[ad_1]

Soar to winners | Soar to methodology

Companions in supporting employees

In the US employees’ compensation (WC) market, accident frequency has been regular or barely downward, however the severity of claims has been growing and prices have been pushed up dramatically.

Influencing this development are:

- Medical and know-how prices related to accident survivability for injured employees who’re surviving what was once deadly accidents

- Catastrophically injured people residing longer

- Superior medical science with accidents resembling extreme burns or quadriplegia; a quadriplegic of their 20s or 30s may reside 30 to 40 extra years, requiring round the clock attendant care

- Massive value drivers related to catastrophic damage claims are sometimes not lined by price schedules, resembling prolonged ICU hospitalizations

- Legislative enlargement of advantages by way of varied measures resembling most cancers presumption legal guidelines within the public entity market

“Our prospects quantity within the 1000’s, and we custom-design packages based mostly on their wants. That differentiates us from different insurance coverage suppliers”

Tom Grove, Security Nationwide

Loretta L. Worters, vice chairman, media relations on the Insurance coverage Info Institute, lays out what a market-leading WC supplier must be.

“Monetary stability, have they got a great credit standing? Whereas each employees’ comp firm should comply with state statutes on protection phrases, limits of legal responsibility and advantages, there are different issues that you simply wish to search for,” she explains. “What’s their repute for paying claims in a well timed method? The supplier must be accessible when you may have questions or issues. They need to be a companion to assist stop office issues of safety.”

All of the IBA 5-Star Employees’ Comp winners show these qualities and are devoted to delivering.

“Claims are the chance to ship on the promise that the coverage represents, [and] we deal with this chance significantly”

Matthew Zender, AmTrust Monetary Companies

What do brokers need from employees’ compensation

insurance coverage firms?

