[ad_1]

In case you are underweight in essentially the most unstable sector of the S&P 500, you in all probability aren’t pumped about your YTD efficiency – right here’s why.

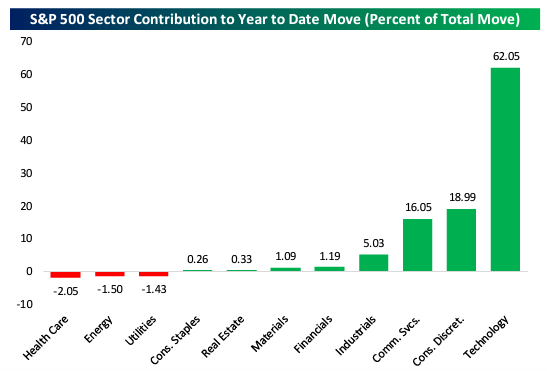

Whereas 8 of the 11 sectors within the S&P 500 have been optimistic contributors to the general return within the S&P 500 for the primary six months of 2023, the actual thanks must be given to the tech sector.

In case you have been unaware, the Tech sector accounted for 62% of the good points within the S&P 500 for the primary six months of 2023.

That’s greater than triple the contribution of the following greatest contributing sector, Client Discretionary, which accounted for 19% of the first-half returns.

After that, Communication Companies got here in at 16%, however I feel that may be a fraternal twin of Tech.

From there, we dipped down into single-digit optimistic proportion contributions from Industrials, Financials, Supplies, Actual Property, and Client Staples.

The three negatives contributing sectors have been Utilities, Power, and Healthcare at -1.4%, -1.5%, and -2%, respectively. So, whereas there have been three laggards, they weren’t vital concerning destructive proportion contribution.

See the chart beneath from Bespoke Funding Group:

The Tech Sector’s Function in Portfolio Returns

However again to the Tech sector. This 12 months, the Tech sector’s contribution was a perform of two various things.

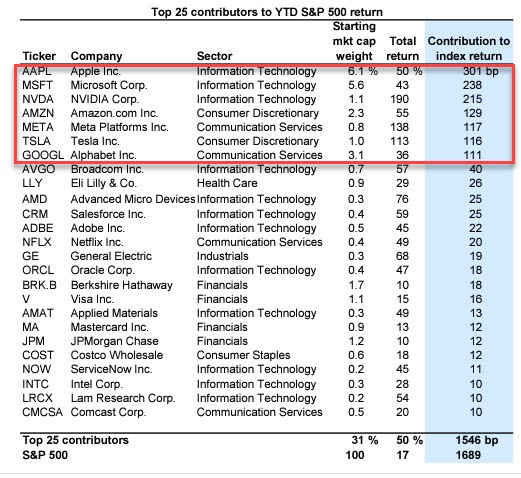

The primary is the tech sector’s large outperformance from a return perspective. The chart beneath exhibits the weighted return of contribution from the highest contributors (Safety Return * S&P 500 Weighting. Chart: Goldman Sachs).

Bear in mind these prime 5 names. I’ll use them once more in two charts beneath.

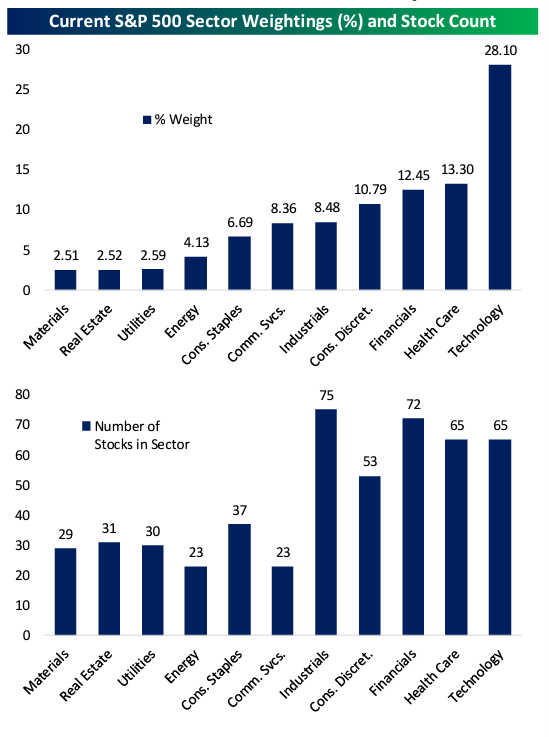

Now, the second is Tech’s outsized weighting as a share of the full S&P 500 market cap relative to all different sectors.

