[ad_1]

An insurance declare comes at a anxious time in a buyer’s life, typically making it a adverse expertise. Not less than, that’s what you may assume. That’s why I used to be shocked when our newest analysis report, Why AI in Insurance coverage Claims and Underwriting,

Velocity of settlement drives claims satisfaction in insurance coverage

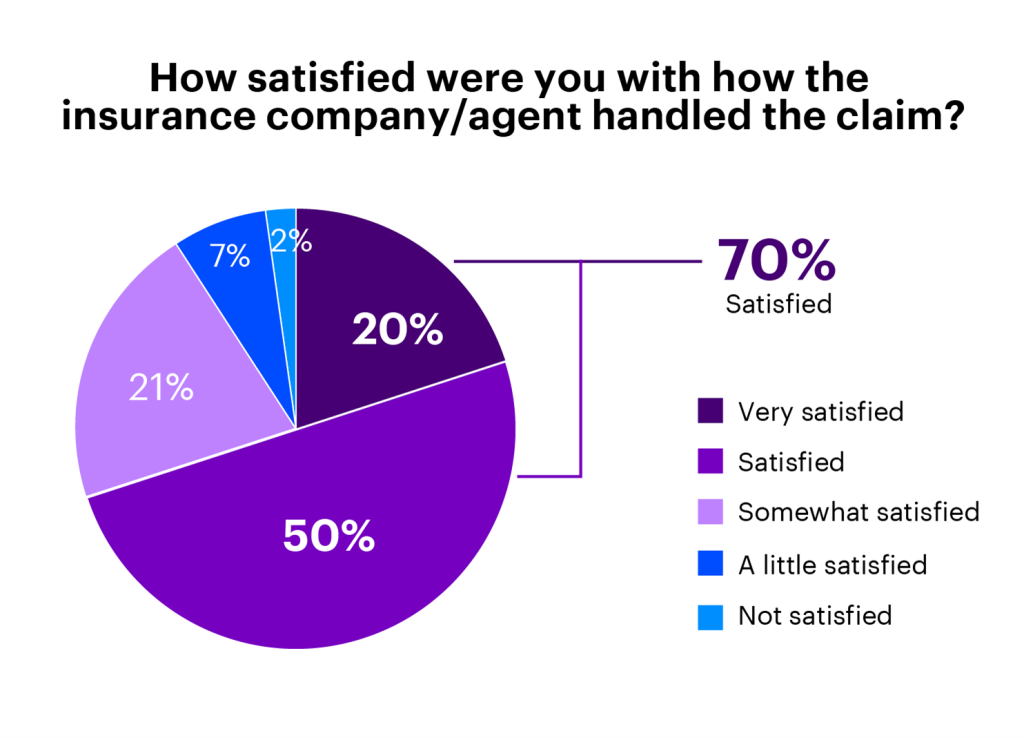

General, our survey discovered that 70% of insurance coverage policyholders stated they have been both happy or very happy with how their insurance coverage firm or agent dealt with their declare.

For claims, that is fairly excessive. And our survey just isn’t the one information level to indicate this. A 2021 J.D. Energy survey targeted on auto insurance coverage confirmed record-high buyer satisfaction on claims, hitting 880 on a 1,000-point scale. An analogous 2021 J.D. Energy survey on property claims confirmed a slight dip in satisfaction charges (from 883 to 871), however this broke a 5-year streak of steadily rising satisfaction scores and is probably going on account of circumstances indirectly associated to insurers (like provide chain disruptions and materials shortages associated to the pandemic). So, what’s inflicting these rising satisfaction charges?

Omnichannel communication and transparency are two causes. Most insurers enable clients to open a declare on a web site or app. Know-how gives comfort when it comes to utilizing pictures for an inspection as an alternative of scheduling an individual to return on-site. And a few insurance coverage firms provide a dashboard to trace a declare all through its lifecycle.

