[ad_1]

Occasion being billed as one of many costliest in marine historical past

Whereas the Worldwide Group of P&I Golf equipment’ (IG) intensive reinsurance safety is anticipated to alleviate a lot of the monetary influence of the current Baltimore bridge collapse, S&P warns of upper reinsurance prices that will happen publish the occasion.

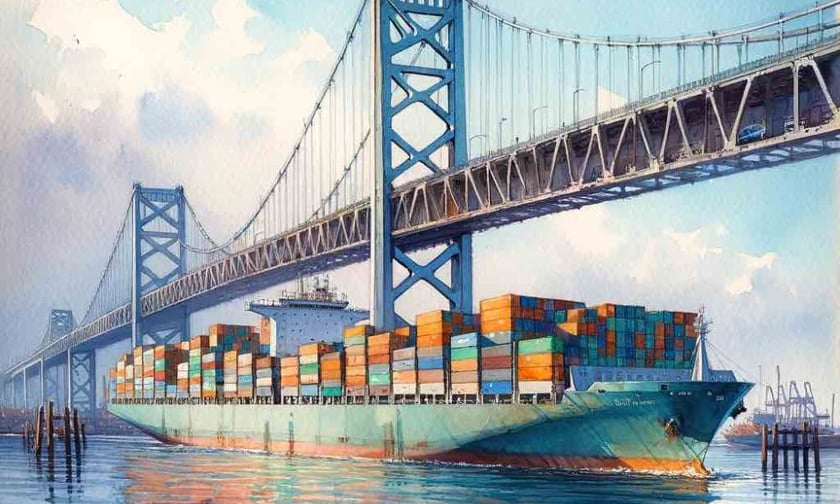

The current Baltimore bridge accident, involving a collision between a cargo ship and the bridge, leading to fatalities and substantial property harm, is more likely to be one of many largest marine losses in historical past, doubtlessly surpassing the Costa Concordia catastrophe of 2012.

The incident has highlighted the essential function of reinsurance in managing catastrophic losses throughout the marine sector.

Sure particulars in regards to the incident stay unsure, however anticipated losses are projected to incorporate property rebuild prices for the bridge, in addition to harm to the vessel and its cargo, and enterprise interruption.

The US president has pledged rapid federal funding for the bridge’s reconstruction, which may expedite the method however introduces uncertainty concerning the extent of ultimate insurance coverage claims.

Reinsurance protection for the Baltimore bridge collapse

The vessel concerned within the accident, named the Dali and insured by Grace Ocean, is registered in Singapore and is a member of the Britannia P&I Membership. Britannia’s legal responsibility protection for the Dali is capped at $10 million, with the IG collectively chargeable for the following $90 million by a pooling association.

AXA XL leads the IG’s $3 billion reinsurance program, which is supported by a consortium of huge worldwide reinsurers. Regardless of the magnitude of the incident, the marine insurance coverage sector, backed by strong reinsurance agreements, is well-equipped to deal with the claims.

AXA XL, particularly, is anticipated to handle its share of the prices successfully, sustaining its monetary rankings and place available in the market, it was said.

Total, the occasion, whereas important, is taken into account manageable for the reinsurance sector, due to sturdy underwriting efficiency lately and ongoing favorable pricing traits projected to proceed into 2024.

S&P additionally famous that the business’s diversified protection methods and substantial reinsurance protections will play pivotal roles in sustaining its resilience in opposition to such marine disasters.

It’s price noting that fellow credit score rankings company Fitch beforehand forecasted a minimal influence on the earnings of particular person reinsurers stemming from the collapse.

What are your ideas on this story? Please be happy to share your feedback beneath.

Sustain with the most recent information and occasions

Be a part of our mailing checklist, it’s free!

[ad_2]