[ad_1]

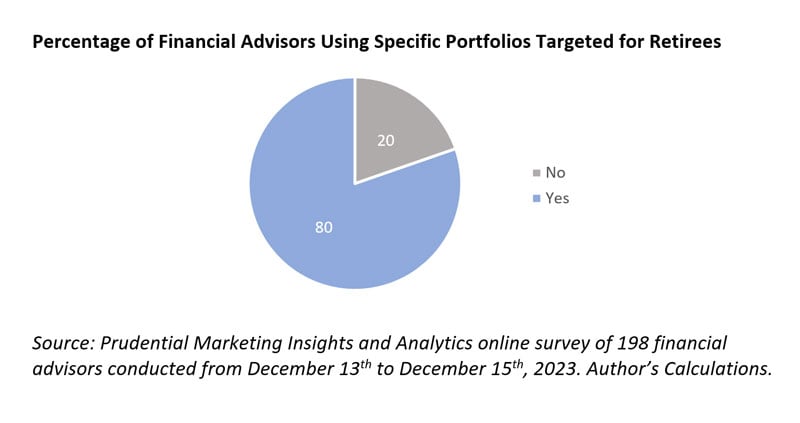

This implies as experience in retirement earnings planning will increase, these numbers might additional improve.

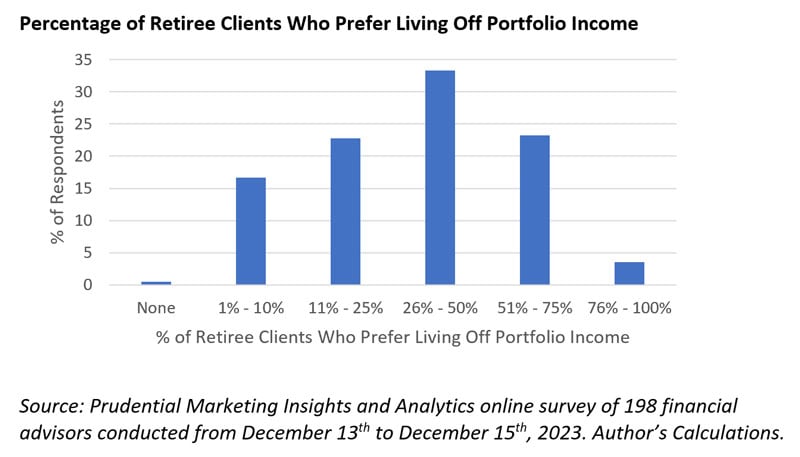

2. Retired purchasers favor to stay off portfolio earnings.

One other query requested: “… Roughly what p.c of your retiree purchasers favor residing off portfolio earnings?” Whereas there’s clearly a range of responses, total it seems about 50% of retiree purchasers favor to stay off of earnings.

This implies advisors should be able to constructing portfolios which have an earnings focus. These portfolios might be very completely different than the extra conventional perspective utilizing imply variance optimization (MVO), which focuses on whole return (a mix of earnings return and value return).

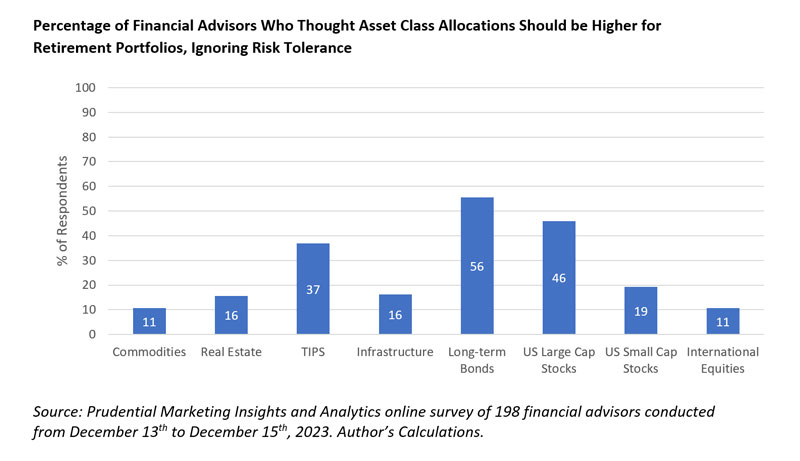

3. Views on utilizing asset courses in retirement portfolios fluctuate notably.

The query requested: “Ignoring threat tolerance, what position do you suppose the next asset courses ought to play in portfolios for retirees (versus non-retirees)?”

The graphic contains the share of respondents who thought allocations ought to be considerably larger or a lot larger. Monetary advisor respondents have been most taken with allocation to long-term bonds, U.S. large-cap equities, and Treasury inflation-protected securities.

Curiosity in TIPS and long-term bonds grew significantly as data of retirement earnings planning elevated. For instance, solely 17% and 33% advisors who weren’t very data thought allocations to TIPS and long-term bonds ought to improve in retirement portfolios, respectively, versus 41% and 58% amongst those that have been very educated, respectively.

