[ad_1]

Jeremy Grantham was on The Compound and Pals with Michael and Josh final week speaking bubbles.

I partially agree and partially disagree with Grantham right here.

I proceed to consider the U.S. housing market is just not in a bubble.

Is the housing market damaged in some ways? Sure.

Is affordability as unhealthy because it’s ever been? Additionally sure.

Does that imply we’re in for one more housing market crash like we skilled through the Nice Monetary Disaster? I don’t suppose so.

Right here’s why:

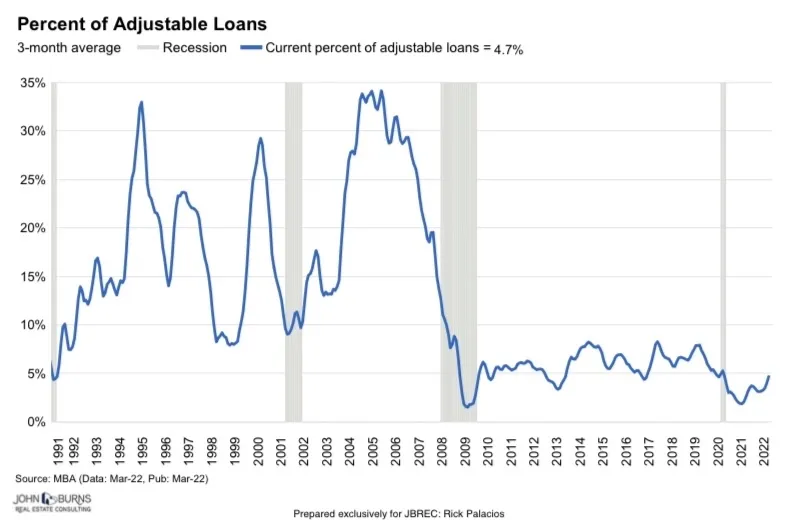

We didn’t binge on adjustable-rate mortgages. One of many greatest causes the housing market crashed final time is that so many individuals took out loans with low teaser charges that adjusted increased a number of years later.

Using ARMs is a lot decrease right now:

Most debtors spent the pandemic years locking in low fixed-rate loans.

Roughly two-thirds of all mortgage debtors have a price beneath 4%. Almost 40% of house owners personal their dwelling outright with no mortgage.

It’s laborious to see pressured promoting when so many individuals have inexpensive housing funds locked down.

