[ad_1]

The division launched this 12 months

The timing was proper for Alliant Insurance coverage Companies to launch Alliant Re, its reinsurance brokerage division, after it had constructed out sufficient functionality and put collectively a robust crew to guide its foray into the market.

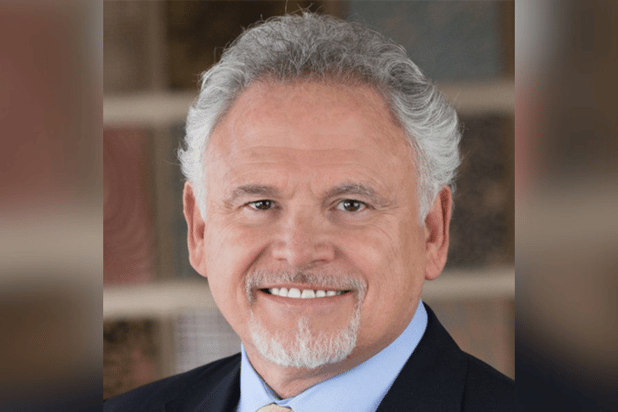

In dialog with Insurance coverage Enterprise, Peter Arkley (pictured), president, Alliant Retail Property & Casualty, pressured it was the “pure development” for the agency, one of many largest and quickest rising insurance coverage brokerage and consulting corporations within the US.

Alliant has additionally established itself in Canada by means of its Calgary and Ottawa workplaces.

“We have now the instruments in addition to the people to go to market and have influence within the reinsurance area,” Arkley stated.

“We noticed a pure alternative for our personal reinsurance operation, to work with our specialties and with our underwriting operations, and placing collectively facultative placements on the again of loads of the applications we’ve got.”

‘Greatest first step’ into the reinsurance market

As to the motivations behind the enterprise, Arkley stated: “Our companies are utilizing reinsurance, and primarily, we wished to get into that enterprise ourselves. We felt like creating our personal facultative operation was the most effective first step.

“Alliant additionally obtained to a dimension the place it actually made sense for us. When you have a look at the options of what enterprise the companies you get into for us going ahead, reinsurance was a pure development for the corporate.”

Alliant had spent a number of years constructing out its technical capability, particularly in information and analytics, forward of the launch in late April.

Armed with its guardian agency’s in depth trade partnerships and insurance coverage experience, Alliant Re goals to ship personalized reinsurance options to its shoppers.

The reinsurance brokerage’s choices embody facultative insurance coverage, computerized and semiautomatic reinsurance buildings, deductible buy-downs, captives, managing normal underwriters (MGU), and particular person threat placements and applications.

Arkley envisions Alliant Re as supporting the broader firm’s specialised enterprise, significantly in property and building. He additionally cited the robust relationships Alliant has constructed with carriers as a lift for its new reinsurance arm.

“We have now nice relationships we have constructed up with the markets over time, and we predict insurance coverage carriers would help Alliant Re as a stable reinsurance associate,” he stated.

Challenges within the property reinsurance market

Property reinsurance is in powerful cycle as proven by this 12 months’s 1/1 renewals. Amid losses from pure catastrophes, financial uncertainty, and the lingering impacts of COVID-19, reinsurers are shying away from key markets or shifting their enterprise away from reinsurance altogether.

“In some areas, it’s nonetheless very troublesome market,” Arkley acknowledged. “Actually, some varieties of specialty companies we’ve got are thought-about troublesome placements. We might look to Alliant Re to offer reinsurance experience in these areas.

“We have employed some excellent folks which might be revered within the facultative area, and we imagine that these proficient people can actually get these offers achieved.”

For Arkley, information and analytics are key to surmounting the challenges in reinsurance. A crew of about 20 people have labored solely on Alliant’s proprietary information and analytics capabilities over the past two years to “inform the story of the market” for shoppers, he shared.

“We’ve been engaged on our information and analytics developments over the previous couple of years. We intent to go deeper into these analytics with our reinsurance operation,” Arkley stated.

“It’s about ensuring that the underwriters have the instruments to make selections, so we have been investing in that and creating that.”

High expertise and authorized dispute over Alliant Re hirings

Lastly, a robust administration crew served because the final piece to finish the Alliant Re image. Nick Ambriano, a greater than 20-year veteran within the reinsurance area, had been tapped as government vp and managing director.

“I used to be very acquainted with [Ambriano] and the expertise that he brings to the desk. We see Nick as a fantastic chief who understands the enterprise very properly,” Arkley stated. “I believe that his management might be excellent for us for creating Alliant Re into a significant participant within the reinsurance area.

“We felt that it was the appropriate time for us [to launch a reinsurance brokerage], significantly since we had the appropriate high quality folks,” stated Arkley.

Alliant has vowed to defend towards the allegations.

Do you’ve any ideas about Alliant’s new reinsurance brokerage? Tell us beneath.

Associated Tales

Sustain with the most recent information and occasions

Be part of our mailing checklist, it’s free!

[ad_2]