[ad_1]

What You Must Know

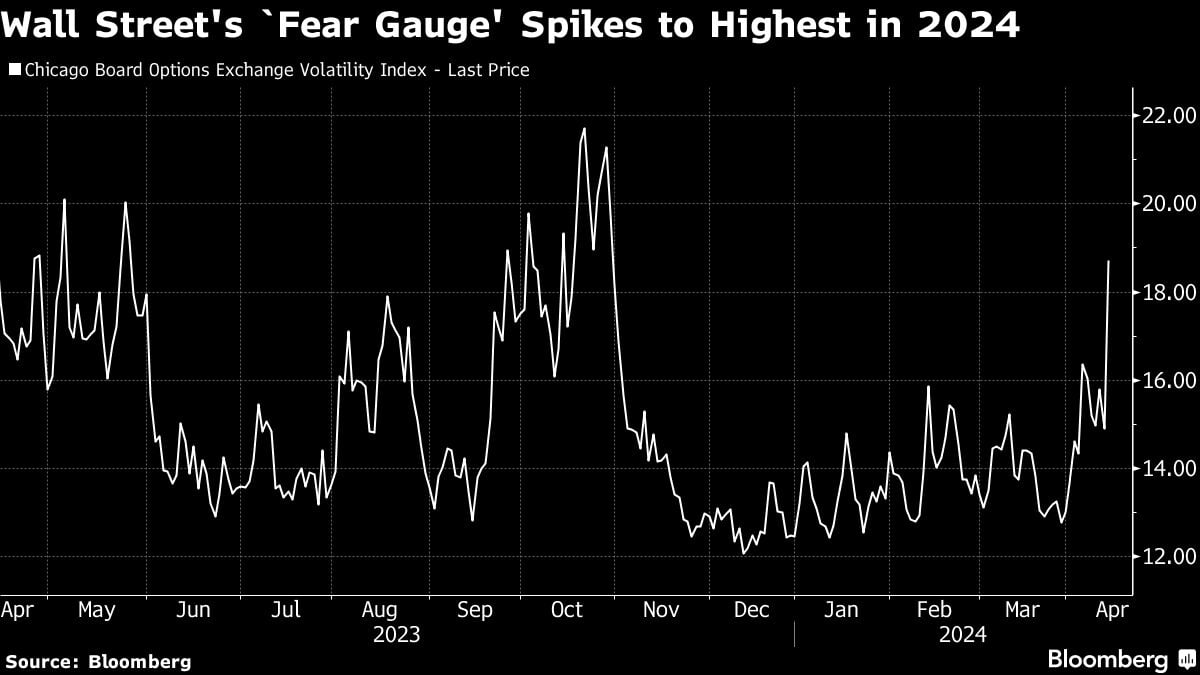

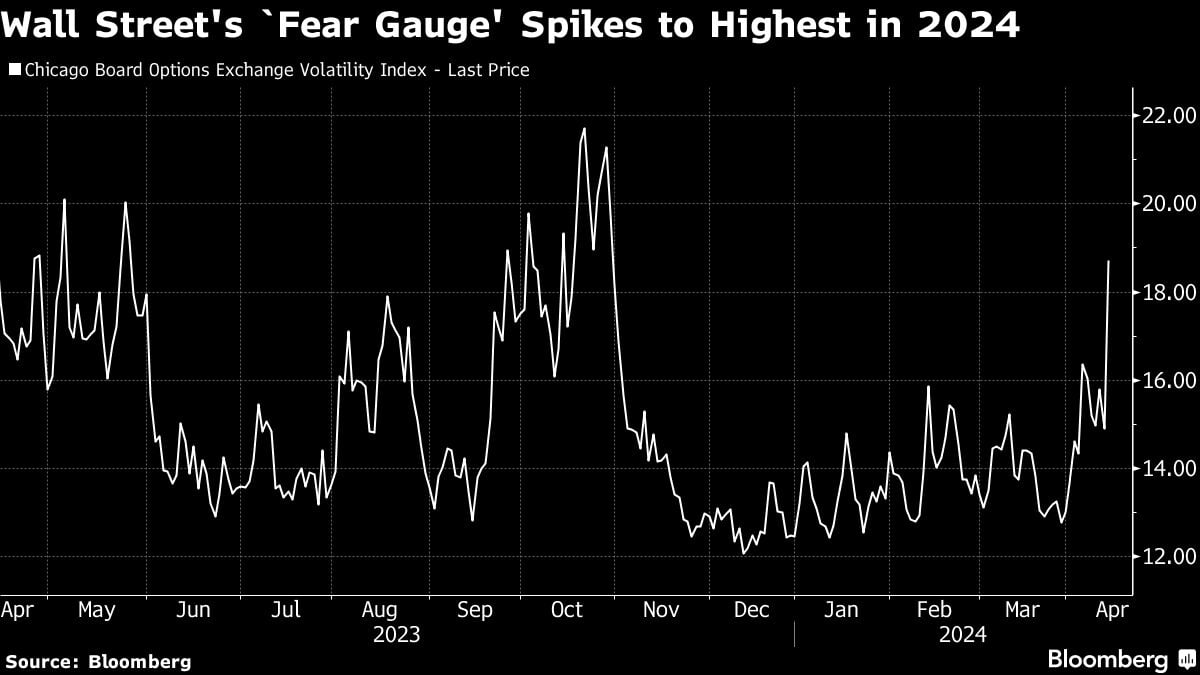

- The S&P 500 was on tempo for its worst day since January, Treasuries climbed, and the VIX spiked to ranges final seen in October.

- JPMorgan Chase & Co. and Wells Fargo & Co. each reported web curiosity revenue — the earnings they generate from lending — that missed estimates amid growing funding prices.

- Bond markets are actually pricing two fee cuts by the top of the 12 months, in contrast with six simply three months in the past, but each the S&P 500 and the Nasdaq 100 are nonetheless hovering close to file highs.

The worldwide monetary world was roiled by a flare-up in geopolitical dangers that despatched shares sliding — whereas spurring a flight to the most secure corners of the market comparable to bonds and the greenback. Oil rallied.

Equities fell on the finish of a wild week on a information report that Israel was bracing for an unprecedented assault by Iran on authorities targets. Roughly 40 launches had been recognized crossing from Lebanese territory, a few of which had been intercepted, the Israel Protection Forces mentioned in a publish on X.

The S&P 500 was on tempo for its worst day since January. Treasuries climbed because the dollar hit the best in 2024. Wall Road’s ”worry gauge” — the VIX — spiked to ranges final seen in October.

To Matt Maley at Miller Tabak, traders have been a lot too complacent about geopolitical points.

“Since gold and oil markets have been pricing in a significant impression on {the marketplace} from this disaster, it’s not out of the query that the inventory market will comply with these different markets and see an outsized response earlier than lengthy,” Maley famous.

The S&P 500 fell over 1%, led by losses in banks and chipmakers. Treasury 10-year yields sank 9 foundation factors to 4.5%. Andrew Brenner at NatAlliance Securities additionally cited “huge brief masking” and fee locking amid an anticipated flurry of debt issuance by banks after earnings.

The greenback headed towards its greatest week since September 2022. Brent crude jumped to its highest since October. Haven currencies just like the Japanese yen and the Swiss franc outperformed.

A direct confrontation between Israel and Iran would imply a major escalation of the Center East battle and would result in a major rise in oil costs, based on Commerzbank analysts together with Carsten Fritsch.