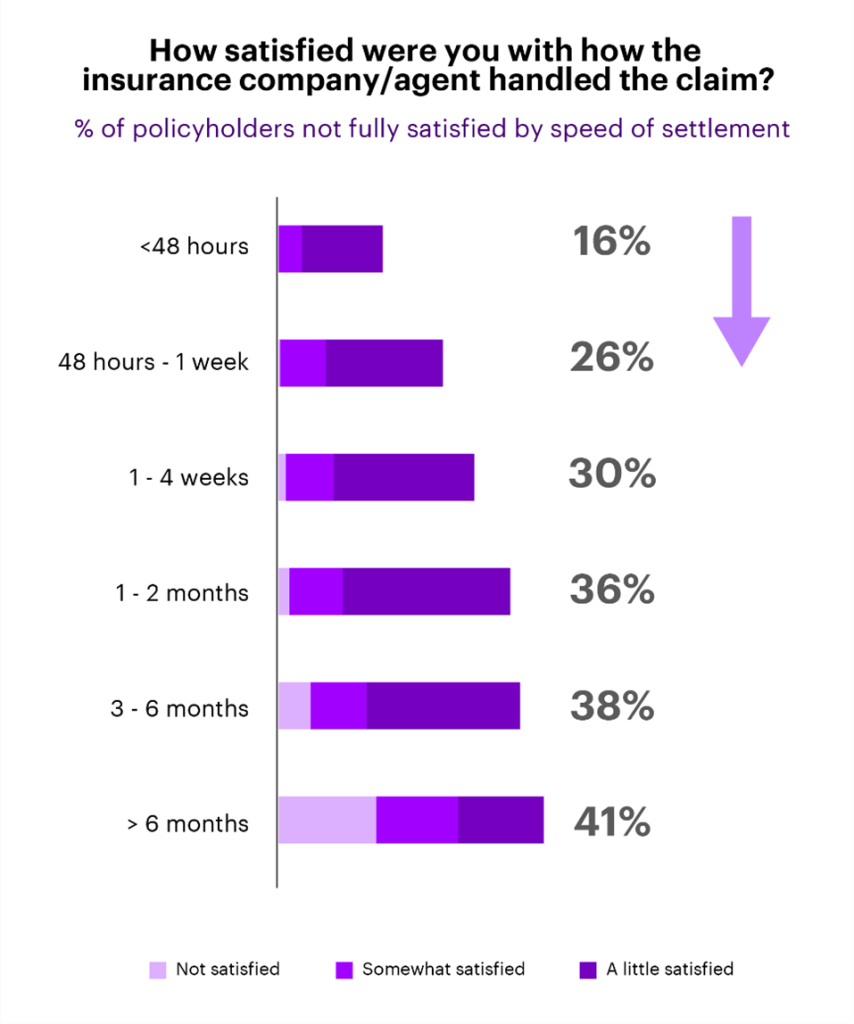

These are all essential modernizations which have helped the claims expertise be extra seamless. Nonetheless, there’s one piece that, in line with our survey, drives satisfaction charges greater than anything: pace of settlement. The longer it takes to settle a declare, the much less happy that policyholder will probably be.

This perception is especially essential for insurers, since claims dissatisfaction is a significant component in driving policyholders to change to a different firm, with 74% of dissatisfied clients both saying they did change suppliers (26%) or are contemplating it (48%).

Insurers ought to give attention to AI to construct on excessive claims satisfaction charges

Understanding that pace of settlement is a core driver, how do insurers proceed to get excessive ranges of satisfaction and, extra importantly, construct on that?

For a few years, insurers have been targeted on the omnichannel. We’re at a degree now the place continued funding in omnichannel is giving diminishing returns. After all, this isn’t to say omnichannel ought to be ignored. New routes that concentrate on youthful generations, like chat apps (WhatsApp, and many others.), will nonetheless be an essential technique for insurers to develop their buyer base. And perfecting or modernizing no matter omnichannel providing insurers at the moment have will probably be essential to remain related. What I’m saying is that omnichannel is low-hanging fruit—most of which we’ve picked already.

As a substitute, insurers ought to give attention to AI to automate the settlement course of to be quick, straightforward and correct. After all, that is simpler stated than achieved. Automating the settlement course of requires strong information and analytics capabilities all linked in a single ecosystem.