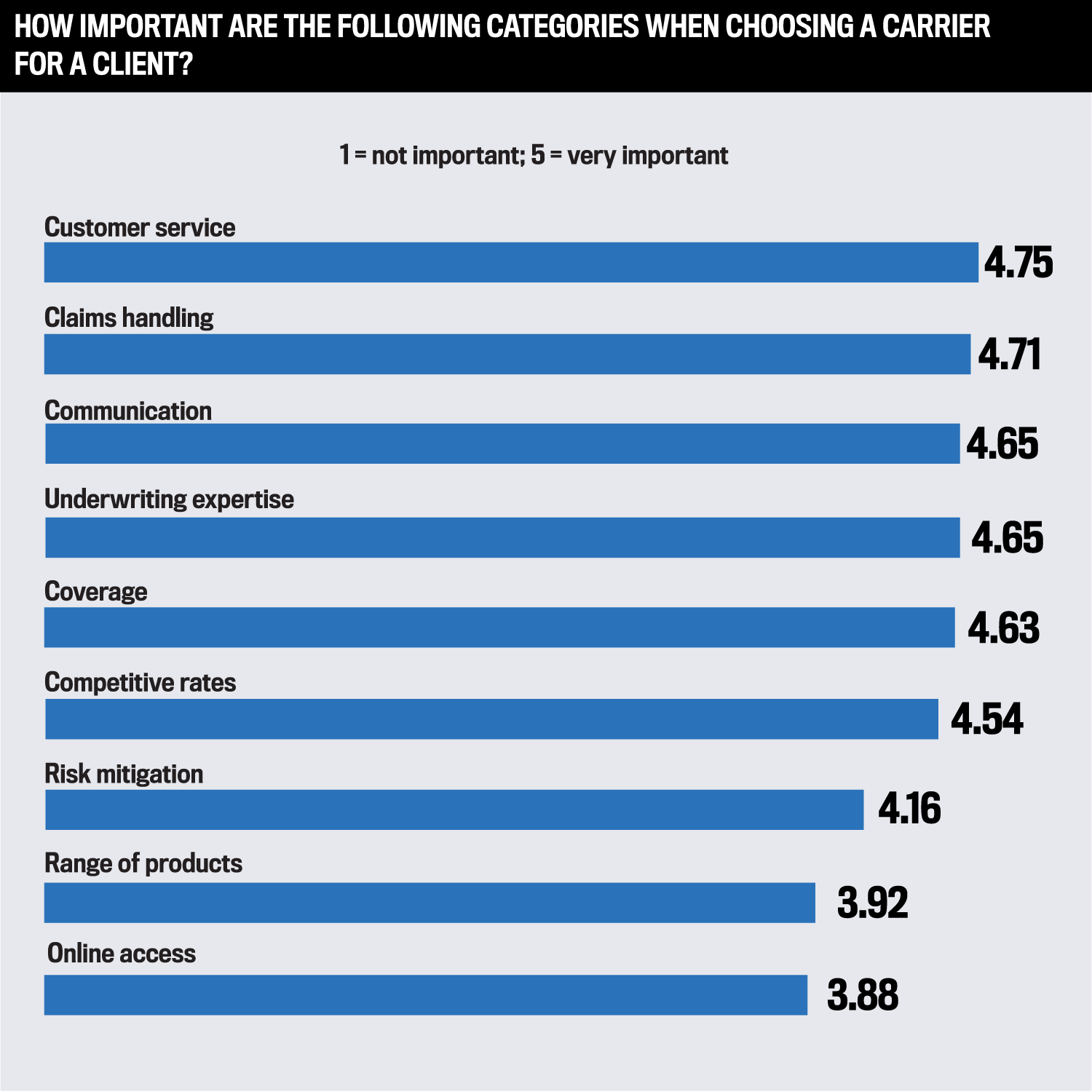

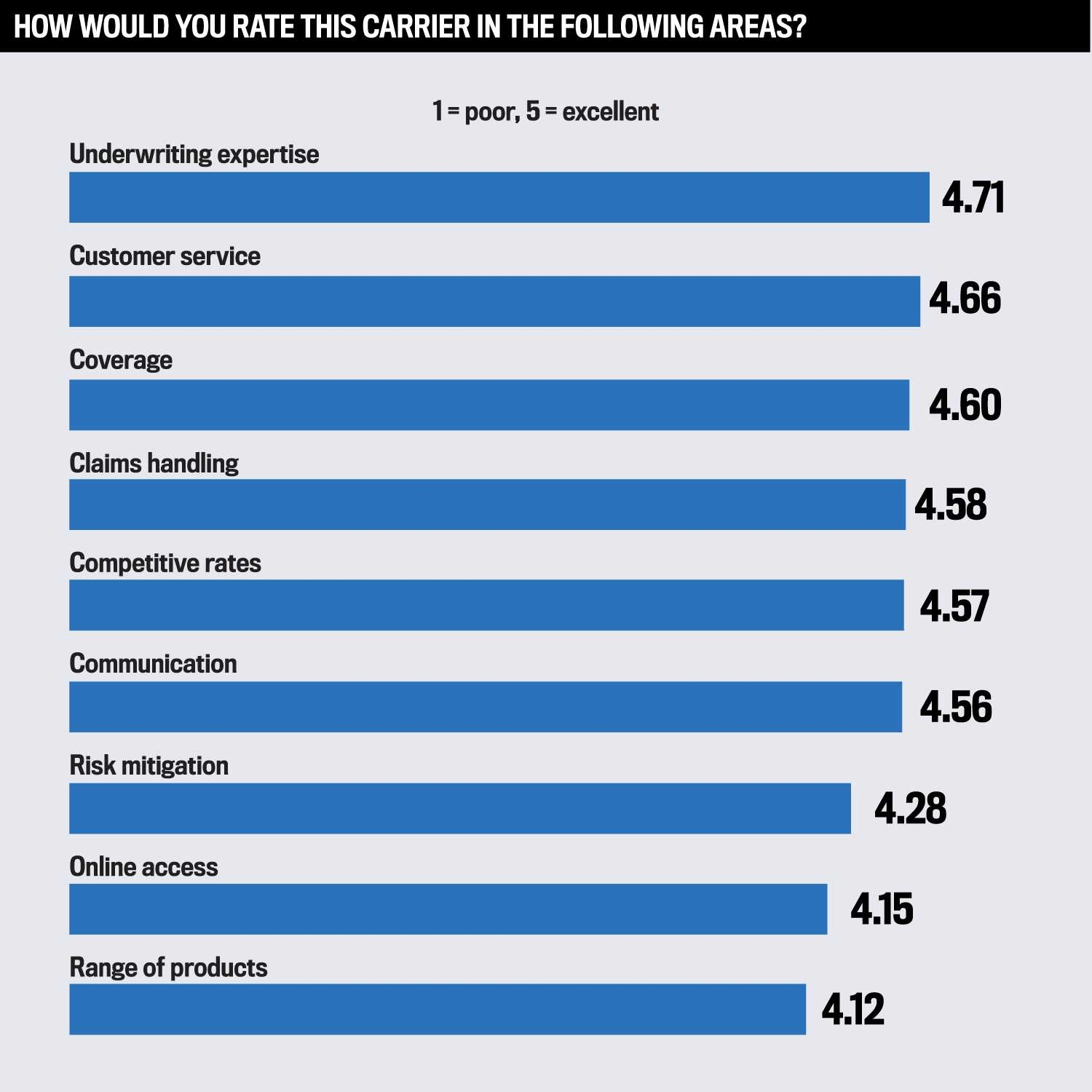

IBA surveyed lots of of brokers to get their tackle what’s most necessary within the prime employees’ compensation insurance coverage firms’ choices.

A few of their ideas on what they wish to see within the business embody:

- “Supply quicker service and extra streamlined communication”

- “Make the underwriting course of and binding course of simpler”

- “Open up urge for food to incorporate extra class codes”

- “Extra versatile billing choices”

A gaggle of 5-Star winners defined to IBA how they’ve met expectations:

- Tom Grove, chief consumer officer, Security Nationwide

- Mary Beth Pittinger, govt vice chairman, employees’ compensation, Chubb Industrial Insurance coverage

- Matthew Zender, senior vice chairman of WC technique, AmTrust Monetary Companies

Customer support

AmTrust Monetary Companies

- “From a employees’ compensation perspective, we perceive the necessity to present service as effectively as doable. We’ve labored to attain the best steadiness between self-service and assist, all so as to set our brokers up for achievement.”

Security Nationwide

- “Customer support just isn’t an method. It’s who we’re. It’s our DNA. That’s what separates us from different insurance coverage firms. Due to our flat group and customised method, our patrons will get to kind relationships with us that we imagine create a superior high-touch expertise with us than they are going to get with some other service.”

Chubb Industrial Insurance coverage

- “Developments in service applied sciences proceed to boost prospects’ expectations of service. Whereas know-how is necessary, employees’ compensation is a service-driven product line and it’s necessary that underwriters, threat engineers, declare handlers, premium auditors, and coverage servicing groups are working collectively to ship private touchpoints throughout varied steps of the employees’ compensation life cycle.”

