[ad_1]

A reader asks:

You talked about how child boomers have a lot cash for a technology, and anecdotally so many monetary plans that I run for our people have them with far more than they want…they’re diligent savers and traders. So we have now all these boomers with extreme financial savings/investments which are unwilling to show the swap to really spend that cash.

So my query turns into: do we have now a everlasting flooring of upper inflation sooner or later as a consequence of boomers truly spending that money that they’ve in retirement, realizing they’ll’t take it to the grave OR as they go it to the subsequent technology who’re extra snug with the spending aspect of the equation—that would create this persistent larger inflation fee for individuals over the subsequent decade or two?

I did inquire about the wealth profile of child boomers in a latest piece.

It’s true that boomers management a lot of the wealth on this nation (52% in response to Federal Reserve information).

That is what I wrote in that beforehand talked about put up:

There isn’t any precedent for the boomer technology. We’ve merely by no means had a demographic this massive with this a lot wealth dwell this lengthy earlier than.

We’ve no historic information to look again at in the case of making an attempt to quantify the inflationary influence right here.

If the entire boomers stated screw the youngsters and their inheritance and spent down all of their financial savings, positive you can argue that will be inflationary.

However with boomers residing longer than earlier generations, that would pressure them to unfold that spending out over a few years, which might mute the influence.

It’s doable will probably be the millennials that may spend more cash.

Jean Twenge at The Atlantic took a sledgehammer to the concept that all millennials are broke.

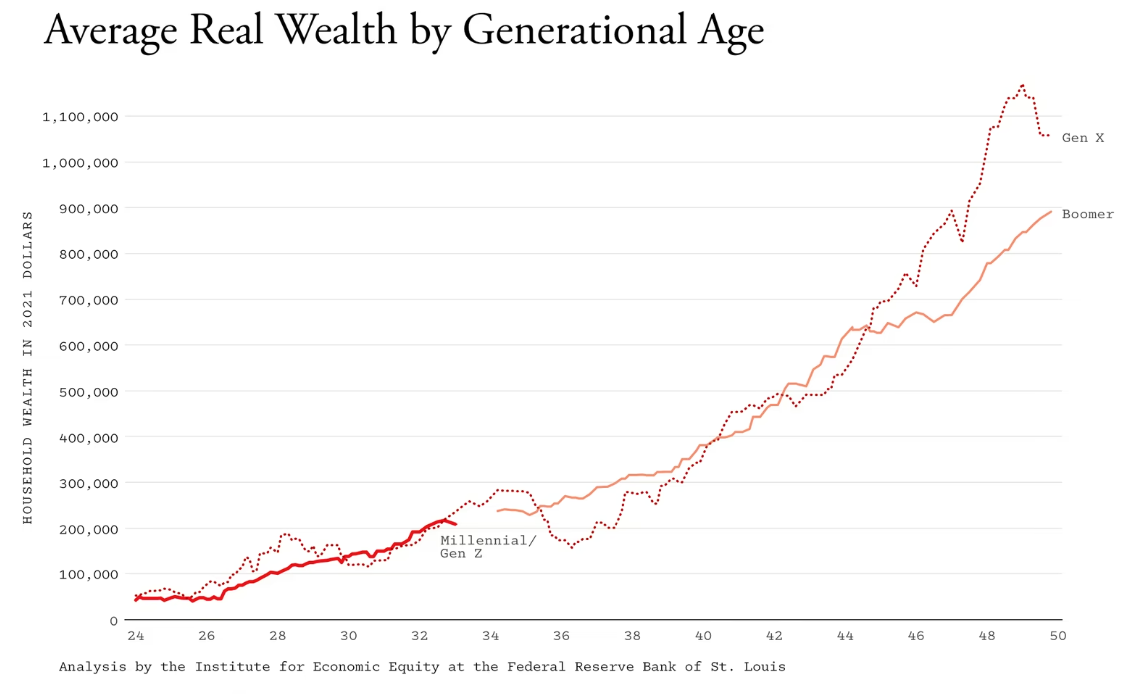

For those who have a look at the long-term pattern of wealth, adjusted for inflation, millennials are proper on monitor relative to earlier generations on the similar level of their lives:

And have a look at the Actuality Bites technology — Gen X has surpassed the boomers by age 50!

The inflation-adjusted median revenue for millennials is round $10,000 larger than the boomers had on the similar age. And after they have been within the 25-to-39 yr age vary, 50% of boomers owned a house. That quantity is 48% for millennials.

Millennials like to complain however as a complete, they’re doing high-quality.

The counter-argument right here can be the entire stuff that’s now dearer for millennials — housing, faculty, daycare, and so on.

However millennials would be the largest, richest technology sooner or later. It’s inevitable.

