[ad_1]

Bounce to winners | Bounce to methodology

Constructing wealth in unstable occasions

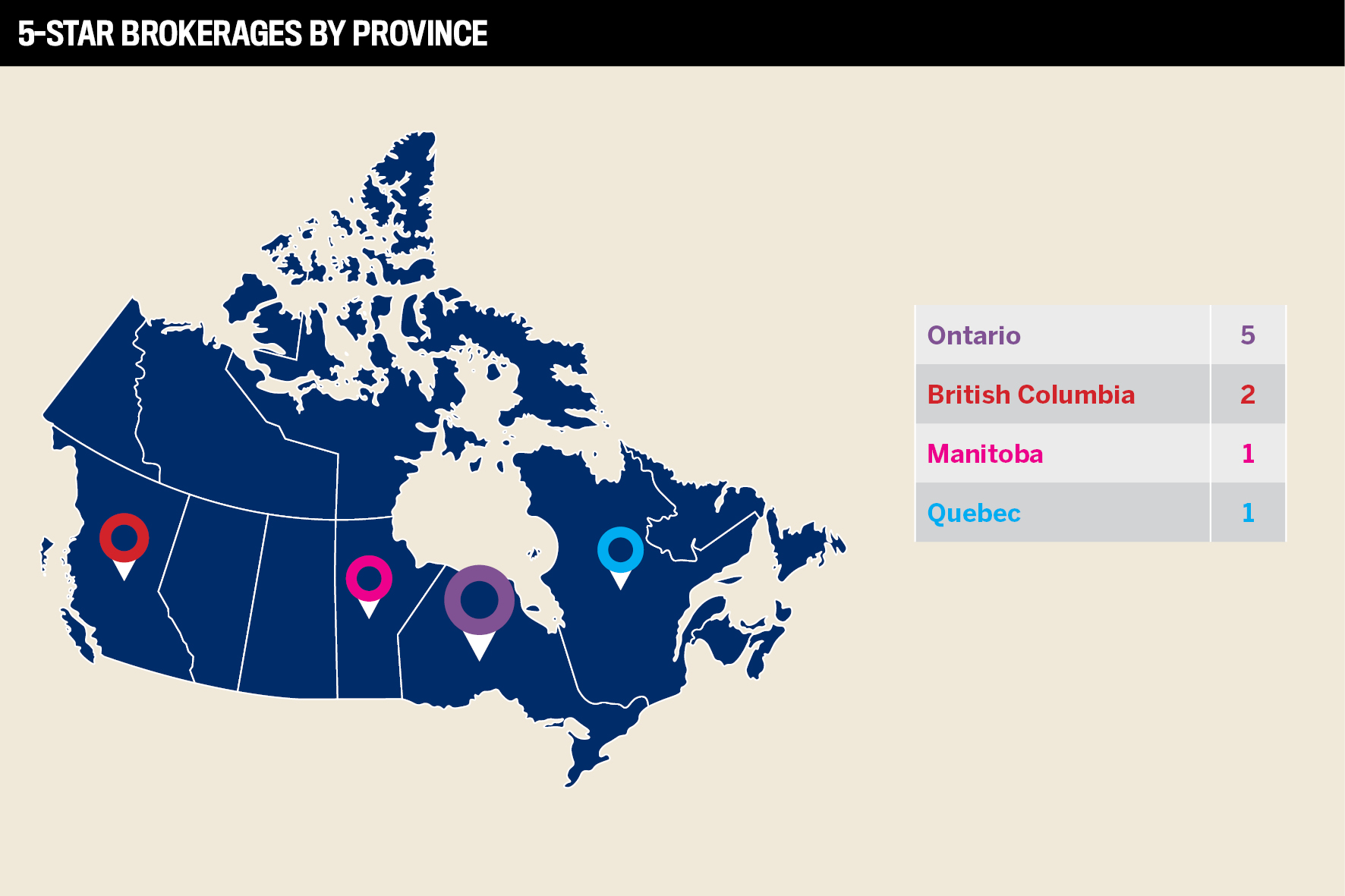

The 2023 Wealth Skilled 5-Star Brokerages awards have fun among the greatest wealth administration corporations in Canada, and their means to innovate and develop over the previous 12 months.

It was a yr marked by unprecedented challenges and financial disruptions, which reshaped the wealth administration trade panorama. Canada proved comparatively resilient, in the end attaining an estimated 3.5% GDP progress fee.

“Whether or not or not there will likely be a recession, the consensus is that the economic system is about to decelerate in 2023,” says Pierre Cléroux, vice chairman of the Enterprise Improvement Financial institution of Canada (BDC). “The slowdown is brought on by the Financial institution of Canada’s struggle towards inflation to carry an overheating economic system beneath management.”