Under is a chart (once more from Bespoke Funding Group) displaying every of the 11 sectors’ proportion weighting contained in the S&P 500 index. As you possibly can see, Tech is by far the most important sector and accounts for nicely over 25% of the full S&P 500 index weighing in at 28.1%. Evaluate that to the following largest sector, Healthcare, at 13.3%.

That’s not even half the dimensions of the Tech sector by market cap.

What can be vital to comprehend in regards to the Tech sector is that it carries the most important weighting and is without doubt one of the bigger sectors by variety of particular person shares.

Know-how and Healthcare have 65 shares of their sector and are solely outgunned by Financials at 72 shares and Industrials at 75 shares.

Curiously, whereas Industrials carry the best variety of particular person securities of any of the 11 sectors, it got here in the midst of the pack by way of index weighting at 8.48%.

Whereas the Tech sector weighting of 28% could appear excessive, it’s value noting it peaked in the course of the 2000.com bubble at 35%. (That’s not within the chart; I simply seemed it up.)

The final level I’ll make in regards to the knowledge is that for all the volatility inside the banking sector within the first half of 2023, Financials did contribute positively to the general first-half return within the S&P 500. I level this out solely as a result of I’m all the time reiterating that the information and the market aren’t all the time essentially telling you an identical factor.

What this implies to you

In case you are taking a look at a well-diversified portfolio and evaluating it towards the S&P 500, it’s possible you’ll be scratching your head and questioning why your efficiency is just not according to the primary half returns of the S&P 500.

In case you are according to the S&P 500, I’ll refer you again to the above and remind you that whereas the S&P 500 holds roughly 500 totally different securities, you’re actually not considerably invested exterior of the highest ten holdings inside that index.

