[ad_1]

There are two guidelines with regards to inventory market aphorisms:

(1) They should be simple to recollect.

or

(2) They should rhyme.

Some basic examples:

Be grasping when others are fearful and fearful when others are grasping.

Purchase when there’s blood within the streets.

The development is your pal.

Don’t attempt to catch a falling knife.

Let your winners experience and lower your losers brief.

Purchase low, promote excessive.

Purchase the rumor, promote the information.

Purchase what .

Purchase the dip.

Promote in Might and go away.

Don’t put all of your eggs in a single basket.

Focus to get wealthy. Diversify to remain wealthy.

Skate to the place the puck goes.

I’m positive I missed just a few however this performs many of the hits.

One factor you need to discover instantly is many of those guidelines of sayings are in battle with each other. I assume that’s what makes a market.

Nevertheless it’s additionally necessary to know that nothing works on a regular basis. That features guidelines of thumb, pithy one-liners and rhymes that make you’re feeling all heat and fuzzy.

Right here’s one other one for the record that appears to be in a state of flux this yr:

Don’t struggle the Fed.

There was this concept within the 2010s that shares have been solely going up due to the Fed. There was the Fed put. And the Fed was printing cash. And the Fed was offering liquidity. And the Fed was blowing bubbles but once more.

If it wasn’t for the Fed the inventory market would crash identical to 1929!

Pay attention, I’m not right here to inform you the Fed had nothing to do with the bull market of the 2010s. The Fed definitely made issues simpler on danger belongings by taking rates of interest to 0%.

However charges have been even decrease in Japan and Europe and so they didn’t get a raging bull market in the course of the earlier decade.

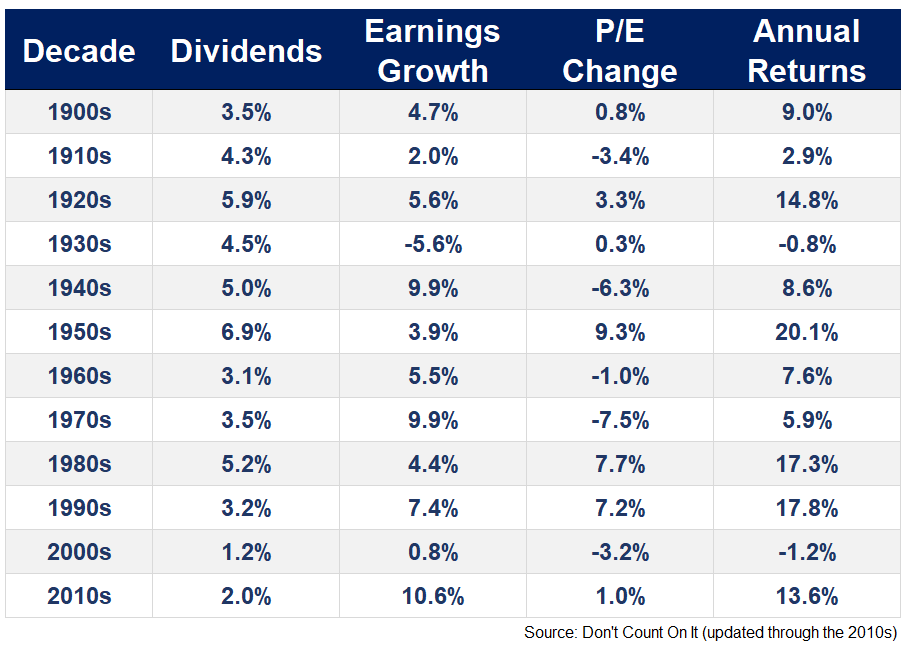

Plus, we have now the John Bogle return formulation that exhibits how fundamentals helped energy the inventory market within the final decade as nicely:

Low charges helped however so did the elemental driver of long-run inventory market returns — earnings progress.

Final yr don’t struggle the Fed made a variety of sense. They raised charges at a feverish tempo and we had a bear market.

However a humorous factor occurred this yr — the inventory market began combating again.

And never simply any shares. The largest winners this yr are tech shares, the very firms most individuals assumed would have the largest drawback with larger charges.

The Nasdaq 100 is up virtually 40% this yr. The largest tech inventory in all of the land — Apple — is up almost 50% in 2023.

That is even supposing the Fed has continued elevating charges, will probably elevate them much more on the subsequent assembly or two and so they have shrunk the dimensions of their stability sheet.

Most issues within the markets (and life) exist in a state of grey, not black or white.

Guidelines of thumb may be useful in sure areas of life.

However more often than not the inventory market doesn’t conform to a phrase that sounds good or looks like it ought to make sense.

The inventory market doesn’t all the time have to make sense.

Generally which means the Federal Reserve doesn’t matter as a lot as you assume with regards to inventory value actions.

Additional Studying:

Are Rising Curiosity Charges Dangerous For Tech Shares?

[ad_2]