[ad_1]

No sense in dwelling on 2022…however for the document, let’s memorialize some stats and figures. (Hat tip @bespokeinvest for the next charts.)

First, let’s begin at a excessive degree

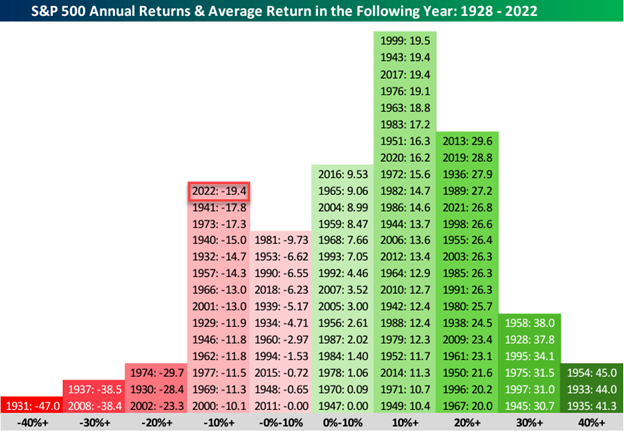

The chart beneath reveals the annual returns of the S&P 500 damaged down into teams of 10 proportion factors intervals. You’ll discover that 2022 was the 14th yr since 1928 that the index has been down between -10 and -20% in a single yr. Not solely that however additionally it is the seventh worst loss since 1920. You simply depend the packing containers from 2022 over to the left to see that.

For those who’ve identified me for any period of time, you’ll know I’m keen on distinguishing between ‘potentialities and possibilities’. Please observe the variety of years that fall out to the correct vs the left on the graph above.

Okay, shifting on…

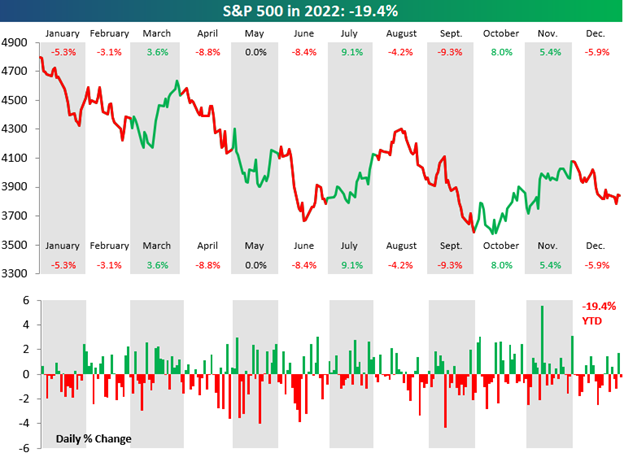

Right here’s the S&P 500 in 2022, damaged down by months

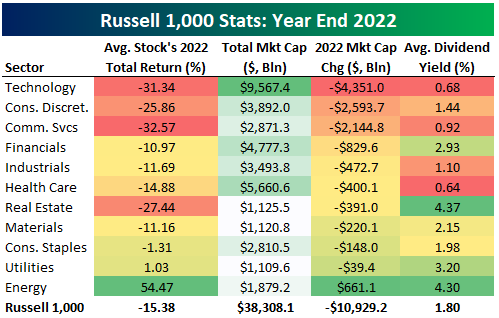

Now, right here’s how the sectors ended up for the yr

I’m utilizing the Russell 1000 (R1000) as a result of some sectors within the S&P 500 solely have a couple of securities, so that is simply extra fascinating.

Under you will note the R1000 sectors by Return / Complete Market Cap / Change in Market Cap / Ave Dividend Yield – have a look at these prime three modifications in market cap.

Power crushed all the pieces in 2022. The truth is, of the 30 finest performing R1000 shares, 22 are within the Power sector. Exxon Mobil (XOM) logged a complete return of ~87% for 2022…and it ranked fifth!

Listed below are the highest 5 performers of the Russell 1000:

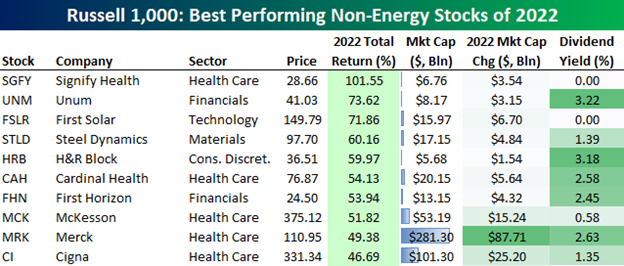

Now, let’s strip-out the shares within the Power sector and have a look at the highest 10

Of curiosity, solely 8 shares outdoors of the power sector had a 50% or greater return for 2022. Two of the most important names in Healthcare, Merck (MRK) and Eli Lilly (LLY), didn’t even clear the +50% hurdle, posting 2022 features of ‘solely’ 49.4% and 34.2%, respectively.

