[ad_1]

I’ve some common ideas in the case of investing which have served me properly over time:

- Easy is best than complicated

- Much less is extra

- Markets are onerous

- Lengthy-term returns are the one ones that matter

- Markets can go loopy as a result of folks could be loopy

- Make good selections forward of time

- Outperforming the market just isn’t simple

There’s extra to it than that however these are Ben’s common investing guidelines to reside by.1

That final one about outperformance is one thing I’ve witnessed firsthand all through my funding profession.

It’s onerous to consider how a lot brainpower, time, effort and cash go into beating the market by hedge funds, mutual funds, separately-managed accounts and stock-pickers…and the overwhelming majority of them fail at their acknowledged objective.

The Wall Road Journal gave an replace on the most recent numbers for this yr. Spoiler alert — they’re not nice:

Just one in three actively managed large-cap mutual funds beat their benchmarks within the first three months of the yr, the worst efficiency because the three-month interval ended December 2020, in accordance with information from Financial institution of America International Analysis.

That marked a shift from final yr when 57% of large-cap mutual funds raced forward of their benchmarks in a market rocked by red-hot inflation, rising rates of interest and worries over a possible recession. Extra funds beat their benchmarks in 2022 than in every other yr since 2007, when 71% of them did so, in accordance with information compiled by Goldman Sachs Group Inc.

To be honest, three months is a ridiculously quick time period in the case of gauging the success or failure of any funding technique. Even a yr isn’t all that useful. One yr doesn’t the long-term make.

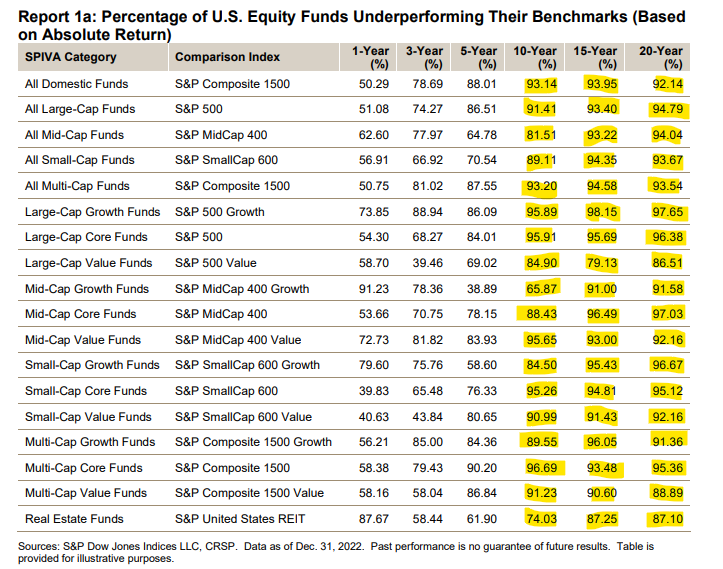

The issue for stock-pickers is the longer you exit the more serious the outcomes. The annual SPIVA Report from Commonplace & Poors seems at quite a few totally different intervals by year-end 2022:

Have a look at these 10, 15 and 20 yr beat charges!

Throughout all these varied asset lessons, easy indexes beat roughly 90% of all actively managed funds.

These funds are stuffed with a few of the most well-educated folks in finance who spend numerous hours performing safety evaluation, assembly with firm administration, doing channel checks and digging into financials.

I’ve been over these items advert nauseam over time so no must beat a useless energetic supervisor right here.

However this did get me serious about the timing of outperformance. Actively managed funds did do higher in 2022 than they’ve achieved in years when it comes to beating their benchmark.

