[ad_1]

After Charlie Munger handed away this week, I went wanting via an previous publish I wrote about his investing rules from a decade in the past.

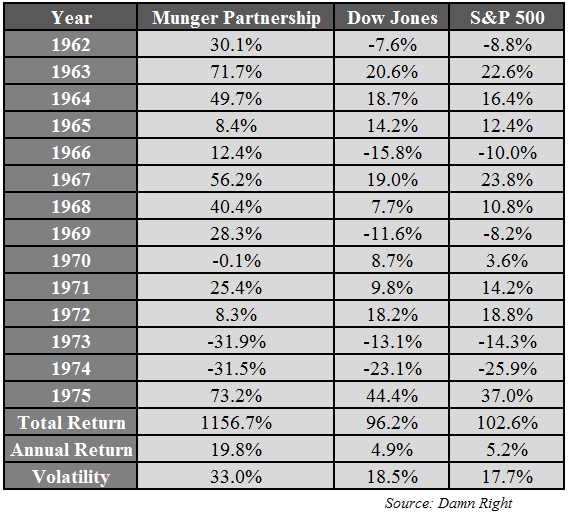

There was a desk I recreated that confirmed the annual returns from the Munger Partnership, which was the fund he ran earlier than becoming a member of Buffett at Berkshire Hathaway for good:

The outcomes are spectacular however have a look at how risky his returns had been. Munger was down greater than 53% through the 1973-1974 bear market.

The losses didn’t matter, after all, as a result of the positive factors greater than made up for them.

The identical dynamic applies to Berkshire Hathaway.

Munger joined Buffett full-time on the former textile company-turned-investment-arm in 1978. Since then Berkshire Hathaway has compounded capital at practically 19% per 12 months, an unbelievable return.

