[ad_1]

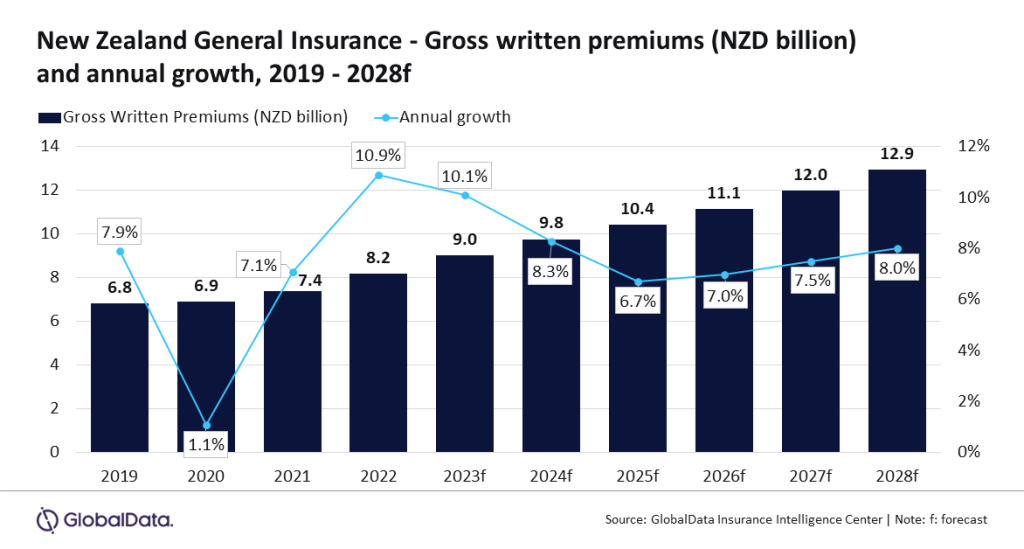

The New Zealand normal insurance coverage sector is predicted to develop at a CAGR of seven.3% from NZD9.7bn ($5.8bn) in 2024 to NZD12.9bn ($7.6bn) in 2028 when it comes to gross written premiums.

That is in keeping with GlobalData which additionally predicted that the overall insurance coverage business in New Zealand will develop by 8.3% in 2024. The property and motor insurance coverage strains will drastically help this as they make up 75% of normal insurance coverage in 2023.

Sneha Verma, insurance coverage analyst at GlobalData, mentioned: “New Zealand’s normal insurance coverage business is predicted to witness a development of 10.1% in 2023 after rising by 10.9% in 2022. The expansion is supported by an increase within the demand for pure catastrophic (nat-cat) insurance coverage insurance policies resulting from a rise within the frequency of maximum climate occasions and a rise in premium costs throughout a lot of the insurance coverage strains pushed by inflation.”

Property insurance coverage is the main line of enterprise within the New Zealand normal insurance coverage business, accounting for a 41.7% share of the overall insurance coverage GWP in 2023. It grew by 9.8% in 2023, pushed by the rise in demand for nat-cat insurance coverage insurance policies because of the nation’s susceptibility to excessive climate occasions.

Moreover, motor insurance coverage is the second largest line of enterprise, accounting for a 32.9% share of the overall insurance coverage GWP in 2023. Motor insurance coverage premiums grew by 9.4% in 2023, primarily resulting from premium price will increase pushed by inflation and excessive declare payouts following Cyclone Gabrielle.

As well as, automobile insurance coverage prices in New Zealand in 2023 have seen an enormous improve as in comparison with final yr.

Entry probably the most complete Firm Profiles

in the marketplace, powered by GlobalData. Save hours of analysis. Achieve aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain e-mail will arrive shortly

We’re assured concerning the

distinctive

high quality of our Firm Profiles. Nonetheless, we would like you to take advantage of

helpful

determination for your enterprise, so we provide a free pattern that you could obtain by

submitting the beneath type

By GlobalData

As per the New Zealand Parliament’s Month-to-month Financial Assessment in February 2024, annual automobile insurance coverage premiums elevated by 30% on a mean and reached $1,190 within the third quarter of 2023, as in comparison with $914 in 2022. The pattern is predicted to proceed in 2024 and motor insurance coverage is predicted to develop at a CAGR of 6.3% throughout 2024-28.

Verma added: “Excessive inflation has additionally performed a serious position in a rise in property insurance coverage costs. The annual inflation in New Zealand stood at 4.7% in 2023, a lot increased than the goal band of 1% to three% set by the Reserve Financial institution of New Zealand. Property insurance coverage is predicted to develop at a CAGR of seven.9% throughout 2024-2028.”

[ad_2]