[ad_1]

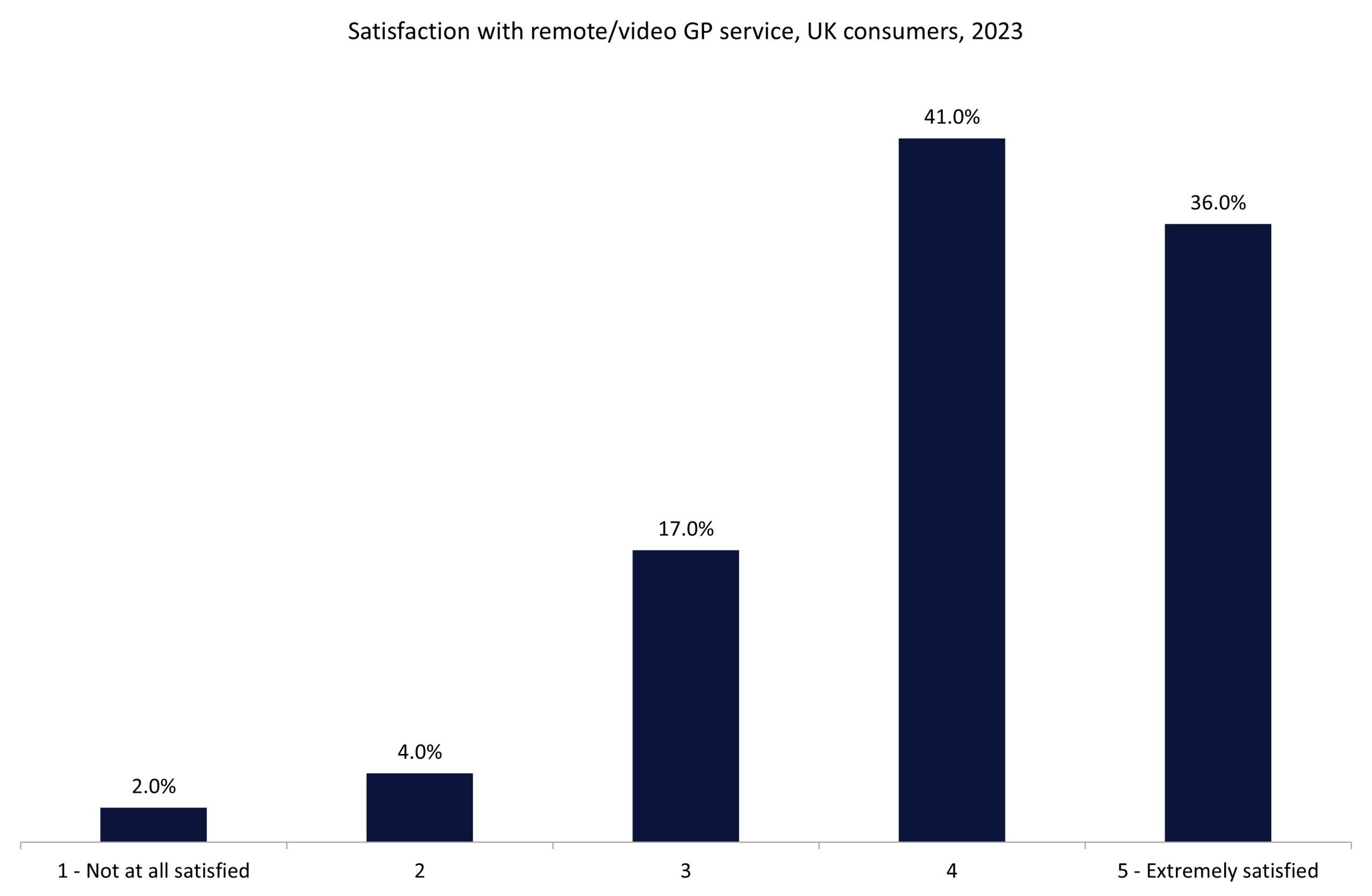

Scottish Widows not too long ago reported a 62% improve in the usage of its well-being app in 2023 in comparison with the 12 months earlier than. GlobalData surveying means that encouraging insurance coverage policyholders to utilise such instruments can improve buyer satisfaction. GlobalData’s UK Insurance coverage Shopper Survey signifies that 77% of shoppers who use a distant GP service are happy with the service they obtain.

Nicely-being apps have gotten more and more prevalent all through UK well being and life insurance coverage. Better digital consciousness and proficiency amongst insurers’ buyer bases, in addition to rising strain on the NHS within the UK, is driving this uptick in utilization. Particularly, insurers are tapping into the prevalence of smartwatches and different units to assist shoppers keep wholesome life, provide advisory companies, and supply easy medical help. Within the personal medical insurance coverage area, 25.2% of shoppers indicated to GlobalData’s 2023 UK Insurance coverage Shopper Survey that they bought the product on account of issues over NHS ready occasions or companies. Distant companies are sometimes seen as a great way of serving to docs see extra sufferers, in addition to permitting for distant monitoring (releasing up hospital mattress area) and rising accessibility for much less cellular sufferers. GlobalData’s survey additional finds that, of the 35% of policyholders who used a distant/video GP service, 77% of them had been happy with it.

Scottish Widows’ breakdown of shoppers who used their well-being app, Clinic in a Pocket, exhibits that 58% of customers had been aged between 26 and 45. This gives additional credence to the suggestion that digitally savvy (youthful) policyholders are extra inclined to make use of such companies. Scottish Widows is a top-ten supplier of whole-of-life assurance within the UK (4.8% market share), in line with GlobalData’s 2023 UK Insurance coverage Shopper Survey. Making continued use of such instruments, in addition to its collaboration with RedArc, the nursing service supplier, will assist to keep up renewals over the approaching interval in addition to present a key level of distinction in attracting new enterprise. Insurers and prospects are beginning to see the advantages of integrating know-how into well being and life insurance coverage companies. As know-how continues to enhance and additional capabilities (presumably pushed by synthetic intelligence) emerge, gamers ought to proceed to implement such capabilities into their choices. Prospects evidently use and revel in such companies, serving to insurers to enhance policyholders’ well being and life whereas additionally creating efficiencies throughout analysis, triage, and declare evaluation.

Entry essentially the most complete Firm Profiles

in the marketplace, powered by GlobalData. Save hours of analysis. Achieve aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain e mail will arrive shortly

We’re assured in regards to the

distinctive

high quality of our Firm Profiles. Nonetheless, we would like you to take advantage of

helpful

resolution for your corporation, so we provide a free pattern which you could obtain by

submitting the beneath kind

By GlobalData

[ad_2]