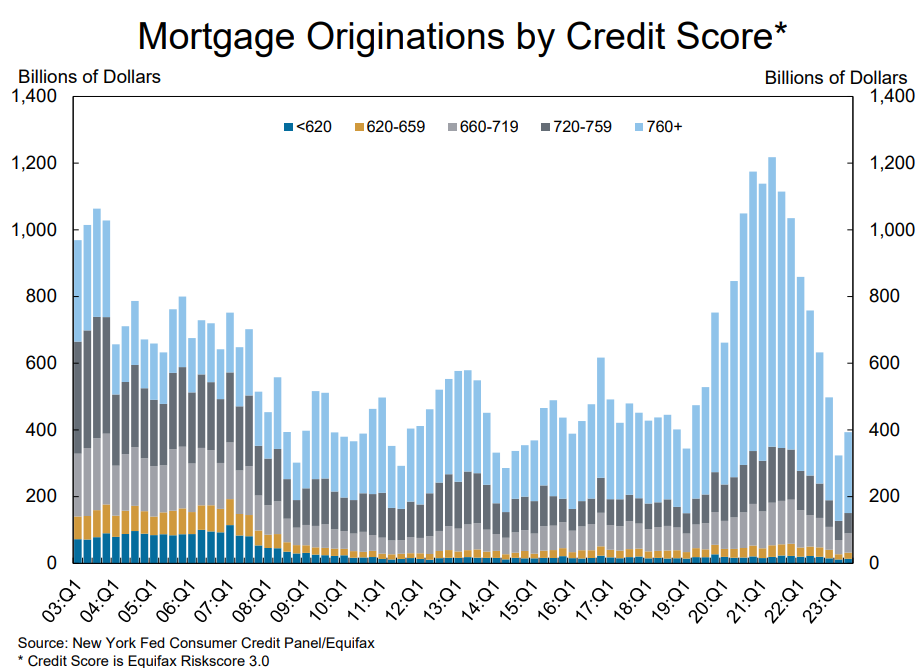

Debtors have much better credit score profiles. We’re not reliving The Large Brief the place strippers may get loans to purchase 5 homes and lenders had been incentivized to make subprime loans:

There aren’t many loans being made proper now however most of them are going to individuals with wonderful credit score scores:

In truth, two-thirds of all mortgage loans since 2017 have gone to debtors with sterling credit score scores (760 and up) whereas simply 2.6% have gone to subprime debtors (620 and under).

From 2003-2007 greater than 11% of loans went to subprime debtors and simply 26% to debtors with the perfect credit score scores.

No extra NINJA loans this time round.

We didn’t construct sufficient homes. From 2000-2007 practically 14 million new houses had been inbuilt the USA. Not solely had been the loans unhealthy however provide started to outstrip demand.

Then the housing bust occurred and we solely constructed 9.1 million new houses within the 2010s.

Once you mix an absence of housing provide with millennials reaching their prime family formation years, costs had been certain to go up.

The pandemic simply supercharged this dynamic.