Disconnect between intention and motion

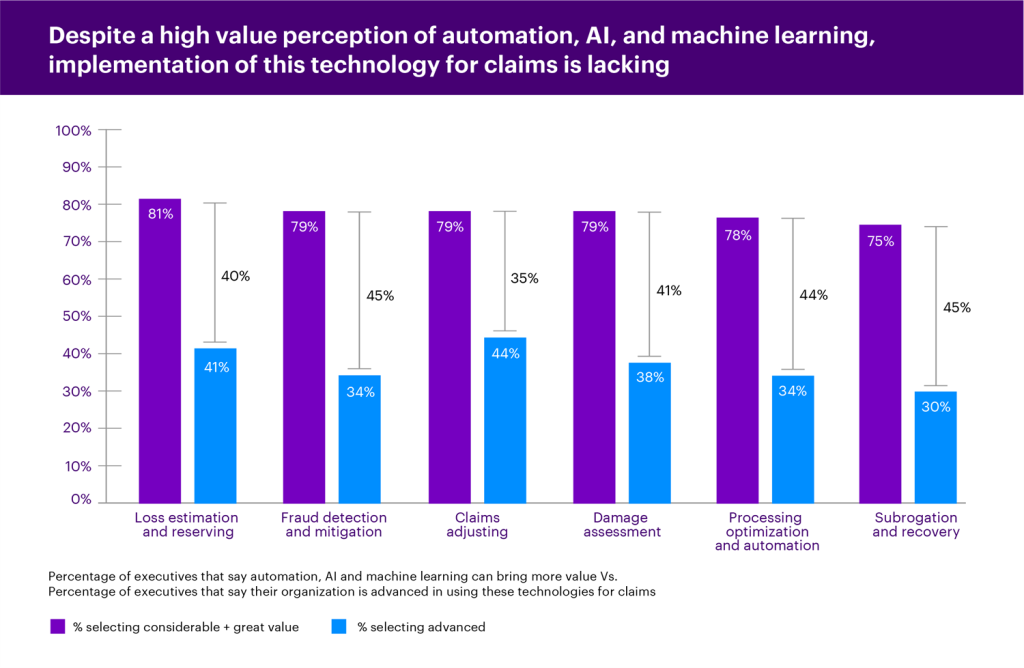

Executives already know the significance of utilizing AI in claims. The graph beneath reveals that, for every space of the claims worth chain, not less than 75% of executives stated AI and machine studying can convey “appreciable” or “nice” worth.

But, there’s a disconnect between this intention and taking motion. The identical graph reveals this hole, the place even probably the most superior space (claims adjusting) nonetheless has solely 44% of executives saying they’re superior of their use of AI, automation and machine studying. On this situation, our definition of “superior” is after the extent “utilizing in preliminary phases.”

Insurance coverage executives ought to take a look at priorities holistically

So, about 80% of executives understand the worth of AI in claims, and about 40% think about themselves superior in several areas. Not surprisingly, investments in claims will speed up over the subsequent three years, with 65% of these we surveyed planning to speculate greater than $10 million.

Insurers shouldn’t be discouraged, nevertheless, as a result of pace of settlement priorities align to different govt priorities, akin to decreasing admin prices and plugging claims leakage—and the options are the identical. That’s why executives ought to keep away from making an attempt to resolve every drawback individually and as an alternative ask how AI, machine studying and different automation can rework the enterprise in a approach that may concurrently hit a number of priorities. For instance, rising pace of settlement by means of automation will naturally scale back admin prices and keep away from claims leakage, whereas rising buyer satisfaction and retention.

Insurance coverage leaders additionally must be brave to deal with these bigger challenges and keep away from placing an excessive amount of time and vitality in easier priorities (like omnichannel).

Insurers know the type of worth AI can provide, however they’re falling behind in implementation. Fortunately, the latest surge in the direction of the cloud will assist. Cloud is a vital basis to leverage real-time information and modeling that may gas the sort of automation.

General, there’s nonetheless lots of work to do to get know-how platforms to the purpose the place they will automate pace of settlement and higher leverage AI throughout the enterprise. But it surely’s clear that AI and automation is the place the funding ought to be going for insurers to reap probably the most advantages: happy clients, empowered workers and a extra resilience enterprise. Learn our full report on AI-led Transformation in Insurance coverage to be taught extra.

Get the newest insurance coverage business insights, information, and analysis delivered straight to your inbox.

STANDARD DISCLAIMER:

Disclaimer: This content material is supplied for basic info functions and isn’t supposed for use rather than session with our skilled advisors.

[ad_2]