[ad_1]

The property insurance coverage market in Japan is prone to survive regardless of losses following the 7.6 magnitude earthquake that struck the Noto Peninsula on 1 January 2024.

That is in accordance with GlobalData, which additionally discovered that earthquake insurance coverage accounted for an 18.2% share of the final reinsurance ceded premiums within the 12 months ending 31 March 2023 in Japan.

The Noto Peninsula earthquake resulted in over 240 casualties and triggered widespread injury to over 4,000 properties, in accordance with Japan’s Hearth and Catastrophe Administration Company (FDMA).

Sravani Ampabathina, insurance coverage analyst at GlobalData, commented: “Japanese property insurers have been capable of keep steady operations regardless of the recurring earthquakes, as majority of the residential insured losses are borne by the federal government. Additionally, insurers carry minimal internet retention on company earthquake insurance policies and cede a lot of the dangers to reinsurers, which assist in retaining a test on their profitability.”

The Noto Peninsula earthquake is estimated to end in financial losses of round JPY1.1–2.6trn ($8.6–$20.3bn) and insured lack of round JPY792bn ($6bn).

Nonetheless, the federal government via the Japan Earthquake Reinsurance Firm (JER) is prone to bear round 98% of insured residential earthquake claims, with a cap of JPY11.8trn ($91.7bn) per earthquake.

Entry probably the most complete Firm Profiles

available on the market, powered by GlobalData. Save hours of analysis. Acquire aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain e mail will arrive shortly

We’re assured concerning the

distinctive

high quality of our Firm Profiles. Nonetheless, we wish you to take advantage of

useful

determination for your corporation, so we provide a free pattern you can obtain by

submitting the beneath type

By GlobalData

Ampabathina continues: “Along with receiving assist from the JER, property insurers’ profitability is predicted to stay resilient as a result of frequent will increase in premium charges of fireplace and pure hazard insurance coverage insurance policies, which accounts for round 85% of the property insurance coverage GWP.”

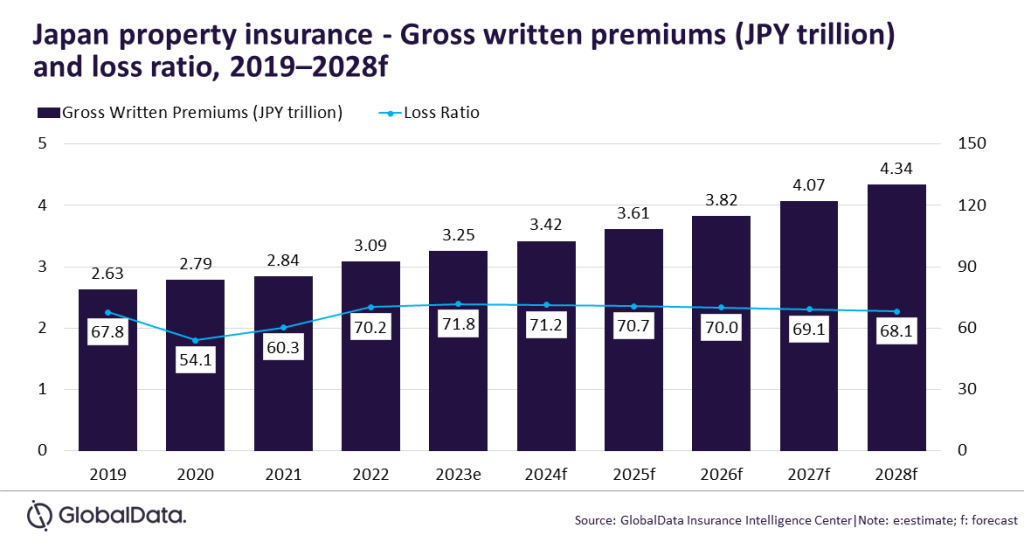

GlobalData forecasts the Japanese property insurance coverage business to develop at a compound annual progress charge (CAGR) of 6.1% from JPY3.4trn ($26.7bn) in 2024 to JPY4.3trn ($38.8bn) in 2028, by way of gross written premiums (GWP).

[ad_2]