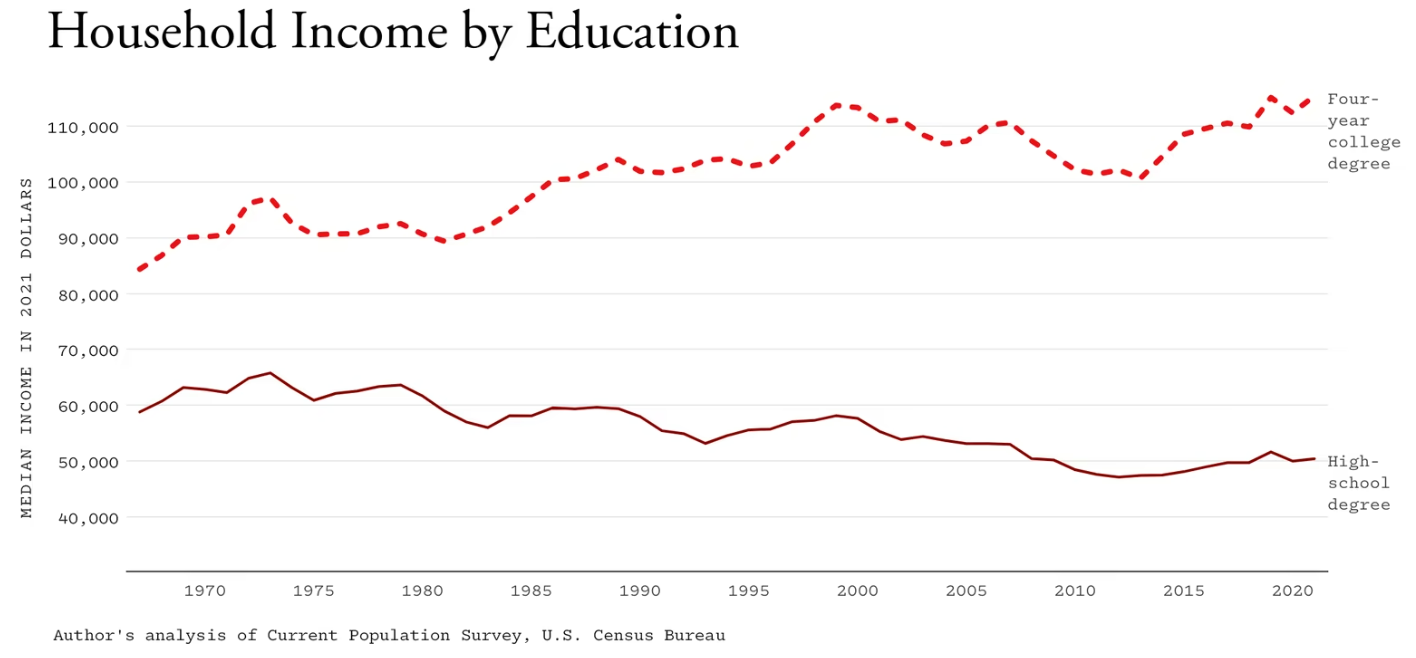

My technology1 is probably the most well-educated technology in historical past and which means larger common incomes which are solely going to extend over time:

So let’s assume millennials are going to spend extra freely and management huge sums of wealth sooner or later from some mixture of their very own earnings and an inheritance from their boomer mother and father.

Will that translate right into a flooring beneath the inflation fee?

It’s doable.

Researchers at The IMF appeared on the relationship between growing old and inflation:

We discovered that the bigger the proportion of younger and outdated within the complete inhabitants, the upper inflation. Put one other means, when the working-age inhabitants is bigger, the impact is disinflationary. This hyperlink between age and inflation holds for a lot of international locations throughout all time intervals.

These results are giant sufficient to clarify most of pattern inflation. For example, the infant boomers elevated inflation by an estimated 6 proportion factors in america between 1955 and 1975 and lowered it by 5 proportion factors between 1975 and 1990, after they entered working life. Development inflation is presently low and secure because the lowering share of younger individuals offsets the consequences of the growing share of outdated individuals within the inhabitants.

We’ve a big proportion of outdated individuals, which ought to be inflationary.