Claims dealing with

AmTrust Monetary Companies

- “Claims are the chance to ship on the promise that the coverage represents. We deal with this chance significantly and we take delight in our claims group and their success.”

Security Nationwide

- Managing high-exposure, catastrophic claims for greater than 80 years has given Security Nationwide distinctive experience. “A claims adjuster’s worst catastrophic declare is a declare we see frequently”.

Chubb Industrial Insurance coverage

- “Deep experience and expertise in dealing with WC claims and offering high quality care to a buyer’s most precious asset — their staff — is desk stakes for being a premier employees’ compensation service. The common tenure of our claims adjusters is 10+ years.”

Communication

AmTrust Monetary Companies

- “We hear, act and reply. We talk related particulars well timed and are there when wanted.”

Security Nationwide

- “Everybody could make guarantees, however we delight ourselves on the follow-through and execution. The paperwork is minimal. We’re simply accessible and nimble, with the flexibility to decide and reply with a solution shortly. We deal with every consumer as a real companion. We’re versatile and communicative by way of each step of the method.”

Chubb Industrial Insurance coverage

- “Collaboration with prospects all through the whole employees’ compensation cycle is crucial to reaching one of the best outcomes. That features serving to insureds to establish hazards and forestall accidents, and dealing with claims promptly and pretty whereas providing assist for injured staff.”