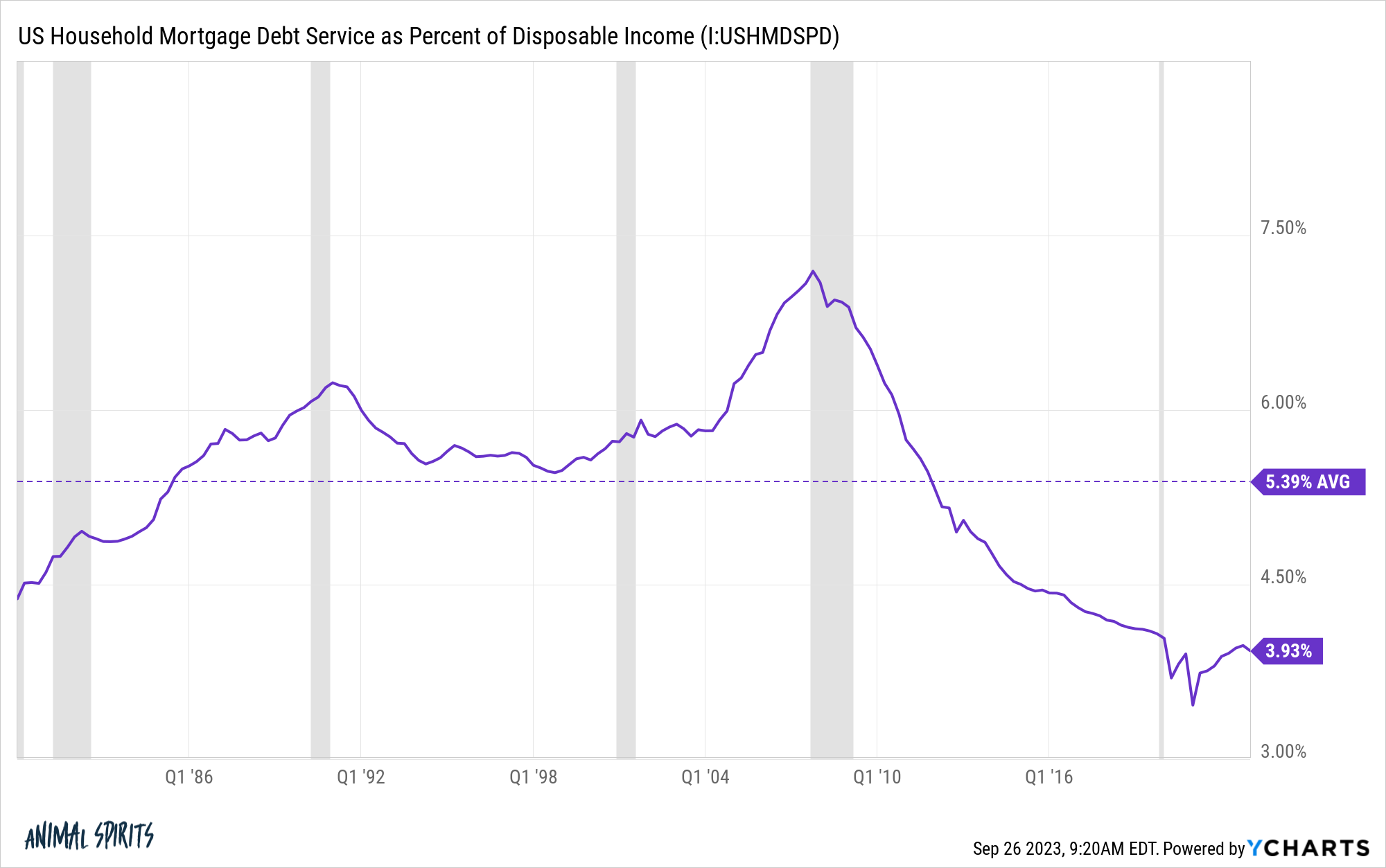

Customers are in fairly good condition. Households nonetheless have the flexibility to pay their mortgage debt:

It could take extreme job losses to deliver a couple of hearth sale of homes in the marketplace.

I’m not saying U.S. housing costs can’t or received’t fall however it’s laborious to name the present state of affairs a bubble, even with the insane run-up we’ve seen in costs.

So the place are the housing bubbles right now?

A number of weeks in the past I in contrast Canada to the USA to indicate what an precise insane housing market seems to be like.

Since I already had the information it made sense to have a look at another overseas markets to see how out of whack value good points have been relative to incomes over the previous 3+ many years.

