[ad_1]

2. Elevating Expectations

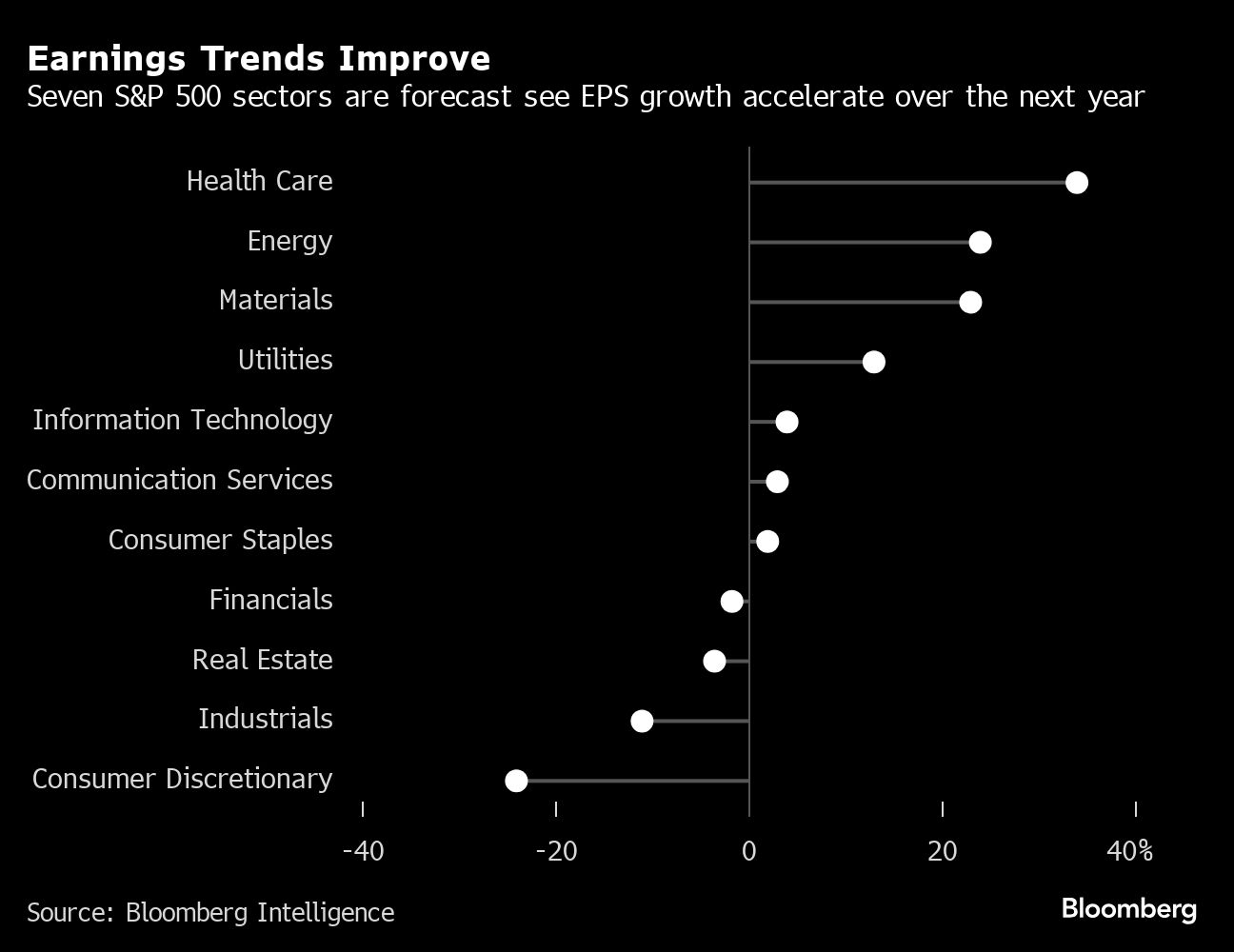

Analysts have been elevating their earnings forecasts quicker than they’re marking them down for beforehand unloved teams, from well being care to utilities.