“Belief is foundational to our enterprise. Compliance is a key companion and ensures that we are able to develop and keep that belief”

Moira Klein-Swormink, Edward Jones Canada

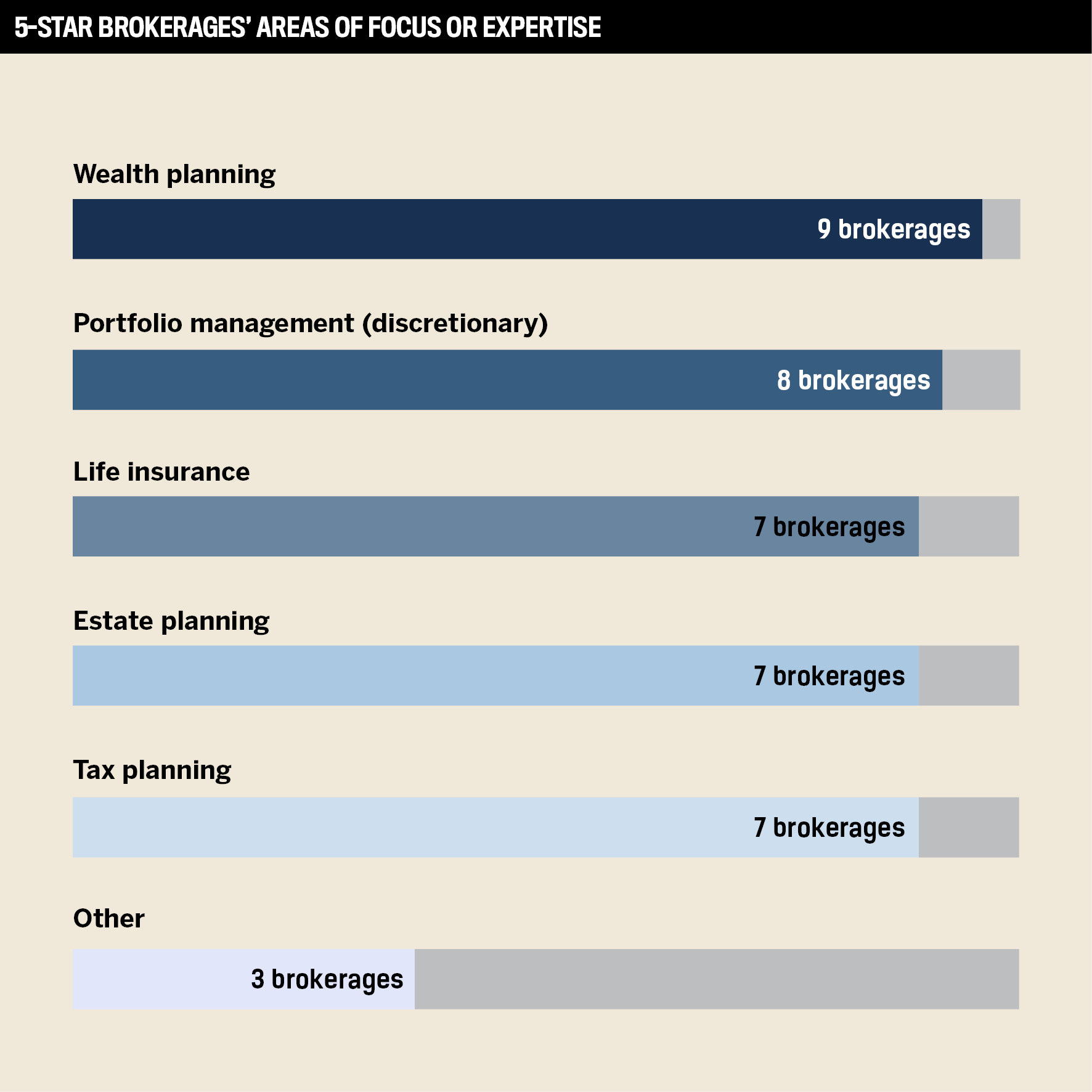

The 9 brokerages acknowledged by WP have demonstrated their functionality to recalibrate and thrive beneath these attempting circumstances. Among the many initiatives they’ve launched into are:

- Leveraging synthetic intelligence to help advisors in strengthening shopper relationships

- Conducting inner cyber danger schooling

- Making a extremely safe shopper cellular app so traders can view or handle accounts

Canada’s greatest wealth administration corporations’ methods

“A five-star brokerage would showcase an ongoing dedication to that company tradition variety and inclusion, coaching, expertise compliance,” says Moira Klein-Swormink, principal, wealth administration recommendation and options, at award winner Edward Jones Canada. “These are completely essential to help advisors, and naturally, to make sure that they’re ready to ship distinctive service to purchasers by means of deep private relationships and complete planning and recommendation.”

