.3%

Shares are a no brainer over the long term.

However simply take a look at the vary of returns from greatest to worst. One of many causes shares pay you a threat premium over the lengthy haul is as a result of they’re so unstable within the quick run.

Within the quick run, something can occur.

The truth is, over the previous 96 years, shares have outperformed bonds and money 59 instances (61% of all years). Bonds have outperformed shares and money 23 instances (24% of the time). And money has outperformed shares and bonds 14 instances (15% of the time).

Shares win more often than not however not all the time.

One of many causes bonds have had such a tough go at it over the earlier 10 years is as a result of yields have been so low. The common yield for the ten 12 months from 2014-2023 was a bit greater than 2%.

That helps clarify the low returns. Yields inform the story in relation to bond efficiency over the long-term.

Beginning yields coming into this 12 months have been round 4%. That’s not out-of-this-world but it surely’s significantly better than mounted earnings buyers have turn out to be accustomed to in a 0% rate of interest world.

Each asset class is sure to expertise intervals of excellent returns and poor returns in some unspecified time in the future. All the pieces is cyclical — the financial system, the monetary markets, investor feelings, funding efficiency.

Durations of excellent efficiency are ultimately adopted by intervals of mediocre efficiency. And intervals of mediocre performances are ultimately adopted by intervals of excellent efficiency.

The laborious half is, as all the time, the timing on these cycles.

Buyers basically have two decisions since market timing is subsequent to inconceivable:

1. Diversification. A portfolio made up of shares, bonds and money is much from good. However a diversified combine of those constructing block asset lessons may be sturdy beneath quite a lot of market and financial environments.

2. Intestinal Fortitude. Should you’re going to pay attention all or most of your cash in a single asset class like shares you want the be disciplined once they get crushed from time-to-time. Having a liquid asset like money will help however some individuals do have the flexibility to sit down on their arms when shares fall.

The selection boils all the way down to your emotional make-up as an investor.

Select correctly.

Additional Studying:

Historic U.S. Inventory Market Returns By 2023

[ad_2]