[ad_1]

To be a profitable investor you’ll want to possess quite a lot of completely different traits.

You want to perceive how math, statistics and chances work. You want to perceive companies and the worldwide financial system usually operate over the lengthy haul. You want an understanding of how the completely different asset courses behave from a danger and reward perspective.

You additionally want a deep understanding of monetary market historical past from booms to busts.

And also you want the emotional self-discipline to stay with an inexpensive funding technique from manias to panics and all the pieces in between.

I gave a chat to a bunch of monetary advisors in Montreal lately that targeted on these final two traits — historical past and habits — by means of the lens of the evolution of monetary recommendation over the a long time.

It’s a brand new presentation I’ve based mostly on the analysis I’ve been placing collectively on this weblog over time.

Right here’s a abstract of the historical past facet of it:

I’m an enormous proponent of considering and appearing for the long term relating to monetary markets. Nevertheless it’s not that tough to make the case for the inventory market when you’ve gotten 10% or so annual returns over the previous 100 years to look again on.

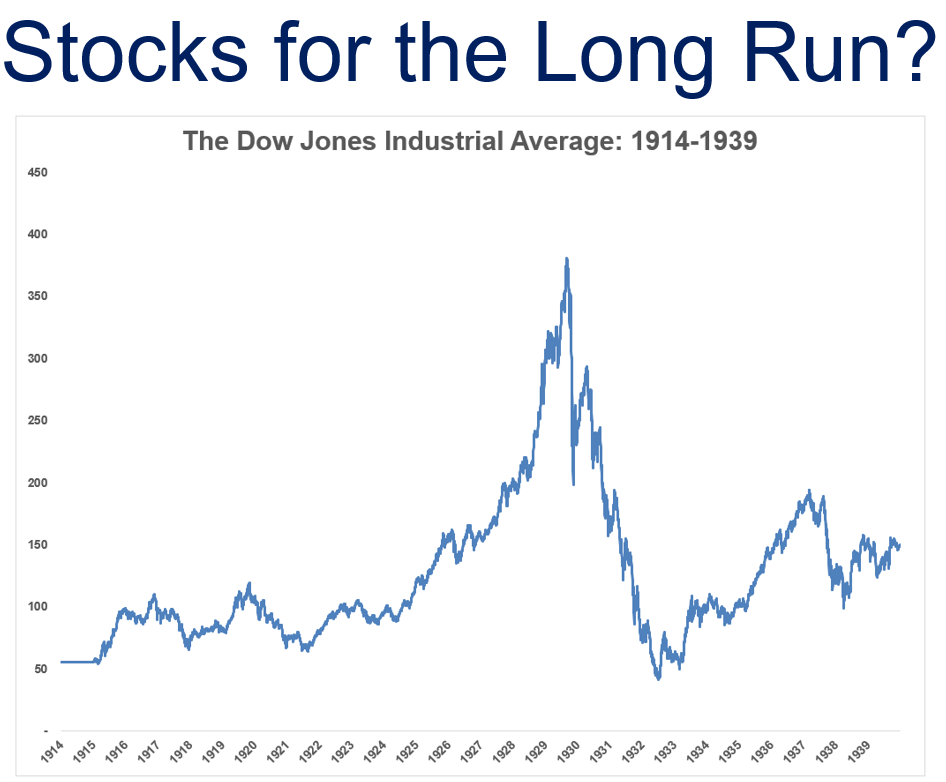

Think about what it will have been like to speak about shares for the long term heading into the Nineteen Forties. Right here’s what buyers lived by means of heading into that decade:

- The inventory market closed for six months on the onset of World Warfare I in 1914. Liquidity merely dried up when everybody went to struggle.

- The Roaring 20s noticed a growth in shopper and monetary merchandise not like anybody had ever seen as much as that time.

- The bust that started in 1929 was additionally not like something anybody had ever seen. The inventory market fell one thing like 85% from the Sept 1929 peak.

- The Dow wouldn’t make new highs once more till 1954.

The historical past books make it seem to be everybody was worn out throughout The Nice Melancholy inventory market crash however most individuals didn’t even personal shares again then.

The truth is, simply 1.5 million folks owned shares by 1929 out of a inhabitants of roughly 120 million, somewhat greater than 1% of the inhabitants.