The truth is, seven of 11 sectors within the S&P 500 are poised to see revenue development speed up over the subsequent yr. Utilities, financials and well being care are the lead sectors when ranked by Twenty fifth-percentile earnings revisions, with power, supplies and communication companies on the backside, BI knowledge present.

3. Money Hordes

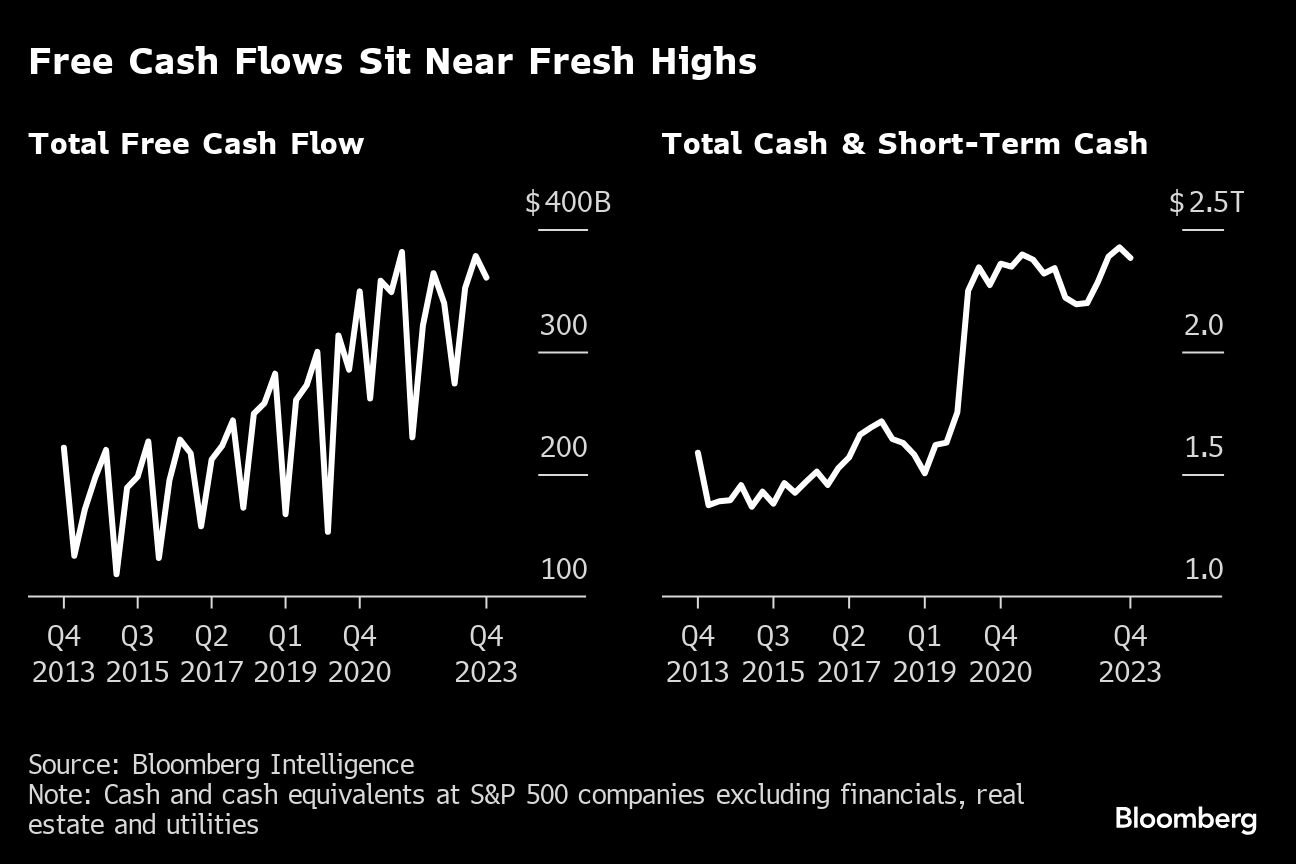

Company money and free money circulation are at file excessive ranges, setting the stage for a restoration in how the most important U.S. firms deploy their capital, whether or not via payouts to stockholders or investing in increasing their companies.

