[ad_1]

GlobalData surveying reveals that the main cause renters lack any type of dwelling insurance coverage is a perception that their landlord has insurance coverage protection for tenants already in place. In the meantime, analysis from AA Insurance coverage Companies highlights {that a} quarter of renters don’t have any type of dwelling insurance coverage.

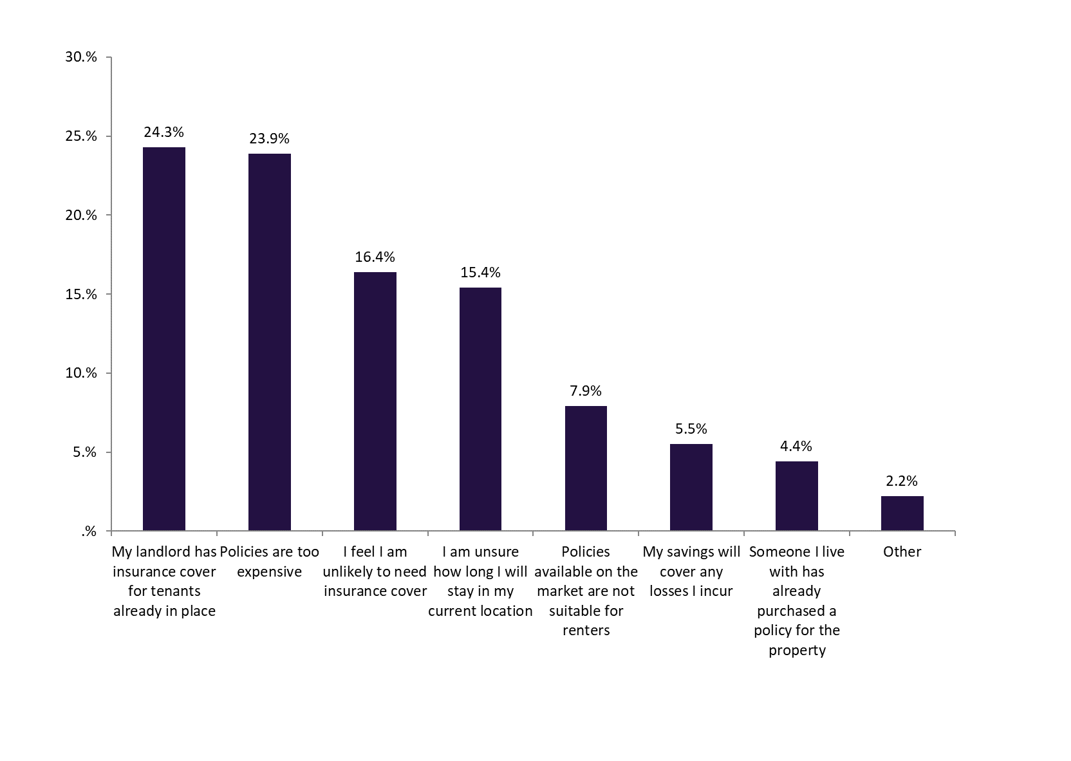

As per GlobalData’s 2023 UK Insurance coverage Shopper Survey, 24.3% of renters state that they haven’t bought a house insurance coverage coverage as a result of their landlord already has insurance coverage cowl for tenants in place. That is adopted by causes similar to insurance policies being too costly (23.9%), they really feel they’re unlikely to wish cowl (16.4%), and uncertainty about how lengthy they’ll keep of their present location (15.4%).

Many renters might mistakenly assume that their landlord’s insurance coverage coverage will cowl their private belongings and supply legal responsibility safety within the case of unexpected occasions. Nevertheless, landlord insurance coverage sometimes solely covers the constructing infrastructure and any furnishings owned by the owner. This leaves tenants susceptible to monetary losses within the occasion of a declare.

It’s essential for renters to know the restrictions of their landlord’s insurance coverage and the significance of getting their very own contents insurance coverage in place. With out their very own insurance coverage coverage, renters could also be left susceptible in conditions similar to water leaks, theft, and different occasions that might lead to harm to or lack of their private belongings.

In the meantime, a survey by AA Insurance coverage Companies discovered that 26% of personal tenants stated they didn’t have any type of insurance coverage in place. Moreover, AA’s survey additionally discovered that 23% of social renters don’t have any type of dwelling insurance coverage. In distinction, only one in 100 householders don’t have any type of dwelling insurance coverage, whereas 92% have buildings and contents insurance coverage.

In opposition to this backdrop, it’s important for renters to be told in regards to the distinction between landlord insurance coverage and renters’ insurance coverage. This might not solely present peace of thoughts for renters but additionally guarantee they’re adequately lined within the occasion of sudden circumstances. Insurers may help tenants by providing renters’ insurance coverage insurance policies tailor-made to their wants. These insurance policies sometimes cowl private property, legal responsibility safety, and extra dwelling bills if the rental turns into uninhabitable resulting from a lined loss. Insurers may also educate tenants in regards to the significance of getting their very own insurance coverage protection, offering peace of thoughts and monetary safety.

Entry probably the most complete Firm Profiles

available on the market, powered by GlobalData. Save hours of analysis. Achieve aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain electronic mail will arrive shortly

We’re assured in regards to the

distinctive

high quality of our Firm Profiles. Nevertheless, we would like you to take advantage of

useful

choice for your online business, so we provide a free pattern that you may obtain by

submitting the under type

By GlobalData

Furthermore, insurers can sort out the affordability drawback cited by 23.9% of renters by providing versatile fee plans or by offering choices for extra and protection ranges, permitting renters to customize their insurance policies to align with their monetary constraints whereas nonetheless guaranteeing satisfactory safety. By tailoring insurance policies and offering versatile fee choices, insurers could make renters’ insurance coverage extra accessible and inexpensive for these in want of safety. Going ahead, insurers can play a pivotal function in educating renters in regards to the significance of dwelling insurance coverage whereas concurrently supporting them by growing customizable insurance policies tailor-made to their wants and budgets.

[ad_2]