Escalating geopolitical tensions — most lately within the Center East but additionally together with assaults on Russian power infrastructure by Ukraine — have spurred bullish exercise within the oil choices market. There’s been elevated shopping for of name choices — which revenue when costs rise — in current days, as implied volatility climbs.

“Gold costs are up once more this morning, as extra traders view it as a greater hedge towards geopolitical threat than authorities bonds attributable to US inflation issues,” Mohamed El-Erian, the president of Queens’ Faculty, Cambridge and a Bloomberg Opinion columnist, wrote in a publish on X earlier within the day.

Meantime, huge banks’ outcomes provided the most recent window into how the U.S. financial system is faring amid an interest-rate trajectory muddied by persistent inflation.

JPMorgan Chase & Co. and Wells Fargo & Co. each reported web curiosity revenue — the earnings they generate from lending — that missed estimates amid growing funding prices.

Citigroup Inc.’s revenue topped forecasts as companies tapped markets for financing and shoppers leaned on bank cards — indicators {that a} extended interval of elevated rates of interest will profit giant lenders.

“Many financial indicators proceed to be favorable. Nonetheless, trying forward, we stay alert to a variety of vital unsure forces,” JPMorgan’s Chief Government Officer Jamie Dimon mentioned. He cited the wars, rising geopolitical tensions, persistent inflationary pressures and the results of quantitative tightening.

Treasuries rallied sharply, following the market’s worst two days since February, through which yields reached year-to-date highs after inflation readings savaged expectations for Federal Reserve interest-rate cuts this 12 months.

Two-year yields — which briefly topped 5% this week — plunged on Friday.

And the most recent financial information did little to change the lowered threat urge for food — with shopper sentiment down as inflation expectations rose.

Views on Fed Pivot

BlackRock Inc. Chief Government Officer Larry Fink mentioned he expects the Fed to chop charges twice on the most this 12 months, and that will probably be troublesome for the central financial institution to curb inflation.

Fink informed CNBC he would “name it a day and a win” if the inflation fee will get to between 2.8% and three%, which is above the Fed’s 2% goal.

[ad_2]