Shareholder payouts rebounded within the fourth quarter for S&P 500 firms, and buybacks revived after 4 consecutive quarters of declines, BI knowledge present.

A rise in capital expenditures will depend upon a rebound exterior the heavy-spending know-how sector, BI’s Soong mentioned.

4. Margins Bettering

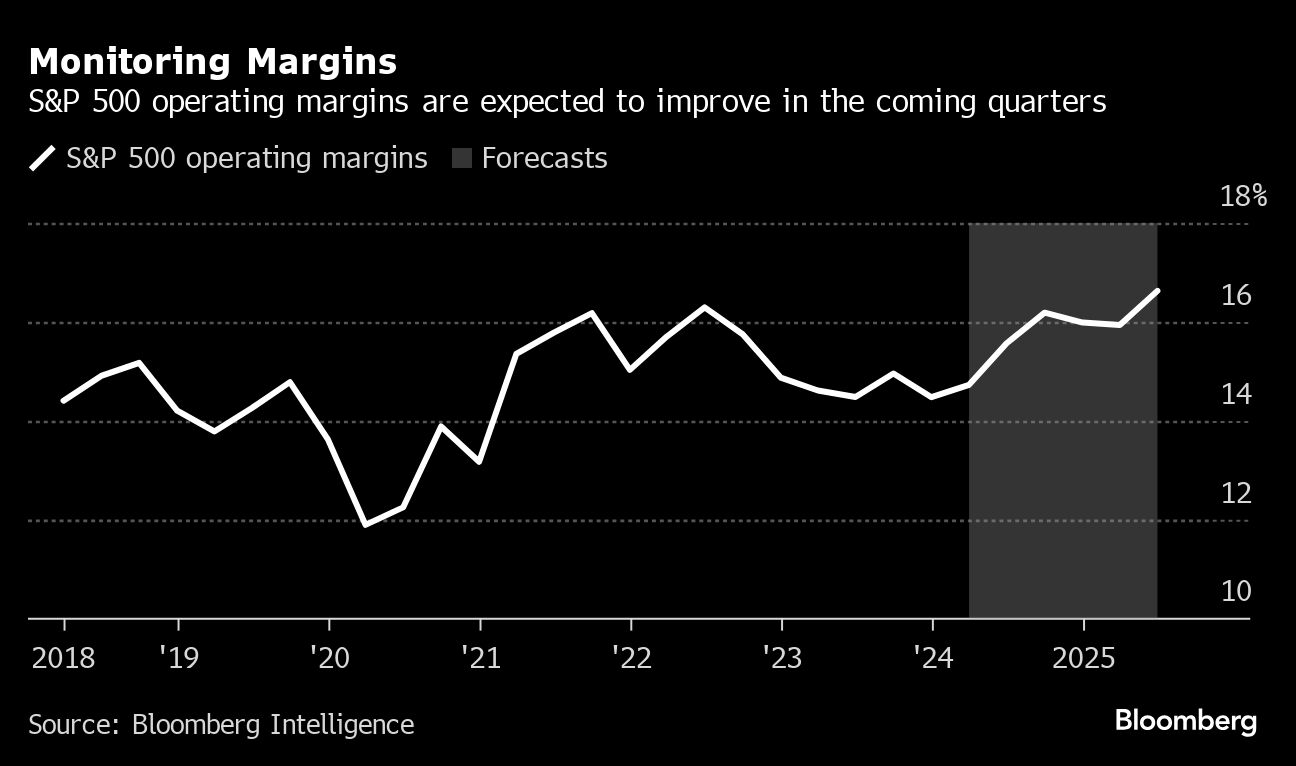

Merchants will likely be maintaining a detailed eye on working margins, a key gauge of profitability that traditionally provides a sign on the place an organization’s inventory worth is headed.