“Collaboration with prospects all through the whole employees’ compensation cycle is crucial to reaching one of the best outcomes”

Mary Beth Pittinger, Chubb Industrial Insurance coverage

Underwriting experience

AmTrust Monetary Companies

- “Understanding the enterprise that we insure is paramount. We glance to acknowledge match in school and use this experience to offer a aggressive quote based mostly on the distinctive traits of every threat.”

Security Nationwide

- “Many carriers write tens of 1000’s or lots of of 1000’s of shoppers, and they’re handled the identical as a result of there may be only a sheer mass of accounts. Our prospects quantity within the 1000’s, and we custom-design packages based mostly on their wants. That differentiates us from different insurance coverage suppliers.”

Chubb Industrial Insurance coverage

- “A couple of key segments we provide underwriting specialists embody skilled companies, life sciences, know-how, vitality, manufacturing, retail/wholesale commerce, and monetary companies, to call a couple of. We perceive the distinctive employees’ compensation exposures generated from every of those particular person segments, and tailor our underwriting and repair choices to offer essentially the most complete program.”

Protection

AmTrust Monetary Companies

- “We be sure that our protection choices are as strong as any discovered within the market.”

Security Nationwide

- “Our underwriting method is to find out what a buyer seeks of their relationship with an insurance coverage service. What are their service wants or the place do they need assistance when it comes to controlling losses or declare administration? We provide you with a aggressive worth and, from there, we ship on our service commitments.”

Chubb Industrial Insurance coverage

- “Whereas employees’ compensation protection is statutory, it’s necessary to know how the completely different state jurisdictions influence an insured’s expertise. Employees in Chubb’s 48 US branches perceive the intricacies of every state’s jurisdiction to offer prospects with employees’ compensation insurance policies that meet the factors of their jurisdiction.”

The numbers converse for themselves

These prime employees’ compensation insurance coverage firms stand out with their quantified achievements.

As of year-end 2022, Security Nationwide reported:

- $3.4 billion in statutory surplus

- $13.8 billion in property

- $2.4 billion in gross written premium

Different accolades embody:

- Being an entirely owned subsidiary of Tokio Marine Holdings, ranked among the many prime 10 insurance coverage firms on the earth with a presence throughout greater than 40 nations

- Incomes the very best scores from AM Greatest (A++, FSC XV), thus lauding the corporate’s monetary stability and lasting energy

- Rating as a Greatest Place to Work in Insurance coverage honoree for a number of years

Zender of AmTrust says, “With over 360,000 insurance policies in drive, and because the third largest author of employees’ comp within the nation, we convey our capabilities to bear every day to assist the wants of our policyholders.”

And in response to the latest 2021 AM Greatest information, Chubb ranks because the fifth largest direct written premium service with over $2.2 billion of direct WC premium.

