[ad_1]

GlobalData’s 2023 UK Insurance coverage Client Survey discovered {that a} third of UK motor insurance coverage clients noticed their premiums rise by over 20% in 2023. With a rising variety of customers prepared to desert driving within the face of spiralling prices, insurers have to be more and more proactive in minimising claims prices to stem their losses.

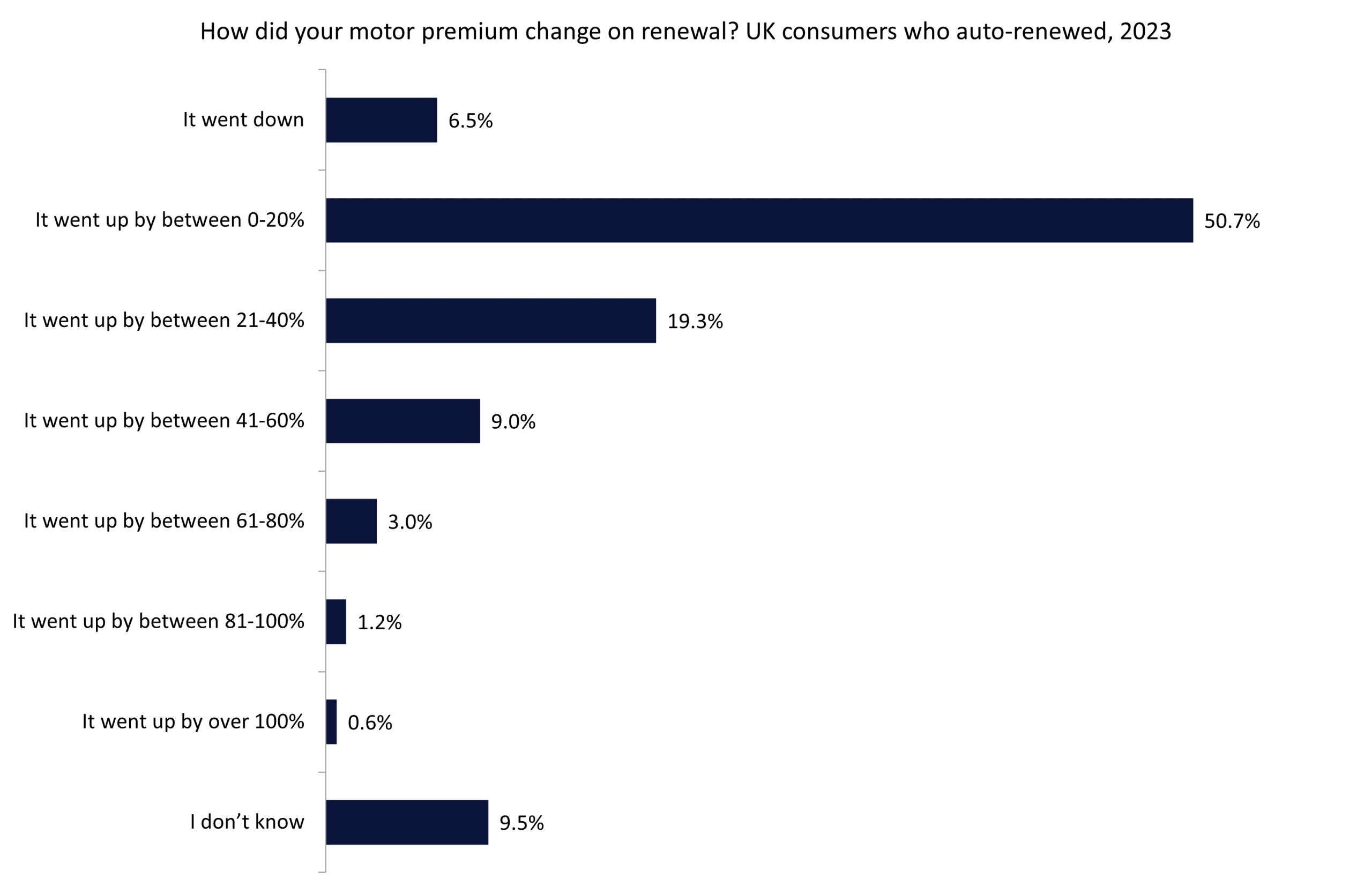

Our 2023 UK Insurance coverage Client Survey discovered that simply over half of motor insurance coverage clients noticed their premiums improve by 0%–20% in 2023. Moreover, 33.1% of respondents said that their premiums elevated by 21% or above, together with 0.6% whose premiums greater than doubled in 2023. In response to the Affiliation of British Insurers, the UK motor line recorded a mixed working ratio of 110.5% in 2022, with EY forecasting much more important losses in 2023. Insurers are thus met with the problem of elevating premiums in step with claims prices with out driving too many customers from the market.

The rising prices of automotive possession and operation are pushing a rising variety of customers to contemplate abandoning driving altogether. With rising restore prices (together with for companies akin to MOTs), excessive gasoline costs, and growing insurance coverage premiums, many customers are discovering that the prices of proudly owning a car now not outweigh the advantages. Though petrol and diesel costs have fallen since their 2022 excessive (of 191p per litre for petrol and 199p per litre for diesel), each fuels stay above their pre-pandemic pricing. The Russia/Ukraine battle and continuous OPEC+ provide restrictions are exacerbating the problem.

In the meantime, provide chain issues (together with the residual semiconductor scarcity from the Covid-19 years) proceed to blight automotive restore networks, particularly as electrical automobiles (EVs) and related vehicles make up extra of the nationwide parc. Whereas insurance coverage prices will naturally rise with these actions, alongside the rise in driving from spring 2021 following intervals of Covid-related lockdowns, customers at the moment are discovering these prices are unmanageable.

Analysis performed by insurtech The Inexperienced Insurer in December 2023 signifies that round 15% of motorists are contemplating forgoing their automotive as a consequence of rising possession prices. The research additionally reviews that 51% of automotive homeowners are involved about rising insurance coverage premiums. Given the pressure on shopper funds in 2024, continuous premium will increase will certainly drive extra customers out of the market.

Insurers ought to subsequently prioritise claims administration and minimisation. Telematics-oriented merchandise can ship a few of these advantages, though regardless of a few years of discuss they’re but to completely ship on their promise. Establishing robust restore networks with dependable provide chains—essential as EVs change into extra fashionable—will assist eradicate lengthy lead instances and unexpected value shocks. In a difficult market, gamers who can handle the brief time period whereas future-proofing their long-term networks shall be in positions to prepared the ground because the auto markets enter their subsequent era.

Entry essentially the most complete Firm Profiles

available on the market, powered by GlobalData. Save hours of analysis. Acquire aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain electronic mail will arrive shortly

We’re assured concerning the

distinctive

high quality of our Firm Profiles. Nonetheless, we wish you to take advantage of

helpful

resolution for your enterprise, so we provide a free pattern you can obtain by

submitting the beneath kind

By GlobalData

[ad_2]