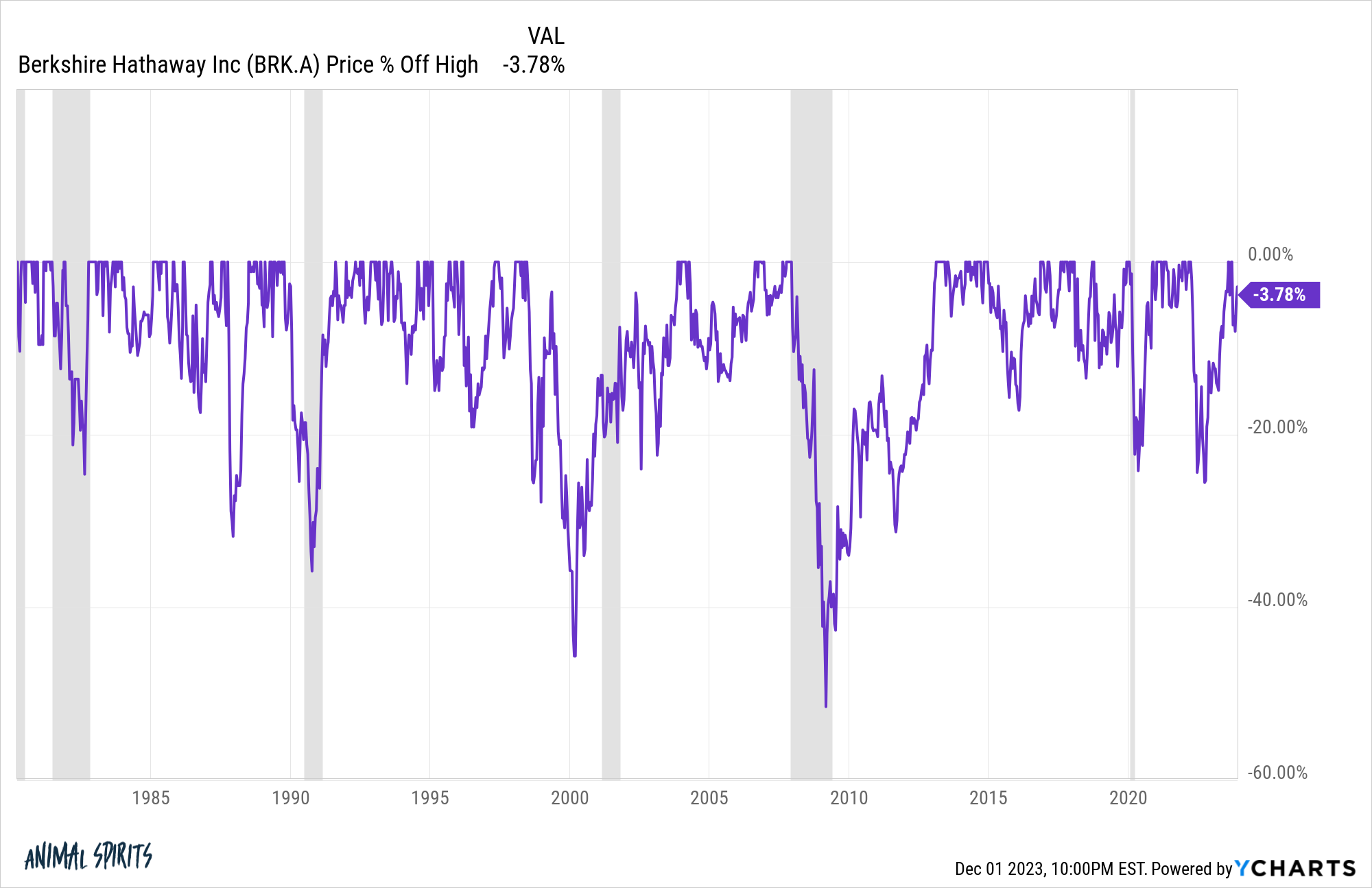

However there have been loads of drawdowns alongside the best way to these unbelievable returns:

Over the previous 40+ years Berkshire Hathaway has skilled drawdowns of -20%, -32%, -34%, -46%, -51%, -22% and -25%. That’s loads of bear markets and crashes.

Which brings us to considered one of my favourite Munger quotes:

When you’re not keen to react with equanimity to a market value decline of fifty% two or 3 times a century you’re not match to be a typical shareholder and also you deserve the mediocre consequence you’re going to get in comparison with the individuals who do have the temperament, who could be extra philosophical about these market fluctuations.

After all, being extra philosophical about market fluctuations just isn’t simple.

Shedding cash isn’t any enjoyable. Earning profits is tough. Investing is HARD.

It may be grueling for mere mortals such as you and I but it surely’s even onerous for legends like Munger and Buffett.

A couple of weeks in the past I listened to considered one of Munger’s closing interviews on The Acquired Podcast.

Even at 99 years previous he was nonetheless cagey and sharp.

The overarching theme of Munger’s message on this interview was how troublesome it was to supply such an enviable monitor file.

I liked his reply when requested if Buffett and Munger might replicate Berkshire Hathaway’s success if each we of their 30s beginning out in the present day:

The reply to that’s no, we wouldn’t. We had… everyone that had unusually good outcomes… nearly all the pieces has three issues: They’re very clever, they labored very onerous, they usually had been very fortunate. It takes all three to get them on this listing of the tremendous profitable. How are you going to prepare to have simply […] good luck? The reply is you can begin early and preserve making an attempt for a very long time, and perhaps you’ll get one or two.

Refreshingly humble.

Munger talked about how onerous it’s to attain funding success on a number of events:

Why shouldn’t or not it’s onerous to earn a living? Why ought to or not it’s simple?

It was by no means simple. It’s completely understood it was by no means simple, and it’s more durable now. These are the 2. But it surely takes time.

I knew once I was 70 that it was onerous. It’s simply so onerous. I understand how onerous it’s now. All the time, people who find themselves getting this 2 and 20, or 3 and 30, or no matter, all of them discuss as a result of oh, it was simple. They usually get to believing their very own bullshit. And naturally, it’s not very simple. It’s very onerous.

I find it irresistible.

There are such a lot of profitable folks in the present day who attempt to make it seem to be it ought to be simple to duplicate their success.

When you simply comply with these 10 easy steps or learn this one ebook or dwell by these inspirational quotes, blah, blah, blah.

Discovering success could be easy but it surely’s by no means simple.

It’s even more durable to recreate the success of another person contemplating how a lot luck is concerned within the course of.

I’ll go away you with a Munger quote from Rattling Proper by Janet Lowe:

Every particular person has to play the sport given his personal marginal utility issues and in a manner that takes into consideration his personal psychology. If losses are going to make you depressing – and a few losses are inevitable – you may be sensible to make the most of a really conservative patterns of funding and saving all of your life. So it’s a must to adapt your technique to your individual nature and your individual abilities. I don’t assume there’s a one-size-fits-all investment technique that I can provide you.

Amen.

Additional Studying:

Charlie Munger’s Investing Ideas

10 Underrated Charlie Munger Quotes

The place I Disagree with Charlie Munger

Buffett & Munger on be a Hack

[ad_2]