[ad_1]

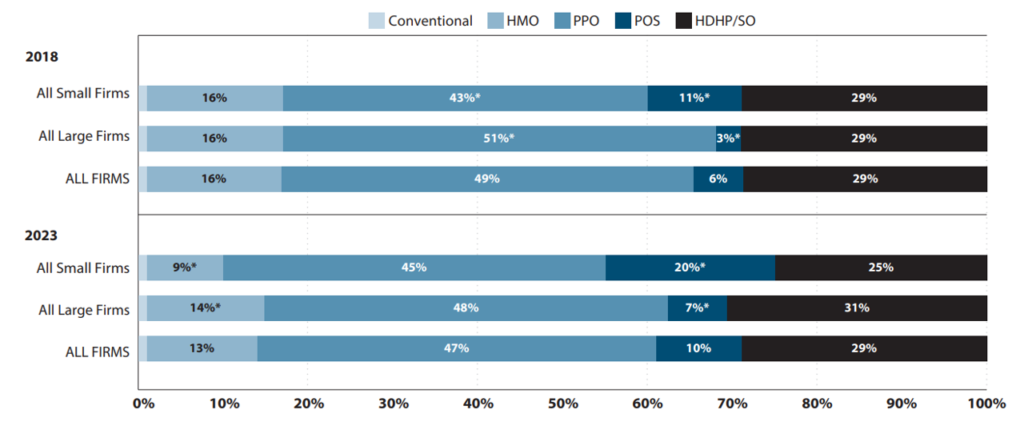

Many researchers are enthusiastic about how value sharing impacts well being care utilization, value and affected person outcomes. That is very true as high-deductible well being plans (HDHP) have develop into extra widespread within the US. In 2023, 29% of coated employees within the US had a HDHP.

One useful sort of knowledge for analyzing HDHPs is claims knowledge. Nevertheless, there are challenges with utilizing these knowledge:

The primary sort [of claims data] consists of detailed details about plan construction however usually has poor externality validity as it’s sometimes sourced from a single well being insurer or small subset of enrollees. The second sort has improved exterior validity by pooling throughout insurers however doesn’t often embrace plan-structure variables needed to differentiate between HDHPs and plans with decrease deductibles, or interpret what binary “HDHP” variables signify.

A paper by Cliff et al. (2024) goals to look at how properly one can predict plan deductibles utilizing claims knowledge utilizing Optum Labs knowledge. The Optum knowledge do have info on plan deductibles which can be used because the “gold customary”. 4 totally different imputation approaches are used:

- Parametric prediction with spending (regress on spending technique). Enrollee’s annual deductible spending is regressed on their whole annual spending (plan plus out-of-pocket), widespread demographic covariates (gender and age), and stuck results for every plan Use regression to foretell deductibles conditional for set spending degree with plan mounted results. Utilizing the coefficients from the best-fit regression mannequin, deductibles are predicted for every plan at a hard and fast quantity of whole spending, (which the authors set at $10,000 to exceed most deductibles).

- Parametric prediction with imputation and plan traits (Regress on imputed deductibles technique). This method makes use of two phases. First, deductibles are inputed for a subset of plans the place they’re simply recognized. For the second stage, a set of covariates is created describing noticed deductible spending and plan traits and collapse knowledge from the person to the plan degree. Utilizing the subset of plans with an imputed deductible, the imputed deductible quantities are regressed on the set of covariates; generated coefficients are then used to foretell deductibles for plans unable to be imputed within the first stage.

- Modal deductible spending (mode technique). This easy technique inputes the best (non-zero) modal deductible spending quantity amongst enrollees in a plan and applies this deductible to all enrollees in that plan.

- eightieth percentile of deductible spending (eightieth percentile technique). Following Rabideau (2021), particular person spending is tracked month-over-month, and people the place spending will increase in a given month however deductible spending doesn’t change are assumed to have reached their deductible. Then, the person degree knowledge is collapsed to the plan degree and the deductible for all enrollees within the plan is ready to the eightieth percentile of annual deductible spending within the plan.

