[ad_1]

That is prone to have been brought on by enhancing financial savings charges on account of continuous Financial institution of England price rises, not an amazing want so as to add to pension contributions.

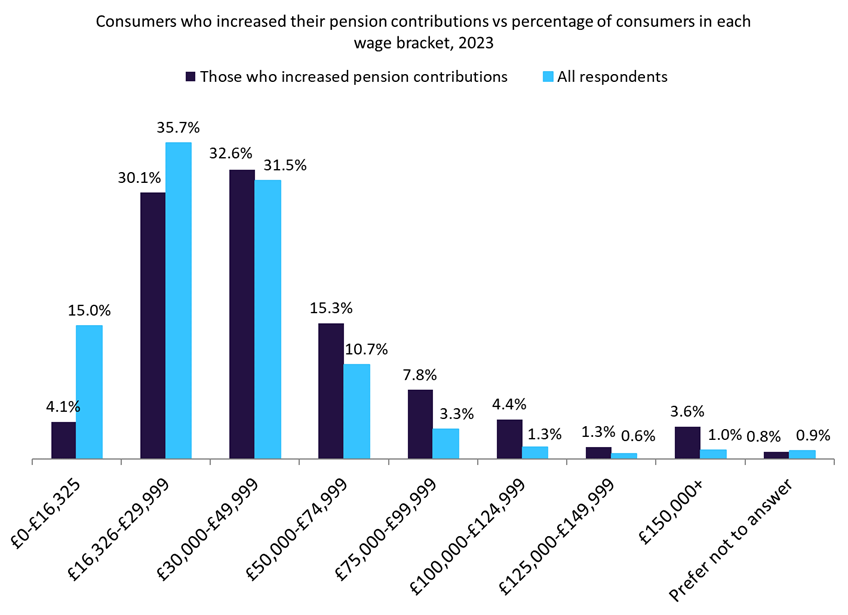

GlobalData’s 2023 UK Life and Pensions Survey discovered that 18.2% of customers elevated their pension contributions over the earlier 12 months, in comparison with simply 3.3% who diminished them. A disproportionate proportion of those that earn in extra of GBP50,000 per 12 months elevated their contribution in comparison with the general proportion of customers who earn that a lot.

It might need been anticipated that individuals would have diminished their contributions in a bid to chop family payments through the cost-of-living disaster pushed by excessive inflation.

Nonetheless, for individuals who can afford it, during the last 12 months financial savings charges have been at their most interesting ranges in a decade. The Financial institution of England raised the central financial institution price for the thirteenth successive time to five.0% in June 2023. This interprets to extra enticing charges for financial savings accounts and pensions funds. But this isn’t all excellent news for savers, because the central financial institution price stays significantly decrease than the newest inflation determine of 8.7%.

Subsequently, even when their pension pots are rising, savers are shedding cash towards present costs. Moreover, pensions aren’t merely financial savings accounts, and a few funds might be pushed in direction of extra dangerous investments by inflation ranges.

Our information reveals that individuals who can afford to spare any cash have been using the improved charges pensions funds have been providing. Though solely 16.9% of customers earn in extra of GBP50,000 per 12 months, 32.4.% of those that elevated their contributions prior to now 12 months fall into that wage bracket. Equally, 42.9% of the three.3% of customers who diminished their contribution had been within the GBP16,000–29,999 per 12 months wage bracket.

Because the saving surroundings continues to enhance and inflation is predicted to fall later in 2023, pension funds ought to proceed to see will increase in contributions from wealthier purchasers.

[ad_2]