The hole between rising shopper and producer costs has narrowed considerably over the previous yr because of company cost-cutting that drove earnings larger, in addition to an sudden synthetic intelligence increase.

Analysts now see working margins for the primary quarter at 15%, with the worst of the ache within the rear-view mirror as forecasts enhance within the coming quarters, knowledge compiled by BI present.

5. Sector Selecting

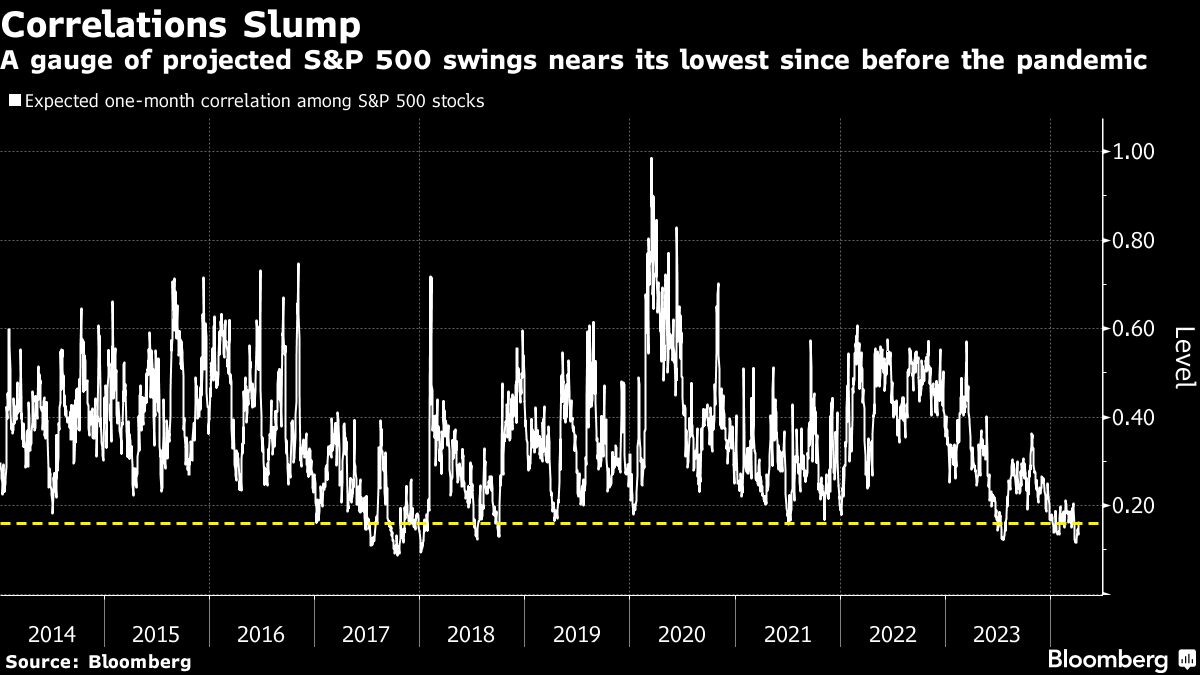

Merchants aren’t anticipating share costs to maneuver in unison this earnings season. Differing inflation outlooks for S&P 500 sectors has left a gauge of anticipated one-month correlation within the index’s shares hovering close to its lowest since 2018, Bloomberg knowledge present. A studying of 1 means securities will transfer in lockstep, it’s presently at 0.16.

This comes as three of the 11 teams — communication companies, know-how and utilities — are anticipated to put up revenue expansions of greater than 20%, whereas power, supplies and health-care firms will probably see earnings shrinking.

Opposite to well-liked perception, average inflation traditionally has been good for earnings broadly as a result of it promotes development, lending and borrowing, in line with Dan Eye, chief funding officer at Fort Pitt Capital Group.

“Earnings are in nominal phrases, so having just a little inflation within the system isn’t a foul factor for company earnings,” Eye mentioned. “The inventory market clearly sniffed that out within the first quarter, given the massive rally.”

(Credit score: Adobe Inventory)

[ad_2]