The crash was gut-wrenching however the financial system collapsing and 25% unemployment had a a lot larger affect than the inventory marketplace for U.S. households.

The limitations to entry have been a lot increased again then when it got here to investing and that features information in regards to the topic as nicely. Nobody knew a lot about how markets functioned.

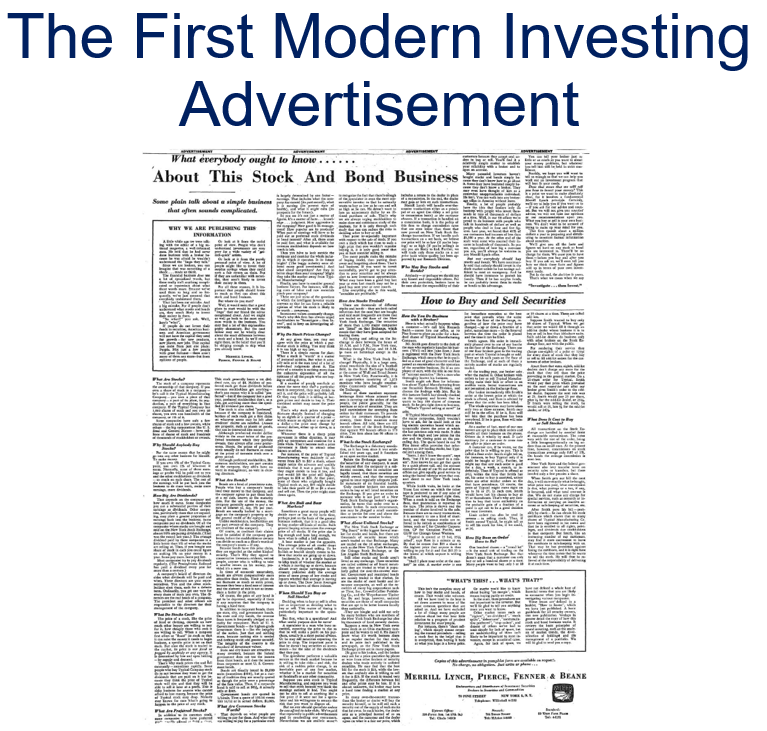

Merrill Lynch tried to vary all that once they tasked Louis Engel with creating the primary fashionable commercial for the inventory market in 1948.

It appeared within the New York Occasions, took up a complete web page of the paper and ran greater than 7,000 phrases. The advert was mainly the primary investing weblog publish ever revealed explaining to folks why they need to purchase shares, the way to purchase shares, why inventory costs change and the way shares are traded.

It was costly however it was an enormous success. Merrill stated they acquired greater than 3 million responses to the advert, which gave their brokers thousands and thousands of recent potential purchasers.

If any of these 3 million folks put their cash into the market within the late-Nineteen Forties it was fortuitous timing.

The Fifties bull market was one of many largest in historical past.

The issue is most individuals nonetheless weren’t all that within the markets, primarily as a result of most individuals didn’t have any disposable revenue to take a position.

That may all change within the post-World Warfare II world. The financial malaise following the Nice Melancholy didn’t actually finish till World Warfare II kicked off a spending and manufacturing spree not like something the world had ever seen as much as that time.

The growth occasions following the struggle modified the trajectory of the US and the remainder of the world when it comes to progress, jobs, revenue, demographics and wealth.

In 1929 almost 60% of American households had incomes that positioned them beneath the poverty line. The typical pay for manufacturing employees was up virtually 90% between 1939 and 1945. The disposable revenue for all People rose almost 75% between 1929 and 1950.

By 1945, GDP was 2.4 occasions the scale of the financial system in 1939. Monetary historian Frederick Lewis Allen known as it, “probably the most extraordinary improve in manufacturing that had ever been completed in 5 years in all financial historical past.”

The center class was additionally kind of born of that post-World Warfare II period by means of a mixture of a federal housing invoice, a child growth, and the massive variety of troopers coming residence seeking to cool down.

The variety of new single-family properties being constructed develop from 114,000 in 1944 to 1.7 million by 1950. Proudly owning a house grew to become the brand new American dream and mainly anybody with a good job might afford a house by the Fifties.

Now that folks owned a house and had some disposable revenue they may lastly take into consideration investing a few of their capital.

