[ad_1]

What You Must Know

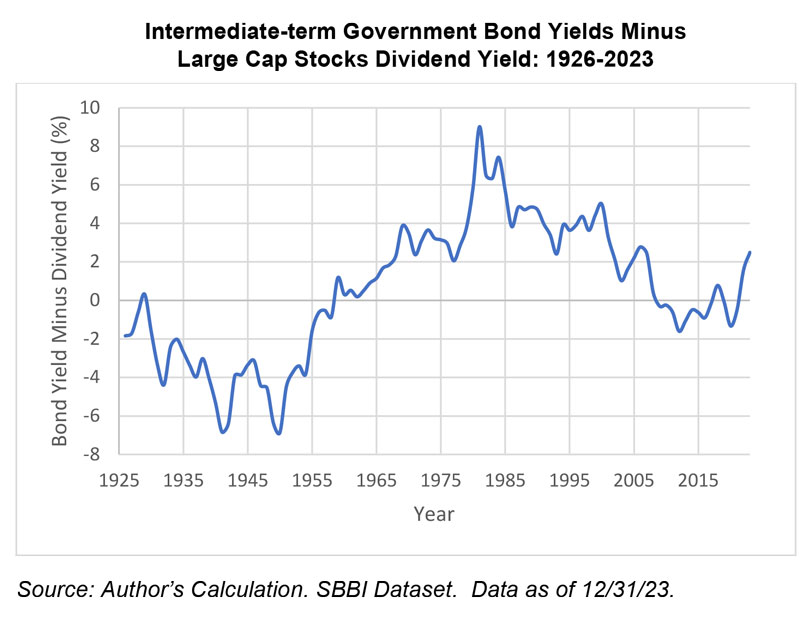

- A couple of years in the past, dividend yields exceeded bond yields. That is now not the case.

- The optimum strategy for income-focused traders adjustments as market dynamics shift.

- It is vital to constantly revisit allocations to make sure they’re environment friendly.

In 2021, I revealed analysis within the Journal of Wealth Administration exploring how an investor with an earnings focus ought to fluctuate the allocation between shares and bonds primarily based on the present yield surroundings. I discovered that equities might be particularly engaging for earnings traders when dividend yields exceeded bond yields, and vice versa.

On the time, that may have instructed a comparatively aggressive portfolio allocation, with 60% or extra in equities. My, how occasions have modified.

Immediately, with bond yields exceeding dividend yields by roughly 300 foundation factors, the emphasis in portfolios for income-focused traders ought to possible be on bonds, particularly given expectations round lowering yields.

Whereas portfolio threat ranges could stay usually static for normal traders, for income-focused traders it’s vital to constantly revisit allocations to make sure they’re environment friendly given the present market surroundings.

Revisiting the Analysis

Sure investor cohorts, resembling retirees, usually have a transparent desire for earnings from a portfolio. For instance, the Society of Actuaries present in a 2015 survey that solely 17% of pre-retirees deliberate to spend down their wealth in retirement, whereas 32% deliberate to withdraw solely earnings and go away principal intact (whereas 27% of pre-retirees deliberate on rising monetary property and 23% had no plan).

In the case of producing earnings, an investor ought to theoretically be detached between liquidating capital and yield, since they’ve related results on portfolio worth. In actuality, income-focused traders usually have a powerful desire towards promoting down principal regardless of the potential inefficiency of the strategy and implications on the out there alternative set of investments. These traders usually have a powerful dislike of annuities, regardless of annuitization extensively thought of to be essentially the most environment friendly strategy for producing retirement earnings (and hedging longevity threat).

I’ve explored methods to construct environment friendly earnings portfolios, in analysis revealed within the Journal of Portfolio Administration in 2015 and, extra not too long ago, for a bit revealed within the Journal of Wealth Administration in 2021. The important thing contribution of that piece was exploring how the potential advantages of investing in shares and bonds can fluctuate for income-based traders primarily based on the yield surroundings.

The yield surroundings has various dramatically over time, which has vital implications for income-focused traders.

Within the Journal of Wealth Administration analysis, I explored how income-focused traders ought to have modified their allocation to equities utilizing historic knowledge from 16 nations from 1870 to 2019, primarily leveraging the Jordà-Schularick-Taylor Macrohistory database.

[ad_2]