[ad_1]

Are you a wealth advisor trying to enter or increase your attain within the high-net-worth (HNW) market? This shopper phase consists of enterprise house owners, executives, inventive professionals, and next-gen heirs with a web price of $5 million or extra.

These potential shoppers signify a various group with distinctive challenges and life objectives far past asset accumulation. To draw and retain HNW shoppers, you’ll want superior technical experience and nuanced abilities in folks and household dynamics administration.

How will you get or fine-tune these abilities? Incomes the Licensed Personal Wealth Advisor® (CPWA®) certification from the Investments & Wealth Institute (IWI) is one solution to accomplish this aim. However is it well worth the time, effort, and cash you’ll dedicate to the method?

That will help you make your resolution, let’s overview what getting a CPWA certification includes and the way it may gain advantage wealth advisors who want to serve HNW shoppers.

What Is a CPWA Certification?

The CPWA certification program includes a novel, multidisciplinary strategy to addressing the monetary wants of HNW shoppers. Candidates to this system can select between two enrollment choices:

-

A 6-month on-line program together with a 1-week, in-person class at a high enterprise college

-

A 12-month online-only program

The conditions are:

Lastly, you need to move a four-hour closing examination overlaying 135 questions.

What Are the High Causes to Take into account the CPWA?

The first advantages cited by many advisors holding this certification are:

-

Aggressive differentiation within the crowded HNW market

-

Extra confidence in working with ultrawealthy shoppers

-

Superior information particular to fixing complicated planning challenges

-

Potential for increased compensation and profession development

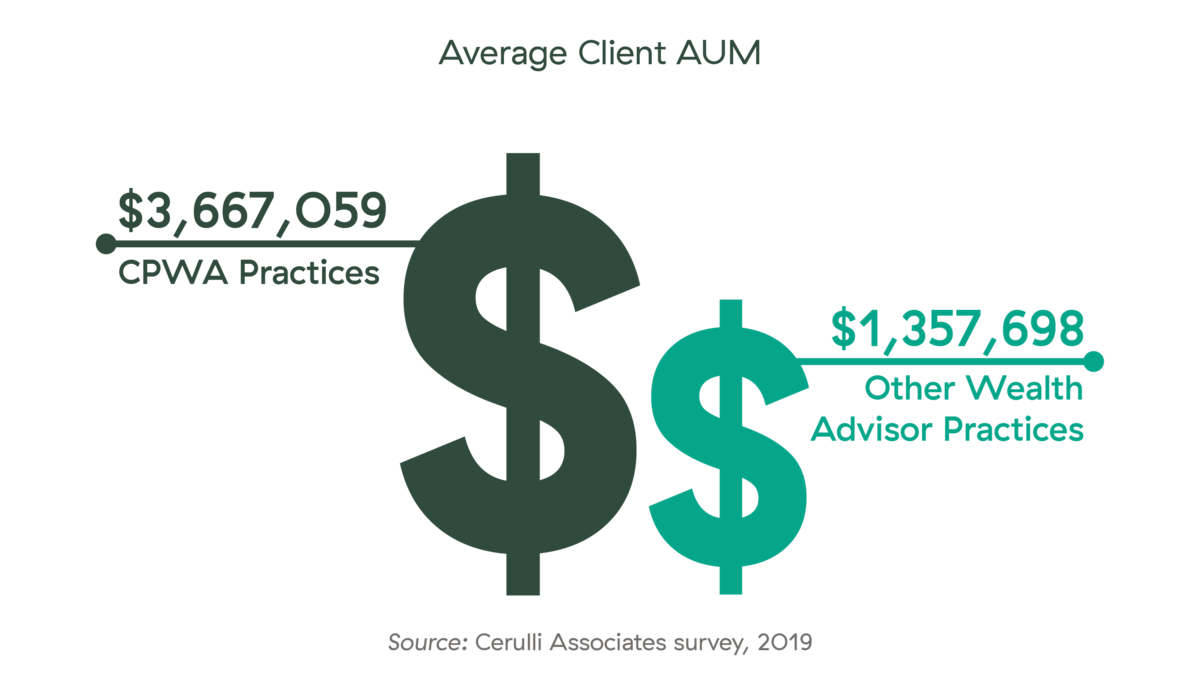

And, latest information tells us {that a} CPWA certification could also be an efficient solution to develop your apply. In keeping with Cerulli Associates, CPWA practices have the biggest common shopper measurement within the trade:

What Will You Be taught?

