[ad_1]

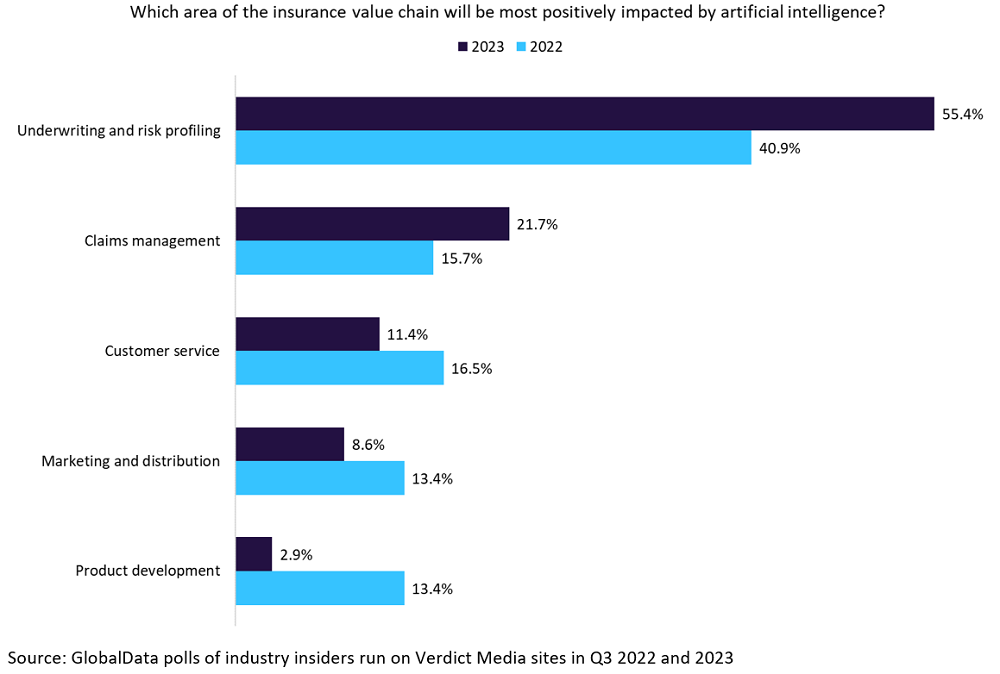

Over the previous 12 months, the insurance coverage trade (in addition to wider society) has develop into extra attuned to the workings and outcomes of the expertise by company trials and prolific media protection. Nearly all of respondents to our ballot prompt that underwriting and threat evaluation is the world through which AI could have probably the most optimistic affect on the trade (55.4%—up from 40.9% the earlier 12 months). Claims administration can be thought to be a key space for disruption, as famous by 21.7% of respondents, an increase of six proportion factors from final 12 months. These two will increase counsel that the trade is beginning to zero in on the important thing areas through which AI will play a key function for the trade going ahead. Shifting away from making an attempt to utilise the expertise throughout all areas of the worth chain, the trade is now discovering the best advantages will come largely in these two segments.

There are specific areas through which the underwriting course of, from software submission to coverage issuance, may be streamlined and improved by the applying of AI fashions. Lowering human and worker touchpoints throughout the method will improve accuracy (machines don’t get drained or bored, nor do they make errors) and unlock time capability for underwriters to dedicate themselves to extra significant or complicated duties.

As with underwriting, the claims administration course of is extremely labor-intensive with appreciable time spent on trivial duties together with admin and processing easy claims. AI is turning into established inside this section of the worth chain because it provides quicker processing of fundamental claims and permits handlers to concentrate on extra complicated circumstances. AI can automate claims processes from first discover of loss (FNOL) by to payout, a bonus typically marketed by main insurtech companies (comparable to Lemonade, a market chief inside this area). Over time, insurers will have the ability to verify how a lot funding to allocate to claims reserves because the expertise might be able to predicting, to excessive levels of accuracy, the anticipated claims payouts in a given interval.

In the end, the utilization of AI in underwriting and threat profiling will drive larger buyer satisfaction by quicker and simpler customer support and larger personalisation of merchandise. Sooner declare settlements, focused investigations, and proactive administration of the claims cycle can assist insurers to chop prices and eradicate frictions and inefficiencies in present methods.

Entry probably the most complete Firm Profiles

available on the market, powered by GlobalData. Save hours of analysis. Achieve aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain electronic mail will arrive shortly

We’re assured concerning the

distinctive

high quality of our Firm Profiles. Nevertheless, we wish you to take advantage of

helpful

choice for your online business, so we provide a free pattern that you may obtain by

submitting the beneath kind

By GlobalData

[ad_2]