[ad_1]

World nomad journey insurance coverage is designed to cowl the distinctive wants of the long-term nomad traveler. Does it go well with you? Learn on and discover out

Nomad vacationers wander the world for prolonged intervals, that’s why their protection wants differ than these of the common traveler. If you happen to belong to this demographic, you then perceive the significance of getting journey insurance coverage to guard you when sudden occasions threaten to disrupt your journey plans.

What options and advantages do you have to think about when looking for the correct safety? Insurance coverage Enterprise solutions this query and extra as we delve deeper into this rising type of protection known as nomad journey insurance coverage. Learn on and study extra about how the sort of coverage works and the way it can shield world nomads such as you.

World nomad journey insurance coverage works like a typical journey insurance coverage plan – it covers bills ensuing from health-related and medical emergencies and different unexpected disruptions to your itinerary. Since such insurance policies are designed for the nomad traveler, additionally they include options that go well with their way of life.

Most insurance policies present medical protection provided that you’re outdoors your house nation. Whereas some plans provide safety for those who return to the US, the extent of protection and size of time that you’re lined are sometimes topic to limits.

As well as, you should buy nomad journey insurance coverage even for those who’re already abroad, not like normal journey plans, which it is best to have earlier than your departure.

Nomad insurance coverage can also be renewable much like annual or multi-trip journey insurance coverage. You can too tailor your coverage to fulfill your altering wants by including or eradicating protection. If you happen to’re touring along with your children, some plans will let you embrace them in your protection freed from cost in the event that they meet a sure age requirement.

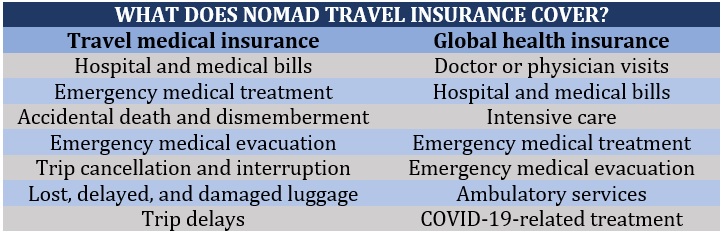

Nomad journey insurance coverage sometimes gives two sorts of protection. These are:

1. World medical or medical insurance

Managing well being care is likely one of the largest challenges nomad vacationers usually face, particularly in a vacation spot the place sufferers are required to indicate proof of their potential to pay earlier than getting therapy. Having the correct journey medical protection is commonly thought-about enough proof you can afford therapy.

World medical insurance comes with a capped quantity, but it surely gives a variety of protection, together with:

- Physician or doctor visits

- Hospital and medical payments

- Intensive care

- Emergency medical therapy and procedures

- Emergency medical evacuation and repatriation

- Ambulance transport providers

- COVID-19-related therapy

Some insurance policies additionally cowl emergency dental care and rehabilitation bills, together with chiropractic care and bodily remedy if these have been ordered by a health care provider.

2. Journey medical insurance coverage

Journey medical insurance coverage for nomads covers most of the gadgets listed above, however the primary distinction is that it additionally gives cowl for travel-related disruptions. These embrace:

- Journey cancellation and interruption

- Misplaced, delayed, or broken baggage and private belongings

- Journey delays and missed flights

- Unintended dying and dismemberment, together with repatriation prices

Some insurance policies additionally provide protection in opposition to private legal responsibility. This and the gadgets listed above are all topic to protection limits.

Right here’s a abstract of the standard inclusions for the various kinds of nomad insurance coverage protection:

Similar to different sorts of insurance policies, nomad journey insurance coverage doesn’t cowl each incident that disrupts your journey. Most plans don’t present protection for the next:

- Sicknesses and accidents attributable to high-risk sports activities and actions

- Alcohol- and drug-related diseases and accidents

- Sickness and accidents ensuing from unlawful actions

- Most cancers therapy

- Pre-existing medical circumstances

It’s also essential to notice that whereas nearly all journey insurance coverage insurance policies don’t cowl pre-existing medical points, vacationers can usually entry a waiver to set off protection. You possibly can study extra about how this profit works by trying out our complete information to journey insurance coverage for pre-existing circumstances.

Some insurance policies additionally include age restrictions, sometimes denying protection for vacationers 70 years previous and above. There are additionally plans that don’t cowl residents of sanctioned nations.

Whereas dangerous actions are sometimes excluded, some nomad insurance coverage insurance policies present protection for sure journey sports activities.

One other factor it is best to bear in mind is that completely different insurance policies provide various ranges of safety. That’s why it’s essential that you simply learn the coverage doc fastidiously earlier than buying a plan, so you’ll know what you’re lined for and what’s excluded.

