[ad_1]

The ten 12 months Treasury yield just lately hit 4.8%, its highest degree for the reason that summer season of 2007.

That’s increased than the dividend yield on all however 53 shares within the S&P 500.

Simply 4 shares out of 30 within the Dow Jones Industrial Common yield greater than the benchmark U.S. authorities bond.1

The dividend yield on the S&P 500 has been falling for years from a mix of rising valuations and the elevated utilization of share buybacks from companies.

However even these lower-than-average dividend yields have been sufficient to supply some competitors to bond yields lately.

Not anymore.

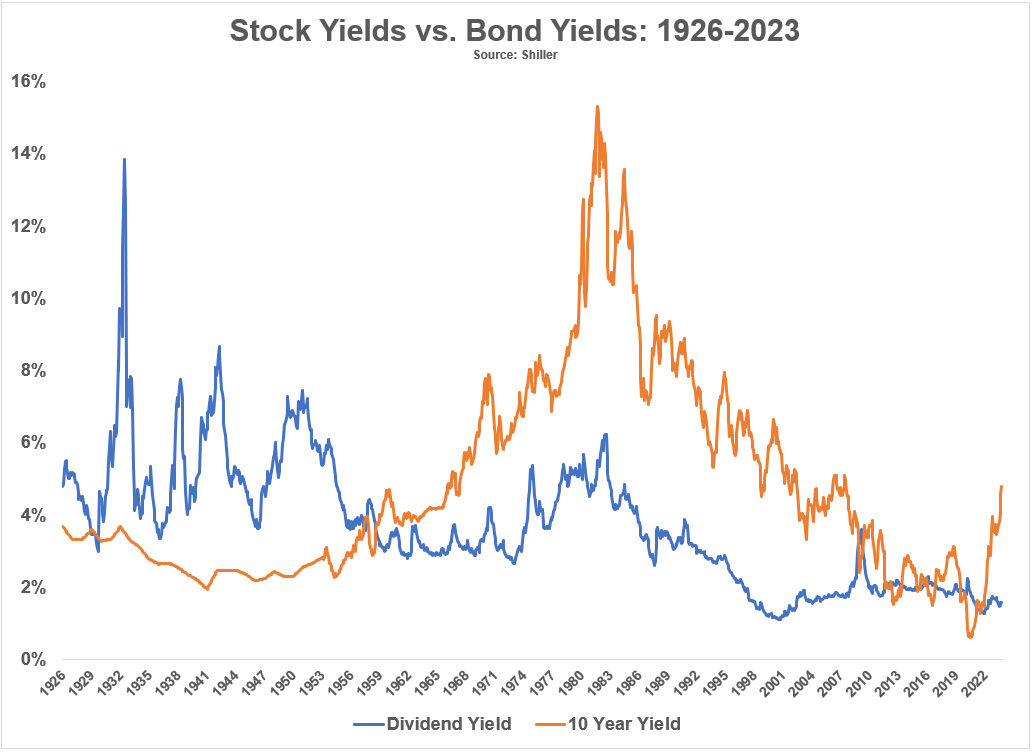

Right here is the historic dividend yield on the S&P 500 in comparison with the ten 12 months Treasury yield going again to 1926:

Within the early a part of the twentieth century, shares really yielded excess of bonds for many years. This was partly as a result of crash within the Nice Despair. It additionally needed to do with the actual fact that there have been fewer fairness buyers again then so companies needed to supply juicy dividend yields to draw consumers.

That relationship flipped throughout the Fifties bull market and the inflationary interval that started within the Sixties. Shares wouldn’t yield greater than bonds once more till a short interval on the backside of the Nice Monetary Disaster in early 2009. There was a back-and-forth ever since then.

Now bonds have a transparent benefit.

Some individuals — myself included — marvel if increased bond yields imply bother for the inventory market. Larger yields are definitely welcome information for fastened revenue buyers but it surely’s essential to acknowledge the distinction in yield traits between shares and bonds.

Let’s say you’re a yield-focused investor who is considering locking in 4.8% in 10 12 months Treasuries for the following decade.

That’s $4,800 a 12 months for a grand complete of $48,000 in curiosity funds over the lifetime of the bond.2

That’s fairly good particularly when in comparison with the paltry yields of the previous 15 years.

The S&P 500 dividend yield of 1.6% and $1,600 in annual revenue don’t come near matching that.

However yields on the inventory market don’t work the identical as common bond coupon funds. Dividend funds are inclined to rise over time.

Since 1926 dividends on the U.S. inventory market have elevated at an annual charge of 5% per 12 months. And although inventory buybacks are an excellent larger a part of the equation lately, dividends have grown even sooner in trendy financial instances, rising 5.7% and 5.9% yearly since 1950 and 1980, respectively.

Traditionally dividends are an exquisite inflation hedge as firms develop these payouts over time.

Let’s be conservative and assume the 5% annual dividend progress charge stays in impact. In 10 years your dividends bounce from $1,600 to just about $2,500. To match the 4.8% return on Treasuries you would wish value progress of simply 2.5% within the inventory market over 10 years.3

That inflation-beating progress charge for inventory market dividends doesn’t come totally free although. Volatility is the apparent trade-off on this comparability.

My level right here is we will’t merely have a look at the yields on shares and bonds to make an knowledgeable funding determination.

Inventory market yields and bond market yields are totally different animals with totally different danger traits. You have to perceive what you’re investing in and why earlier than allocating to any asset class or technique.

The excellent news is that the totally different nature of shares and bonds makes them helpful for diversification functions.

Bonds present common revenue at preset intervals whereas shares present entry to money flows and earnings which have traditionally grown greater than the inflation charge.

Inflation is a long-term danger for bond money flows however shares assist shield you in opposition to the dangerous affect of rising costs.

The inventory market is unpredictable within the short-run whereas bonds are typically extra steady and boring (at the least short-term bonds).

And if we wish to take this a step additional, money equivalents like cash markets or T-bills are a a lot better hedge than bonds in a rising rate of interest/inflation charge surroundings. Money is a horrible long-run inflation hedge however an exquisite volatility and rate of interest hedge within the short-run.

Add all of it up and a portfolio utilizing some mixture of shares, bonds and money supplies a sturdy possibility utilizing easy asset courses.

Diversification doesn’t work on a regular basis but it surely works more often than not and that’s about nearly as good as you possibly can hope for within the markets.

One of many largest causes for that is the totally different options shares, bonds and money have in several financial and market environments.

Absent the flexibility to foretell the long run, a diversified portfolio that’s sturdy sufficient to resist a variety of outcomes remains to be your greatest wager for long-term survival within the markets.

Additional Studying:

Why Aren’t Buyers Promoting Shares to Purchase Bonds?

1Walgreens, 3M, Verizon and Dow Chemical.

2I’m leaving out the thought of reinvestment danger right here as properly, relying on what you do with that revenue.

3For 30 12 months bonds the maths is much more in your favor for shares. After 30 years of 5% progress in dividends, you’d be incomes greater than $6,500 yearly within the inventory market.

[ad_2]