[ad_1]

Even because the Smokehouse Creek Fireplace – the biggest wildfire ever to burn throughout Texas – was declared “almost contained” this week, the Texas A&M Service warned that situations are such that the remaining blazes may unfold and much more would possibly escape.

“At present, the hearth atmosphere will help the potential for a number of, excessive impression, giant wildfires which might be extremely resistant to manage” within the Texas Panhandle, the service stated.

This yr’s historic Texas fires – just like the state’s 2021 anomalous winter storms, California’s latest flooding after years of drought, and a surge in insured losses as a consequence of extreme convective storms throughout america – underscore the variability of climate-related perils and the necessity for insurers to have the ability to adapt their underwriting and pricing to mirror this dynamic atmosphere. It additionally highlights the significance of utilizing superior information capabilities to assist threat managers higher perceive the sources and behaviors of those occasions to be able to predict and forestall losses.

For instance, Whisker Labs – an organization whose superior sensor community helps monitor dwelling hearth perils, in addition to monitoring faults within the U.S. energy grid – recorded about 50 such faults in Texas forward of the Smokehouse Creek fires.

Bob Marshall, Whisker Labs founder and chief govt, advised the Wall Avenue Journal that proof suggests Xcel Vitality’s gear was not sturdy sufficient to resist the form of excessive climate the nation and world more and more face. Xcel – a significant utility with operations in Texas and different states — has acknowledged that its energy traces and gear “seem to have been concerned in an ignition of the Smokehouse Creek hearth.”

“We all know from many latest wildfires that the implications of poor grid resilience may be catastrophic,” stated Marshall, noting that his firm’s sensor community recorded related malfunctions in Maui earlier than final yr’s lethal blaze that ripped throughout the city of Lahaina.

Function of presidency

Authorities has a essential function to play in addressing the chance disaster. Modernizing constructing and land-use codes; revising statutes that facilitate fraud and authorized system abuse that drive up declare prices; investing in infrastructure to cut back pricey harm associated to storms – these and different avenues exist for state and federal authorities to help catastrophe mitigation and resilience.

Too typically, nevertheless, the general public dialogue frames the present state of affairs as an “insurance coverage disaster” – complicated trigger with impact. Legislators, spurred by calls from their constituents for decrease premiums, typically suggest measures that might are inclined to worsen the issue as a result of they fail to mirror the significance of precisely valuing threat when pricing protection.

The federal “reinsurance” proposal put forth in January by U.S. Rep. Adam Schiff of California is a working example. If enacted, it will dismantle the Nationwide Flood Insurance coverage Program (NFIP) and create a “catastrophic property loss reinsurance program” that, amongst different issues, would set protection thresholds and dictate score elements primarily based on enter from a board through which the insurance coverage trade is barely nominally represented.

U.S. Rep. Maxine Waters (additionally of California) has proposed a Wildfire Insurance coverage Protection Examine Act to analysis points round insurance coverage availability and affordability in wildfire-prone communities. Throughout Home Monetary Companies Committee deliberations, Waters in contrast present challenges in these communities to situations associated to flood threat that led to the institution of NFIP in 1968. She stated there’s a precedent for the federal authorities to step in when there’s a “non-public market failure.”

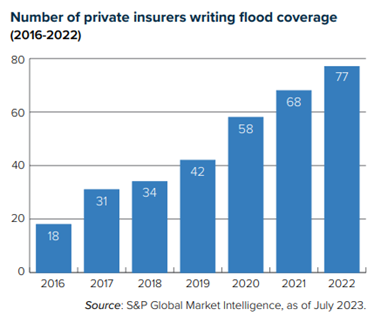

Nonetheless, flood threat in 1968 and wildfire threat in 2024 couldn’t be extra totally different. Earlier than FEMA established the NFIP, non-public insurers have been usually unwilling to underwrite flood threat as a result of the peril was thought of too unpredictable. The rise of subtle pc modeling has since given non-public insurers a lot better confidence overlaying flood (see chart).

In California, some insurers have begun rethinking their urge for food for writing householders insurance coverage – not as a result of wildfire losses make properties within the state uninsurable however as a result of coverage and regulatory selections revamped 30 years in the past have made it arduous to write down the protection profitably. Particularly, Proposition 103 and its regulatory implementation have blocked using modeling to tell underwriting and pricing and restricted insurers’ capacity to include reinsurance prices into their premium pricing.

California’s Insurance coverage Commissioner Ricardo Lara final yr introduced a Sustainable Insurance coverage Technique for the state that features permitting insurers to make use of forward-looking threat fashions that prioritize wildfire security and mitigation and embrace reinsurance prices into their pricing. It’s affordable to anticipate that Lara’s modernization plan will result in insurers growing their enterprise within the state.

It’s comprehensible that California legislators are desperate to act on local weather threat, given their lengthy historical past with drought, hearth, landslides and newer expertise with flooding as a consequence of “atmospheric rivers.” But it surely’s necessary that any such measures be properly thought out and never exacerbate present issues.

Companions in resilience

Insurers have been addressing climate-related dangers for many years, utilizing superior information and analytical instruments to tell underwriting and pricing to make sure adequate funds exist to pay claims. In addition they have a pure stake in predicting and stopping losses, fairly than simply persevering with to evaluate and pay for mounting claims.

As such, they’re perfect companions for companies, communities, governments, and nonprofits – anybody with a stake in local weather threat and resilience. Triple-I is engaged in quite a few initiatives geared toward uniting various events on this effort. For those who signify a corporation that’s working to deal with the chance disaster and your efforts would profit from involvement with the insurance coverage trade, we’d love to listen to from you. Please contact us with a quick description of your work and the way the insurance coverage trade would possibly assist.

Be taught Extra:

Triple-I “State of the Threat” Points Transient: Wildfire

Triple-I “State of the Threat” Points Transient: Flood

Triple-I “Tendencies and Insights” Points Transient: California’s Threat Disaster

Stemming a Rising Tide: How Insurers Can Shut the Flood Safety Hole

[ad_2]