[ad_1]

Is the time proper for insurers to make main strikes based mostly on new buyer sentiments? Utilizing three buyer personas, under, we study a brand new alternative in insurance coverage: customer-directed prevention and safety. Every state of affairs offers us perception into how insurers may collaborate with policyholders to scale back danger.

Cameron pays consideration to all of the neighborhood information on his Nextdoor app. He notices that lots of his neighbors have put in their very own surveillance programs by corporations like Ring and Nest. He likes the thought of video programs which might be tied in along with his full house community, together with thermostats. He enjoys the management he has over his house programs, even when he travels. He feels extra snug being away when he can remotely tune in to his house.

Sheila had her automobile stolen outdoors of her residence in March. She preferred her automobile, however what she disliked most about shedding it was the inconvenience of the method. When she requested her agent what she may do to maintain it from occurring once more, the agent instructed including some safety tech to the car. Proper after buying a brand new automobile, Sheila had a splash cam put in. She added a GPS monitoring tag and a wheel lock. She is now on the lookout for an residence with safe storage parking.

Natalie purchased herself an Apple Watch after a co-worker confirmed her how nicely it was monitoring her train and sleep. The watch’s ECG perform caught an irregular coronary heart rhythm that allowed her to get handled earlier than one thing main occurred, resembling a stroke. Now Natalie refers to her watch because the “lifesaver.”

What’s fascinating is that in every of those instances, the shopper has the motive to spend their very own cash on decreasing their very own danger. At the exact same time, their insurers (which have each purpose to be happy) aren’t that interested by discovering out who’s and who isn’t proactively defending themselves and their property, not to mention develop new merchandise that worth in a different way for it. Insurers who develop extra digitally adept and information savvy can create and develop a brand new sort of buyer relationship, solid on a typical need for danger avoidance and mitigation.

It’s time to get .

A bridge to the long run with foundations in a shared need to decrease danger

Three of Majesco’s annual studies, our Client Developments report, SMB Client Developments report, and Strategic Priorities report, are designed to assist insurers grasp the methods by which they may join their companies with the wants, expectations, and motives of shoppers. As we dig into the main and minor particulars of buyer developments, we additionally make recommendations about how insurers may make the most of shifts in utilization or shifts in motive. We ask questions relating to life, buy patterns, and areas of curiosity. We glance carefully at connections and disconnections between what prospects need and what insurers are offering and use this as enter to our product roadmaps to assist our prospects keep in-sync or forward of their buyer wants and expectations.

As we take a look at the subject of danger resilience, we’re beginning to see a quickly rising want for insurers to coalesce their considering behind a brand new imaginative and prescient of danger — the shopper’s view of danger. It’s at this level that insurers can reply their very own questions on the suitable merchandise, pricing, and channels that match in the present day’s buyer wants and expectations.

For insurers centered on new merchandise, pricing, and new channels, the main focus is on development and profitability. A method is by lowering the circumstances of danger in a world the place danger appears to be shifting and rising by leaps and bounds. Prevention and safety have gotten the advertising love language of the insured — eclipsing restore and restoration. If we glance by way of the lens of statistics, we could conclude that there’s a new dynamic in insurance coverage — a tightening bond between the shopper relationship and insurer efforts to decrease danger considerably. Right here’s an outline of the problem at hand based mostly on our analysis:

- Clients are more and more interested by defending themselves, their property, autos, and well being.

- Insurers are, general, extra preoccupied with inside operational areas. They’re much less involved about a number of the dangers that their prospects are involved about.

- If insurers may successfully faucet into buyer curiosity in decreasing danger, they might create a win-win for themselves and their prospects by build up resilience in opposition to danger. In doing so, insurers may considerably affect and positively affect prices, profitability, and buyer retention.

Let’s take a look at every issue individually.

Clients are more and more extra interested by defending themselves, their property, autos, and well being.

Client spending on sensible house gadgets has skyrocketed in recent times. Between 2020 and 2021, there was a 43% improve in sensible house system gross sales. House safety spending was anticipated to succeed in $5.43 billion in 2022 and $9.14 billion by 2027.[i]

Video cameras had been the fastest-growing sensible house equipment within the first half of 2022 (55% development from 2021 to 2022). Good doorbells additionally had a 43% improve yr over yr. Video doorbells at the moment are owned by at the least 14.6% of Individuals.[ii]

Development is astounding within the wearable health monitoring sector, with utilization tripling between 2016 and 2019, then doubling from 2019-2022. Globally, over 1.1 billion folks personal and put on a health monitoring system. Over 30% of US adults use a wearable healthcare system, with 82% of those that are “keen to share their well being information with their care suppliers.”[iii]

These statistics level in the identical course. Persons are rising snug with utilizing know-how to guard themselves and to know and management their lives and well being. Can insurers make the most of this new degree of curiosity and utilization to have interaction prospects in a protecting partnership? Can insurers and prospects work extra carefully collectively to keep away from danger and assemble a framework for danger resilience?