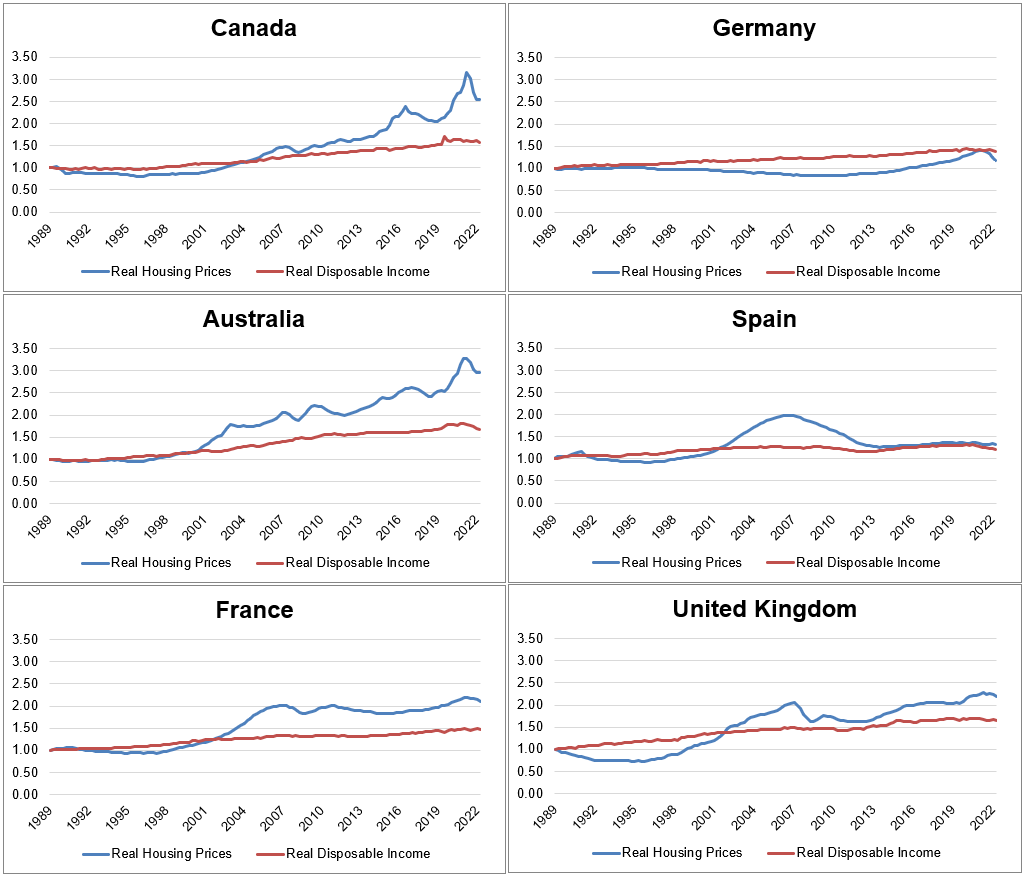

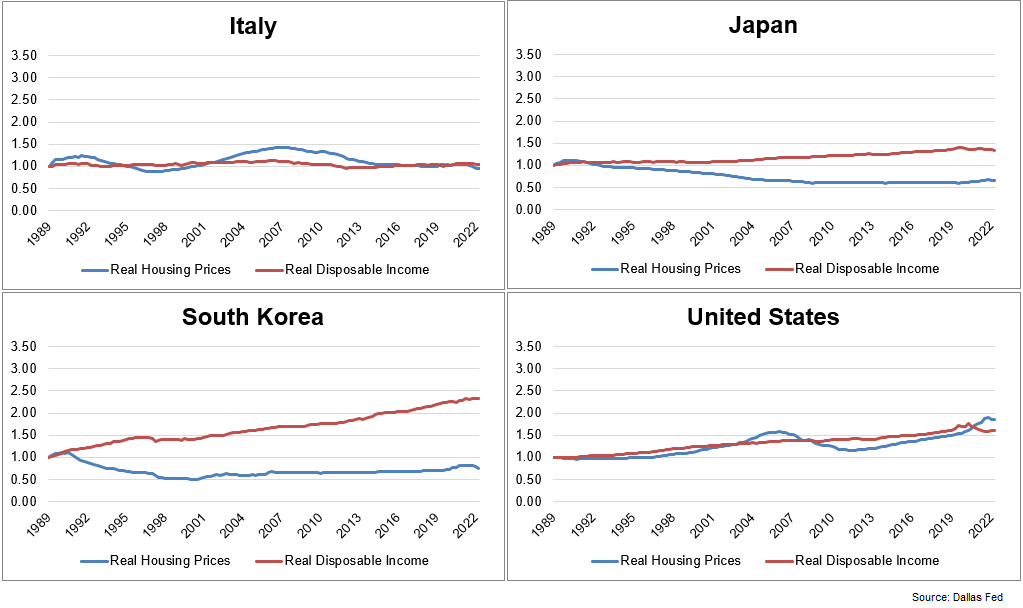

These charts present the actual (inflation-adjusted) progress in each housing costs and disposable incomes since 1990:

Canada and Australia stand out because the outliers by way of housing costs rising a lot sooner than incomes. France and the UK are up there too.

The US, Spain and Germany look comparatively tame with costs and incomes rising in tandem for many of this era.

Then you may have costs getting into the wrong way in Japan and South Korea however that’s extra of a operate of the Japanese housing bubble of the Nineteen Eighties.