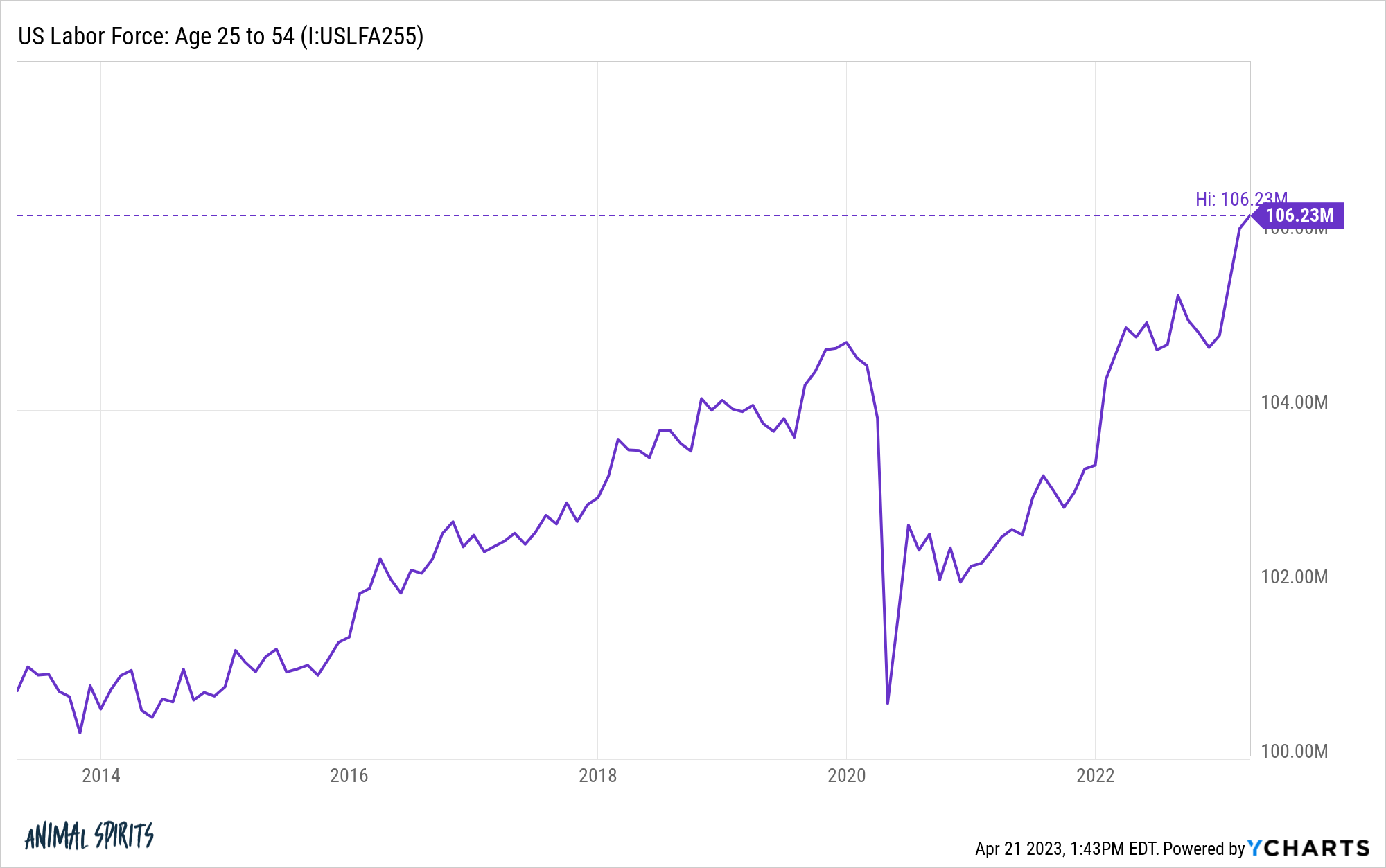

However we even have a big proportion of working-age individuals, which ought to be disinflationary.

All of which is to say, it is a difficult subject that doesn’t have a clearcut reply (welcome to finance).

Inflation may very well be larger if boomers spend down all of their financial savings or millennials don’t save as a lot.

Or AI may show to be a deflationary pressure that offsets any inflationary results of huge demographics.

If the previous 10 years have taught us something about macroeconomics, it’s that there’s a lot we nonetheless don’t find out about inflation.

The Fed tried its damnedest to extend inflation within the 2010s by holding charges low.

It didn’t work.

A pandemic hits, provide chains get disrupted, the federal government spends trillions of {dollars} and inflation goes bananas.

Now the Fed has aggressively raised charges to extend unemployment and gradual inflation.

Inflation has slowed however the labor market stays sturdy.

Within the immortal phrases of Cousin Eddie, “She falls down a effectively, her eyes go crossed. She will get kicked by a mule, they return. I don’t know.”

Predicting inflation is tough. Understanding the demographic make-up of the nation in all probability doesn’t make it any simpler to foretell its future path.

Michael and I spoke about generational wealth and rather more on this week’s Animal Spirits:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

Demographics vs. the Inventory Market

Now right here’s what I’ve been studying currently:

1I don’t really feel like a millennial however was born in 1981 so technically I’m on of the oldest millennials within the nation.

[ad_2]