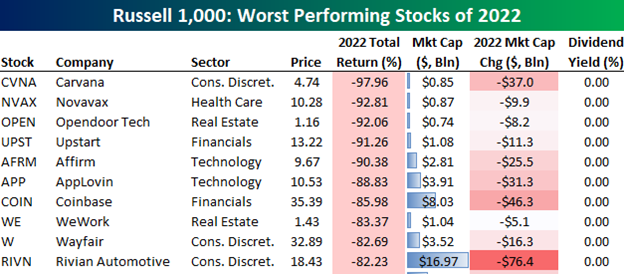

And now, let’s have a look at the ten worst performers within the R1000 of 2022

Breaking it down, it shakes out like this: 45% of shares fell 20% or extra (whole return), 30% fell 30%+, nearly 20% fell 40%+, and 11% fell by 50% or extra. It’s possible you’ll discover your eyes scanning for Tesla as a result of effectively that appears to be the one inventory the press desires to speak about, however it was solely down 65.3%. It was, nevertheless, within the prime 5 market cap losers of 2022 (second chart).

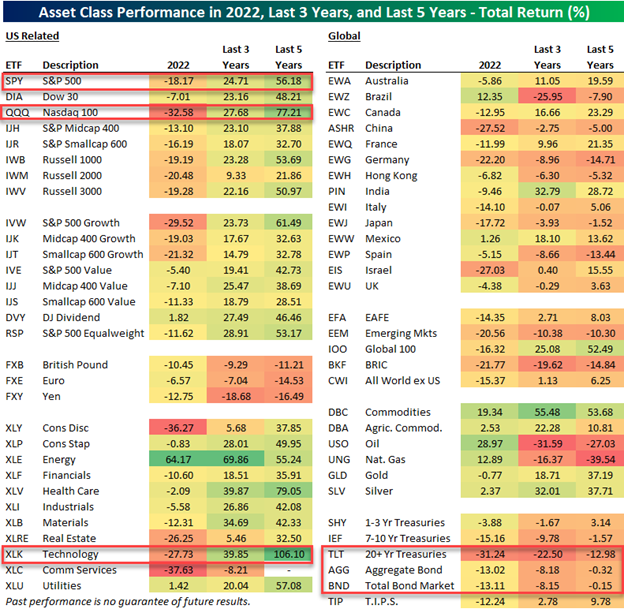

Let’s conclude by ETF whole returns throughout asset lessons

We’ll have a look at these ETF returns for not simply 2022, however during the last three and 5 years as effectively as a result of (damaged document alert) we preach elevating the money you want for the following 12-18 months to assist keep away from compelled gross sales to fund your wants when the market is down.

Under you’ll discover that some areas that did the worst in 2022 are nonetheless up essentially the most on a 5-year foundation. For instance, the Nasdaq 100 (QQQ) was down greater than another main index ETF in 2022, however while you look out over that previous 5 years, it’s nonetheless up essentially the most.

Expertise (XLK) is an apparent sector to take a look at. It was one of many worst sectors in 2022, however it’s the one sector up greater than 100% during the last 5 years.

For bonds, the long-term Treasury ETF (TLT) has had a complete return of -12.98% during the last 5 years however that’s primarily because of the 31% drop in 2022. Two different combination bond market ETFs (BND, AGG) are additionally barely down over a 5-year whole return foundation.

Ahem…examine that to the S&P’s (SPY) five-year acquire of 56.2%.