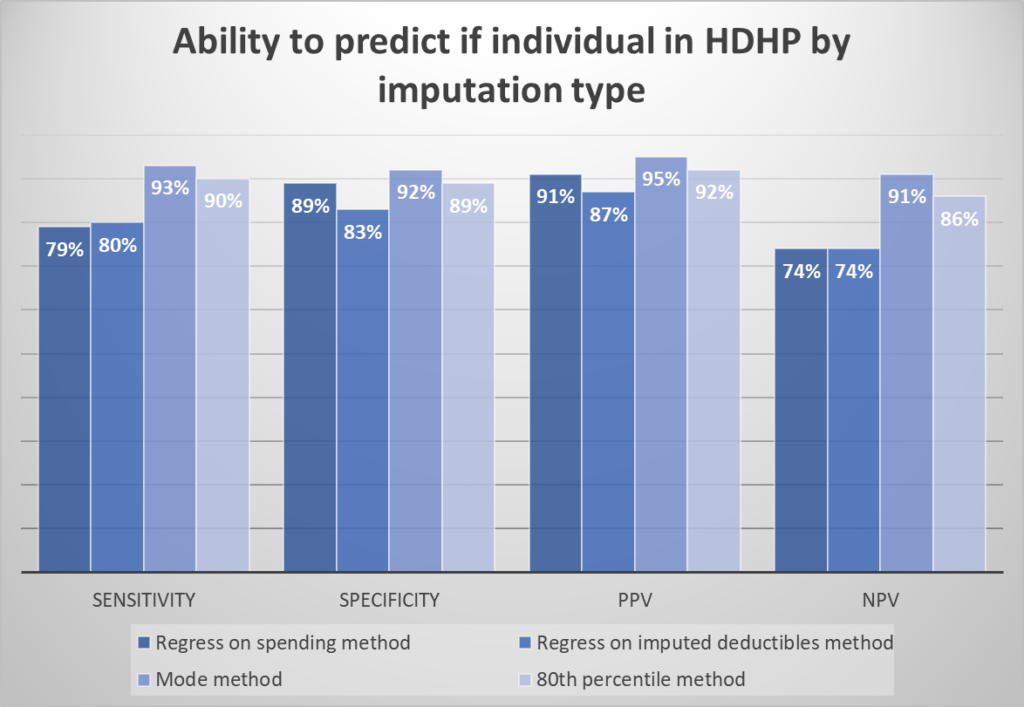

To judge the accuracy of the imputation approaches, the authors calculate the sensitivity, specificity, and optimistic/damaging predictive worth (PPV/NPV) of every technique for classifying enrollees into HDHP vs. non-HDHP plans.

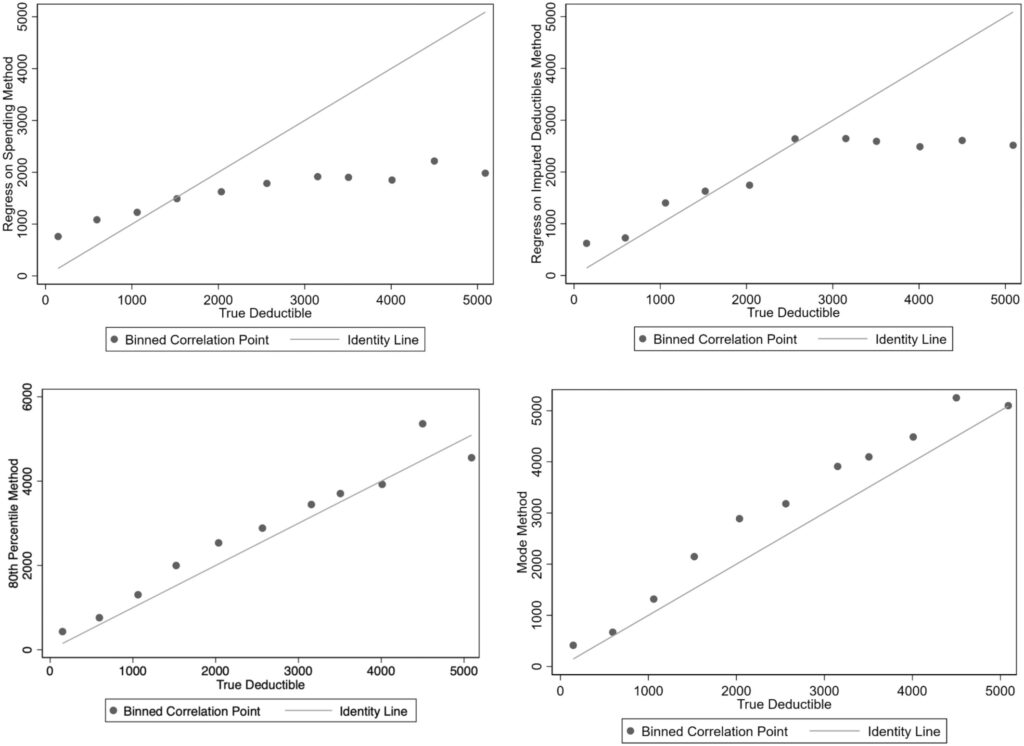

Surprisingly, the straightforward “mode technique” carried out finest when it comes to classifying people into HDHP vs. not. It additionally carried out properly when it comes to predicting deductible spending.

The mode technique performs finest; 72% of plans are appropriately labeled into every class and 69% of plans have an imputed deductible inside $250 of the particular deductible. For this technique, limiting imputation to teams with greater than 50 enrollees improved sensitivity to 85% of plans appropriately labeled by class and diminished the typical distinction between the imputed and precise deductible from $700 to $496

You’ll be able to learn the total paper right here.

[ad_2]