Healthcare’s lesson for P&C and L&AH insurers

With out going right into a historical past lesson on Client Directed Well being Care (CDHC), the idea behind it’s essential. The extra that folks have a say in the place and the way cash is spent on their well being, the much less they are going to spend on pointless procedures and the extra they are going to maintain their well being. Not each aspect of consumer-directed care is working. For instance, consumer-directed care was purported to drive down the prices of well being care as a result of folks would “store round” for suppliers. That portion has but to show true.

Most consumer-directed care, nevertheless, is working. Persons are paying extra consideration to their well being and their care. The motivation to remain wholesome is bettering well being, plus it’s bettering curiosity in private well being statistics, like these measured with wearables resembling an Apple Watch and Fitbit.

The identical customer-directed motives can be utilized by insurers within the P&C and L&AH areas. It’s the suitable time to companion with prospects within the choices they must make about how, the place, and once they shield themselves. Insurers ought to be ready to know their prospects higher and be able to step in to help those that are motivated to remain protected and wholesome.

Insurers could also be much less involved about a number of the dangers that prospects are involved about.

Many insurers are nonetheless prioritizing their inside points over their buyer understanding and experiences. Once they do have shared considerations over danger, insurers are usually much less engaged and fewer anxious than their prospects.

Are insurers and prospects aligned on their considerations?

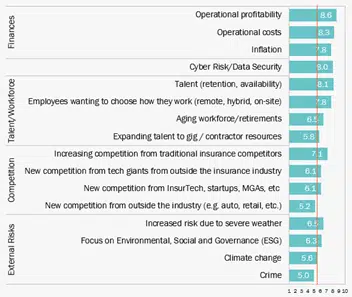

Current Majesco analysis uncovered some buyer/insurer disconnects that we are able to use as examples. In our latest thought-leadership report, Recreation-Altering Strategic Priorities Redefining Market Leaders, we tracked insurers’ top-of-mind points. (See Fig. 1).

Determine 1 – Crucial points for insurers

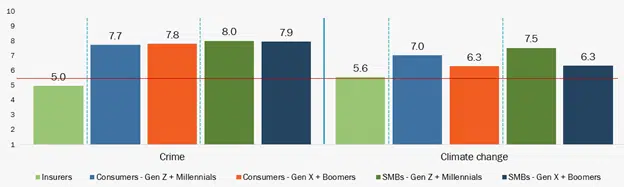

If you happen to skim simply the highest six considerations, you see inside priorities that concern executives. These are definitely essential to insurance coverage operations. Nevertheless, insurers’ decrease concern about Exterior Dangers is misaligned with their prospects’ views, particularly on the problems of crime and local weather change. (See Determine 2. Pay shut consideration to the Insurers’ degree of curiosity vs. their prospects.) Gaps in considerations about crime are giant, starting from 36% to 38%. Gaps in local weather change concern are decrease however nonetheless regarding, from 12% to 26%. Gen Z and Millennial SMB homeowners are additionally extra involved about elevated dangers as a consequence of extreme climate (7.3 vs. 6.5) and give attention to ESG elements (7.2 vs. 6.3). As prospects more and more take a look at who they do enterprise with throughout different elements, resembling ESG and local weather change positions, this might shift who they do enterprise with long-term.

Determine 2 -Disconnects between insurers and prospects in considerations about crime and local weather change

It’s simple to dismiss statistics like this, however why would you wish to? An understanding of shoppers may help insurers as they put together to have interaction extra deeply. For instance, “74% of Individuals who’re involved about local weather change personal a wise house system.” The hyperlink between the 2 is probably not simply understood, however it’s clear. Many smart-home gadgets are designed to save lots of vitality. Folks involved about saving vitality could also be involved concerning the surroundings. Local weather change can be more and more tied to catastrophic danger occasions. It’s the sort of statistic that exhibits how crucial it’s for insurers to know which of their buyer varieties are more than likely to companion with them in efforts to guard and stop.

Insurers ought to be profiting from the truth that prospects need extra management over the dangers of their lives. To do that, they might want to perceive their buyer’s motivations and their needs to self-direct their safety.

