[ad_1]

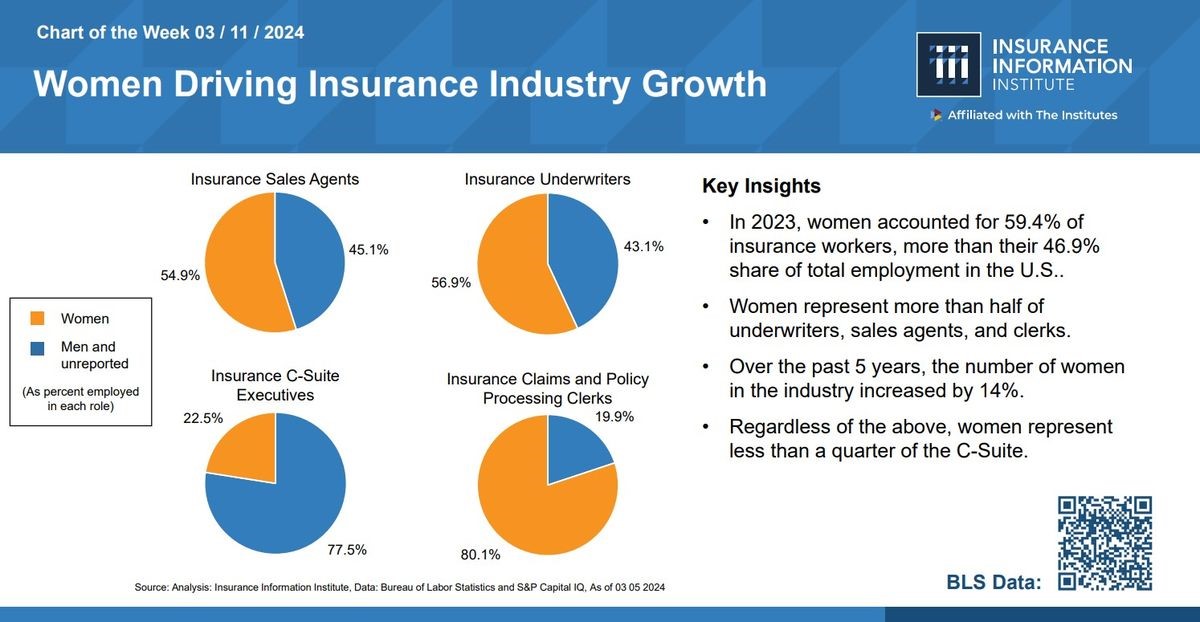

The insurance coverage trade is on observe for continued development, with girls enjoying an enormous half, however gender fairness on the high stays a great distance off. Bureau of Labor Statistics (BLS) knowledge reveals the expertise pipeline isn’t a difficulty, as girls account for 59.4 p.c of the insurance coverage workforce. They comprise 80.1 p.c of staff serving as claims and coverage processing clerks, 54.9 p.c in gross sales roles, and 56.9 p.c of underwriters. But, solely about 22 p.c (lower than 1 in 4) of staff within the C-Suite are girls.

Regardless of the setbacks of the early pandemic years, through which girls shouldered the brunt of associated workforce losses, girls have made up roughly 60 p.c of the insurance coverage workforce every year since 2012, exceeding their share of whole employment within the U.S. (46.9 p.c).

Personal sector analysis provides extra particulars to this stark image. A Marsh research carried out in 2022 revealed that “25 out of 27 (92.5 p.c) of the biggest insurance coverage firms had been led by males.” Equally, a McKinsey research confirmed, “white girls make up 45 p.c of entry-level roles but…fewer than one in 5 direct reviews to the CEO are girls.” Gender disparities additionally seem to extend throughout race and ethnicity.

A current research from Liberty Mutual and Safeco Insurance coverage reveals that the variety of girls house owners or principals in insurance coverage businesses decreased from 31 p.c to 26 p.c between 2022 and 2023. In distinction, girls comprise 75 p.c of customer-facing employees in these organizations.

S&P World Analysis evaluation findings recommend “girls may attain parity in senior management positions between 2030 and 2037, amongst firms within the Russell 3000.” Whether or not which may play out in the end for insurance coverage isn’t clear. The August 2023 report additionally reveals that the “majority of progress in the direction of gender parity is coming from girls taking seats on firm boards.” Nonetheless, C-suite management throughout all industries might not present full gender parity till the 2050s, and “the best ranges in CEO and CFO positions may take even longer.”

Gender parity can supply options for a wholesome monetary future

In the meantime, the trade expects to face huge attrition as 1000’s of staff (together with their management abilities and data) finally exit the workforce within the coming years. Automation and synthetic intelligence/machine studying (AI/ML) might remove the necessity for some roles. Nonetheless, insurers will undoubtedly want to keep up an ecosystem of effectivity and innovation to stay worthwhile. Elevated implementation of data-driven processes and decision-making brings new moral implications and regulatory obligations.

Organizational variety is often outlined as individuals from quite a lot of backgrounds and views working collectively to unravel enterprise issues. Strategic long-term success requires figuring out, growing, and selling various expertise in any respect ranges. Nonetheless, an absence of variety on the C-suite degree can undermine probably the most valiant recruitment efforts in different components of the group. Right now’s pushed and career-focused candidates are cautious of glass ceilings and might want proof that inclusion and fairness come from the highest.

Analysis has indicated girls in management can positively influence the organizations they run. After a collection of 4 research over a number of years, findings from McKinsey point out that “management variety can be convincingly related to holistic development ambitions, better social influence, and extra glad workforces.” Additional, the newest research additionally notes the “enterprise case for gender variety on government groups has greater than doubled over the previous decade.” Different analysis signifies that, amongst U.S. property-casualty insurance coverage firms, feminine CEOs are related to “decrease insurer insolvency propensity, increased z-score, and decrease commonplace deviation of return on belongings.”

Within the period of the nation’s first feminine vice-president, in the end, company boards may discover that reflecting the market demographics the savviest and most compelling of all causes to diversify senior management. Collectively, U.S. millennials and the oldest Gen Zers (already taking over grownup obligations) command almost $3 trillion in spending energy every year. Each generations have duly ready themselves to advance within the workforce, turning into extra educated than earlier generations. And they’re going to little doubt seize a chance the place they will discover it.

[ad_2]