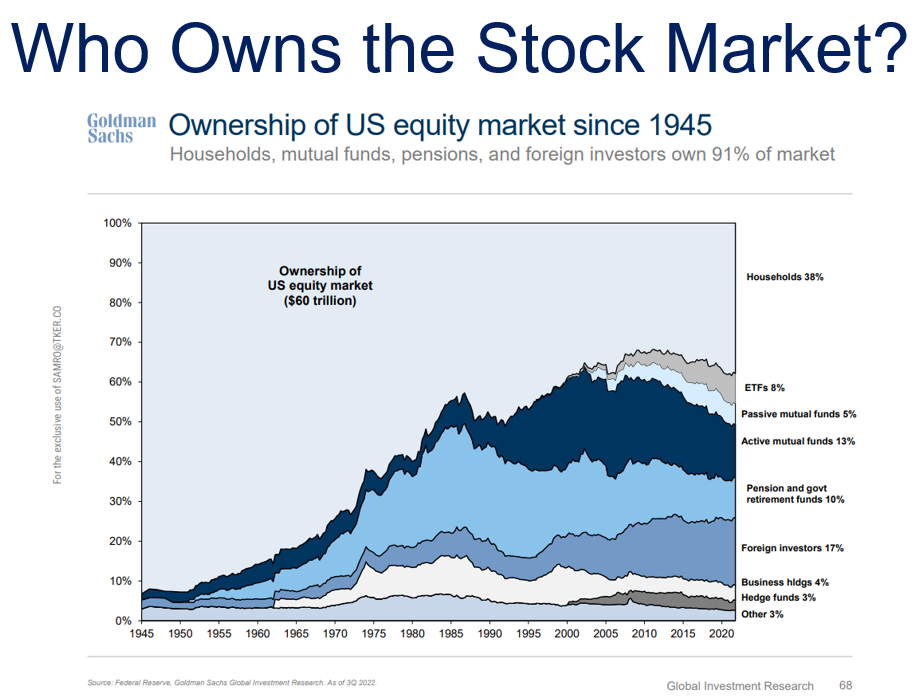

Practically 95% of all shares within the Nineteen Forties and Fifties have been owned by particular person buyers. They have been largely buy-and-hold buyers, simply seeking to earn some dividends. Greater than 95% of all buying and selling was achieved by particular person buyers. In the present day that quantity is extra like 2% with 98% of buying and selling being carried out by institutional buyers and machines.

Wall Avenue wasn’t Wall Avenue simply but. Issues have been nonetheless pretty rudimentary when it comes to institutionalization.

One of many different causes ‘shares for the long term’ wasn’t actually a factor again then is as a result of nobody knew what the long-term returns in shares even have been. Nobody had the information to compile a long-term observe file for the inventory market.

Keep in mind our man Louis Engel, the one who created the primary fashionable investing commercial?

He helped on this entrance too.

Engel contacted the Chicago Graduate College of Enterprise, who stated they’d carry out a historic research if Merrill Lynch would conform to fund it. So within the early Nineteen Sixties a bunch of professors collaborated on a historic dataset of NYSE-listed shares from 1926-1960.

It took them almost 4 years to finish what’s now often called the Heart for Analysis in Safety Costs (CRSP). CRSP information supplied, mainly for the primary time ever, the typical long-term returns within the inventory market. For as soon as, all of these brokers had some ammunition as a result of they have been fairly darn good.

Even with the gargantuan crash through the Nice Melancholy, the U.S. inventory market was up greater than 2,700% in complete from 1926-1959. That’s 10.3% per 12 months, manner increased than anybody assumed.

The issue is it was nonetheless comparatively troublesome to achieve entry to the inventory market should you didn’t have the flexibility to choose shares your self and the prices have been nonetheless insanely excessive.

Mutual funds took off in a giant manner through the Nineteen Sixties however Nineteen Seventies would take it to a different degree, ushering in a few of the largest breakthroughs buyers had ever seen.

John Bogle’s newly shaped funding agency Vanguard launched its first index fund on December 31, 1975.

Bogle hoped the fund would increase $150 million. As a substitute, it raised somewhat greater than $11 million. And that first Vanguard S&P 500 Index Fund got here with a hefty 8.5% gross sales load.

