[ad_1]

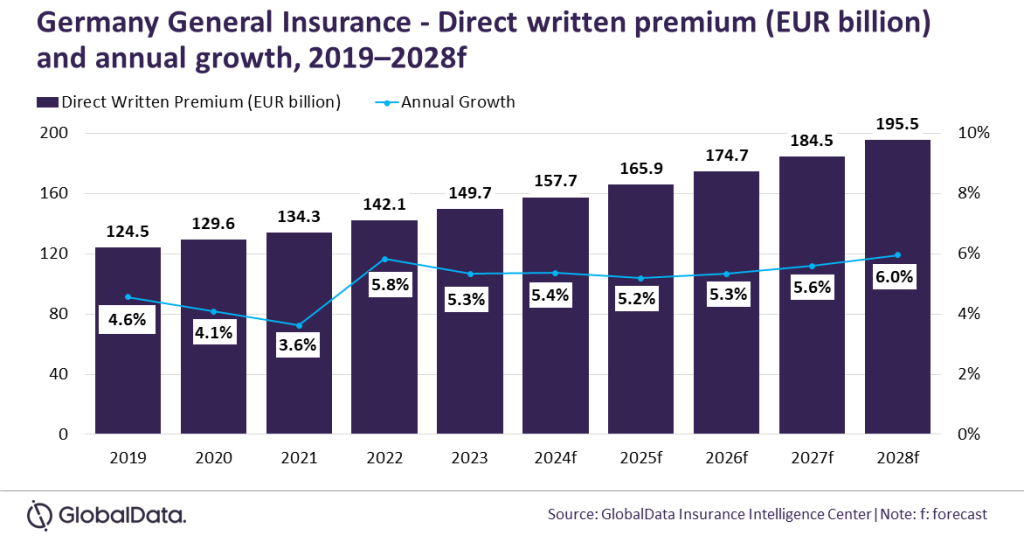

The overall insurance coverage business in Germany is about to develop at a CAGR of 5.5% from EUR149.7bn ($152.8bn) in 2023 to EUR195.5bn ($205.2bn) in 2028.

That is in line with GlobalData and its insurance coverage database which additionally revealed that Germany common insurance coverage is predicted to develop by 5.4% in 2024. The expansion is supported by a rise in motorcar gross sales, rising demand for pure catastrophic (nat-cat) insurance coverage insurance policies and an inflation-led rise in premium charges throughout most common insurance coverage strains.

Sneha Verma, insurance coverage analyst at GlobalData, commented: “The expansion price of Germany’s common insurance coverage business is predicted to stay constant between 5-6% throughout 2023-28. It will likely be primarily supported by well being and property insurance coverage, pushed by the post-COVID-19 pandemic enhance in well being consciousness and growing demand for nat-cat insurance coverage insurance policies.”

As well as, private accident and medical health insurance (PA&H) is the main line of enterprise, accounting of 37.7% of the final insurance coverage market in 2023. It is usually anticipated to develop by 3.8% in 2024 and 4.2% in 2025, boosted by a rise in well being consciousness after Covid-19.

In accordance with the German Insurance coverage Affiliation, non-public medical health insurance premium is predicted to extend by 4% to five.5% in 2024. PA&H insurance coverage is projected to develop at a CAGR of 4.4% throughout 2023-28.

Moreover, motor insurance coverage is the second largest line of enterprise, accounting for a 21% share of the Germany common insurance coverage DWP in 2023.

Entry probably the most complete Firm Profiles

in the marketplace, powered by GlobalData. Save hours of analysis. Achieve aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain electronic mail will arrive shortly

We’re assured concerning the

distinctive

high quality of our Firm Profiles. Nonetheless, we wish you to take advantage of

useful

resolution for your online business, so we provide a free pattern that you may obtain by

submitting the under kind

By GlobalData

Motor insurance coverage DWP grew by 1.8% in 2023, supported by a rise in whole automobile gross sales. In accordance with the Federal Motor Transport Authority, automobile gross sales elevated by 7.2% to 2.84 million in 2023 from 2.65 million in 2022. The pattern is predicted to proceed in 2024.

Verma added: “Along with automobile gross sales, a rise in premium costs as a result of inflation can even assist motor insurance coverage development. An prolonged interval of excessive inflation has resulted in an above-average enhance in spare components and restore prices, resulting in the next price of claims. This has impacted insurers’ profitability, resulting in the mixed ratio for the motor insurance coverage business surpassing 100% in 2022 for the primary time within the final 10 years. Motor insurance coverage is predicted to develop at a CAGR of two.2% throughout 2023-2028.”

[ad_2]