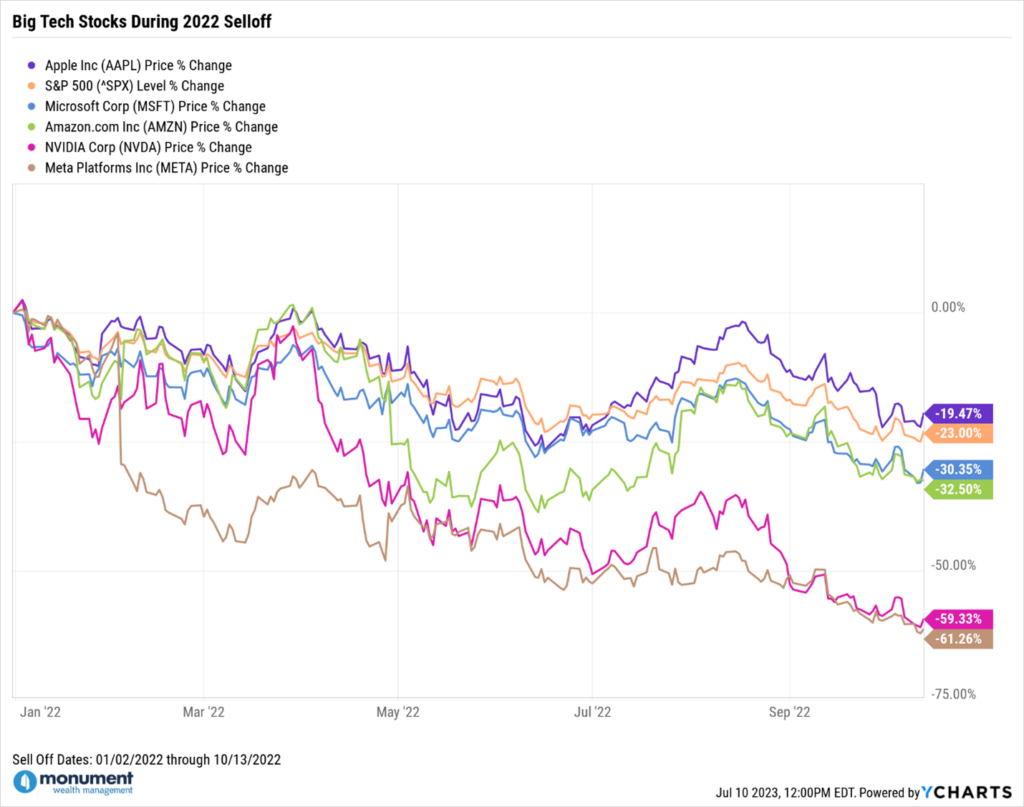

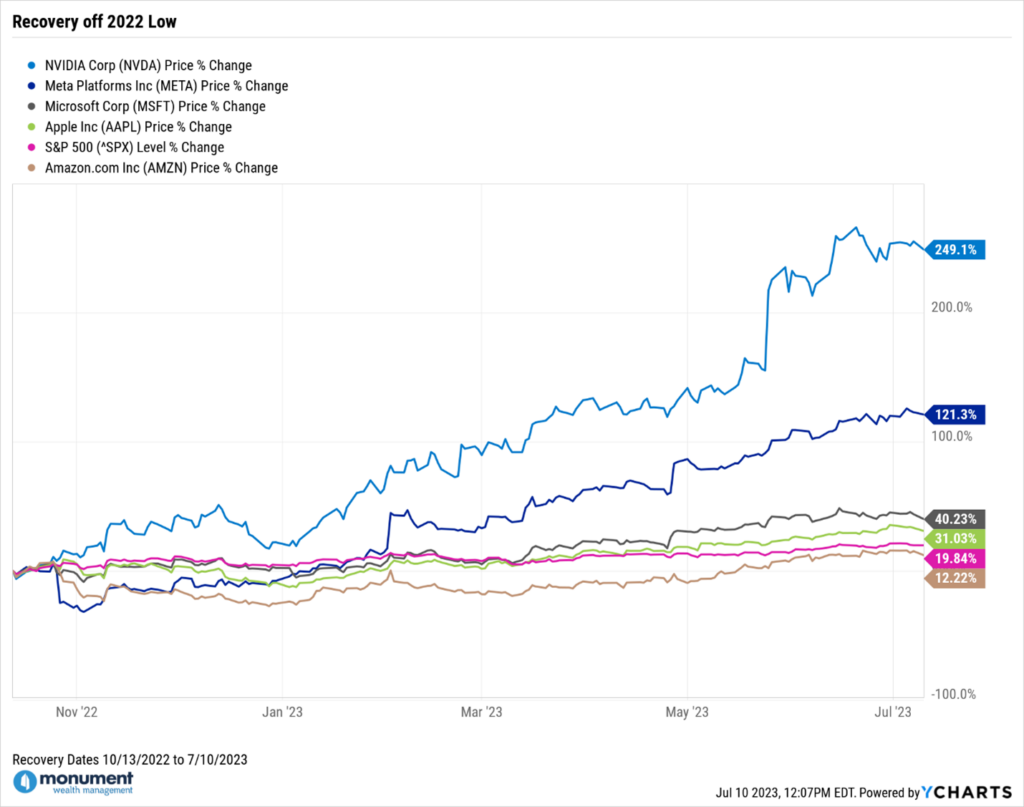

For these of you who fall into the latter bucket, I do know it feels good proper now, nevertheless it’s crucial to recollect again to the later phases of 2022 when the tech sector was feeling much more warmth than the opposite sectors. Right here it’s visually in two charts – the “Large Tech Shares Throughout 2022 Promote Off” after which the “Restoration off 2022 Low.”

I’m not preaching; I’m simply stating that most individuals really feel actually good when their portfolios are going up and really feel twice as unhealthy when their portfolios are happening.

In case you are over-allocated to Tech, please keep in mind that level.

I’ll consistently preach about my absolute conviction {that a} well-diversified fairness portfolio will all the time carry out very nicely over an extended interval, which is what all traders needs to be taking a look at.

Lastly, this can be a nice time to lift money when you’ve got been residing out of your money bucket for the previous 12 months. Whereas the market has not recovered absolutely to its earlier all-time excessive, it has recovered sufficient for you to be ok with refilling your money bucket.

The one draw back to refilling your money bucket now could be the chance price of doable future development over the following 6 to 12 months. Conservative traders needs to be extra involved about having a full money bucket than the chance price of these returns.

Please attain out when you’ve got any questions. Giving individuals unfiltered opinions and simple recommendation is our worth proposition.

Maintain wanting ahead,

[ad_2]