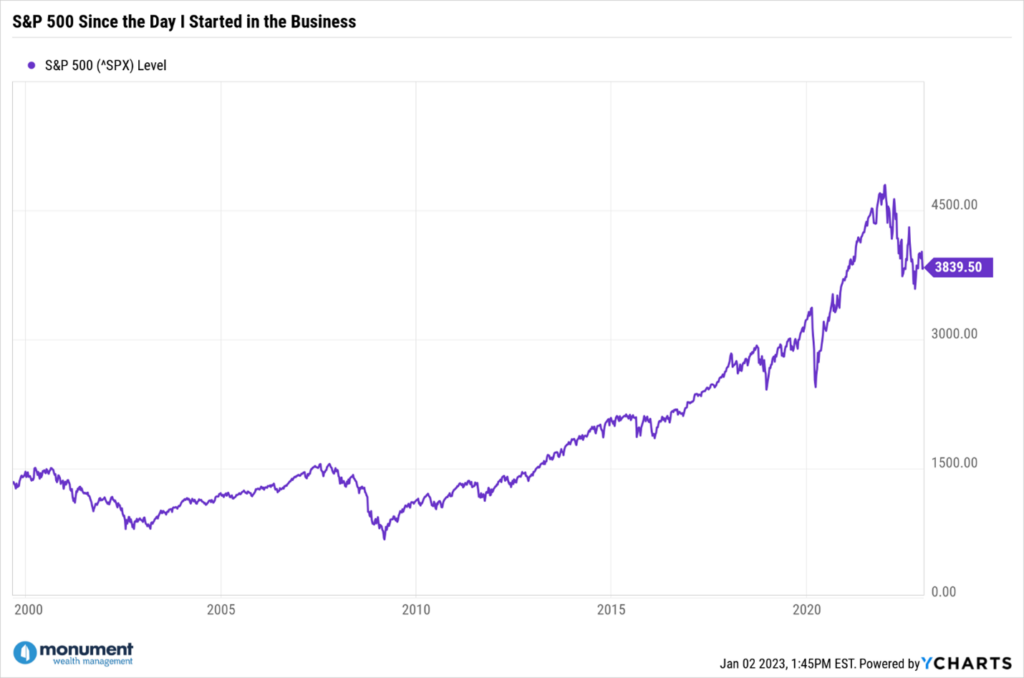

I’ll conclude with this

Over the long run, the inventory market is undefeated.

We now have been by way of dangerous instances earlier than and so they at all times grow to be actually good alternatives for long-term traders to both proceed to be affected person or to put some money to work.

There’s after all no assure that subsequent yr will likely be higher than this yr, however for these individuals who have the correct long-term perspective on investing and have aligned their portfolios with their targets and aims issues will grow to be okay.

How can I be so certain? Refer again as much as that very first chart and you will note that there have been 20 years the place losses within the S&P 500 have equaled 10% or extra. In any other case referred to as double digit losses.

Since I began out within the business in 1999, I’ve lived by way of 25% of these double-digit losses and in reality, I lived by way of three of them back-to-back – 2000, 2001, & 2002.

Right here’s the chart:

The important thing to 2023 – and endlessly

Confidence is essential.

It’s possible you’ll be saying to your self, “Congrats Dave, you get a gold star for experiencing 25% of these loss durations…however so what?”

Right here’s what: I bear in mind the teachings realized, and people experiences had been formative and useful for after I give folks recommendation.

So right here it’s…as an investor it’s crucial that you simply grow to be comfy with uncertainty. Whereas many individuals will talk about the thought of portfolios that take away uncertainty, the truth is that it will possibly by no means be absolutely eliminated.

A portfolio that reduces uncertainty solely removes anticipated return. If there isn’t any threat of loss, there can by no means be a acquire. It’s merely the way in which this works. For those who lock a roll of quarters in a secure, bury it in your yard, and dig it up 10 years later, you’ll have a roll of quarters.

I may maintain occurring in regards to the function inflation would play on this instance, however I’ll go away it there.

Please let go of the fantasy that you simply (or your advisor!) can management all the pieces or see into the longer term with some type of magic crystal ball. Concentrate on the issues you possibly can management and have a plan and technique for these that you could’t.

Portfolios ought to by no means be set in stone, however methods are a unique story.

If I’ve realized one factor since 1999, it’s that traders who arrange a plan and a method that lowers and even eliminates the necessity to liquidate holdings to fund residing bills when the market is down will improve their potential to be financially unbreakable.

All the time have a portfolio you might want to have slightly than the one you would like you had.

We’re with you each step of the way in which

Be sure you subscribe to our Off The Wall Podcast. Along with persevering with our knowledgeable visitor interviews, 2023 will carry on extra conversational episodes with simply our staff the place we discuss extra in-depth in regards to the markets and investing methods. Shoppers will proceed to obtain our month-to-month portfolio updates by way of e mail, however we will likely be including a podcast model of that replace as effectively the place we discuss by way of our thought course of. Moreover, we will likely be introducing video to the podcast, which you’ll watch and subscribe to on our YouTube channel.

Truthfully – I simply suppose it’s extra enjoyable and instructive to offer folks with a medium that lets you hear us speaking, bantering, debating, and discussing slightly than studying an e mail and/or weblog. We get pleasure from civil discourse and it’s in line with our worth proposition of ‘Unfiltered opinions and easy recommendation”, so we would like you to listen to it.

And albeit the info helps this – the podcasts and movies are “extra clicked and consumed” than the written stuff. Emails and blogs will nonetheless exist, however I think that including the audio and video medium will show to be extra common, so we’re increasing into including these.

Final yr sucked…little question about it however please bear in mind to…

Maintain wanting ahead.

[ad_2]