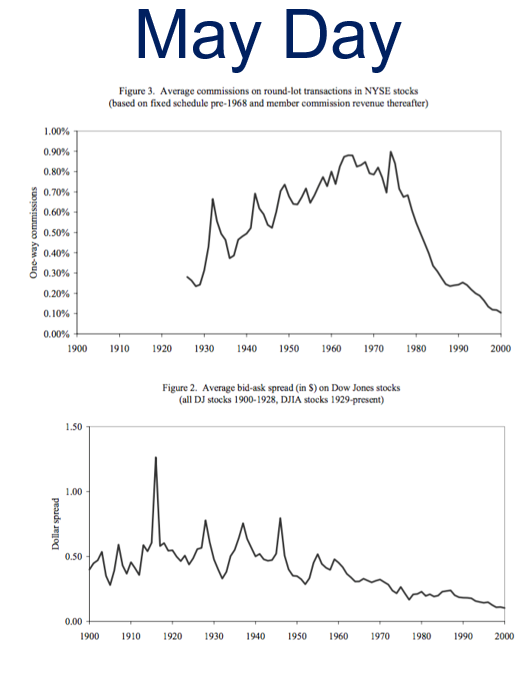

The precipitous decline in charges might be traced again to each Vanguard and a change in guidelines instituted by the SEC again in 1975. That’s when the SEC abolished fixed-rate commissions for inventory buying and selling.

Earlier than then buyers have been paying a mean of 1-3% to purchase or promote a inventory. So the prices didn’t scale even when the scale of your trades went up. Plus the bid-ask spreads have been broad sufficient to drive a truck by means of.

Have a look at how far each have fallen since:

Particular person buyers have gone from paying excessive charges with large spreads to zero greenback trades, extra liquidity and narrower spreads.

Might Day helped usher within the low cost brokerage agency.

Charles Schwab opened its first department simply 4 months later. An organization like Robinhood doesn’t exist with out Might Day or Charles Schwab.

Buyers got here out of the Nineteen Seventies with charges lastly on track, extra funding choices and simpler entry to the markets.

But fewer than 20% of households owned shares in some type by the early-Nineteen Eighties. That’s higher than Nice Melancholy ranges however nonetheless comparatively low.

The Nineteen Seventies have been a crummy decade for buyers as a result of inflation was so excessive however one of many causes so few folks owned shares is as a result of many individuals relied on pension plans for his or her retirement.

