[ad_1]

Amazon Insurance coverage Retailer, which provided a variety of dwelling and contents insurance policies, has already closed its doorways having solely launched as not too long ago as October 2022. GlobalData surveying means that the restricted availability of merchandise and suppliers on the platform could possibly be a contributing issue to the shop’s lack of success.

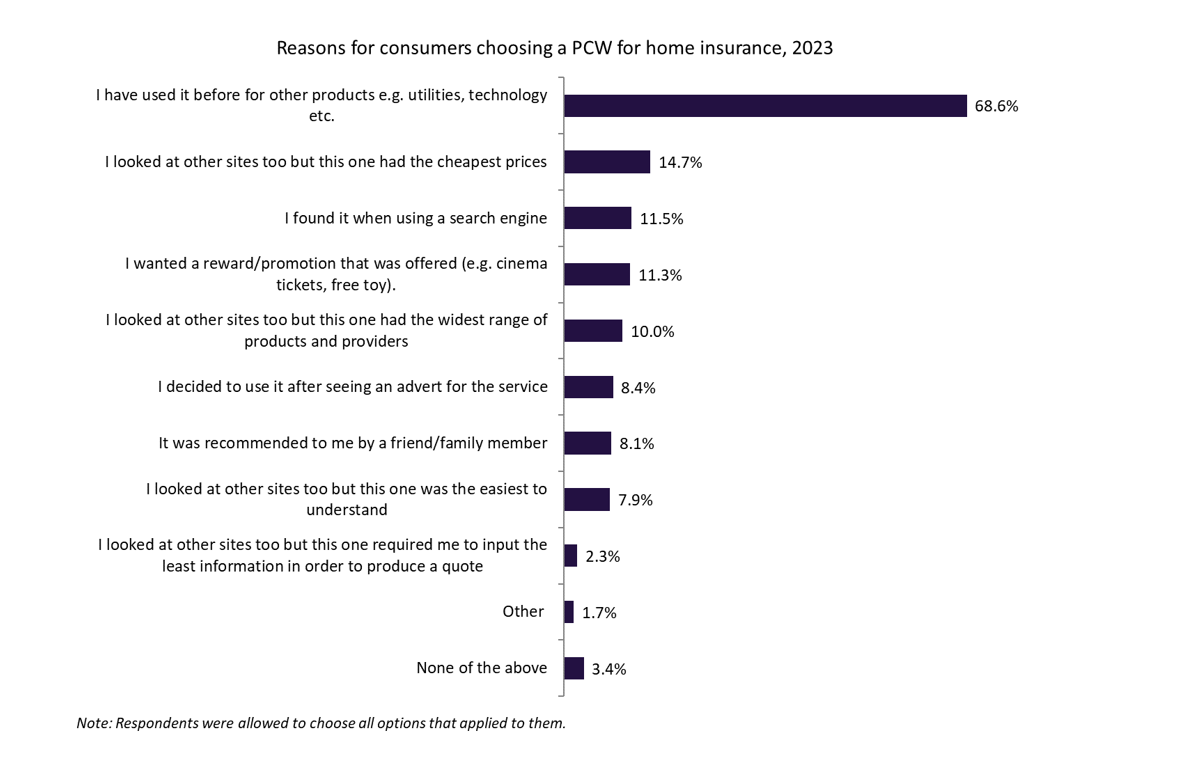

In response to the 2023 UK Insurance coverage Client Survey by GlobalData, 68.6% of respondents chosen a specific worth comparability web site (PCW) primarily based on prior utilization. This pattern posed a problem for the comparatively new Amazon Insurance coverage Retailer, launched simply 15 months in the past, because it lacked a longtime consumer base. Likewise, 10.0% of survey members selected a particular PCW on account of its in depth vary of merchandise and suppliers. Regardless of Amazon Insurance coverage Retailer providing dwelling and contents insurance policies, the absence of different important merchandise reminiscent of automotive or journey insurance coverage might have restricted its enchantment. Furthermore, with just a few suppliers on the platform, together with Ageas UK, Co-op, LV=, Coverage Professional, and City Jungle, Amazon’s providing fell brief by way of the various vary of suppliers that buyers usually search on established PCWs. This restricted choice may need contributed to the challenges confronted by Amazon Insurance coverage Retailer in gaining traction amongst shoppers.

Regardless of Amazon’s international status and model recognition, getting into the insurance coverage PCW market is a difficult job. GlobalData’s 2023 UK Insurance coverage Client Survey signifies that 95.6% of shoppers who utilized a PCW to buy their dwelling insurance coverage coverage opted for both CompareTheMarket (47.9%), MoneySuperMarket (19.0%), Go.Evaluate (14.6%), or Confused.com (14.0%). This dominant market share held by established gamers presents a barrier for brand spanking new entrants. A living proof is the closure of the reverse public sale market Honcho in July 2022, which discovered the competitors with main PCWs to be too nice a hurdle. Apparently, Amazon’s enterprise into the UK insurance coverage PCW market lasted across the identical size of time because the Google Comparability challenge, an aggregator launched by the search engine in 2012. This additional highlights the persistent challenges confronted by tech giants in establishing a foothold on this extremely aggressive panorama. Even with Amazon’s in depth attain and recognition, the problem of displacing the well-established gamers within the insurance coverage PCW panorama stays a big hurdle.

General, Amazon’s wrestle to realize important traction could also be attributed to elements reminiscent of restricted product choices, an absence of consumer familiarity, and a comparatively small variety of suppliers on its platform. Regardless of Amazon’s international status, the platform didn’t compete in opposition to established gamers reminiscent of CompareTheMarket, MoneySuperMarket, Go.Evaluate, and Confused.com that proceed to dominate the market.High of Kind

Entry essentially the most complete Firm Profiles

in the marketplace, powered by GlobalData. Save hours of analysis. Achieve aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain e mail will arrive shortly

We’re assured in regards to the

distinctive

high quality of our Firm Profiles. Nonetheless, we wish you to take advantage of

useful

choice for your small business, so we provide a free pattern which you can obtain by

submitting the beneath kind

By GlobalData

[ad_2]