Premiums for a world nomad journey insurance coverage coverage rely on a variety of things which fluctuate per traveler, that’s why it’s tough to offer a certain quantity. However primarily based on the value comparability and insurer web sites that Insurance coverage Enterprise checked out, the value ranges from about $40 to effectively above $100 month-to-month for a single traveler.

The primary elements that influence premiums embrace:

- The traveler’s age: Nomad vacationers above 30 to 40 years previous can anticipate to pay considerably larger than their youthful counterparts, generally greater than double. For senior vacationers, or these aged above 60, the premiums are even larger.

- The variety of vacationers: Extra folks included in your coverage additionally means larger premiums. One factor to notice is that almost all insurance policies have limits on the quantity and age of the individuals you’ll be able to add.

- Size of journey: Whether or not you’re staying in a single location for prolonged intervals or often touring to a number of locations has a direct influence on the price of nomad journey insurance coverage.

- Stage of protection: If you happen to’re continually touring to completely different places, it’s possible you’ll want so as to add protection to go well with the necessities of your vacation spot. These further advantages can push up your insurance coverage charges.

One other approach to go to a number of locations in a single go is thru cruises, particularly for those who’re not into spontaneous journey. If you happen to desire the sort of journey as a substitute, it’s possible you’ll want a special sort of coverage known as cruise ship journey insurance coverage. Study extra about this type of protection by clicking the hyperlink.

Completely different vacationers have various wants however for those who’re a nomad traveler, there are particular protection you can’t go with out. Listed below are a number of the coverage options which might be thought-about important in your way of life.

Emergency medical protection: Well being and medical care may be extraordinarily costly, particularly for those who’re abroad. This coverage covers you financially for those who get sick or injured whereas touring abroad.

Emergency medical evacuation cowl: Such a protection is essential for those who’re touring to a distant location with insufficient medical infrastructure. This pays out for the price of transporting you to a medical facility that may present correct therapy. Evacuation cowl can also be obtainable throughout incidents of struggle, terrorism, political instability, and pure calamities.

Protection for journey cancellation, interruption, and delay: There are a number of explanation why your journey could also be reduce brief, postponed, and even cancelled and so they’re not at all times medical. In these situations, it pays to be lined. Journey cancellation and interruption insurance coverage means that you can get again your pre-paid non-refundable journey bills.

Baggage cowl: This covers you in case your baggage is misplaced or broken, or it doesn’t arrive at your vacation spot on time. Such a coverage comes with a capped quantity and is topic to closing dates.

24/7 emergency help providers: Medical emergencies and different disruptions to your itinerary come with out warning. Your world nomad journey insurance coverage coverage ought to present the mandatory service whenever you want it.

The US is dwelling to a number of insurers providing nomad journey insurance coverage. Some are specialists whereas others are conventional carriers offering protection as a part of their complete journey plans. Listed below are a couple of of the highest corporations within the nation that provide insurance coverage for nomad vacationers. The record is organized alphabetically.

1. Insured Nomads

1. Insured Nomads

Insurtech agency Insured Nomads makes a speciality of offering journey and well being protection to expats, distant staff, and nomad vacationers. Its journey insurance coverage merchandise encompass:

- Journey medical insurance coverage

- Journey cancellation insurance coverage

- Warzone cowl

- Journey group advantages

Its World Explorer Journey Medical Insurance coverage plan gives as much as $2 million in medical advantages for single journeys, starting from seven to 364 days, together with a complimentary 12-month membership. Among the many outstanding options of this coverage are:

- Entry to 24-hour emergency medical care

- Protection for acute onset of a pre-existing situation

- Emergency dental therapy

- COVID-19 cowl

- Entry to native ambulance transport providers

- Evacuation and repatriation cowl

- Lodging cowl throughout pure disasters

- Entry to airport lounge for registered delayed flights

- Misplaced baggage protection

- Psychological wellness advantages

- Protection for sure journey and marine sports activities

Policyholders also can entry journey alerts and country-specific datasheets, permitting them to make knowledgeable selections about their journeys.