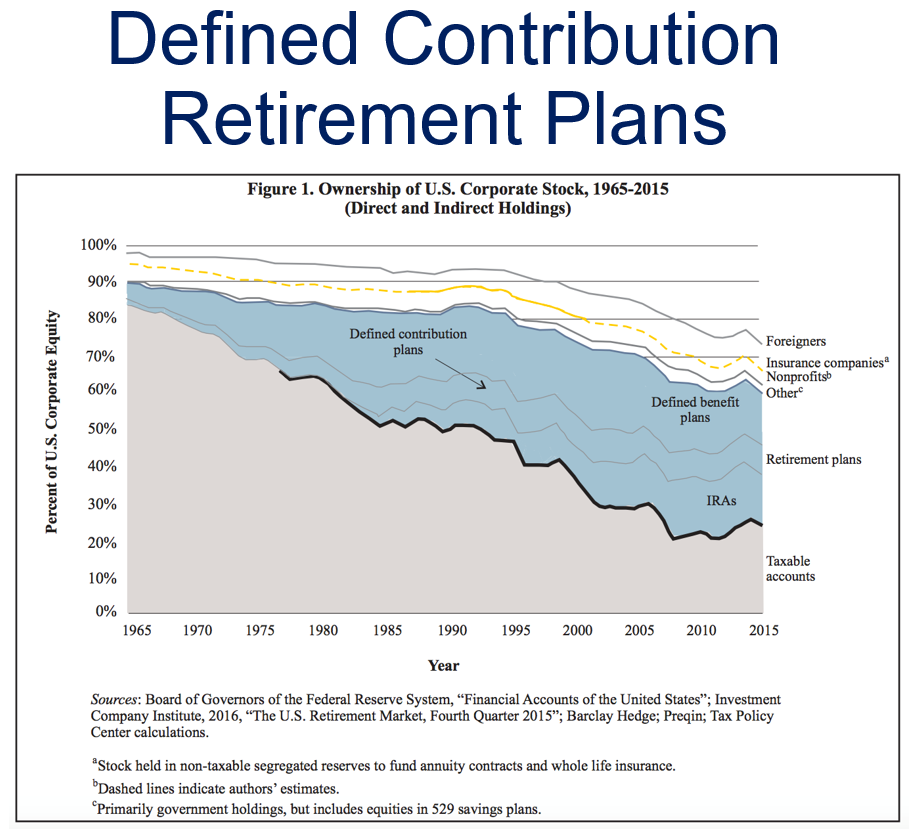

That began to vary within the late-Nineteen Seventies when outlined contribution retirement plans have been created, first the IRA after which the 401k.

You may see greater than 80% of the cash within the inventory market was taxable within the Nineteen Sixties:

There’s much more diversification in each the kinds of accounts folks maintain shares in and the investor base.

Plus retirement continues to be a comparatively new idea. In 1870, simply 34% of individuals ever reached their sixty fifth birthday. And in the event that they did their retirement plan was mainly working till they keeled over.

This was new floor for a complete technology of savers and buyers.

Now that folks have been on their very own when it got here to saving for retirement, there was a higher want for monetary recommendation.

Sadly, there was no Google again then. Nobody actually knew in the event that they have been getting helpful monetary recommendation or not.

The Nineteen Eighties have been the “belief us, we received this” period of monetary recommendation. You selected an advisor due to the title on the door as a lot as the standard of the recommendation.

Funding merchandise have been offered not purchased.

Vanguard is synonymous with index funds however it was cash market funds that carried Jack Bogle’s firm within the Nineteen Eighties as a result of rates of interest have been so excessive.

Banks was capped on the quantity of curiosity they may pay. Then the primary cash market fund got here alongside that allowed folks to place their cash to work with a financial institution by means of prevailing rates of interest.

By 1981, Vanguard held simply 5.8% of mutual fund business property. That quantity dropped to five.2% by 1985 and 4.1% by 1987. Their hottest fund sequence, the Wellington Funds, noticed 83 consecutive months of outflows.

Through the Nineteen Eighties, mutual fund property jumped from $241 billion to $1.5 trillion. The cost was led by cash market funds, which soared from $2 billion to $570 billion, accounting for nearly half the rise.

One of many largest causes for this huge improve in mutual fund flows was an enormous proportion of the newborn boomer technology hitting their increased incomes and family formation years.

There have been a variety of causes the U.S. inventory market was up 18% per 12 months from 1980-1999.

The biggest demographic of patrons coming into the market throughout a time when it was changing into simpler to purchase shares is definitely considered one of them.

There are 10,000 child boomers retiring each single day within the U.S. from now till 2030. That’s lots of people in want of monetary recommendation within the coming years.

The bull market of the Nineteen Eighties and Nineties mixed with the biggest demographic we’ve ever seen beginning to make some cash helped usher in an entire new class of buyers within the inventory market.

Monetary asset bubbles all the time finish in tears ultimately however many market manias can result in unintended advantages. The dot-com bubble supercharged participation in shares.

We went from 1% inventory market possession in 1929 to 19% in 1983 to almost 60% by 2000.

Virtually 60% of households who owned shares had bought their first share after 1990. One-third of all patrons entered the market in 1995 or later.

It didn’t damage that the S&P 500 was up 20% or extra for five straight years from 1995-1999 whereas the Nasdaq Composite was up a blistering 41% per 12 months in that very same stretch.

Everybody was getting wealthy and the rise of the web broke down much more limitations to entry as firms like E-Commerce introduced an entire new phase of buyers into the market.

The Nineties additionally gave us the change traded fund which was one more arrow within the quiver for each advisors and buyers alike.