The CPWA program’s curriculum is designed to provide the idea and sensible strategies you’ll must serve HNW shoppers—and to move the required certification examination. The 11 core matters are damaged down into the next 4 classes:

1. Wealth administration. Understanding the massive image is important to optimizing planning for the ultrawealthy. This phase will assist you to analyze and suggest tax-efficient options and learn to construct and handle portfolios that meet complicated HNW objectives.

-

Tax planning. This deep dive into HNW-specific taxation will information you in speaking about methods with shoppers, simplify planning, and assist you to work successfully with shoppers’ tax attorneys.

-

Portfolio administration. This phase will elevate your skills to harmonize wealth-building strategies, threat administration, tax consciousness, and portfolio methods with shoppers’ assets and objectives.

-

Danger administration and asset safety. You’ll be taught to guage acceptable insurance coverage and asset methods to guard shoppers by means of life occasions together with marriage, divorce, and dying.

The [CPWA program] content material was implausible and considerably elevated my skill so as to add worth to my goal market ($1 million–$5 million investable, primarily company VP-level folks).”

Justin Hutt, CooperDavis Monetary Group,with Commonwealth since 2017

2. Human dynamics. Working with any shopper phase requires sturdy abilities in managing expectations, decision-making, and relationships, however you’ll want to lift your sport when serving the extremely prosperous.

-

Ethics. Studying to establish and classify moral and regulatory points throughout the wealth administration spectrum will can help you work confidently with a classy shopper base.

-

Behavioral finance. Cognitive and emotional biases can intrude with a shopper’s skill to make sound choices. By studying tips on how to establish biases, you’ll be higher outfitted to right or complement these tendencies.

-

Household dynamics. Tailoring methods for household organizations, trusts, and enterprise entities will depend on your understanding of key household roles, household workplace infrastructures, and the nuances of performing shopper discovery.

3. Legacy points. For those who haven’t mastered the complexities of how charitable and property planning options assist shoppers switch wealth, this phase gives you the superior abilities you want.

-

Charitable giving and endowments. You’ll be taught to evaluate the benefits and drawbacks of private and non-private charities, foundations, and trusts, in addition to the tax implications of giving methods in complicated shopper eventualities.

-

Property trusts and wealth switch. Though elements of property planning might lie outdoors your obligations, a full understanding of wealth switch, end-of-life planning, and fiduciary points is important to the work of an HNW wealth advisor.

4. Specialty shopper providers. There are particular challenges concerned with enterprise planning along side HNW shoppers’ broader planning and portfolio administration wants.

-

Govt compensation. This phase addresses tips on how to consider inventory choices, deferred and fairness compensation plans, and concentrated inventory conditions, together with guidelines, restrictions, and tax implications.

-

Intently held companies. As a major inhabitants of the $5 million-plus shopper base, intently held enterprise house owners want advisors who could make acceptable suggestions about enterprise entity buildings and their tax implications, buy-sell agreements, valuation strategies, the enterprise lifecycle, and succession planning.

-

Retirement. To information shoppers with huge belongings by means of the distribution part, you’ll want to grasp return sequencing, analytical forecasting, tax therapies, Roth conversions, distribution necessities, and analysis of certified plans and web unrealized appreciation (NUA) guidelines.

So, Is the CPWA Certification a Worthwhile Funding?

If your corporation aim is to draw and retain HNW shoppers, the information and insights provided by a CPWA certification might assist you to goal—and higher serve—this nook of the advisory market. However, ensure you’ve got a transparent plan earlier than diving in. Making lasting connections along with your desired clientele all the time will depend on your agency’s service choices and the shopper expertise you ship.

FREE DOWNLOAD

Superior Monetary Planning Methods

for Excessive-Internet-Price Shoppers

Discover inventive, complete monetary planning options—from asset safety to

charitable giving—to your high-net-worth shoppers’ distinctive wants.

Commonwealth and IWI are separate and unaffiliated entities. Please seek the advice of your member agency’s insurance policies and procure prior approval for any designation/certification packages.

[ad_2]