2. SafetyWing

2. SafetyWing

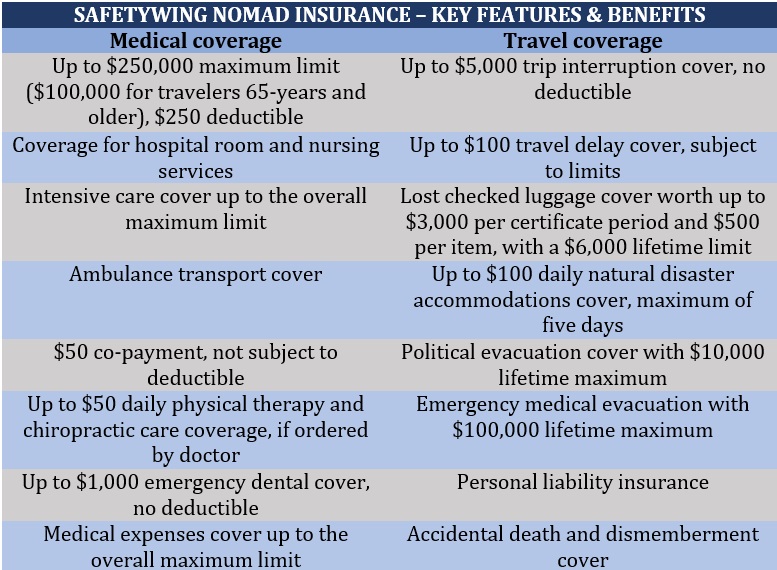

SafetyWing is one other nomad journey insurance coverage specialist. Its plan consists of two elements:

- Medical protection: Gives cowl for those who get sick or injured, or in want of medical help whereas touring overseas.

- Journey protection: Pays out for travel-related disruptions, together with flight delays, misplaced baggage, or journey cancellations. The desk beneath particulars what these insurance policies cowl.

SafetyWing’s nomad journey insurance coverage additionally means that you can subscribe to steady protection for those who’re touring to a number of nations. You might be additionally lined for temporary visits again to the US, normally as much as 15 days so long as you could have spent a minimum of 90 days overseas. If you happen to’re touring with kids, you’ll be able to add as much as two children beneath 10 years previous to your coverage without spending a dime.

3. Travelex

3. Travelex

Travelex gives journey insurance coverage for nomads underneath its Journey Choose plan, one among its most complete journey insurance policies. It covers journeys lasting 364 days. Policyholders can entry these options:

- Journey cancellation cowl, as much as 100% of the non-refundable journey value or a most of $50,000

- Journey interruption cowl, as much as 150% of the non-refundable journey value or a most of $75,000

- As much as $2,000 journey delay cowl with a each day sublimit of $200, topic to closing dates

- As much as $750 missed connection cowl, topic to closing dates

- As much as $50,000 emergency medical expense protection, together with $500 dental cowl

- As much as $500,000 emergency medical evacuation and repatriation of stays cowl

- As much as $1,000 baggage and private results cowl

- As much as $200 baggage delay cowl, topic to closing dates

- As much as $200 sports activities tools delay cowl, topic to closing dates

- As much as $25,000 unintentional dying and dismemberment cowl

If you happen to’re touring with kids 17 years previous and youthful, you’ll be able to add them to your coverage without spending a dime. The plan will also be upgraded to incorporate automotive rental safety and cancel-for-any-reason protection.

4. World Nomads

4. World Nomads

World Nomads gives worldwide journey insurance coverage and journey security providers. It gives customizable journey insurance policy designed for nomad vacationers. What units its world nomad journey insurance coverage insurance policies other than business rivals is that the plans cowl a complete record of over 200 sports activities and journey actions.

You possibly can select between two sorts of insurance policies – the extra inexpensive Normal Plan and the extra complete Explorer Plan, which has the next inclusions:

- As much as $100,000 emergency medical cowl

- As much as $500,000 emergency evacuation cowl

- As much as $10,000 journey safety cowl

- As much as $3,000 private gadgets cowl

Policyholders also can entry 24-hour journey help providers backed by a workforce of multilingual representatives.

Being a nomad traveler presents a novel set of dangers completely different from these confronted by an everyday traveler. Oftentimes, having journey insurance coverage is as important as carrying your passport.

Whilst you can entry protection by a typical coverage – which generally prices much less – a world nomad journey insurance coverage plan can present higher safety suited in your wants.

You possibly can select to take out a coverage from a nomad journey insurance coverage specialist or a standard journey insurer that gives complete protection. What’s essential is that the safety it gives matches your private preferences and circumstances.

If you wish to know what sort of protection the highest insurers throughout the nation present, you’ll be able to try our newest rankings of the high journey insurance coverage corporations within the US.

Do you suppose world nomad journey insurance coverage is critical for the nomad traveler or is an everyday journey insurance coverage coverage sufficient? Chat us up within the feedback part beneath.

Sustain with the newest information and occasions

Be part of our mailing record, it’s free!

[ad_2]