If insurers may successfully faucet into buyer curiosity in decreasing danger, they might create a win-win for themselves and their prospects by build up resilience in opposition to danger. In doing so, insurers may considerably affect and positively affect prices, profitability, and buyer retention.

Clients need confidence and safety, however insurers promote them a loss-recovery contract. Whereas most insurers are centered on how they’ll higher assess danger, many extra are increasing to additionally give attention to the prevention of losses and creating danger resilience for purchasers. The outdated adage of “management what you’ll be able to management” is now entrance and heart for insurers as they take a look at new danger administration methods as an important part of their underwriting and customer support technique.

What are insurers doing in the present day?

It’s essential to establish, assess, and create plans to reduce danger. Main insurers are leveraging know-how resembling IoT gadgets, sensible watches, loss management surveys, and value-added providers to not solely assess and monitor danger however to proactively reply to it with mitigation providers and actions. From concierge providers to monitoring water hazards and the security of staff, to serving to to dwell wholesome life, main insurers are shifting to danger resilience methods that not solely drive higher enterprise outcomes but additionally nice buyer loyalty and retention.

The place does Cameron’s house insurer match into his need for whole-home monitoring? Can his insurer step in with incentives, with higher monitoring software program, or with expanded sensors for issues like water harm to offer real-time alerts? He’s prone to respect the cooperative efforts of his insurer to guard his house. Chubb, for instance, is a proponent of leak detection applied sciences. Chubb shares system prices by providing premium credit to some policyholders that set up leak detection gadgets.[iv] The place are there different alternatives for danger mitigation the place insurers and policyholders can work collectively?

How can Sheila’s auto insurer give her higher peace of thoughts safety and an expertise that matches together with her have to preserve her automobile from theft? Can auto insurers do a greater job of defending in opposition to theft, directing auto consumers to vehicles which might be powerful to steal, or bettering their means to get well shortly? To this point, insurers aren’t motivated to provide steep reductions for the usage of protecting applied sciences. Are they at the least capable of finding out which policyholders are actively working towards danger prevention?

Using Apple Watch and Fitbit information for all times insurance coverage is well-documented, however nonetheless not in vast use outdoors of John Hancock’s Vitality. However the place are the opposite life and voluntary profit insurers who may crew up with policyholders which might be making nice strides for his or her well being? With well being information monitoring on the rise, insurers ought to be methods by which life/property safety applied sciences can work throughout silos to profit each insurers and policyholders.

How can insurers information their insureds to eat more healthy, train frequently and avoid recognized dangers? How can they domesticate a brand new sort of buyer relationship that’s based mostly on bettering their lives, defending folks and property, and understanding dangers in any respect ranges.

For many insurers, danger resilience begins with correct use and understanding of buyer information and preferences by way of next-generation core, digital and information know-how.

Are insurers ready to collect and analyze the various kinds of information that may give them insights into buyer habits and motivators? Are they then ready to develop services and products that match customer-directed motives for their very own safety? As danger grows globally, insurers want to organize by switching their applied sciences over to cloud-based platforms the place information flows simply, connectivity is simplified and safe, and insights are visible.

At the next degree, insurers want to contemplate their prospects as companions in danger resilience — tapping into their very own need to maintain themselves wholesome, protected, and safe. For extra data on creating a risk-resilient know-how surroundings, you’ll want to watch Majesco’s webinar, Creating Buyer Worth, Safety and Loyalty in Instances of Change by Rethinking Insurance coverage. Additionally take a look at Majesco’s market-leading options together with P&C Core, L&AH Core, Knowledge & Analytics, Loss Management, Underwriter360 and IQX Underwriting which might be offering the inspiration and capabilities of a risk-resilient know-how surroundings. And, for a deeper dive into the strategic priorities of market leaders, you’ll want to learn, Recreation-Altering Strategic Priorities Redefining Market Leaders.

Management what you’ll be able to management … a subsequent technology danger resilient know-how basis.

[i] Good House Report 2022 – Safety, Statista, December 2022

[ii] Good House Market Report, p. 13, August 2022, PlumeIQ

[iii] Chandrasekeran, Ranganathan, Vipanchi Katthula, Evangelos Moustakas, Patters of Use and Key Predictors for the Use of Wearable Well being Care Units by US Adults: Insights from a Nationwide Survey, October 16, 2020, Nationwide Institutes of Well being

[iv] Rabb, William, Insurers Making Waves with Wider Use of Leak, Temp Sensors, January 31, 2022, Insurance coverage Journal.

[ad_2]