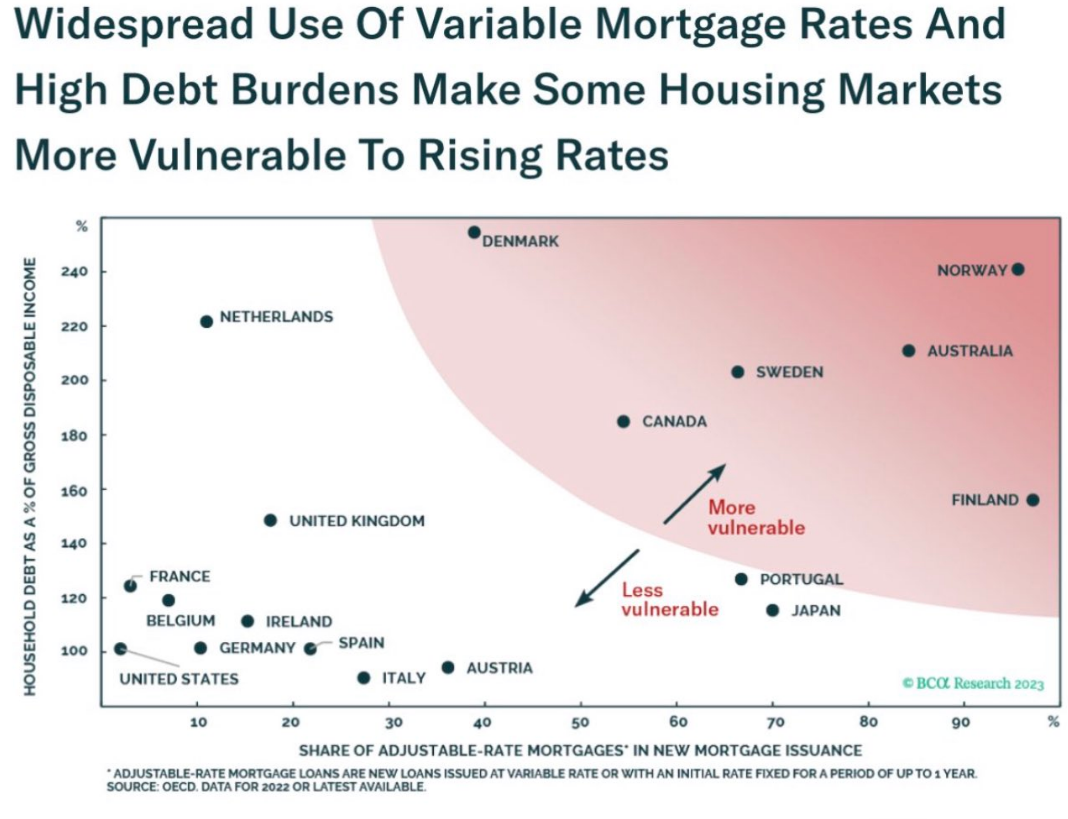

Many of those overseas markets are extra vulnerable to falling costs as a result of increased rates of interest may have a a lot larger influence on debtors. Within the U.S. we’re used to mounted price mortgages however plenty of developed nations rely closely on variable mortgage merchandise:

In nations like Canada and Australia, many loans routinely reset charges each 5 years or so. This was an exquisite factor for debtors when charges had been falling. However now that mortgage charges have greater than doubled, householders are a lot increased borrowing charges.

The markets are beginning to value this in (though we’ve got a protracted solution to go by way of getting again to extra inexpensive ranges).

For the reason that second quarter of final yr, housing costs in Canada are down 20% on an actual foundation. In Australia, costs are down 10% after accounting for inflation. Costs in France and the UK are down marginally, -5% and -4%, respectively.

I don’t have the flexibility to foretell housing costs. However when you’re in search of a possible bear market in housing, the USA is in a lot better form than different nations across the globe.

Costs have grown a lot sooner in Canada, Australia and the UK. And debtors in these nations at the moment are wanting down the barrel of a lot increased mortgage charges.

If there’s a housing bubble it doesn’t seem like in the USA.

In The Large Brief 2, Steve Carell and Ryan Gosling wouldn’t be making journeys to Las Vegas and Florida.

They might be paying visits to Toronto, Sydney, Vancouver and ghost cities in China.

Additional Studying:

The U.S. Housing Market vs. the Canadian Housing Market

[ad_2]