[ad_1]

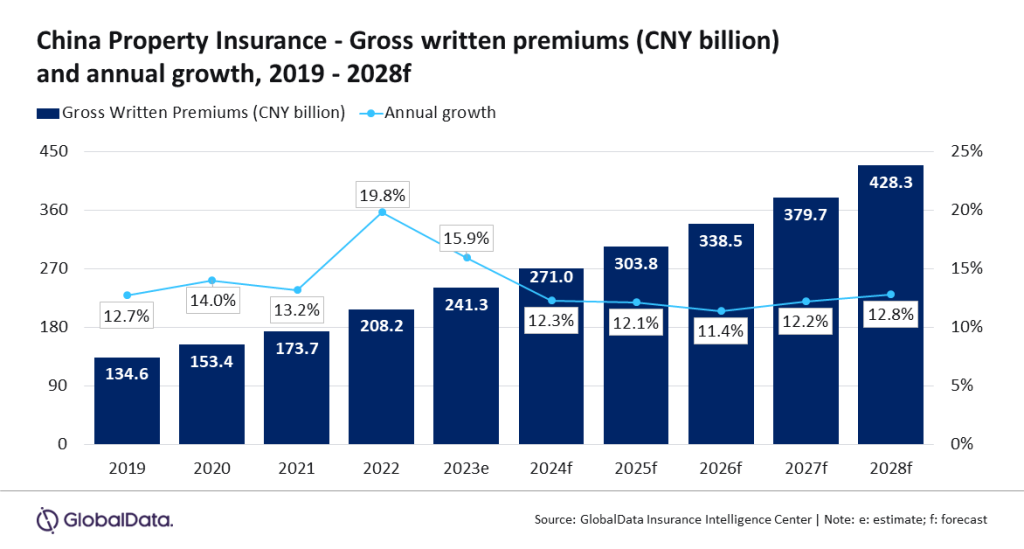

The Chinese language property insurance coverage enterprise is about to develop at a CAGR of 12.1% over 2024-28, from CNY271bn ($40.5bn) in 2024 to CNY428.3bn ($67.7bn) in 2028.

That is in response to GlobalData, which additionally discovered that the Chinese language property insurance coverage business is predicted to develop by 12.3% in 2024. That is due to constructive regulatory developments in addition to a rise in need for fireplace and residential multi-risk property insurance coverage.

Manogna Vangari, insurance coverage analyst at GlobalData, commented: “The Chinese language property insurance coverage business witnessed a progress of 15.9% in 2023 resulting from increased demand for insurance policies protecting NatCat occasions, rising demand for agriculture insurance coverage, and investments in infrastructure tasks. The pattern is predicted to proceed in 2024, which can help property insurance coverage progress.”

China is the biggest agricultural-producing nation on the earth. Agricultural insurance coverage is the biggest product throughout the property insurance coverage phase and is estimated to develop by 15.3% in 2024. The expansion in agriculture insurance coverage will probably be supported by an elevated frequency of maximum local weather circumstances equivalent to warmth waves and heavy rains within the nation.

In Might 2023, the Insurance coverage Affiliation of China issued new requirements to unify the web operation of agricultural insurance coverage underwriting and settlement. The implementation of latest pointers will assist native regulatory businesses and insurance coverage establishments with quicker underwriting and declare settlements and enhance the general administration of agricultural insurance coverage.

Vangari added: “Regulatory reforms aimed toward streamlining on-line operations and enhancing the actuarial system of agriculture insurance coverage will assist in rising agriculture insurance coverage uptake and help the expansion of property insurance coverage.”

Entry probably the most complete Firm Profiles

available on the market, powered by GlobalData. Save hours of analysis. Acquire aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain e mail will arrive shortly

We’re assured concerning the

distinctive

high quality of our Firm Profiles. Nonetheless, we wish you to take advantage of

useful

choice for what you are promoting, so we provide a free pattern which you can obtain by

submitting the beneath kind

By GlobalData

[ad_2]