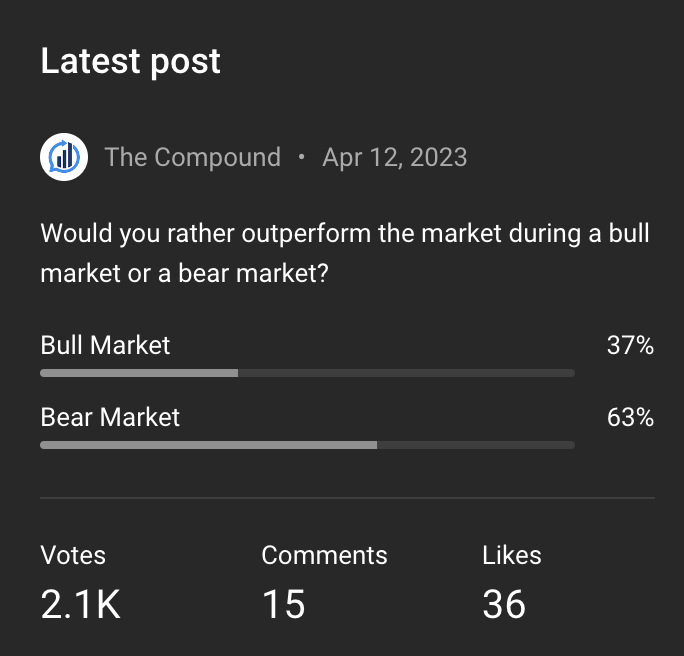

Would traders be higher off outperforming throughout bull markets or bear markets?

Our viewers at The Compound appears to choose outperformance throughout a downturn:

This is smart when you think about how a lot we abhor losses as a species. Shedding cash is painful.

I can see why folks would favor making 40% when the market is up 50% and being down 10% whereas the market is down 20%. The RPMs of your feelings redline throughout a bear market.

Positive, there’s greed and FOMO throughout bull markets however so long as you’re making a living, most traders are content material even when they’re not making as a lot as different folks.2

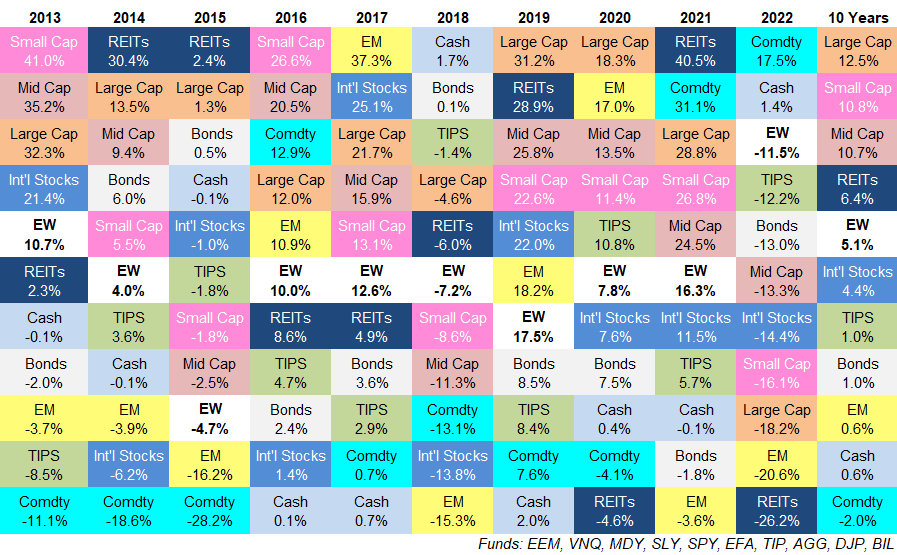

Diversification mainly ensures that you simply’ll underperform one of the best asset class throughout a bull market and outperform the worst asset class throughout a bear market:

(Individuals all the time ask once they see this chart — EW is equal weight or a easy common of every asset class.)

It’s a lot tougher to be invested within the excessive flyers always as a result of the inevitable busts that observe the growth occasions could be so brutal.

But when you consider the best way the inventory market usually works, the beneficial properties far outweigh the losses so the bull markets greater than make up for the bear markets.

The inventory market is up 3 out of each 4 years on common. Bull markets last more than bear markets.

I’m positive there are people who find themselves wired to personal the stuff that’s supercharged throughout a raging bull market with the understanding that the opposite facet of the height is a deep valley.

Whether or not they knew it or not, that’s the profile of many tech traders who went all in on software program shares and crypto throughout this cycle. The beneficial properties have been huge through the upswing however devastating on the downswing.

Clearly, generally you don’t get a selection in the case of while you outperform the markets.

Most individuals spend all their waking hours in pursuit of the ever-elusive alpha that’s practically not possible to return by.

Most traders could be higher served making an attempt to keep away from underperforming their very own holdings by continually making an attempt to time the markets or guess which asset class or technique would be the subsequent massive winner.

The markets are onerous sufficient as it’s so there’s no purpose to make them any tougher than they need to be.

Michael and I talked about outperforming the market and way more on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

Markets Are Laborious: Seth Klarman Version

Now right here’s what I’ve been studying these days:

1These are my private tips. They don’t work for everybody however they do work for me.

2I’m generalizing right here in fact. It actually is determined by your emotional make-up as an investor.

[ad_2]