- Utilized Underwriters

- Chubb Industrial Insurance coverage

- Employers

- Encova

- FFVA Mutual Firm

- ICW

- Lion Insurance coverage

- Markel

- Midwest Employers Casualty

- Midwestern Insurance coverage Alliance

- Omaha Nationwide

- Pie Insurance coverage

- State Fund

- SteadPoint/Benchmark

- The Hartford

- XSWC – Security Nationwide

Claims Dealing with

- Utilized Underwriters

- Chubb Industrial Insurance coverage

- Encova

- FFVA Mutual Firm

- ICW

- Lion Insurance coverage

- Markel

- Midwest Employers Casualty

- Midwestern Insurance coverage Alliance

- Omaha Nationwide

- Pie Insurance coverage

- State Fund

- Steadpoint/Benchmark

- The Hartford

- XSWC – Security Nationwide

Communication

- Utilized Underwriters

- Chubb Industrial Insurance coverage

- Employers

- Encova

- FFVA Mutual Firm

- ICW

- Lion Insurance coverage

- Markel

- Midwest Employers Casualty

- Midwestern Insurance coverage Alliance

- Omaha Nationwide

- Pie Insurance coverage

- State Fund

- SteadPoint/Benchmark

- The Hartford

- XSWC – Security Nationwide

Aggressive Charges

- Utilized Underwriters

- Chubb Industrial Insurance coverage

- Employers

- Encova

- FFVA Mutual Firm

- ICW

- Lion Insurance coverage

- Markel

- Midwest Employers Casualty

- Midwestern Insurance coverage Alliance

- Omaha Nationwide

- Pie Insurance coverage

- State Fund

- SteadPoint/Benchmark

- The Hartford

- XSWC – Security Nationwide

Protection

- Utilized Underwriters

- Chubb Industrial Insurance coverage

- Employers

- Encova

- FFVA Mutual Firm

- ICW

- Lion Insurance coverage

- Markel

- Midwest Employers Casualty

- Omaha Nationwide

- Pie Insurance coverage

- State Fund

- SteadPoint/Benchmark

- The Hartford

- XSWC – Security Nationwide

Buyer Service

- Utilized Underwriters

- Chubb Industrial Insurance coverage

- Employers

- Encova

- FFVA Mutual Firm

- ICW

- Lion Insurance coverage

- Markel

- Midwest Employers Casualty

- Midwestern Insurance coverage Alliance

- Omaha Nationwide

- Pie Insurance coverage

- State Fund

- SteadPoint/Benchmark

- The Hartford

- XSWC – Security Nationwide

On-line Entry

- Utilized Underwriters

- Chubb Industrial Insurance coverage

- Encova

- FFVA Mutual Firm

- Lion Insurance coverage

- Markel

- Midwest Employers Casualty

- Omaha Nationwide

- Pie Insurance coverage

- SteadPoint/Benchmark

- The Hartford

Vary of Merchandise

- Utilized Underwriters

- Employers

- FFVA Mutual Firm

- Lion Insurance coverage

- Markel

- Midwestern Insurance coverage Alliance

- Omaha Nationwide

- Pie Insurance coverage

- State Fund

- SteadPoint/Benchmark

- XSWC – Security Nationwide

Threat Mitigation

- Utilized Underwriters

- Chubb Industrial Insurance coverage

- FFVA Mutual Firm

- Lion Insurance coverage

- Markel

- Midwest Employers Casualty

- Omaha Nationwide

- Pie Insurance coverage

- State Fund

- SteadPoint/Benchmark

- The Hartford

- XSWC – Security Nationwide

Underwriting Experience

- Utilized Underwriters

- Chubb Industrial Insurance coverage

- Employers

- Encova

- FFVA Mutual Firm

- ICW

- Lion Insurance coverage

- Markel

- Midwest Employers Casualty

- Midwestern Insurance coverage Alliance

- Omaha Nationwide

- Pie Insurance coverage

- State Fund

- SteadPoint/Benchmark

- The Hartford

- XSWC – Security Nationwide

Specialised Employees’ Compensation

- Amerisafe

Arduous-to-place threat - Utilized Underwriters

Development - BerkleyNet

Excessive hazards - Clear Spring

Lengthy-haul transportation - ICW

Tree operations - Omaha Nationwide

Contracting - State Fund

Arduous-to-place threat

Excessive-Threat Employees’ Compensation

- Utilized Underwriters

Heavy building - Berkley Industrial

Excessive hazard threat - Clear Spring

Contractors and transportation - ICW

Contracting - Omaha Nationwide

Artisan contractors - PEO

Cell tower climbers - Pie Insurance coverage

Roofing - State Fund

Trucking

To pick out one of the best employees’ compensation insurers for 2023, Insurance coverage Enterprise America enlisted a few of the business’s prime specialists. Throughout a 15-week course of, IBA’s analysis crew carried out one-on-one interviews with specialist brokers and surveyed 1000’s extra inside its community to realize a eager understanding of what insurance coverage professionals consider present market choices. Brokers have been first quizzed on what options they thought have been most necessary in WC insurance coverage insurance policies, after which requested to appoint WC carriers and insurance policies throughout key areas together with claims processing capabilities, customer support, aggressive premiums, flexibility, communication, and extra.

On the finish of the analysis interval, the insurance coverage suppliers that provided one of the best general service to brokers have been named 5-Star award winners.

[ad_2]