To raised help advisors over the previous 12 months, Edward Jones Canada has undertaken a number of improvements together with:

- Renegotiating the lease on its head workplace, permitting the corporate to relocate expenditure into expertise modernization, versatile crew and workplace buildings to extra deeply serve purchasers all throughout Canada

- Designing and launching a shopper attraction toolkit to a gaggle of preferrred purchasers who’ve $250,000 or up in belongings and who worth recommendation from a monetary advisor

Klein-Swormink says, “We emphasize plenty of progress mindset. Let’s be in a state of steady studying, let’s think about what private enlargement can do to the general agency’s enlargement and to our purchasers’ enlargement and success. How will we stay, study and actually embody our mission, which is to companion for optimistic affect to enhance the lives of our purchasers and colleagues, after which collectively to raised serve communities and society.”

One other award winner is Nour Personal Wealth, a brokerage that believes in delivering a bespoke “white glove” service.

“We consider {that a} 5-Star brokerage is one which understands that each shopper and each advisor is exclusive. And every shopper has their very own monetary wants and objectives,” explains CEO Elie Nour. “In order a agency, it’s essential for us to have the ability to not generalize or create a one-size-fits-all answer to all purchasers, however at all times have the flexibility to maintain this white glove, specialised, personalised service and methods that align with their objectives and their preferences, whether or not that’s expertise investments, no matter it’s that they’re on the lookout for.”

“We spend money on our employees, staff, advisors, everyone, so we now have a program that pushes them to enhance their schooling”

Elie Nour, Nour Personal Wealth

Canada’s greatest wealth corporations: fostering progress and innovation

Edward Jones Canada drove progress through an in depth plan that extends into the long run.

“We created a expertise modernization roadmap that lays out a three-to-five-year plan with important technological upgrades or additions, and about 11 totally different areas,” explains Klein-Swormink. “Recognizing the elevated demand for high-quality recommendation and planning, investing in really understanding our purchasers in a number of methods by means of perception gathering and social listening to essentially perceive what it’s they wish to perceive and know and study, and how much recommendation they’re searching for. After which we started to reply these questions.”

As a part of the method, the agency has added employees to make sure that they’ve the sources and abilities to ship for his or her purchasers.

Klein-Swormink provides, “We have now constructed out our crew, our capabilities, by way of our high-net-worth planning crew, by way of our recommendation and steerage crew, ensuring that we now have CFPs, and CPAs, and cross-border specialists all accessible to the sector to assist develop our planning capabilities, such that as we proceed to advance in expertise, once you marry the 2 collectively, we’re in a position to present that basically personalized expertise.”

Nour Personal Wealth has adopted an identical two-pronged strategy. In relation to expertise, the brokerage’s CEO explains, “We partnered up with HubSpot for the CRM. We carried out part of our complete firm system, monetary planning. Then, we added one other software program known as Conquest, which turned a part of connecting the data that we now have in our database.”

The opposite focus is on their employees and making them extra invaluable belongings.

“We spend money on our employees, staff, advisors, everyone, so we now have a program that pushes them to enhance their schooling. We’ve lined the prices of something that they’re planning to take. And we do plenty of coaching from social media to cybersecurity, monetary planning, tax, and property planning,” says Nour.

The agency can be eager to broaden and, having earned its license within the US, now has the flexibility to tackle the belongings of purchasers who’ve:

- 401(okay) plans

- IRAs

- Roth IRAs

Tradition and compliance

As for the significance of tradition, Klein-Swormink says Edward Jones Canada’s first core worth is placing the purchasers’ wants first. “We act with braveness and conviction round these shopper wants to verify we’re constantly making the strikes that have to be made to remain forward of shopper expectations.”

She provides, “We take actually nice delight to find alternatives to take motion to make the mandatory investments as a way to foster that tradition that embraces variety, creates alternatives for associates to essentially leverage their strengths.”

Nour can be pleased with the ethos that runs by means of his agency. “We take delight in having this very wholesome tradition the place each single particular person helps one another out… The corporate is rising and earlier than we begin hiring individuals from exterior of the corporate, we like to provide an opportunity to individuals throughout the firm.”

In the meantime, Klein-Swormink says good compliance is a “no brainer.” “Popularity issues,” she explains. “Belief is foundational to our enterprise. Compliance is a key companion and ensures that we are able to develop and keep that belief.”

Concerning compliance, Nour says, “We put issues in place – preventative measures – to assist advisors keep away from any errors. In the beginning to guard the purchasers, then shield the corporate and advisors… Generally errors occur however our job is to assist them keep away from or reduce these errors as a lot as attainable.”