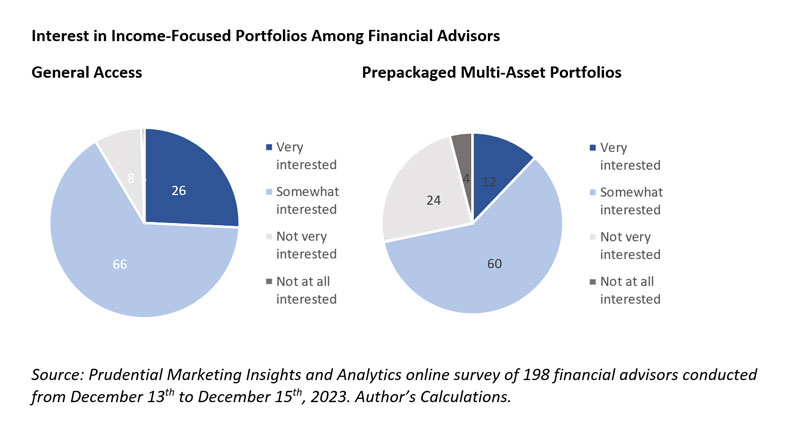

4. Curiosity in income-focused portfolios is comparatively excessive.

One query targeted usually on gaining “entry to extra income-focused portfolios” and one other “utilizing a multi-asset (prepackaged) portfolio technique…” Each counsel a comparatively excessive stage of curiosity, though there’s clearly extra curiosity generally entry.

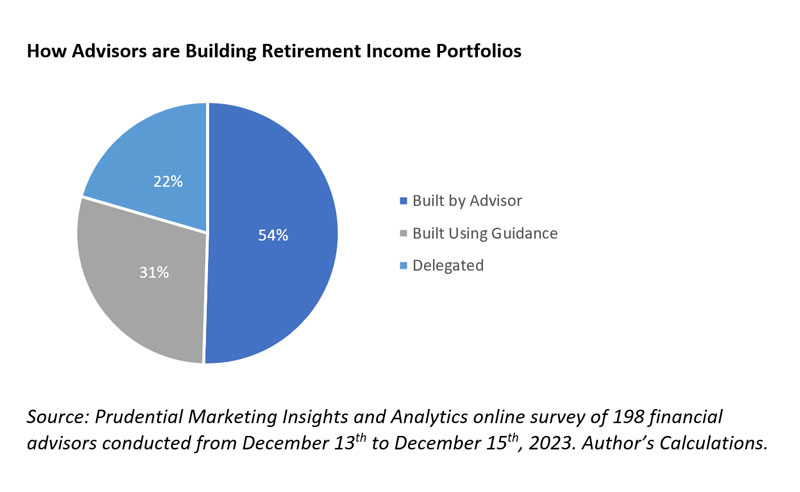

5. Advisors are largely constructing retirement portfolios themselves.

One other query focuses on whether or not advisors are constructing portfolios utilizing their very own analysis, constructed utilizing fashions or steering from third events, or some sort of third-party allocation (i.e., delegated). Monetary advisors who weren’t very educated about retirement earnings planning have been more likely to delegate portfolio development (at 32%) and the least prone to construct their very own portfolio (36%).

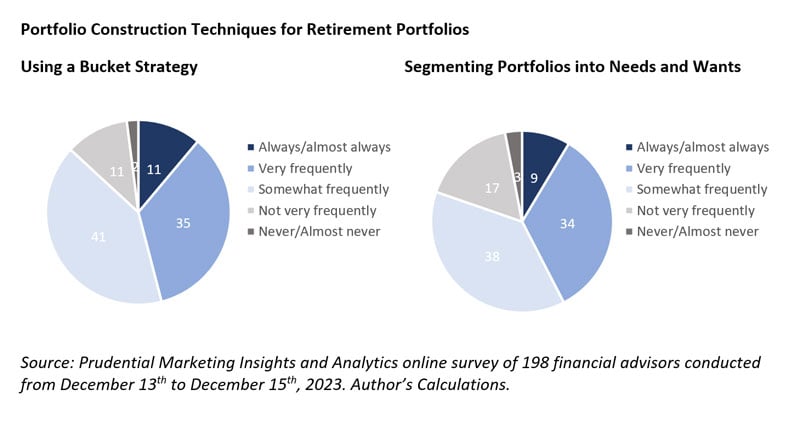

6. Retirement portfolios are focused towards the objective.

One query targeted on the frequency of utilizing a bucket technique in retirement portfolios, and one other requested about segmenting the portfolio by investing extra conservatively for extra important bills and taking better threat to fund extra discretionary bills (i.e., separate wants and desires portfolios).

Bucket approaches have been barely extra widespread, however responses counsel advisors are actively utilizing portfolio administration approaches with retirees which can be focused particularly across the objective (both timeframe or spending flexibility).

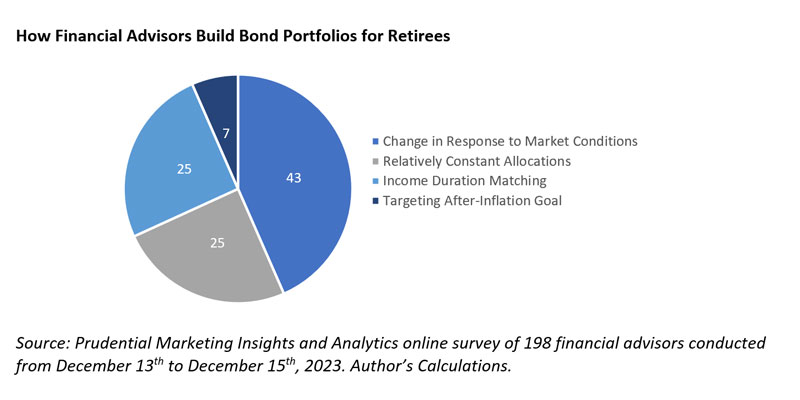

7. Advisors are comparatively tactical with bond allocations.

A query asks how the advisor builds a bond portfolio technique for a retiree. Nearly half of respondents (43%) mentioned they modified length and credit score threat in response to market situations.

Responses have been comparatively constant by retirement earnings data stage, suggesting monetary advisors are comparatively tactical with bond allocations for retirees.

[ad_2]