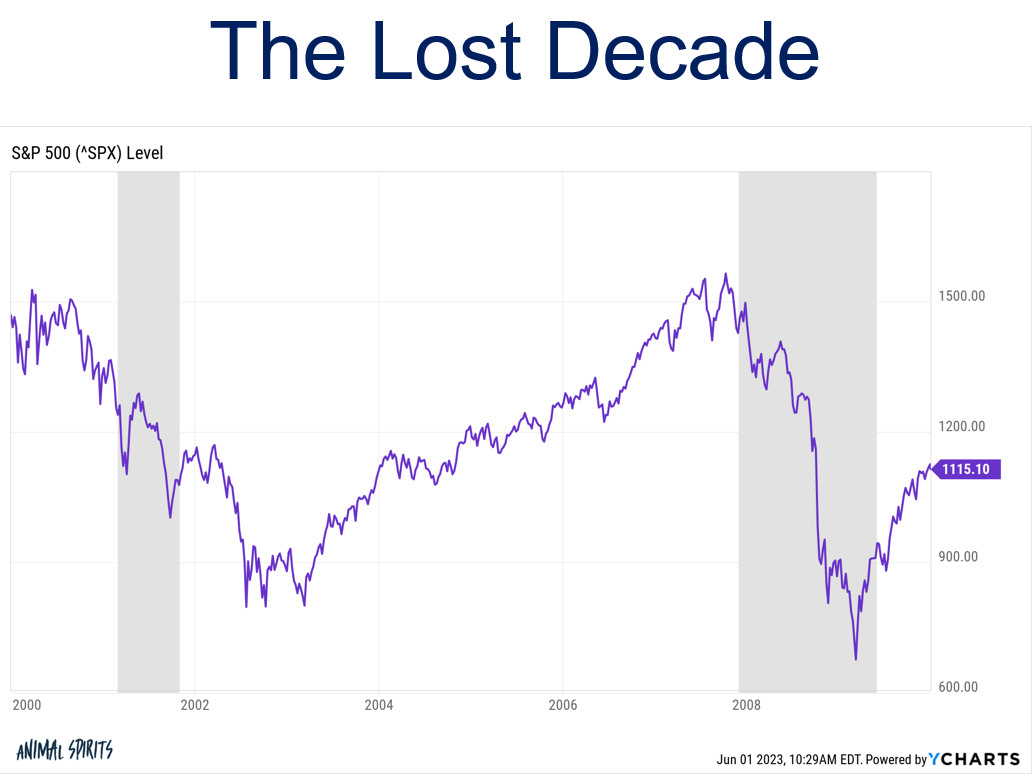

The Nineties have been a enjoyable decade for buyers. The 2000s weren’t.

The S&P 500 misplaced round 10% in complete through the first decade of the twenty first century, a ten 12 months stretch that noticed the market get chopped in twice.

Issues felt fairly bleak popping out of the Nice Monetary Disaster of 2008.

I used to be an institutional investor on the time and all anybody within the pension and endowment area might discuss have been tail-risk hedging methods, black swan funds and hedge funds.

Everybody was so involved with discovering the following Massive Brief that they virtually missed the Massive Lengthy of the 2010s.

If the Nineteen Seventies gave us index funds, the Nineteen Eighties gave us cash market funds, the Nineties gave us ETFs and the 2000s gave us heartburn, the 2010s gave us automation as roboadvisors like Betterment and Wealthfront burst on the scene.

It appears foolish now however there have been loads of assume items on the time declaring the robots have been gonna put monetary advisors out of enterprise.

Automation in duties like tax loss harvesting, rebalancing, reinvesting and contributions was definitely a step ahead for particular person buyers however these instruments have additionally been useful to advisors.

If something robo-advisors made it clear {that a} portfolio just isn’t the identical factor as a monetary plan.

There’s a lot extra that goes right into a complete plan past asset allocation. Advisors who targeted on monetary planning, tax planning, insurance coverage, property planning, and so on. might simply distinguish themselves from the robos.

Including automation to zero-dollar trades has opened up an entire new world of customization choices for buyers that might have been cost-prohibitive up to now.

Which brings us to the current.

We now have all of this technological innovation, decrease charges, higher funding merchandise, fewer limitations to entry and extra data than we all know what to do with.

So what’s left?

Conduct is and all the time would be the ultimate frontier.

It doesn’t matter how nice your portfolios and monetary plans are should you can’t or gained’t follow them. And now that data is changing into a commodity it’s going to be much more essential to filter out the noise and concentrate on what’s essential.

Monetary recommendation is extra essential than ever in a world with an abundance of decisions and fewer frictions to transact.

I’ve some extra takeaways on how advisors can get forward within the new world of monetary recommendation however I’ll save that for an additional day.

*******

Be happy to achieve out should you’re desirous about having me converse to your group right here.

[ad_2]