- Blue Harbour Monetary

- Harbourfront Wealth Administration

- iA Personal Wealth

- Nicola Wealth

- Nour Personal Wealth

- Richardson Wealth

- Wellington-Altus

- Worldsource Monetary Administration

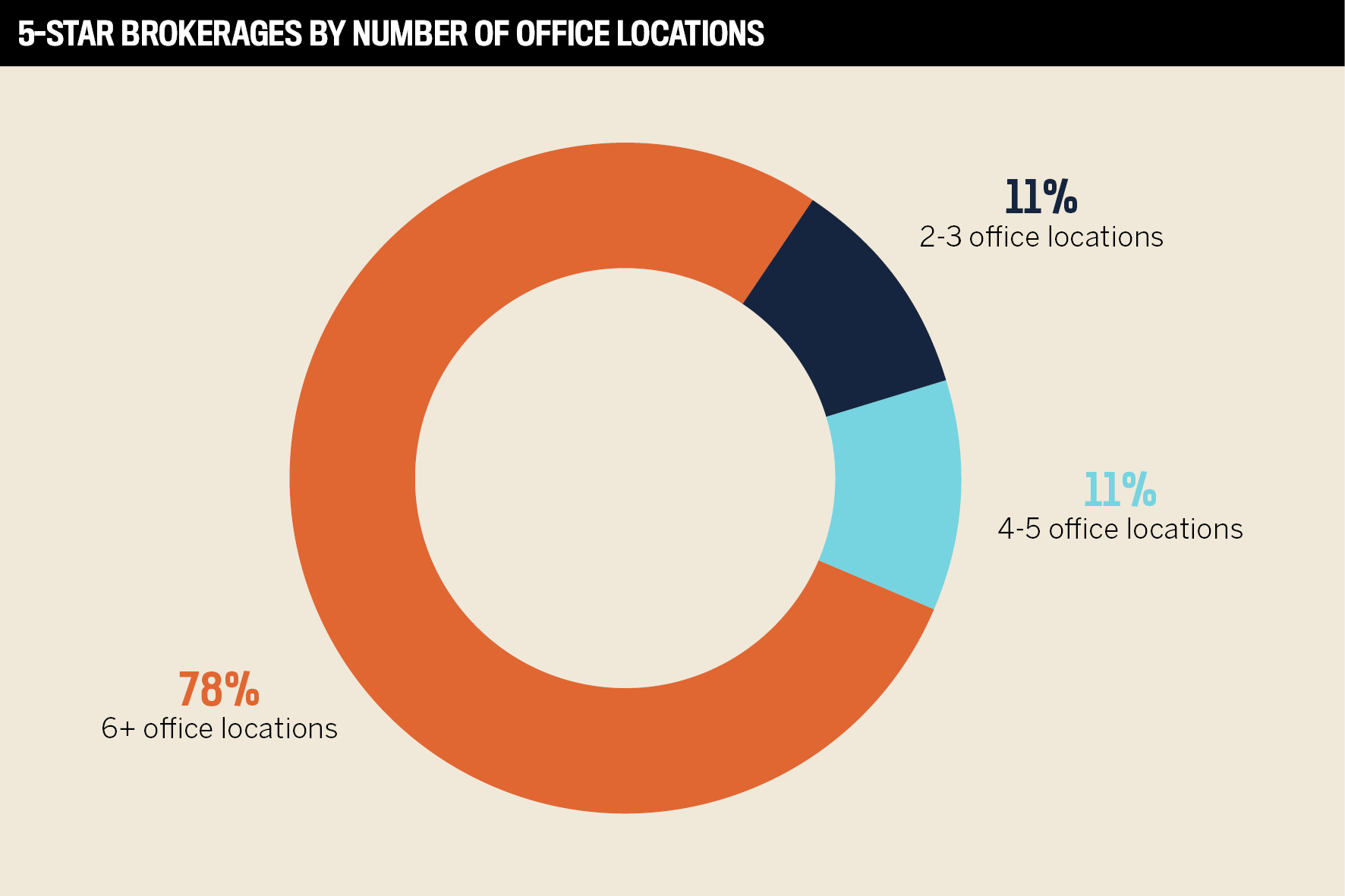

To seek out the 5-Star Brokerages of 2023, Wealth Skilled solicited purposes from brokerage corporations throughout Canada. WP invited candidates to clarify how they had been excelling in key areas like tradition, compliance, coaching, and expertise. To be eligible, every agency needed to be a full-service brokerage with a minimal of three areas.

Winners had been judged by the substance of their nominations, primarily based on particular examples of outcomes that had been achieved and the related information to help their claims. The WP crew fastidiously reviewed every nomination, inspecting how every brokerage had made a significant and tangible distinction within the monetary companies trade.

[ad_2]